Hook

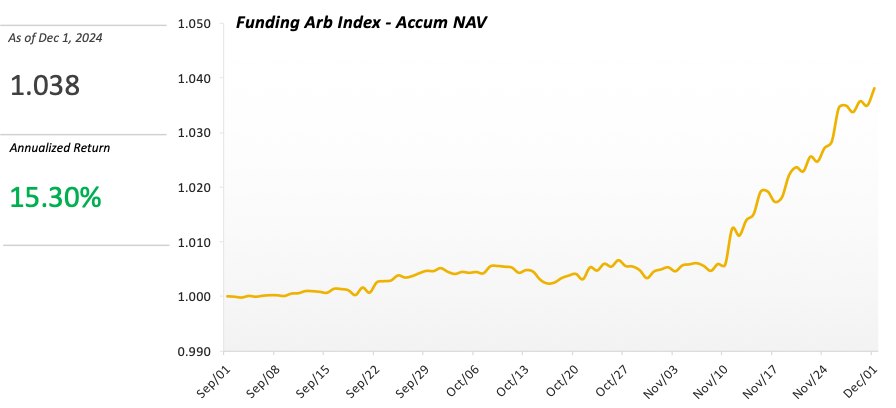

In this research, 1Token Team collaborated with six crypto trading teams to create an index benchmark specialized for funding fee arbitrage from to , including key metrics such as period returns, maximum drawdown, unit leverage returns, and asset concentration. This benchmark provides valuable insights into the most-traded market-neutral arbitrage strategy in the crypto trading ecosystem, making it an essential reference for crypto funds, SMA allocators, and other players in the digital asset industry.

Parameters

- Quote source: CMC

- Granularity: Daily

- Index start time: September 1st at UTC 0

- Cut-off-time: 0:00 UTC+0

- Sample Exchange Distribution: Binance (4 teams), OKX (2 teams)

- Accum. NAV calculation method: TWR

Note: The selection of the exchange, Binance and OKX, may influence the total performance, as they have different funding fee mechanisms. Our report does not take the mechanism difference into consideration, assuming no underlying variables affect the comparison.Index

Index

Calculation method

We have retrieved the assets of multiple crypto trading teams to the same starting point () utilizing a historical retrieving mechanism, calculated the accumulated NAV for each team using the TWR (Time-Weighted Return) measure, and then take the arithmetic mean to derive an index benchmark that represents the market’s funding fee arbitrage strategy.

Note: We use the arithmetic mean instead of the weighted average because the current sample size is relatively small, and the weights in a weighted average cannot accurately reflect the actual weights of the trading team. Therefore, the impact of principal has been normalized.

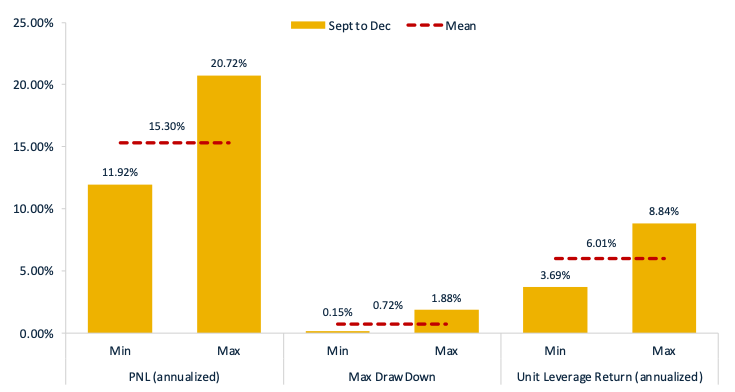

Indicators

Given the relative stability of funding fee arbitrage, the Sharpe Ratio is not included in the scope of this study. Instead, we have selected 1-2 metrics from three perspectives: returns, risk, and investment preferences for market reference.

· Profit and Loss (PNL) and Risk

Note:

- PNL is calculated based on TWR, Max DrawDown, and Unit Leverage Return are calculated based on daily data.

- Unit leverage return refers to the additional return generated by each increment of leverage when making an investment using leverage. We calculated unit leverage return using daily PNL / daily leverage / daily principal.

- We use gross exposure % as leverage, with the formula: Gross exposure % = Total Gross Exposure / Portfolio Net Asset; Total Gross Exposure = SUM (Gross Exposure by Underlying excluding stable and fiat coins).

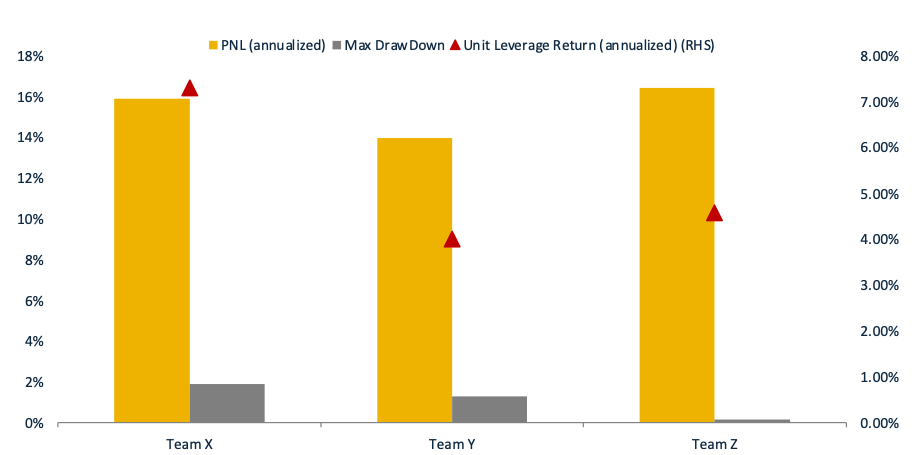

To better reflect the correlation between the metrics, we selected data from three out of six teams based on indicators above. As shown, when the annualized returns are similar, teams with higher unit leverage returns tend to have higher maximum drawdowns as well.

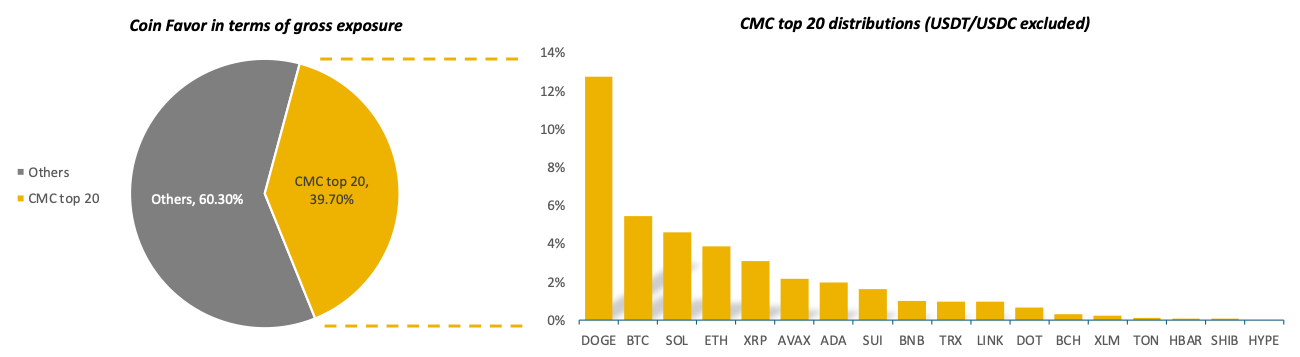

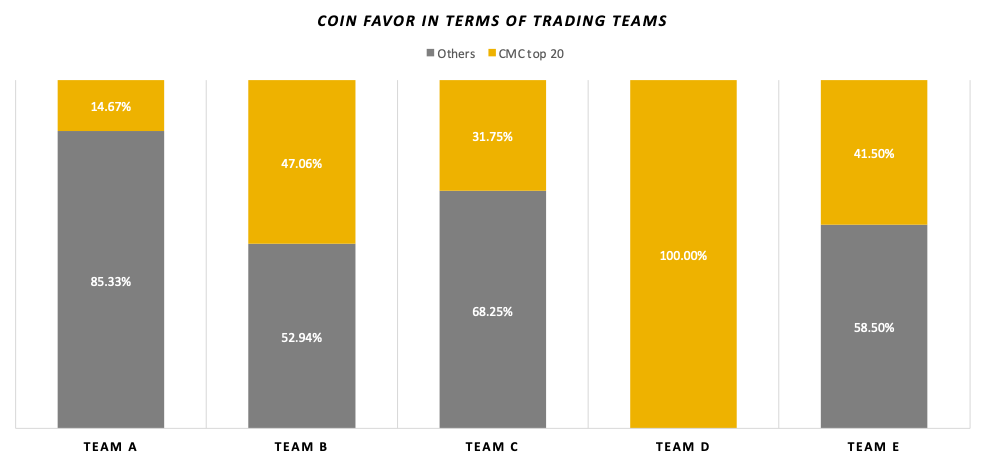

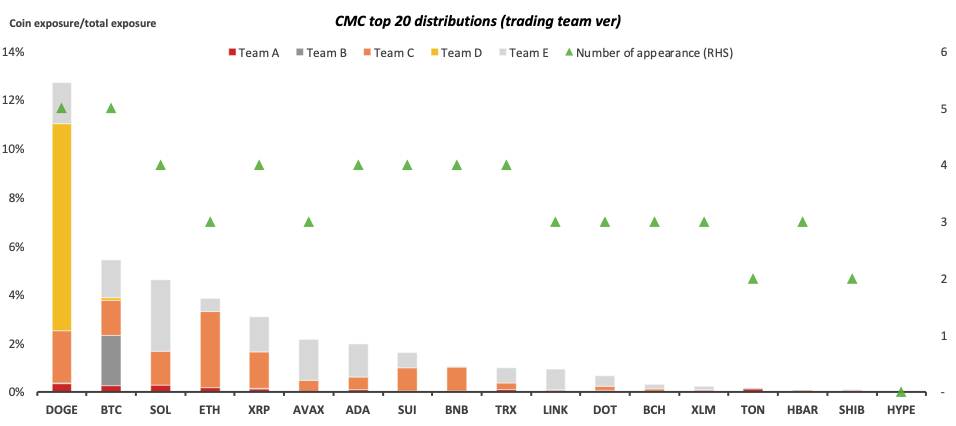

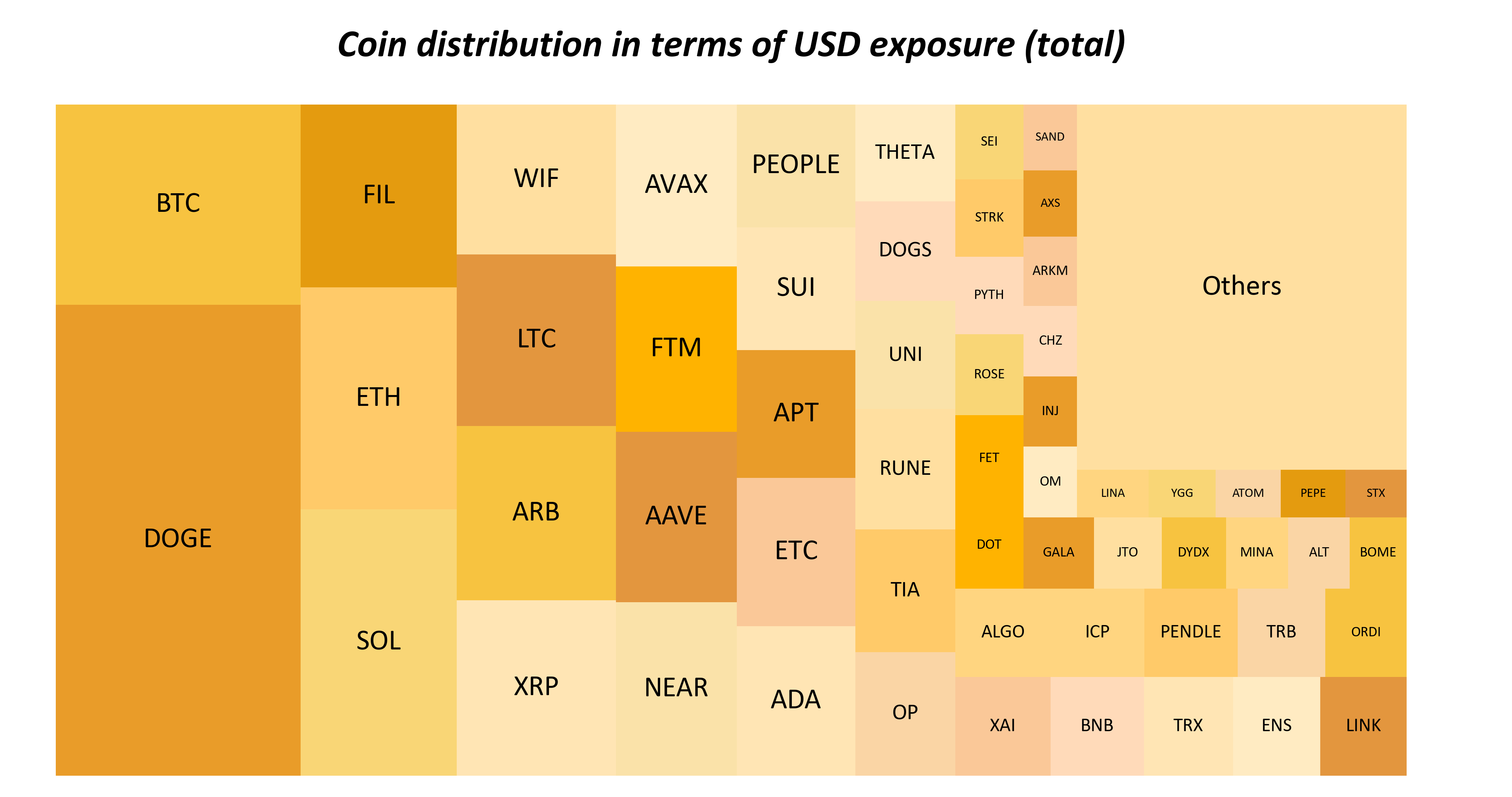

· Coin Distributions

We have combined daily snapshot data from trading teams to summarize the asset positions from 9/1 UTC 0 to 12/1 UTC 0, and aggregated the USD exposure for each underlying currency based on the underlying assets.

Overall: The proportion of small-cap coins is significantly higher than that of large-cap coins (CMC top 20). Among the large-cap coins, the samples of our collaborators indicate a relatively higher weight on DOGE, BTC, SOL, and ETH holdings over the past three months.

Note:

- USD exposure = Delta*Underlying Price

- We calculated the distribution ratio using each coin's gross exposure divided by total gross exposure.

- We summarized the data based on underlying currencies and normalized the impact of principal.

The value of β is calculated based on the squared sum of coin exposure by underlying, which is then normalized. For the period from September to December, we derived an aggregation degree β=0.033 for funding fee arbitrage, indicating a highly diversified strategy.

Funding fee arbitrage is one of the most famous trading strategies in the crypto market. There are more indicators that can be analyzed and taken into consideration. In our future report, we will also consider MMR/UniMMR, ADL, Loan rate, etc., to provide the market with well-rounded strategy research on a quarterly basis.

Additionally, the total AUM of the teams we collaborate with has exceeded $1.5 billion. In the future, we aim to increase the number of teams we monitor, along with the total AUM, which will also lead to a noticeable improvement in diversity.

Authored by Quinn Hu and Violet Tan from 1Token, with data kindly provided by six trading teams.

Reference

- Binquant

Founded in 2018, Binquant focuses on quantitative development and asset management in the digital asset market and is now one of the largest digital asset managers. The main strategies include market-neutral arbitrage, CTA,high frequency, and DeFi. Main clients include hedge funds, VC funds, large financial institutions, family offices, and exchanges for asset accretion.

- BSSET

BSSET (binary asset) is a leading digital asset management company specializing in high-frequency trading and market-neutral quantitative strategies across/in both centralized exchanges (CEX) and decentralized exchanges (DEX). Our experienced team is dedicated to delivering superior alpha to our clients consistently. Using advanced proprietary trading infrastructure and a custom research platform, Bsset identifies and exploits pricing inefficiencies across various instruments. Our main strategies include funding rate arbitrage, spread arbitrage, and high-frequency market making, which reduce execution costs and offer comprehensive risk management. We have a 7*24-hour risk control system that continuously monitors and manages potential risks in real-time.

- Grandline

GrandLine Technologies is a systematic multi-strategy trading firm established in 2018. Grandline specializes in deploying mid-frequency market-neutral strategiesacross major digital assets on both centralized and decentralized exchanges. With decades of expertise in quantitative portfolio management, the team is recognized for its exceptional research and risk management process, earning accolades from esteemed institutions like Hedgeweek and HFM.

- JZL

JZL Capital, specializing in Spot-Perpetual Arbitrage, is a top-tier quantitative team in Asia providing stable return performance and achieving over $200 million in AUM. The core team comprises members passionate about academic research and actively expanding its global client base by providing unparalleled quantitative trading solutions.

- Pythagoras

Established in 2014, Pythagoras manages a suite of crypto funds based on quantitative modeling. As one of the longest-running crypto hedge funds, it is known for delivering outstanding returns in both bearish and bullish market cycles. Using systematic, non-discretionary, and automated trading strategies, Pythagoras specializes in market-neutral and dollar-neutral strategies to consistently outperform the crypto market.

- Trade Terminal

Trade Terminal (TT), a crypto quantitative hedge fund, delivers high Sharpe quantitative strategies, market-making services, early-stage funding, and consulting. Named Binance's TOP 2024 Liquidity Provider of the Year, TT operates globally across spot and derivatives markets, leveraging advanced technology and strong risk management to optimize performance.