Author: Poopman, IOSG Researcher

Compiled by: 0xjs, Golden Finance

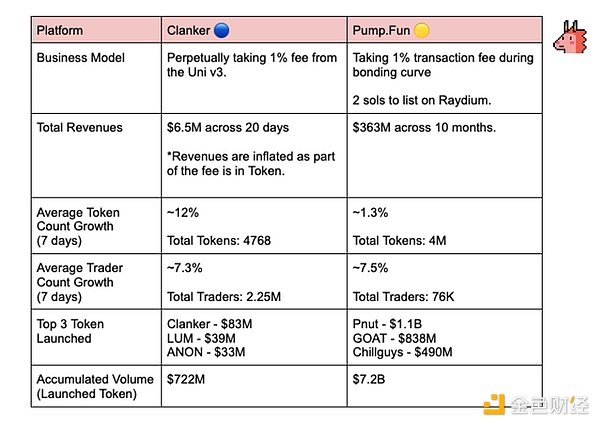

1. Business Model

PumpFun: 1% transaction fee + 2 sols during the bonding curve period to be listed on Raydium.

Clanker: Since there is no bonding curve, permanently charge 1% fees from Uni v3 and use the #LpFeesCut function.

New Upgrade: 0.4% of fees will be returned to issuers, providing more incentives for issuing tokens.

2. Total income

PumpFun: $363 million in revenue in 10 months. Currently 55 times larger than Clanker.

Clanker: $6-7 million in revenue in 20 days. Revenue is inflated because some of the fees are in tokens.

3. Token quantity growth (7 days)

PumpFun 4 million tokens, daily growth of about 1.3%)

Clanker currently has 4768 tokens, with a daily growth of about 12%.

4. Top 3 Tokens by Market Cap

PumpFun:

- Pnut - $1.1 billion

- GOAT - $838 million

- Chillguys - $490 million

Clanker:

- Clanker - $83 million

- LUM - $39 million

- ANON - $33 million

Some key points:

While Clanker has managed to direct a lot of volume on Base, it has yet to send any positive signals for Farcaster.

Early bot sniping appeared to be a problem, but there was no clear/accurate data on its toxicity.

Farcaster has a limited user base, which may hinder the growth of the number of tokens. However, this design can provide strategic value to both Base and Farcaster.

The increasing diversity of assets on Base is the key to unlocking the "real" Base Season.