1. Market observation

Although the United States extended the tariff suspension period to August 1, it threatened again this week to increase tariffs on imports from major trading partners, causing uncertainty about the final tariff level to continue to ferment. According to a UBS report, the current tariffs are equivalent to a tax of 1.5% of GDP on US importers, and the annualized tariff revenue has exceeded US$300 billion. Its lagged effect on inflation is expected to be reflected in the July CPI data released in August. This delay is due to corporate inventory buffers, slow price transmission of intermediate products, and the bimonthly sampling mechanism of CPI. Historical experience shows that it takes 2-3 months for a 10% general tariff to be fully reflected in the price index. In terms of interest rate policy, the Federal Reserve is facing a dilemma: the New York Fed survey shows that one-year inflation expectations have fallen back to 3%, but sub-items such as medical expenses (9.3%) and college tuition (9.1%) are under significant pressure, while the labor market shows contradictory signals - unemployment concerns have eased but re-employment has become more difficult.

As the Hong Kong Stablecoin Ordinance is about to take effect in August, the market is full of expectations for the compliance dividends brought by the relevant regulatory framework. HashKey Chief Analyst Jeffrey Ding pointed out that Hong Kong stocks such as Jinyong Investment have doubled recently, reflecting the market's strong expectations for compliance dividends after the ordinance takes effect in August. The regulatory framework revealed by Deputy Secretary for Finance, Xu Zhengyu, will cover core requirements such as anti-money laundering and reserve audits. The first batch of licenses planned to be issued this year may reshape the industry's competitive landscape. However, Jeffrey Ding also warned that stablecoins still need to break through three obstacles to subvert the traditional payment system: the profit distribution mechanism between financial institutions and technology companies, the problem of cross-border regulatory coordination, and the systemic risk pressure test under extreme market conditions.

The cryptocurrency market is undergoing a critical technical breakthrough and cycle verification phase, with bulls and bears competing fiercely around $110,000. Analyst 0xENAS pointed out that if the price fails to break through this resistance level, it may quickly fall back to $100,000; otherwise, it is expected to hit $120,000. A more optimistic forecast comes from analyst Ted Pillows, who combined the trend of the M2 money supply and believed that Bitcoin may rise to the range of $120,000 to $125,000 in the next stage. From a longer time period, analyst Rekt Capital calculated based on the historical halving cycle that the peak of this bull market may occur in mid-September to mid-October 2025, which coincides with the trading plan of analyst Jelle, who has begun to gradually reduce his position and plans to completely exit the market by October 2025. Ali said that Bitcoin has solid support around $106,360.

Regarding Ethereum, analyst Open4profit said that after reaching $2,600, ETH is approaching the triangle resistance level of $2,630. Open4profit suggested paying attention to the change in trading volume to confirm the trend. At the same time, the market's optimism about Ethereum has also spread to stocks holding related tokens. GameSquare's stock price soared 58.76% in a single day, and related listed companies such as Sharplink (+28.57%) and Bit Digital (+7.47%) also strengthened simultaneously.

In the altcoin market, Vertex announced that it would migrate the DEX on Arbitrum to the Ink network and gradually phase out the native token VRTX, causing VRTX to plummet 60% in 24 hours. Although the battle between Solana ecosystem Letsbonk and Pump.fun's MEME tokens is still hot, the related token LetsBONK has experienced a callback of more than 30%, and the market temporarily lacks a sustainable new narrative. It is worth noting that the market value of $Lore tokens exceeded 2 million US dollars when retweeted and commented on the X platform.

2. Key data (as of 12:00 HKT on July 9)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $108,513 (+15.99% YTD), daily spot volume $21.324 billion

Ethereum: $2,600.10 (-22.06% YTD), with daily spot volume of $15.521 billion

Fear of Greed Index: 67 (greed)

Average GAS: BTC: 0.52 sat/vB, ETH: 0.3 Gwei

Market share: BTC 64.2%, ETH 9.3%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, CRO, BONK

24-hour BTC long-short ratio: 0.9728

Sector ups and downs: DeFi sector rose 2.89%; L2 sector rose 2.78%

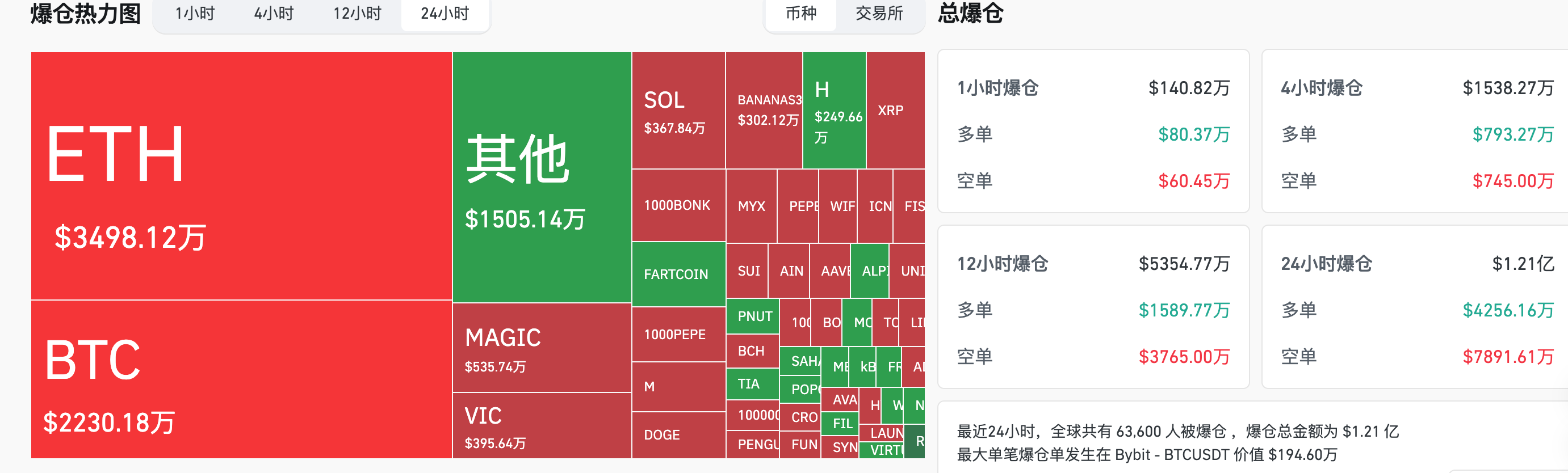

24-hour liquidation data: A total of 59,563 people were liquidated worldwide, with a total liquidation amount of US$121 million, including BTC liquidation of US$22.3 million, ETH liquidation of US$34.98 million, and MAGIC liquidation of US$5.35 million

BTC medium and long-term trend channel: upper channel line ($108,964.14), lower channel line ($106,806.44)

ETH medium and long-term trend channel: upper channel line ($2545.01), lower channel line ($2494.61)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 8)

Bitcoin ETF: +80.08 million USD, 4 consecutive days of net inflow

Ethereum ETF: +46.6308 million USD, net inflow for 3 consecutive days

4. Today’s Outlook

Binance Alpha and Binance Futures will list Tanssi Network (TANSSI)

The Federal Reserve released the minutes of its monetary policy meeting. (July 10, 02:00)

2025 FOMC voting member and St. Louis Fed President Moussallem delivered a speech on the U.S. economy and monetary policy. (July 10, 21:00)

Number of initial jobless claims in the United States for the week ending July 5 (10,000): previous value 23.3, forecast value 23.5 (July 10, 20:30)

The biggest gainers in the top 500 by market capitalization today: Treasure (MAGIC) up 46.05%, Banana For Scale (BANANAS31) up 31.92%, Zebec Network (ZBCN) up 16.77%, Cronos (CRO) up 16.70%, and VVS Finance (VVS) up 15.75%.

5. Hot News

Vertex will shut down its existing DEX and migrate to Kraken-supported Layer 2 network Ink

"Yiwu merchants begin to collect stablecoins" ranked fourth on Baidu's hot search list

Listed Real Estate Company Murano to Build Bitcoin Reserve with $500 Million Equity Deal

Bit Digital sells 280 Bitcoins, uses proceeds to buy Ethereum

Publicly traded GameSquare raises $8 million to launch Ethereum fund management strategy

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.