Written by Shaofaye123, Foresight News

The stablecoin track has always attracted much attention. Usual rose from 0.25 U to 0.8 U before the market opened. The Trump family's crypto project World Liberty chose to invest in ENA. Binance bet on the Solana chain stablecoin infrastructure Perena, while the Base chain stablecoin seems to have been tepid. This article takes you through ANZ, from breaking the issue price to a 4-fold increase. Is it a new Alpha opportunity or a one-time project?

Starting from the wealth effect of FJO

In mid-November, the market rebounded, on-chain liquidity gradually overflowed, and funds began to look for speculative targets. The spillover effect of the on-chain new platform Fjord is particularly obvious, especially in hot tracks, such as: AI Agent, whose launch project odds are extremely high, with the highest increase of 33 times. The online projects are often sold out within minutes, and some scientists even booked the entire quota. With the overflow of the wealth effect of the platform's launch projects, the opening of pledges and potential airdrops have also increased its platform token FJO from 0.5 U to 1 U.

As a long-term hot spot for speculation, the stablecoin track has attracted much attention on December 2. The Base chain (USDz) stablecoin project Anzen launched by Fjord has attracted much attention. The token was sold out as soon as it was launched. However, it was broken after its launch, from 0.01 U to 0.005 U. Is it a Rug project or an Alpha opportunity?

Anzen Finance Background Information

Anzen is the issuer of USDz, which is in the RWA track. It is currently on 4 chains and will expand to more chains in 2025. USDz plans to be launched on platforms such as Movement, Berachain, Plume, Mantra, Monad, and Initia. Users holding USDz can obtain sustainable RWA income. Like projects such as Usual, its underlying is also treasury bond income. Users obtain sUSDz by staking USDz tokens. DeFi users have the opportunity to obtain sustainable returns and diversify their portfolios. It currently offers an annual interest rate of 14.8%.

Anzen's Secured Private Credit Portfolio

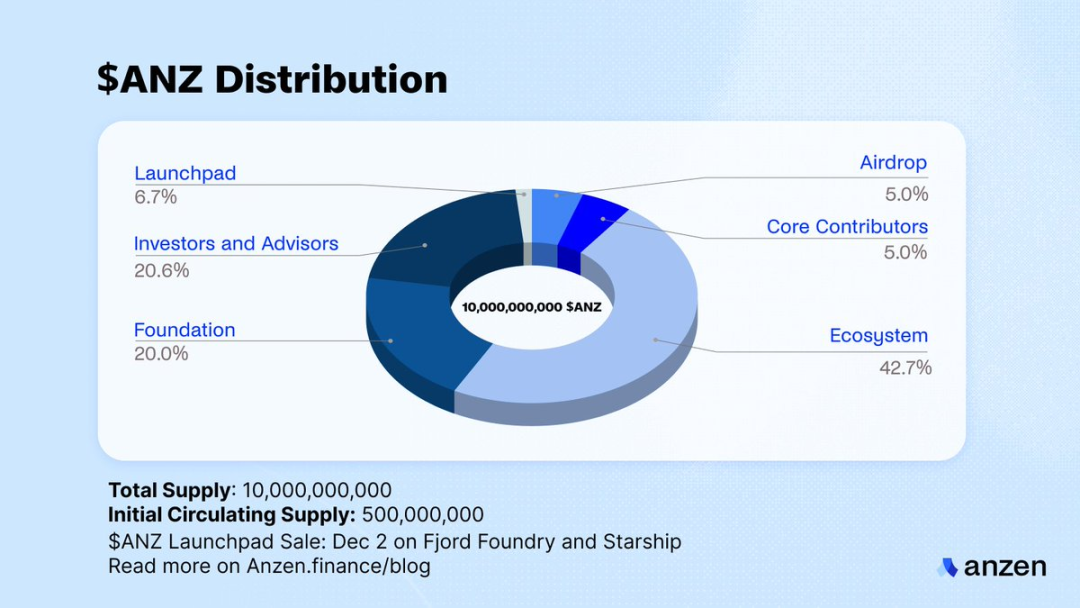

ANZ adopts the ve model, which will be used to manage and develop the Anzen protocol and ecosystem, including: liquidity incentives, ANZ holder functions, basic rewards, protocol fees and voting pool incentives. The public sale of ANZ was launched on December 2 through FJO Launchpad, with a fixed price of 0.006 U. The total supply of tokens is 10,000,000,000, with Launchpad accounting for 6.7%, community airdrops accounting for 5%, and ecological rewards accounting for 2.7%. Currently, its circulation is about 11.6%.

Comprehensive Strength

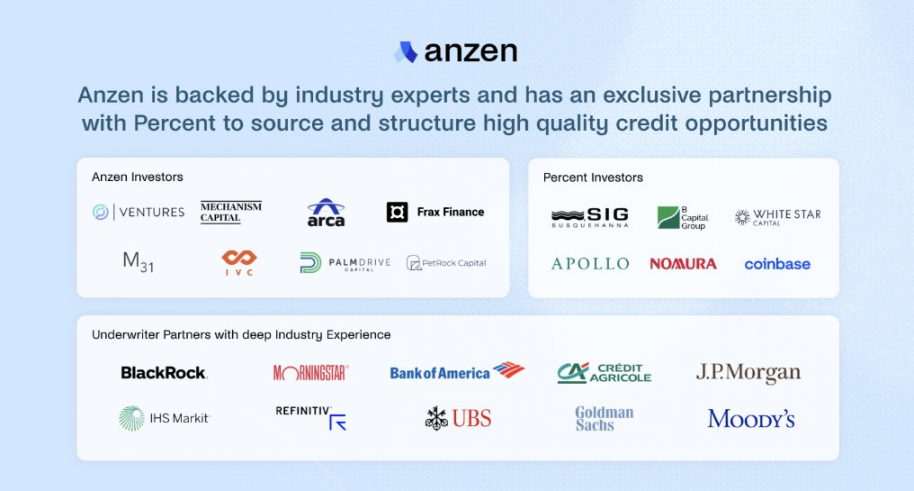

According to The Block, Anzen Finance has now received $4 million in seed round financing to support the development of its RWA-backed stablecoin. Mechanism Capital, Circle Ventures, Frax, Arca, Infinity Ventures, Cherubic Ventures, Palm Drive Ventures, M31 Capital, Kraynos Capital and other companies participated in this round of financing.

The Anzen Finance team is from Taiwan and consists of a credit investment team with more than ten years of experience in joint lending. Since 2018, the team has been studying the mechanism of putting credit assets on the chain. Its underwriting and custody partner is Percent, which has a transaction volume of 1.6 billion, an annual yield (APY) of 16%, and a default rate of 2% in the past seven years.

The ANZ project seems to have no shortage of cooperative resources, and it also has close relations with major KOLs and NFT communities. Doodles, PudgyPenguins, etc. all have its presence. The project seems to be well versed in operations. On December 16, it also changed its avatar to a fat penguin.

In addition, according to the author's observation, the ANZ project has been continuously adding small amounts of funds to the pool since its launch, and smart money has been continuously buying. The price of its token ANZ has risen 4 times from the bottom.

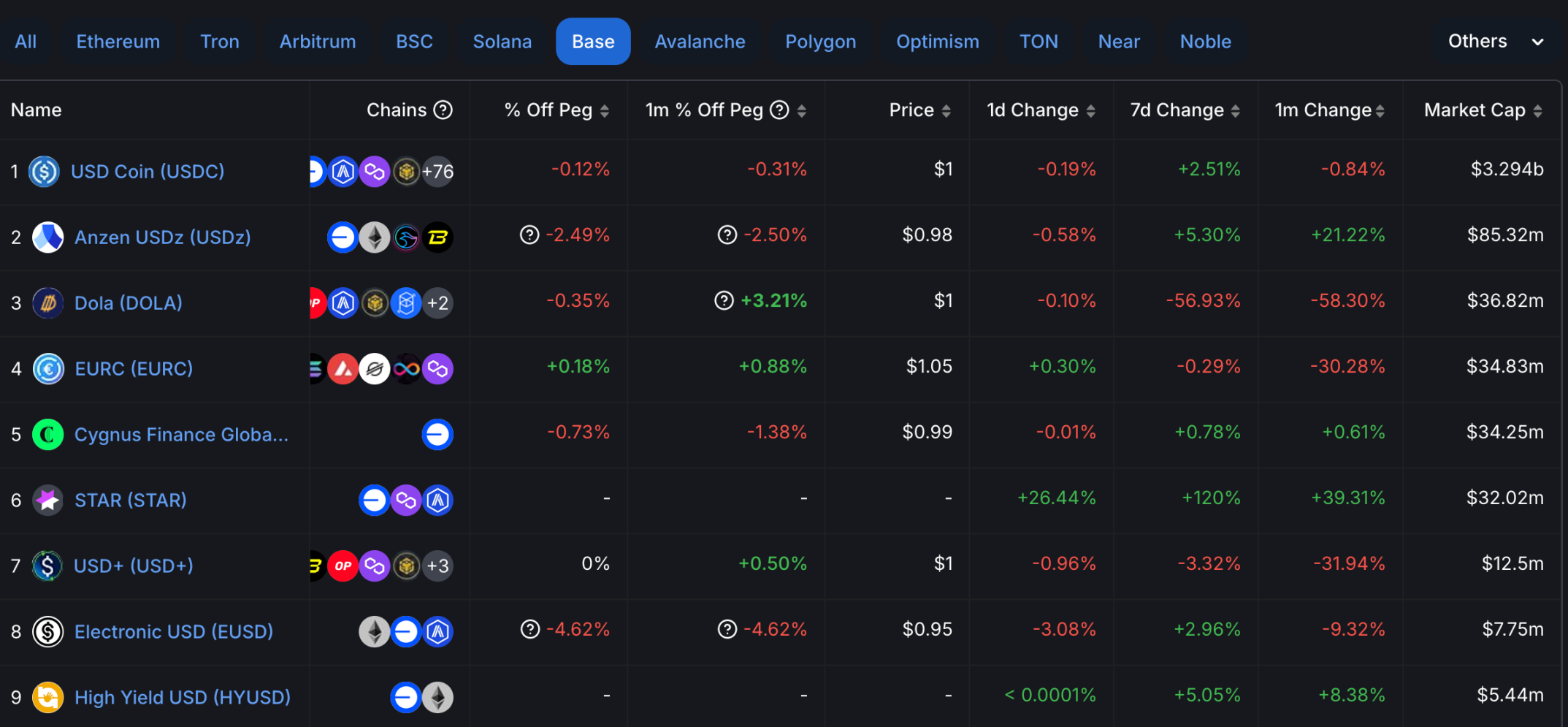

The TVL of the entire stablecoin track has grown from 130 billion at the beginning of the year to 203 billion. With the rise of Trump and the acceleration of the compliance process, the stablecoin track still has great development potential. At present, USDC still occupies the leading position in the Base chain stablecoin (TVL reaches 3.3 billion), and the third-ranked stablecoin DOLA has experienced multiple depeggings of more than 2% in history. Since its release, USDz has surpassed DOLA to become the second largest stablecoin in Base, but both TVL (90 million) and ANZ's current market value (20 million) are still at a low level, and the risk of participation is high.