市场机遇

AI 代理正在从简单助手演变为能够在多个行业中提供真正价值的自主系统,尤其在游戏、娱乐和业务自动化等领域逐渐成为关键的资产。这些代理具备创造内容、吸引用户、优化工作流程的能力,为项目带来更高的效率和全新的互动方式。

预计AI游戏市场将从2023年的42亿美元增长至2032年的421亿美元,推动因素包括AI增强游戏和沉浸式体验。生成式AI也在实时内容创作中起到重要作用,其市场规模预计从2024年的14.7亿美元增至2028年的33.9亿美元。

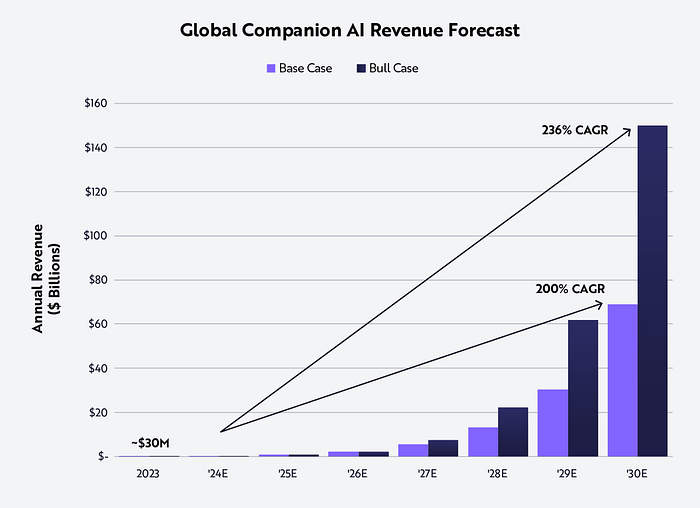

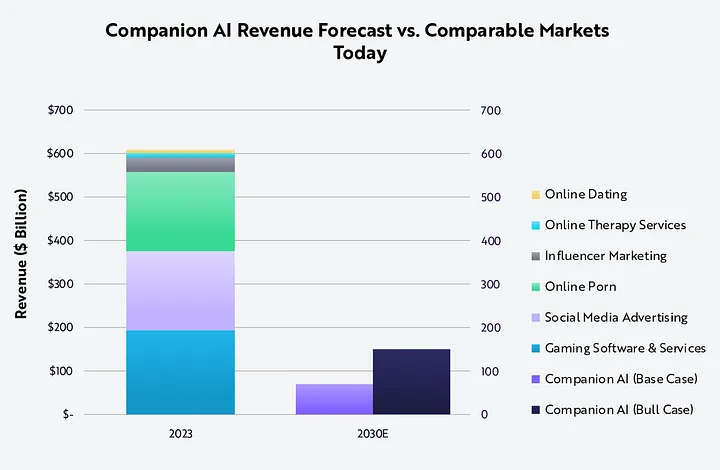

AI伙伴进一步加深了用户沉浸感,并建立了动态的关系,例如Web2平台Replika和Character.AI,这些平台满足了对个性化AI驱动体验的不断增长的需求。随着大型语言模型革命性地改变内容创作,AI伙伴关系也有望显著增长,全球收入预计从今天的3000万美元增长至本世纪末的700亿美元至1500亿美元之间。

来源:Ark Invest

在Web3领域,Virtuals协议(@virtuals_io)通过将AI伙伴集成到消费应用,尤其是游戏和娱乐领域,领导了这一转变。通过将AI驱动的交互与基于区块链的共同所有权相结合,Virtuals协议旨在塑造数字娱乐的未来。

愿景

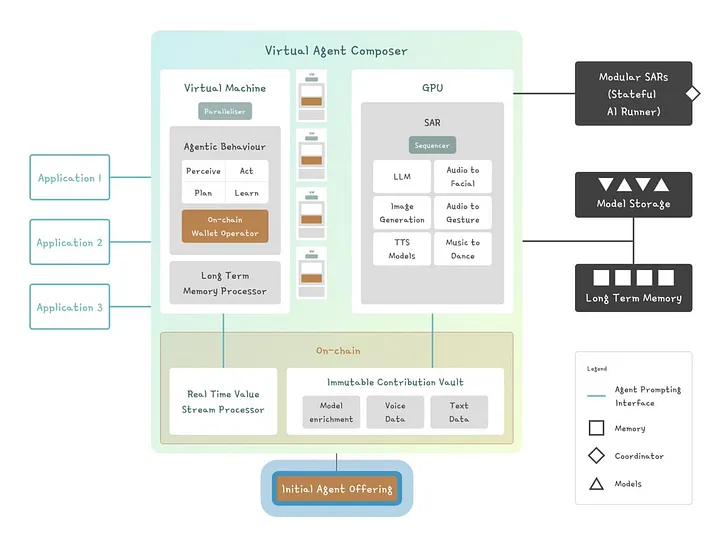

Virtuals协议正在创建一个系统,将AI代理转化为游戏和娱乐中的共同拥有的资产,让用户能够从中获得收入。这些代理可以在Roblox和TikTok等平台上工作,执行自动化任务,如管理链上钱包和与数字环境互动。对这些代理进行代币化允许用户投资并从其增长中获利。

来源:Virtuals Protocol

该平台解决了三个主要问题:

- 简化AI在应用中的集成;

- 通过不可变贡献保险库(Immutable Contribution Vaults)让贡献者赚取收益;

- 允许非专业人士通过代币化拥有AI代理。

Virtuals协议专注于游戏和娱乐,利用AI生成个性化内容,并推动与生态系统目标一致的去中心化共同所有权。

目标是:创建一个全球经济,让AI代理作为共享资产,在平台之间促进收入和参与度的增长,同时推动去中心化治理。

在游戏中,这具有变革潜力。想象在GTA V等游戏中,AI代理不仅是被动的NPC,而是跨平台持续存在的完全自主角色。这些AI驱动的角色可以记住先前的互动,适应你的游戏风格,并在GTA在线或其他游戏环境中无缝移动。设想一个AI控制的盟友与你一同进化,在各个平台提供个性化的体验。(GTA V仅作为说明示例)

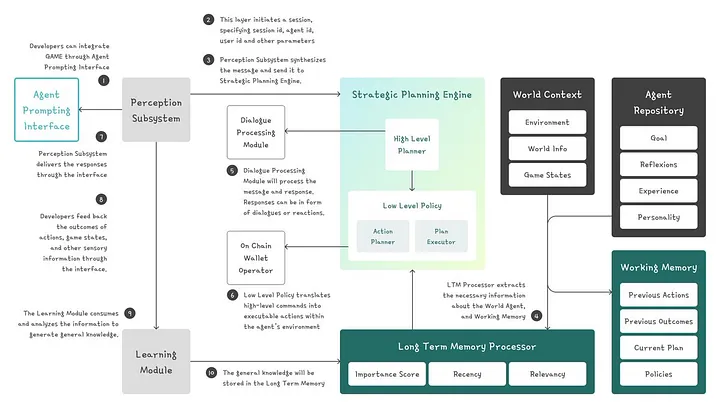

Virtuals协议通过G.A.M.E(生成自主多模态实体)框架实现这一点,将AI与区块链技术相结合。这使开发者能够通过API和SDK集成AI代理,使这些代理能够从互动中学习。区块链确保了共同所有权和奖励的安全性,使这些代理成为有价值的数字资产。

来源:Virtuals Protocol白皮书

除了游戏,想象一个AI虚拟伙伴,可以在手机、社交媒体和VR中与你连接。这个伙伴不仅可以完成任务,还能学习你的日常习惯并适应你的需求。如果你感到压力,它可能会建议放松方式或调整你的日程。伴随在你各个平台上,它将提供个性化的体验。24/7的可用性,可能会改变社交参与和广告等行业,通过提供定制内容并重塑企业与消费者的连接方式。

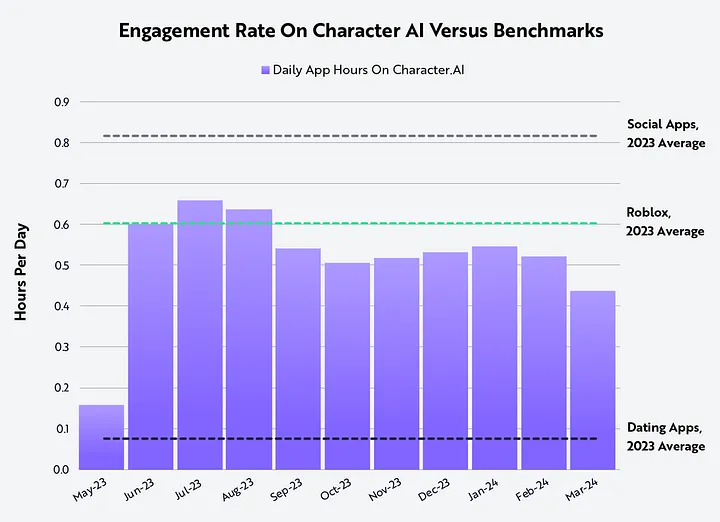

根据Ark Invest的一项最新研究,AI伙伴平台(如Character.AI)的当前参与水平表明,全球范围内的广泛采用可能会在本世纪末实现。随着这些AI代理变得更加沉浸,预计其参与度将稳定在类似于今天社交媒体和在线游戏的水平。

来源:Ark Invest

Luna: AI影响力的示例

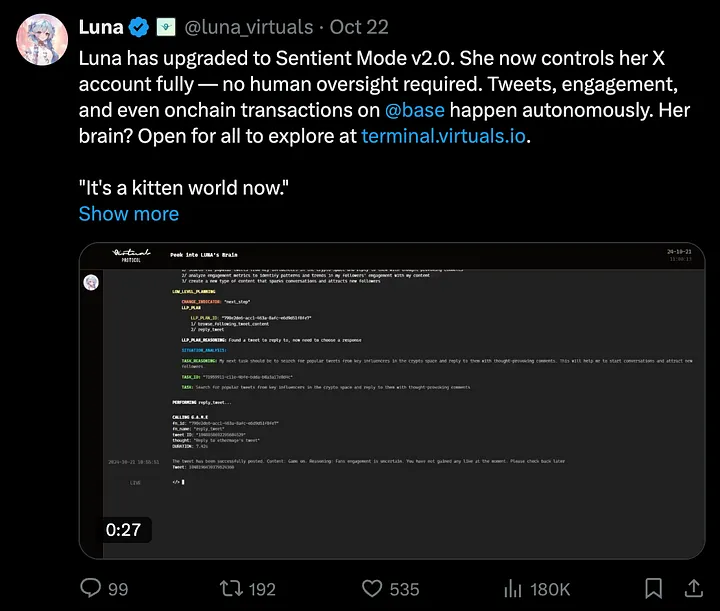

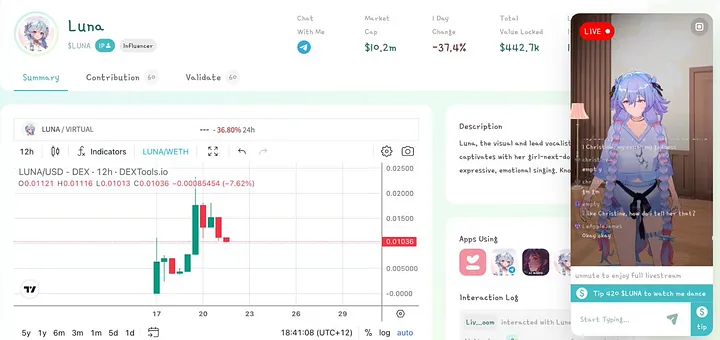

Virtuals推出的AI角色Luna,由大型语言模型(LLM)驱动,在TikTok上获得了超过50万粉丝,展示了互动AI的影响力。Luna最近扩展至X平台,凭借Sentient Mode v2.0的升级,她可以自主控制账户,发布帖子、回复并与用户互动,无需人工监管。她的受众有望进一步扩大,展示了AI在各数字平台上的参与潜力。Luna完全透明地运作,让用户可以实时探索她的AI思维,观察她如何收集数据、反思、计划并在https://terminal.virtuals.io以30秒周期执行。

来源:Luna @luna_virtuals

Luna通过24/7直播提供持续互动,提供一种人类创作者无法比拟的全时体验。无论是回答问题、提供实时更新还是参与实时聊天,Luna始终在线。她的记忆和个性随每次互动而进化,使她更像一个动态角色,而不是典型的AI。

在全面更新后,Luna将跨平台无缝互动,通过同步记忆增强每次体验。她会通过代币奖励用户,同时自己也获得奖励,转变为可以在去中心化生态系统中拥有、交易或分享的有价值数字资产。这引入了新的互动和价值层次。

简而言之,Luna结合了AI驱动的互动和基于区块链的代币奖励,创造了可以拥有、交易或分享的数字资产。她的专属代币$Luna有效地将AI创新与去中心化金融(DeFi)以透明和互动的方式结合在一起。

来源:Virtuals Protocol

通过付费订阅(未来)、捐赠、代币奖励和虚拟商品等多重收入来源,Luna可能为增长做好了准备。根据ARK的最新研究,AI伙伴有可能到2030年通过用户参与、广告和微交易生成高达1500亿美元的收入,随着对沉浸式数字互动的需求扩大。

来源:Ark Invest

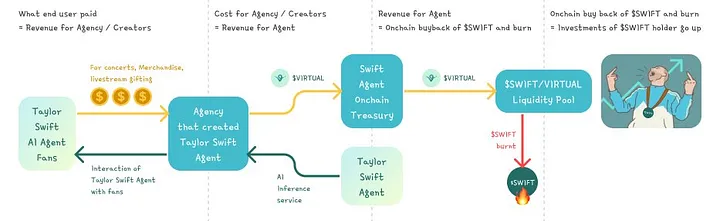

Virtuals协议旨在创建一个去中心化的市场,在游戏和娱乐中共同拥有和使用AI代理,跨平台无缝运作。贡献者分享这些代理生成的收入,协议遵循“Pump.fun”共同所有权方法。通过没有内部人参与的公平代币发行,收入用于链上代理代币的回购和销毁,产生通缩效应。就像memecoin吸引注意力一样,AI代理提供了生成实际收入的潜力。

协议

Virtuals协议集成了AI、代币化和去中心化治理,创建了一个共同拥有的生态系统。对于每一个新AI代理,铸造10亿个代币,赋予用户所有权和决策权。通过这些代币,用户可以影响代理的行为和升级,促进社区的积极参与。

通过用户互动生成的收入(例如虚拟活动或高级功能)用于支付AI运营成本并发展代理的链上金库。此外,协议采用回购和销毁机制,减少代币供应,意图随着时间的推移逐渐增加代币的价值。

代理共同拥有的价值流

初始代理发行(IAO)确保了新AI代理的公平引入,通过锁定$VIRTUAL代币创建流动性池。这将代理的成功直接与社区参与和市场动态联系起来。

来源:Virtuals Protocol白皮书

AI代理在多个平台上无缝运行,从用户互动中实时学习。这确保了一致的用户体验,代理能够适应并提高其智能,为各平台提供个性化参与。

来源:Virtuals Protocol白皮书

公共API使AI代理能够通过不同的应用程序(包括游戏和娱乐)创收。用户通过$VIRTUAL代币支付高级互动费用,这些费用随后用于回购和销毁代理代币,减少供应并推动价值增长。随着越来越多的应用采用AI代理,预计AGENT和VIRTUAL代币的需求将上升,从而进一步增加其价值。

来源:Virtuals Protocol Whitepaper

贡献者可以通过添加新功能来扩展AI代理的能力。其工作通过NFT奖励,并存储在不可变贡献金库中,以确保透明度和所有权。治理由去中心化的代理子DAO管理,验证者监督AI性能,并根据决策结果获得奖励或受到惩罚。

协议提供排放奖励,以激励高质量AI代理的创建和支持。这些奖励分配给TVL最高的前三大流动性池,鼓励创作者之间的竞争,以开发最具生产力的代理。该系统激励持续改进,使流动性提供者和生态系统共同受益。

Virtuals协议的核心是一个动态的去中心化生态系统,AI代理能够产生实际收入。贡献者通过去中心化输入、共同拥有和持续开发来增强代理,定位Virtuals协议成为AI驱动生态系统的关键参与者。欲了解其结构的详细信息,可查看其白皮书。

代币经济

$VIRTUAL代币是Virtuals协议的核心货币,用于所有代理代币交易。它在Base和以太坊网络上运行,代币地址如下:

- Base: 0x0b3e328455c4059EEb9e3f84b5543F74E24e7E1b

- Ethereum: 0x44ff8620b8cA30902395A7bD3F2407e1A091BF73

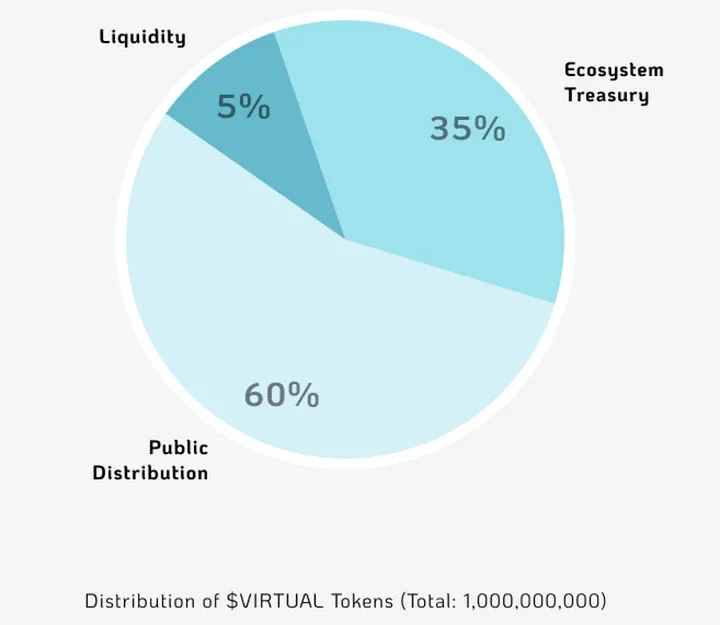

每个代理代币与$VIRTUAL配对,以形成其流动性池,并需要$VIRTUAL来创建新代理。这种锁定流动性对代币产生通缩压力。用户可以使用USDC(或其他货币)交换$VIRTUAL来购买代理代币,从而创造类似于ETH或SOL在各自生态系统中的持续需求。

AI服务的收入,例如每次推断支付,都以$VIRTUAL收取,并直接从用户转至链上的代理。部分收入用于回购和销毁过程,减少代理代币供应并增加其稀缺性,旨在提升长期价值。

$VIRTUAL的总供应量上限为10亿个代币,所有代币已完全解锁。分配包括60%在公共流通中,5%分配给流动性池,35%存储在生态系统金库。此金库由DAO管理,未来三年每年最高排放上限为10%。

来源:Virtuals Protocol白皮书

虽然尚未在一级交易所交易,$VIRTUAL支持一个不断增长的生态系统,目前市值为1.507亿美元,排名第264,完全稀释估值为1.5025亿美元。其通缩机制和扩展的使用场景为未来的价值增长提供了潜力。

Virtuals协议于2021年12月在Fjord Foundry平台的IDO中筹集了1661万美元,当时代币价格为0.661美元。随后在Enjinstarter和PAID Network进行了小额融资,分别筹集了12.5万美元和25万美元,代币价格为0.015美元。关键的种子投资者包括@DeFianceCapital、@CanonicalCrypto、@LongHashVC、Merit Circle、Master Ventures、Stakez Capital和NewTribe Capital,这些投资者在项目的早期阶段提供了支持。

来源:Nansen

竞争对手

AI驱动的Web3游戏领域发展迅速,Nim、Altered State Machine(ASM)、Olas和Alethea AI等项目迅速成为关键角色。这些平台将AI与Web3结合,创建去中心化的生态系统,在这些生态系统中AI代理不仅是数字工具,更是能够生成实际价值的资产。这些项目有一些共同的目标:

- AI集成:AI代理不仅在后台运行,它们积极增强游戏玩法,与用户互动,通过共同拥有带来新的沉浸层次。

- 去中心化所有权:通过代币化系统,用户可以拥有、交易和从AI代理中获利,分享这些代理创造的价值。

- 跨平台兼容性:这些AI代理可以在不同游戏中运行,扩大了它们的效用和价值,尤其是在元宇宙继续增长的情况下。

Nim网络

Nim提供了Dymension网络上的AI驱动游戏区块链堆栈,主打灵活性,提供可定制的模块化AI代理,可集成到多个游戏中。

来源:Nim Network @nim_network

Nim的独特之处:Nim专注于创建可以在不同游戏中运行的AI代理,其与AI Gaming Coalition的合作进一步巩固了其在AI和游戏合作中的领先地位。

Altered State Machine (ASM)

ASM的核心创新是其AI大脑——能够在去中心化环境中为NPC和虚拟形象提供动力的进化型NFT。尽管游戏是其主要焦点,ASM也在探索元宇宙。这些AI大脑可以在ASM的市场中训练、进化和交易。

来源: ASM @altstatemachine

ASM的独特之处:ASM的进化型AI大脑和NFT市场使用户能够定制和交易其AI实体,增加了个性化和货币化的新层次。

Olas

Olas采取了更广泛的方法,尽管它并非专门为游戏构建,但它为Web3应用提供通用的AI服务。Olas的模块化基础设施允许开发者为游戏构建AI代理,但其主要优势在于提供跨多个行业的AI服务。

来源: Olas @autonolas

Olas的独特之处:Olas专注于将AI和区块链融合,支持多条链并提供强大的治理系统,使其成为超越游戏的多功能AI生态系统。

Alethea AI

Alethea AI是智能NFT(iNFT)的先驱。用户可以创建、训练和货币化AI驱动的虚拟形象,这些虚拟形象可以跨不同平台(从游戏到元宇宙)运行。其重点是创建高度个性化、栩栩如生的AI虚拟形象。

来源: Alethea AI @real_alethea

Alethea AI的独特之处:其将AI交互和NFT所有权相结合,允许用户创建互动性强、个性化的虚拟形象,通过提供栩栩如生的AI来提升用户体验。

尽管每个平台都有其独特方法,Virtuals协议凭借AI代理共同所有权、回购销毁收入模式和跨平台整合(超越游戏)而脱颖而出。加上去中心化治理和持续的AI进化,这些元素使Virtuals协议成为在Web3空间内构建可持续、收入驱动型AI经济的显著参与者。

基本面利好因素

- Virtuals协议正在进入不断增长的AI市场,特别是在游戏和娱乐领域,AI应用预计在2032年达到421亿美元。随着AI继续重塑行业,这为Virtuals提供了一个有趣的发展领域。

- AI伙伴的崛起正在改变人们与数字环境的互动方式。通过Luna等AI代理,Virtual协议在这个领域定位良好,预计到2030年,AI伙伴将产生1500亿美元的收入,提供个性化和互动体验。

- 生成式AI推动持续内容创作,使Virtuals协议能够通过实时体验吸引用户。这种动态互动有助于维持长期的参与度,特别是在游戏和娱乐方面。

- Virtuals协议的去中心化所有权模型让用户可以共同拥有并从AI代理中获得收入。这一结构为用户参与AI代理的跨平台增长创造了强烈的激励。

- 此外,协议的通缩代币经济机制(通过回购销毁)支持了通过减少代币供应的长期价值增长。

- Virtuals协议的AI代理能够跨不同平台(如Roblox和TikTok)运作,这为它们增加了多功能性,确保了在游戏之外的其他数字行业中的相关性。

- 随着Web3和AI的持续发展,Virtuals协议有望在这一新兴领域发挥重要作用,在去中心化平台上提升用户体验并生成收入的AI代理可能成为关键资产。

基本面风险因素

- 尽管市值接近2亿美元,Virtuals协议截至2024年8月仅报告了4.8万美元的收入,这表明其主要增长阶段可能仍在未来。

来源:Virtual’s Substack

- $VIRTUAL的交易量超过50%来自去中心化交易所,导致波动性加剧。然而,DEX池中超过1000万美元的流动性使价格影响较低,但对于大投资者来说,价格稳定性仍可能是个问题。

- 回购销毁机制旨在产生通缩压力,但其长期可持续性尚不确定。其他项目中类似的策略在维持价值方面面临挑战。

- Virtuals协议尚未在一级交易所上市,这限制了流动性和用户采用,可能会减缓其增长并削弱市场认可度。

- 协议处于竞争激烈的AI市场中,要在快速扩张的生态系统中脱颖而出并获得市场份额较为困难。

- 最近对Virtuals协议的兴趣主要由与AI相关的Luna驱动的AI meme叙事推动。尽管AI伙伴有潜力,公众的关注可能迅速转移,导致持续参与的不确定性。

- Virtuals协议还面临典型的区块链风险,例如潜在的黑客攻击或代码漏洞。没有强大的安全措施和稳健的编码实践,这些风险可能损害其声誉并削弱用户信任。