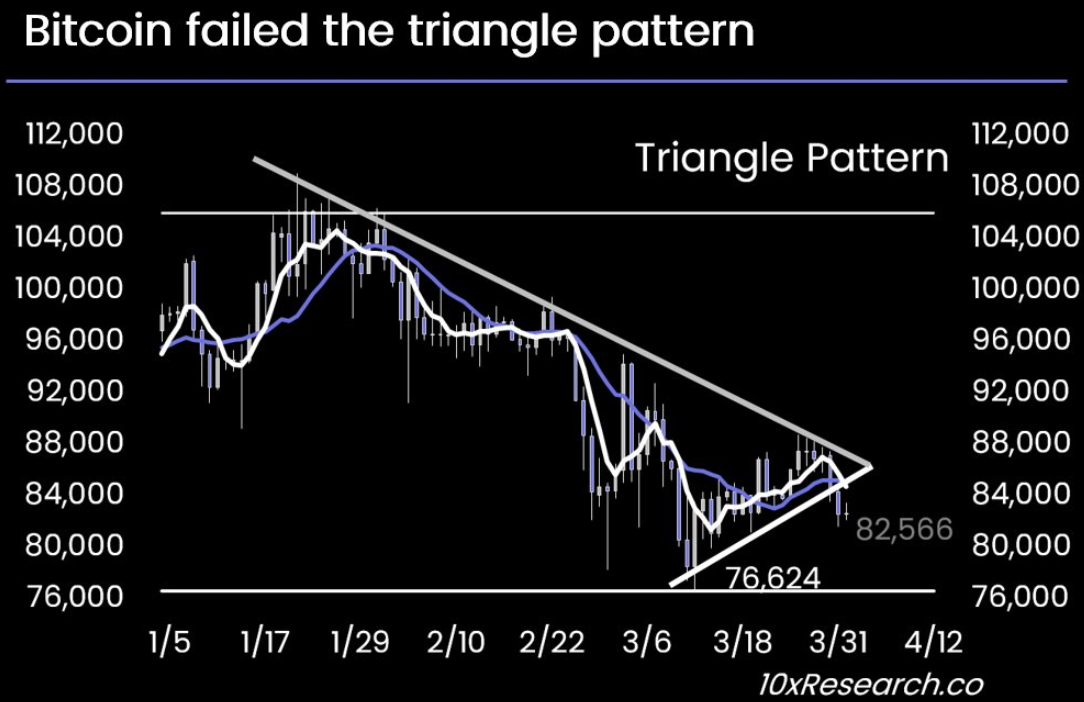

PANews reported on March 31 that according to 10x Research, Bitcoin's rebound over the past three weeks was frustrated by higher-than-expected core PCE data. The data showed rising inflation, partly driven by Trump's tariff policy, which weakened consumer confidence. One-year inflation expectations rose to 5.0%, leading to poor performance of risky assets and triggering stop losses on its short-term bullish strategy.

10x Research predicts that Bitcoin may fall below $80,000 this week as multiple risk-averse factors may put pressure on the stock market and affect the cryptocurrency market. Trump's tariff policy has shifted from the initial mild expectations to a more aggressive one, and the market is worried that tariffs may be implemented first and the negotiation process will be delayed. This change has significantly increased market uncertainty.

In addition, if the ISM manufacturing PMI data is weak, it may increase market pressure; and if the US employment data continues to be strong, it may delay the Fed's intervention, putting further pressure on the market. It is worth noting that the VIX index is still low, indicating that many traders may underestimate the short-term downside risks.