Author | Wu says blockchain

This article is for information sharing only and does not constitute any investment advice. Readers are requested to strictly abide by local laws and regulations and not participate in illegal financial activities.

Recently, the stock chain has been hotly discussed in the community, represented by the models of xStocks and Robinhood supported by Backed. In comparison, the stock chain model supported by xStocks has more significant openness and composability, and ordinary users can also trade freely on the chain; while Robinhood is only open to users of EU exchanges with clear regulatory levels under the premise of compliance, and does not allow transfers to non-compliant addresses. The following will explore these two models through multiple sets of data.

Backed and xStocks

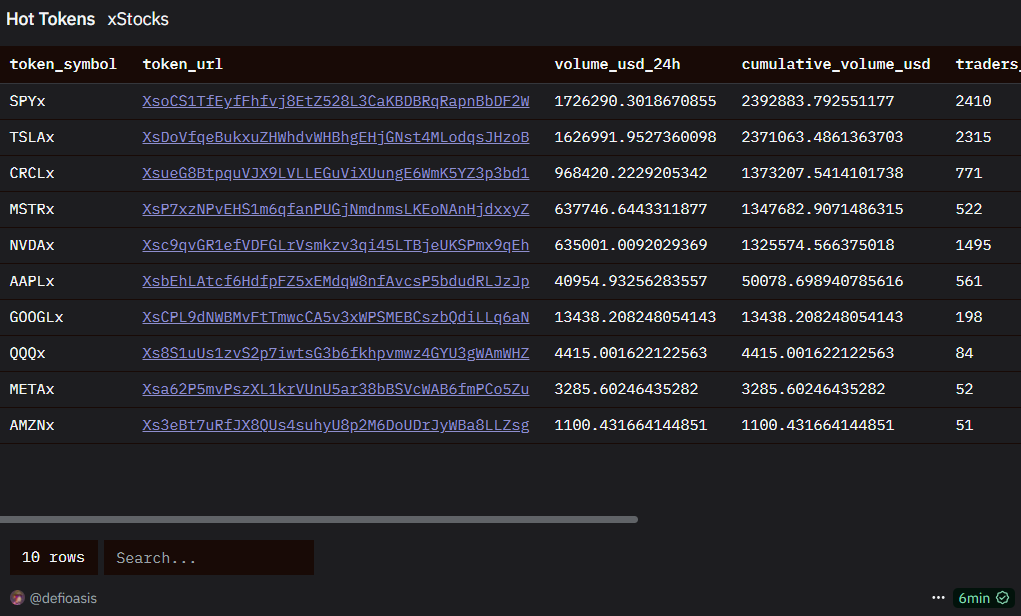

xStocks supports 61 stocks, 10 of which have generated trading volume on the chain

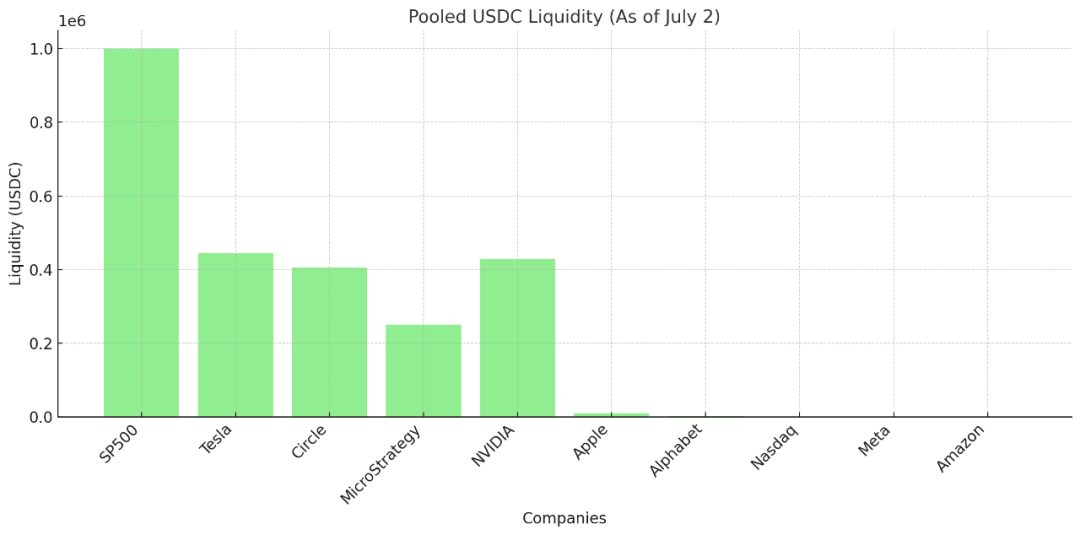

Although it has only been launched for a few days, as of July 2, SPY TSLA CRCL MSTR and NVDA have accumulated more than $1 million in trading volume. In addition, AAPL GOOGL QQQ META and AMZN have also generated user transactions. Some meme trading platforms such as GMGN have also launched xStocks trading partitions.

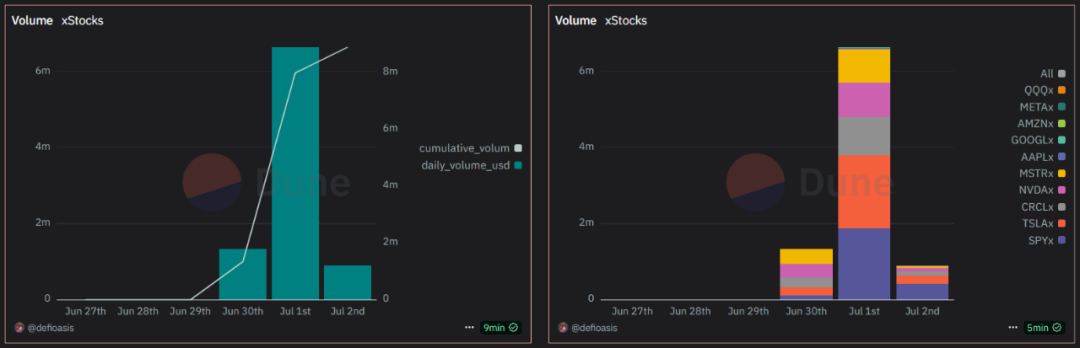

xStocks stock token trading volume surges after being supported by Bybit and Kraken

After announcing the support of Bybit and Kraken, xStocks' trading volume increased significantly for two consecutive days, reaching US$6.641 million on July 1, with more than 6.5k trading users and more than 17,800 transactions. On that day, the daily trading volume of TSLA SPY and CRCL both exceeded US$1 million.

1 coin is anchored to 1 share

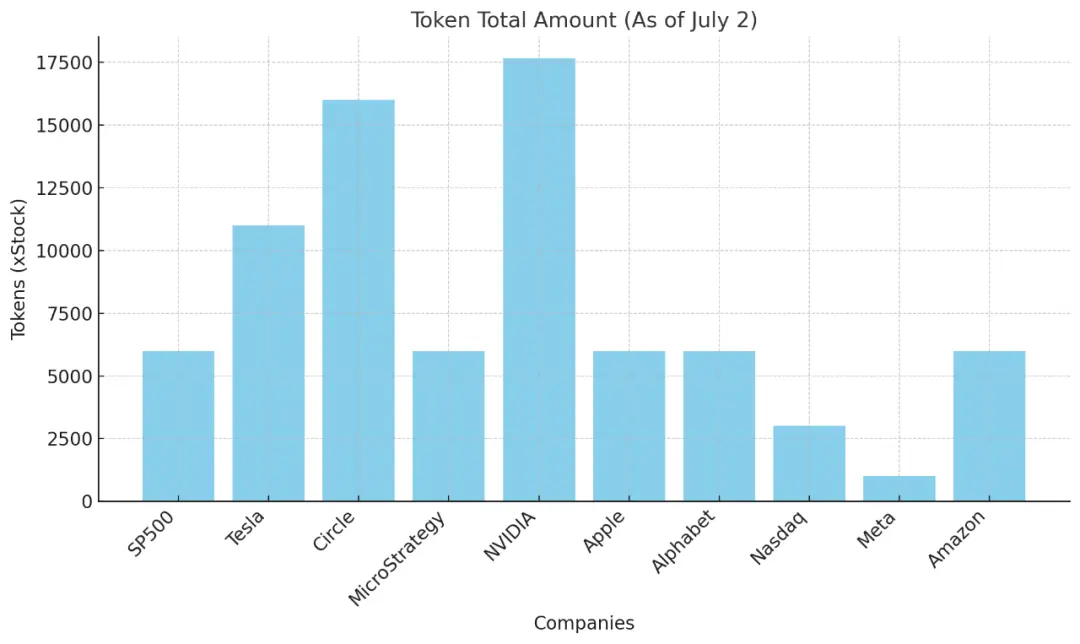

xStocks follows the logic that 1 token equals 1 share of stock. Professional investors or compliant investors can apply for a Backed Account to purchase stocks through Backed. Backed will help these primary investors to purchase stocks at brokerages. The purchased stocks are held in custody by a third-party institution and the number of purchased stocks is minted into a corresponding number of tokens through xStocks and returned to the primary investors. Primary investors with Backed Accounts can issue and redeem stock tokens at any time. Among the 10 xStocks stock tokens that have been traded, NVDIA, Circle and Tesla stock tokens have the largest total amount, all exceeding 10,000.

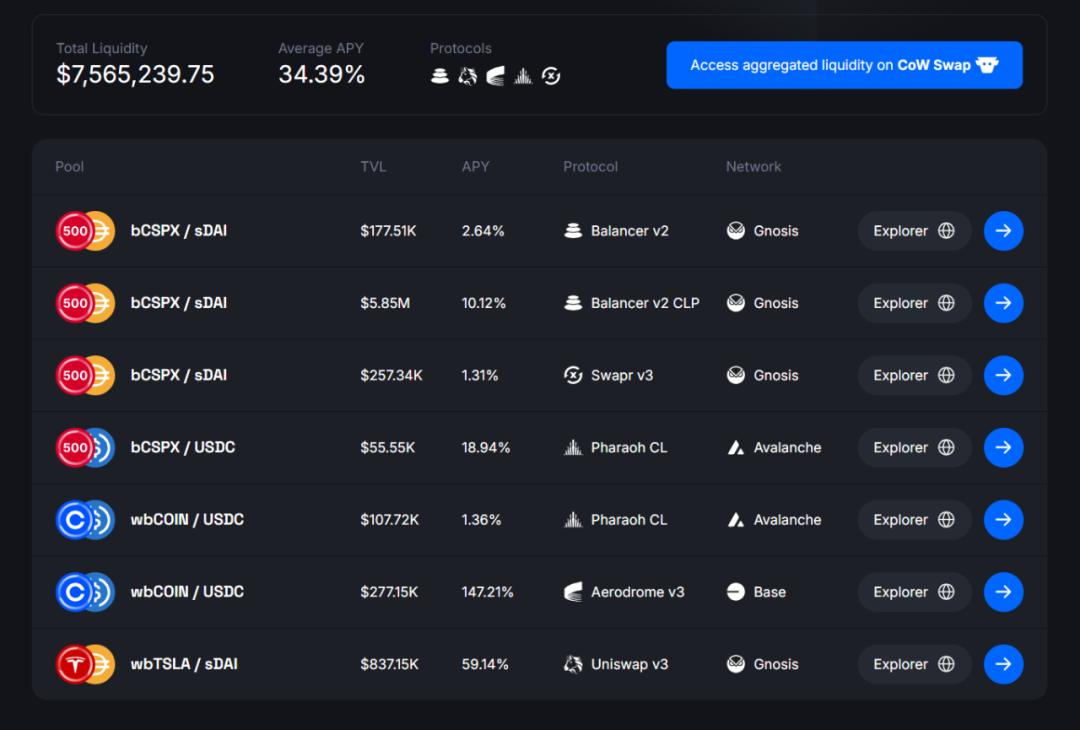

Liquidity depends on exchange market makers

The issuance rights of stock tokens are concentrated in the hands of primary professional investors, but they are issuing stock tokens, so who will provide liquidity becomes a problem. The significance of xStocks' cooperation with exchanges is not only to provide distribution channels for stock tokens, but also to make exchanges a part of primary issuance and use the market maker resources of exchanges to provide better liquidity. The activeness of transactions and the depth of the pool complement each other. The more active the transactions, the more liquidity will be provided. In particular, the SP500 (SPY), which has the highest trading volume, has a USDC-based liquidity of 1 million US dollars on the chain, which exceeds the market value of the stock tokens currently issued. However, stock tokens with low trading volumes are facing the embarrassing situation of no one providing liquidity.

Use third-party DeFi protocol tokens to guide and incentivize retail investors to provide stock token liquidity

In the future, the xStocks stock tokens issued on Solana should refer to bStocks issued on the EVM network and supported by Backed, and reach certain cooperation with public chains and mainstream DEXs, using such third-party protocol tokens to incentivize and guide the liquidity of stock tokens. Currently, xStocks is also actively cooperating with DeFi protocols on Solana, including DEX aggregator Jupiter and lending protocol Kamino.

Robinhood Stocks on Chain

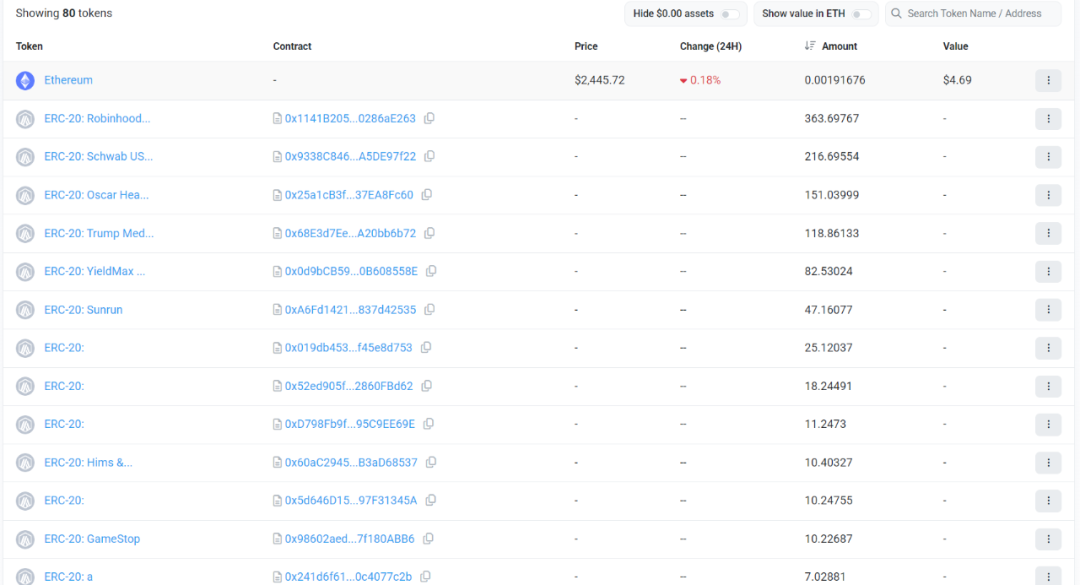

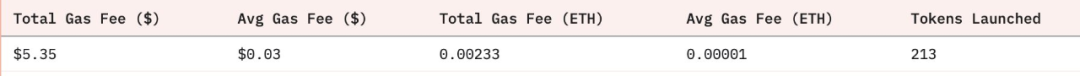

Robinhood: Deployer has deployed 213 tokens or is testing stock tokens

Robinhood chose Arbitrum to issue its stock tokens, deploying 213 stock tokens at a cost of only $5.35, with an average cost of only $0.03 per token. Low transaction fees are one of the important factors for Robinhood to choose Arbitrum. Next, Robinhood will develop its own proprietary chain Robinhood Chain based on Arbitrum.

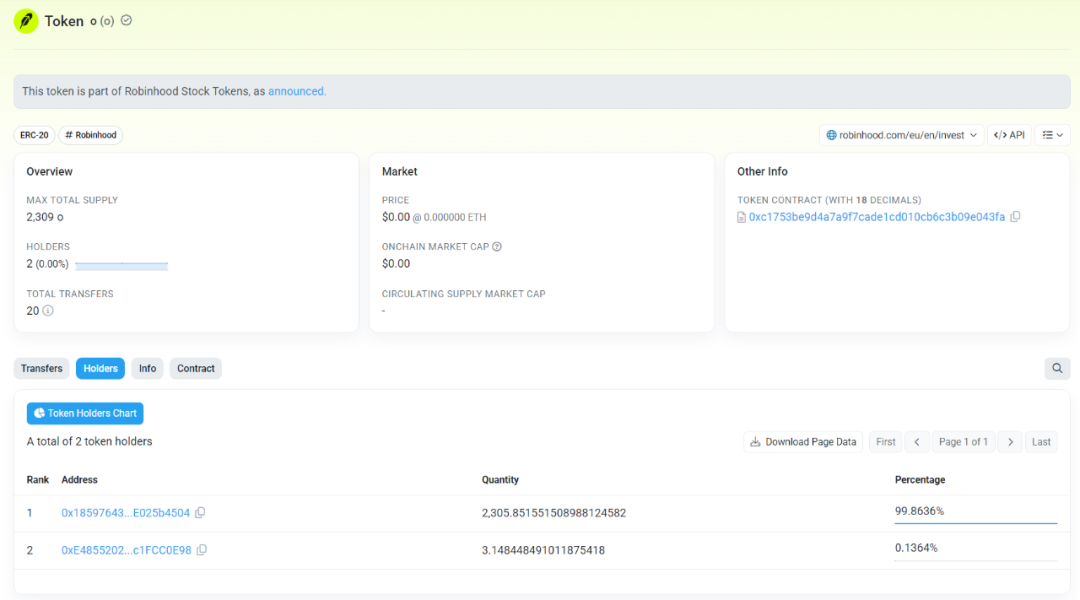

Robinhood has minted 2,309 OpenAI(o) tokens

Robinhood announced that Robinhood EU will launch the world's first batch of private company stock tokens, including OpenAI and SpaceX tokens. Making Crypto a pre-market for high-value potential private company stocks is undoubtedly the most exciting thing for Robinhood to put stocks on the chain. In the future, Crypto users may be able to access and buy those stocks that are about to be listed earlier than traditional stock market investors. Currently, Robinhood has minted 2,309 OpenAI (o) tokens.

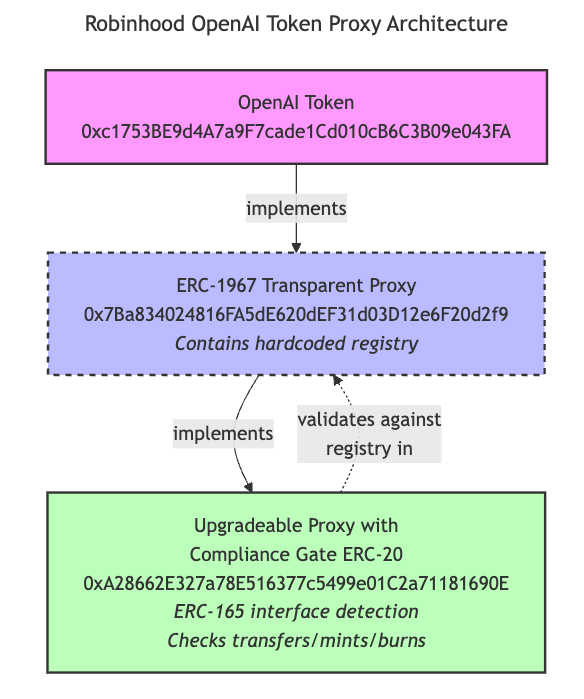

Robinhood’s stock token contracts have compliance requirements built into them

After decompiling Robinhood's stock token contract, Electric Capital researcher Ren found that this is a closed system. Each transfer needs to check the approved wallet registry (KYC/AML). These tokens may not be able to interact with DeFi, but CeFi with distribution functions may benefit. Even if users in the European Union buy stocks on the chain, they cannot transfer stock tokens to other non-registered addresses. Such transfers will be blocked.

79 stock tokens have metadata set and will be launched soon

In addition to OpenAI, Robinhood-related addresses have set metadata for 79 deployed stock tokens, including stocks such as Robinhood Markets, Trump Media & Technology Group, GameStop, and ETFs such as Schwab US Dividend Equity ETF and Yieldmax MSTR Option Income Strategy. Some stock tokens with metadata set have been minted in small quantities.