In a recent

letter disseminated a few days ago, the OCC has announced fresh guidance on

stablecoins. From here on out, the OCC will now allow US Banks to provide

banking services to stablecoin issuers. As if they weren’t already but more on

that later. The letter, which was drafted by Jonathan V. Gould, Senior Deputy

Comptroller and Chief Counsel, lays out the interpretation of how national

banks and Federal Savings Associations (FSAs) should position themselves. Below

are the main points from the 6-pager letter which can also be accessed here.

o

Stablecoin

issuers may desire to place assets in a reserve account with a national bank to

provide assurance that the issuer has sufficient assets backing the stablecoin

in situations where there is a hosted wallet*

o

The

bank or FSA verifies at least daily that reserve account balances are always

equal to or greater than the number of the issuer’s outstanding stablecoins

o

Banks

must conduct their own internal due diligence and comply with applicable

federal securities laws and other regulations such as the Bank Secrecy Act,

AML, and section 326 of the USA Patriot Act

* A hosted

wallet is an account-based software program for storing cryptographic keys

controlled by an identifiable third party. These parties receive, store, and

transmit cryptocurrency transactions on behalf of their accountholders; the

accountholder generally does not have access to the cryptographic keys

themselves. In contrast, an unhosted or personal wallet is one where an

individual owner of a cryptocurrency maintains control of the cryptographic

keys for accessing the underlying cryptocurrency.

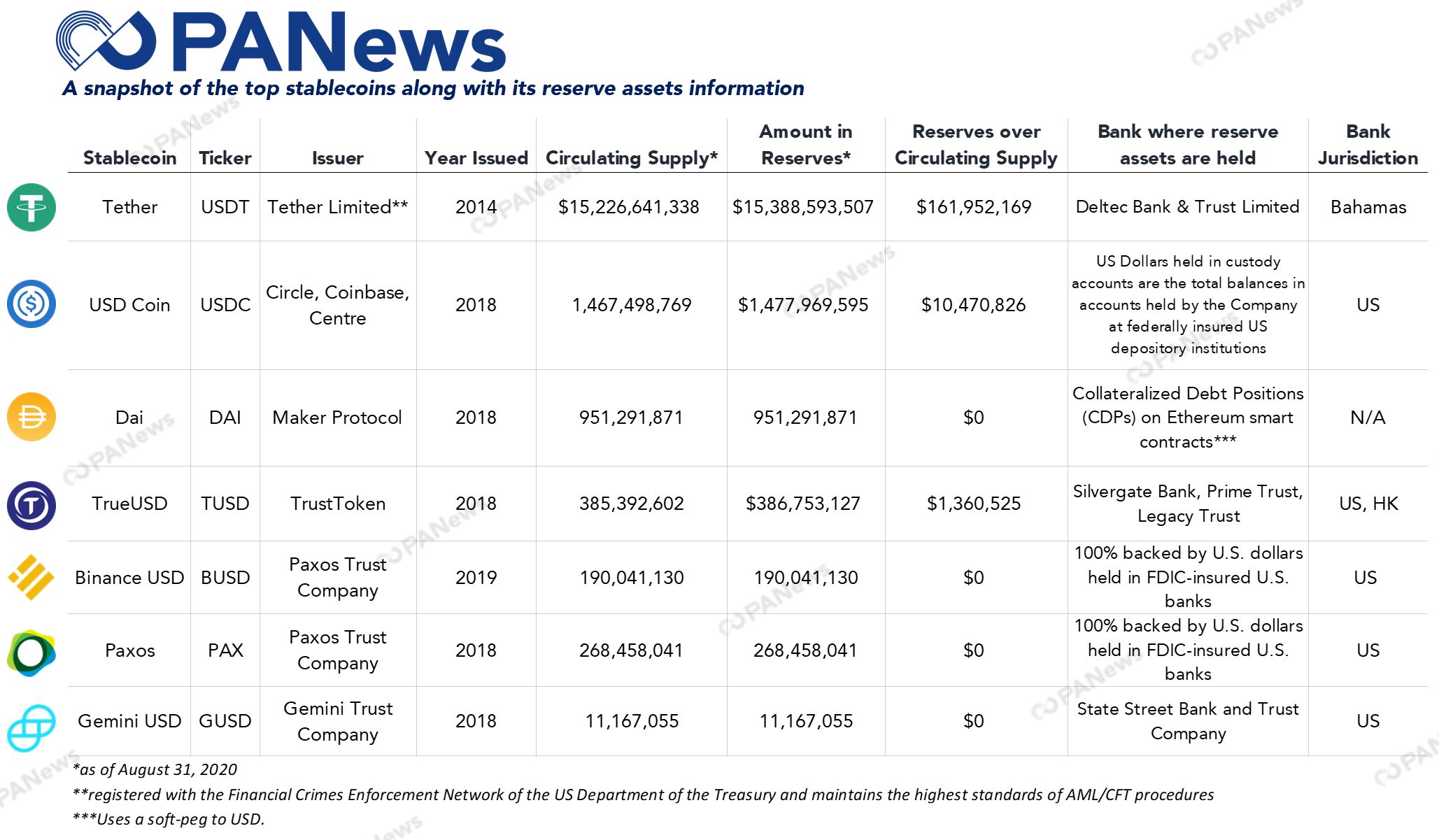

In essence what this interpretation is stating is that stablecoins issuers must be clean and have enough in actual dollar reserves backing up each dollar stablecoin. Something that has been questioned before in many instances but the times have changed and many stablecoin issuers have also leveled up their internal reporting and transparency standards. Below is a snapshot of some of the top US Dollar backed stablecoins along with their corresponding circulation supply.

(Figure 1) A snapshot of the top stablecoins along with its reserve and circulating supply and where they attest there reserves are located.

By in no means

do I want to make a political stand or opine on a subjective bias that may be

construed critical, but it is important to look at this topic from different

vantage points. There are two ways to look at this interpretative letter which

I will list below then go more into detail about them:

The first

point is that for face value, it’s great for awareness, regulatory

friendliness, and the whole narrative of crypto mass adoption. Any more

elaboration on this would just be redundant.

On the second

point, one could also say it’s a political and economics ploy to grab hold of

whatever they have of US Dollar hegemony. At the end of the day, it’s all about

control and power. The click bait headline “fall of the US dollar hegemony” has

been sweeping the financial media (including crypto media) rounds over the past

few months in reflex response to the trillions of dollars printed. For those

who have positioned the stance that USDT or any of these stablecoins is the

ultimate contender to the US Dollar are a bit faulty in their arguments and can

be construed as a misleading thesis. These points have been taken into

consideration but if anything, stablecoins are probably complementing the US

dollar.

How exactly is

the USDT bringing down the dominance of the US dollar when it’s backed by those

same US dollars? Most top stablecoins are US dollar backed stablecoins,

with their US dollar reserves parked in US financial

institutions. Don’t forget, it’s called USDT, it’s called USDC, it’s called

BUSD, etc. For Pete’s sake the names itself are promoting the US dollar rather

than the other way around. As shown in the graphic above, regardless of the

fact that now the SEC is playing buddies with stablecoin issuers is trivial, most

of the stablecoin issuers have already parked their US dollars in multiple US

banks.

What’s

interesting is the timely nature of this release by the OCC. Why now are they

giving US banks the liberty in servicing stablecoin providers? Have they

succumbed to the whole crypto narrative of “when adoption”? Was it the workings

of Brian Brooks, Coinbase’s former Chief Legal Officer, now currently acting

comptroller of the OCC? Not sure if I want to trust the guy who states that he

recognizes the centralized faults in our financial systems but at the same time

rubs elbows with the SEC and does round trips in discussions about which crypto

assets Coinbase will be listing next. Seems like an oxymoron.

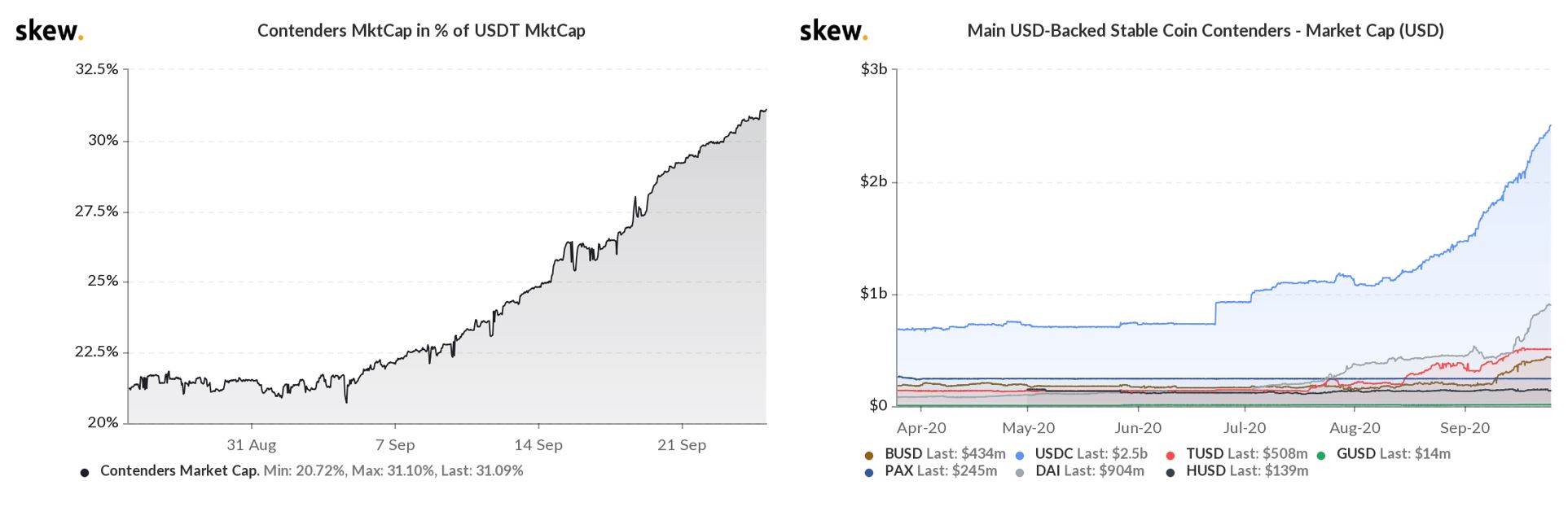

(Figure 2) The growth of stablecoins have been on a tear the past few months with USDC leading the way. The chart on the left shows the % of stablecoins ex-USDT in value has risen from around 21% in August to a current level of 31%. A huge contributor to this is show in the chart on the right with USDC issuing $1.7 billion more in its circulating supply.

To avoid

insinuating any maligned opinions, he actually has been a breath of fresh air

to the antiquated financial system. Just recently before this, Brian has been a

huge proponent of restricting the way the OCC gives out banking charter

licenses. Specifically, he has pushed for these licenses to be given out to

non-depository financial institutions, meaning that tech payment companies such

as Paypal could hold a national banking charter. And actually the first banking

license of this nature was granted to a fintech called Varo Money. Then in

August, Brian was a crucial part of the announcement by the OCC to allow US

banks to hold and custody crypto assets. But for what reason on could ask?

Control? Like with anything, there are two sides to every coin.

“If you went

back 10 years, the OCC regulated about 100 percent of payments,” he said. “And

then because of a bunch of technology innovations, some of that work that used

to be done in banks started leaking outside the system…I can supervise the

payments activities of JPMorgan, but I can’t supervise the payments activity of

Square,” he added. “That seems really weird to me.”

Would the same

proponents, adopters, and users of stablecoins side with the statement made

above? Or is the inevitability of regulation in this industry already here? On

June 16 of this year, it was confirmed by Centre (one of the 3 in the USDC

consortium) that an Ethereum address holding 100,000 USDC stablecoins has been

blacklisted in response to a request from law enforcement. It wouldn’t be

surprising if we see a resurgence in interest in privacy coins such as Monero

or Dash despite their delisting exodus over the past year.

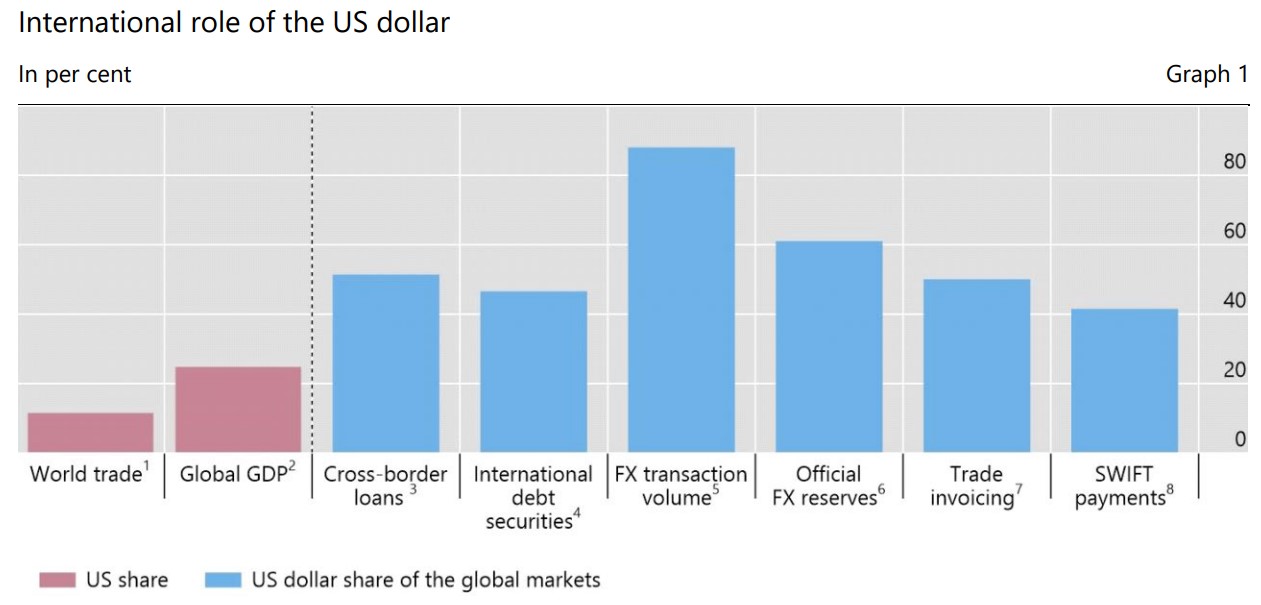

To pivot back to the topic of US dollar hegemony, stablecoins probably aren’t anytime soon going to be the tipping point of pulling down US dollar dominance. Make no mistake, PANews is not trying to play sides here with which currency will become the de facto currency of the world, but it is very hard to put up that argument when the billions of dollars in volume of stablecoin transactions are only a fraction of the trillions of US dollars that are circulated everyday. Without getting too in depth with economic theory, there are other macroeconomic and political levers that are non-crypto related that have the real force in deciding this thesis.

(Figure 3) Source: Bank for International Settlements. The US dollar plays a huge role in the international markets commanding an over 80% market share of FX transactional volume. Stablecoins alone will not be the harbinger of the US dollar’s demise.

“Uncertainty

is the driving factor behind recent fluctuations in Gold prices and U.S. Dollar

valuations, but forgone domestic consumption, savings, resulting in a net

external investment position would be a better indicator of long-term currency

valuations than current economic assumptions. Regardless of the dollar’s

current value, the U.S. would only lose its reserve status by allowing its

institutions to impose stringent restrictions on international dollar

denominated securities market” – Rogan Quinn

Better yet,

stablecoins issued by private entities aren’t a threat to US dollar hegemony,

but more so controlled central bank digital currencies are.