Author: @xingpt

Before analyzing the AI Agent track, it is better to step out of it and take a look at what crypto has experienced in this cycle as a whole:

Decoupling Bitcoin from the cryptocurrency world

Before this round of Bitcoin, it was almost equivalent to the currency circle. Buying Bitcoin means buying encrypted assets, which means recognizing crypto and decentralization.

However, after the passage of the Bitcoin spot ETF, from the US President to listed companies, buying Bitcoin and recognizing its value seem to have become the mainstream opinion; but the significance of the existence of crypto, especially Ethereum and Altcoins, does not seem to have been recognized by mainstream society and funds.

The reasons are complex.

The main reason is asset positioning: Bitcoin is seen as an alternative asset pegged to gold, and its asset value preservation properties of hedging against inflation and surpassing sovereign currencies are widely recognized.

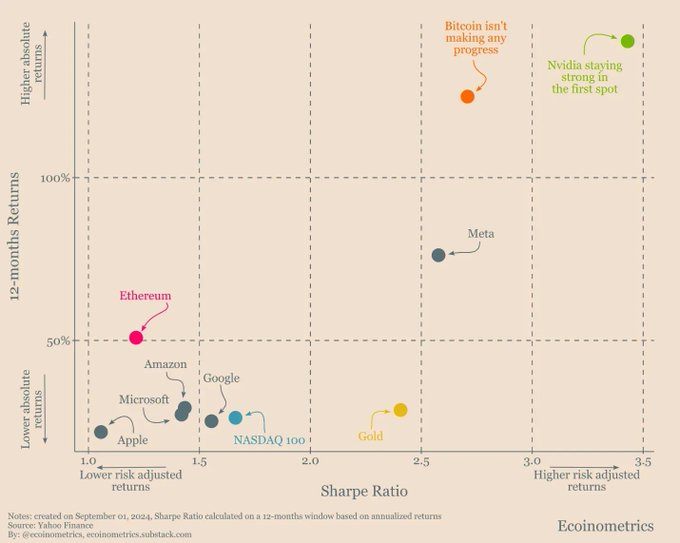

Ethereum and other altcoins are still tech meme stocks without mature and sustainable business models in the eyes of Wall Street old money. But compared with hardcore tech companies like Nvidia, Microsoft, and Amazon that have users, products, and demand, Ethereum and other small-time cryptocurrencies have high valuations and insufficient return elasticity. From an asset allocation perspective, they are assets with extremely low risk-return ratios.

As shown in the figure below, Ethereum's Sharpe Ratio is lower than that of Meta, Google and other technology companies. Bitcoin's Sharpe Ratio is second only to Nvidia, which is the most popular company in this cycle.

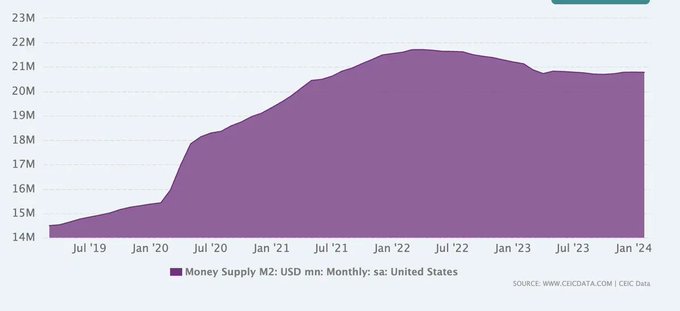

Another important factor is that the overall macro interest rate and monetary easing are still not comparable to the previous cycle of pandemic relief, coupled with the booming AI industry, which makes crypto less attractive to OTC funds. The reason is easy to understand, there is only so much money in total, and if you spend it on buying AI stocks and GPUs, you won’t be able to buy altcoins and Ethereum.

The US dollar M2 money supply has not yet recovered to its 2022 high (data source: CEIC)

The huge imbalance in the circulation ecology of the cryptocurrency circle ( Imbalance)

Since the cryptocurrency market lacks the ability to attract off-market funds, the question is whether the funds within the market can generate sufficient purchasing power.

If we roughly estimate the amount of funds on the exchange using the total amount of stablecoins + contract positions, it is not difficult to find that the total amount of funds on the exchange has far exceeded that of the last bull market. However, except for BTC, most altcoins have not reached new highs. What is the problem?

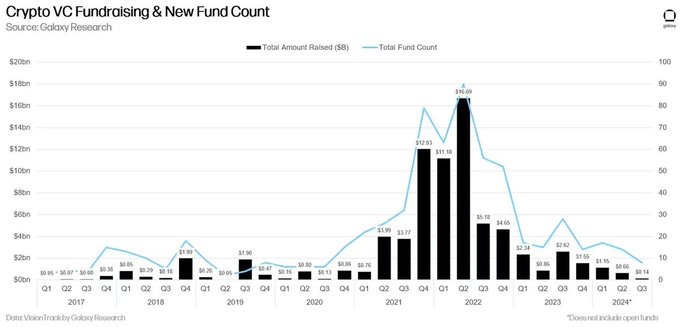

The root of the problem lies in the imbalance between supply and demand. On the supply side, there are a large number of new projects with extremely high valuations, most of which have not found the actual application scenarios of their products (PMF) and do not have many real users.

The reason why these projects exist is due to the bull market in 2022 and the excessive financing of VCs in the cryptocurrency circle. Since VCs in the cryptocurrency circle raised too much funds, and most of these funds were limited to 5 years, with an investment period of about 3 years and an exit period of 2 years, the funds ignored the quality of the projects in order to complete the investment tasks and made crazy investment layouts.

So who will provide the buying power for these projects?

Previously, the main exit channel was centralized exchanges, but centralized exchanges became the target of public criticism after the FTX incident. The long-arm regulation of the Eagle Sauce made centralized exchanges miserable. Not only did they worry about being fined a huge amount of money, but they also had to worry about the risk of their founders being imprisoned. As a result, the goal of centralized exchanges will change from expanding users and increasing trading volume to making profits.

An exchange that focuses on expanding its user base must inevitably give concessions to users, including lowering the valuation of new projects, sharing early project participation opportunities (IEO), and a series of offline and off-site activities to attract new users and expand the circle.

Under the heavy blow of regulation, exchanges have reduced offline and regional expansion and new customers, and have actively or passively stopped profit-sharing businesses such as IEOs. This has also led to insufficient momentum for growth in demand and buying on the exchange.

AI Agent has unique advantages over Meme Coin

As we all know, the core application scenarios of the cryptocurrency circle are asset trading and asset issuance; and each bull market can only generate a wealth effect by allowing users to participate in the new model of asset issuance and asset trading, thereby triggering a bull market phenomenon in which funds within the circle are leveraged and funds from outside the circle enter the circle.

However, under the premise of high valuation of on-site projects and serious imbalance between supply and demand, Meme coin became the first track to break through.

Meme is characterized by its VC-free financing and fair launch, which generates wealth effect through a model of rapid surge in low market value, and has also led to new tracks for asset issuance (pump.fun) and asset trading (Gmgn, TG bot).

One of the most important features of Meme is that it has no practical use. This kind of financial nihilism can deconstruct VC schemes and is also suitable for a small number of crypto users with IQ 50 and IQ 150. For most practitioners and institutions with IQ 100, it is still too difficult to participate. It is hard to imagine that you explain to the LP of the fund that the reason for investing in Mooden is that it is too cute, and the reason for selling Mooden is that it has become fat and is not cute anymore (I still love moodeng).

But AI Agent can gather the consensus of most people: to fund LPs, you can tell the story of investing in AI infrastructure; to Degen with IQ 50 and IQ150, you can talk about the logic of on-chain memes and golden dogs; to crypto practitioners and currency circle VCs with IQ100, you can talk about the logic of investing in AI Agent track projects.

In short, AI Agent is the greatest common divisor of the web3 industry in this cycle.

How do I view the AI Agent project?

How should IQ 100 view AI Agent - From Dapp to AgentApp

IQ100 represents the vast majority of cryptocurrency practitioners and investment institutions, including me, so I will first analyze AI Agent using the investment framework that I am familiar with.

I think the most important thing for investment institutions in the cryptocurrency circle is to understand that AI Agent has reshaped the upstream and downstream industrial chains and valuation logic of crypto.

Through the two waves of cryptocurrency bull markets in 2017-18 and 2020-21, the industrial chain and valuation logic of blockchain projects have gradually taken shape:

The underlying public chain; the market cap ceiling is Ethereum, with a current market cap of 400 billion US dollars; the second largest blockchain, Solana, has a market cap of about 1/4 of Ethereum, and may reach 1/3 or even 1/2 in the future;

Middle layer: For example, Chainlink, a oracle, has a total market value of 20 billion US dollars, which is about 5% of Ethereum.

DeFi and other basic protocols, Uniswap FDV has a market value of 13 billion US dollars; AAVE has a market value of about 5 billion US dollars, which are 3% and 1.25% of Ethereum respectively;

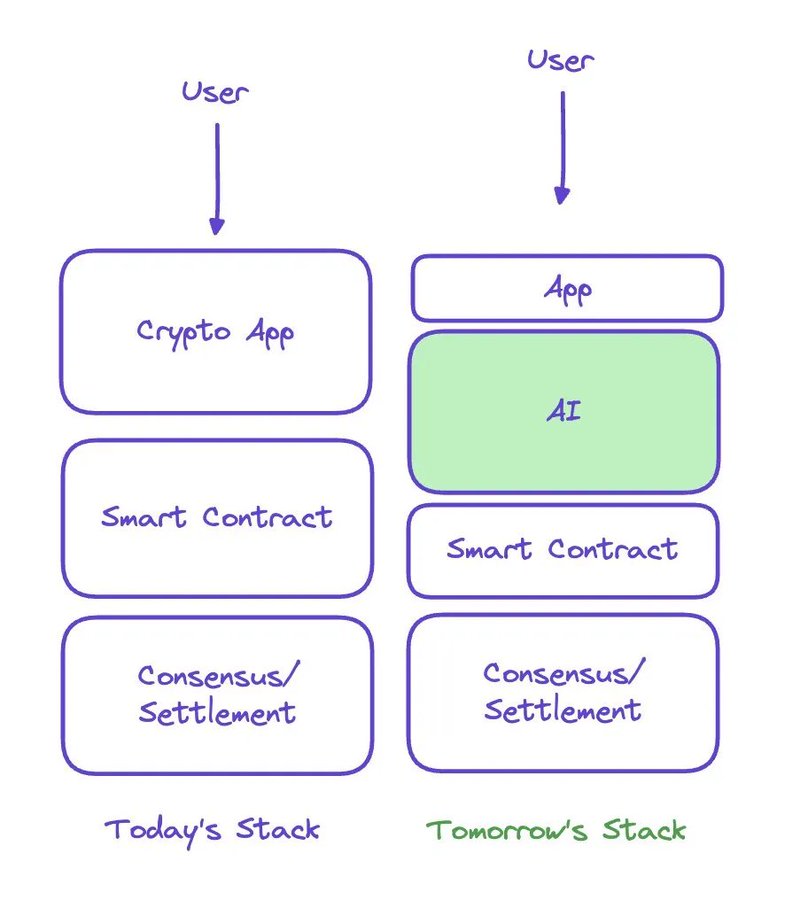

The underlying logic of DeFi is based on smart contracts, and the functional limitations of smart contracts also limit the innovation of other applications in the cryptocurrency circle.

Now that AI has been incorporated into the underlying technology stack of blockchain, the AI layer has become the underlying technology layer that runs parallel to smart contracts, the so-called Fully-onchain AI Agent Layer.

Image source: ( https://x.com/karsenthil/status/1874471383066984706 )

This can also explain another question: why AI projects before AI Agent failed to lead a new narrative, because whether it is token incentives for shared GPU, Data, data annotation and other projects, they still use blockchain as an incentive layer and have not jumped out of the scope of smart contract applications (DAPP), while the application of AI Agent exists as a glue between the underlying blockchain and off-chain data and a better UX interface. (Refer to https://x.com/jolestar/status/1872935141326373237 )

Based on this logic, let's look at the valuation. If Chainlink, the leading middleware of DeFi, can account for 5% of Ethereum's market value, analogous to the Framework of AI Agent, we boldly assume that the leading Framework of AI Agent can also account for 5%. The current market value of ai16z is about 2.5 billion US dollars, and there is still 8-10 times of room for growth. Here we take ai16z as an example, of course there may be other better Agent frameworks.

A launch platform like Virtual's built-in framework is equivalent to Chainlink + Uni. The current market value of Chainlink + Uni is 33 billion US dollars, and Virtual's 5 billion US dollars still has 6 times of room for growth.

Freysai (FAI) is a bit like AAVE, low-key but the product quality it delivers is extremely high. The verifable application of AI TEE will also become the standard configuration of AgentApp in the future. The market value ceiling is 1.25%-3% of Ethereum, corresponding to 5 to 10 billion US dollars.

Other leading benchmarks include Spore, which is equivalent to Suanwen or Launchpad in the previous cycle, and aixbt, which is similar to DeFi aggregator 1inch. The lower limit is a valuation of 1 billion US dollars, and the upper limit depends on market developments.

You can check other AI projects yourself, so I won’t go into details here.

How should IQ 100 view AI Agent - How to change the internal ecology of the cryptocurrency circle

In this cycle, almost all wealth effects have occurred on the chain since the beginning of Meme, but the operation threshold of on-chain memes is still too high for non-circle users and IQ100 institutions, and most users are still accustomed to trading on exchanges.

But the biggest advantage of Agentapp is its interaction

Buying assets : In the past - you could deposit and place orders to buy coins from centralized exchange apps and websites;

Agent era - Agents can use natural language to buy coins directly, and can even intelligently assist in trading and investment advisory decisions;

Financing : In the past, you would come up with a concept, build a team and package it, then look for VCs to raise seed rounds, and then look for top VCs or exchanges to take over and raise valuations;

Agent era - directly upload products to GitHub, spread them to the community, and the community directly pays money;

**Coin issuance: **In the past - launch the testnet, publish high valuation information of VC financing six months ago, attract studios to testnet, negotiate terms with exchanges but get cut, then issue a coin dump to recover;

Agent era - AI automatically issues coins, agents hold private keys, agents add funds to the pool, and agents go to the community to make calls;

The entire cycle follows several important criteria:

- The project is open source, the application is real and visible, and the code is queryable and verifiable

- Funds are relatively safe, and the private key is in the hands of the Agent to prevent Dev from withdrawing from the pool

- Financing and coin issuance are transparent, avoiding issues such as insider trading on exchanges, opaque airdrop rules, and VC core circle cliques.

Of course, Agent coin issuance also has problems such as chain preemption and KOL information advantage, but compared with the black box operation methods in the past, it has obviously been a great improvement.

Agentapp that can win the user's trading entrance is very likely to benchmark the valuation of the exchange platform currency.

How should IQ150 view AI Agent

Since I am Mid-Curve, I would like to quote my friend Alen's opinion from more than a month ago (

https://x.com/qiqileyuan/status/1858357959807635854), he believes that AI

Agents will form a new AI society in the future. The AI population in this AI society will create a social economy worth more than one trillion US dollars, and Bitcoin and crypto will become important assets in the currency and economic cycle in this AI economy.

For AI life forms, AGI is the brain, robots are the body, and crypto provides autonomous identity and economic systems.

To sum it up in one sentence: Don’t think about what AI can do for you, think about what you can do for AI.

How should IQ50 view AI Agent

The one with the bigger breasts is the one I’ll take.

What stage has the Agent project reached?

According to cookie.fun data, the total market value of AI Agent is about 18.6 billion US dollars, which is about 64% of the total market value of DeFi projects of 29 billion US dollars, 75% of the total market value of GameFi projects of 24.6 billion US dollars, and 62% of the total market value of all Layer2 projects of 30 billion US dollars. (Track classification according to Coingecko)

Data source: cookie.fun

Although market capitalization statistics are relatively rough, judging by market sentiment, AI Agent has just passed the halfway point, which is equivalent to the sun around 12 noon to 1 o'clock, and is in its prime.

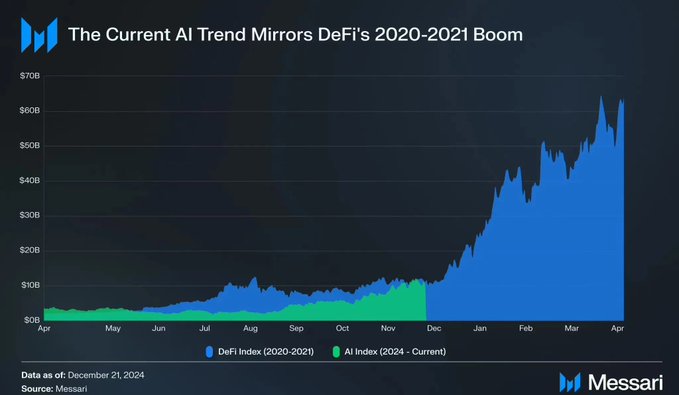

The general trend of this chart made by Messari is more optimistic, with AI Agent approaching the midpoint, but the subsequent growth will be more significant.

Reference document: https://x.com/Defi0xJeff/status/1873272066834841699;

So, what are the possibilities for subsequent hype?

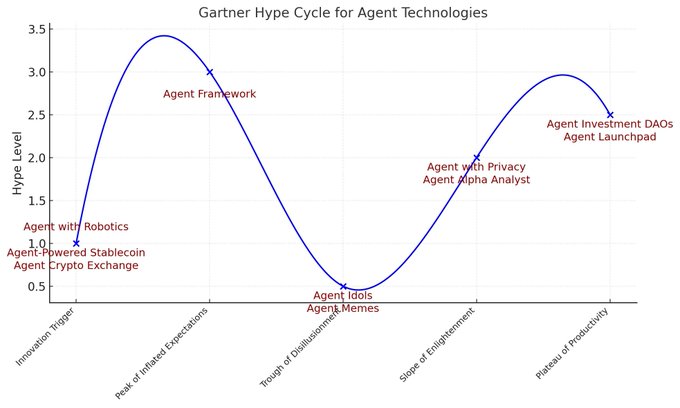

I used the Gartner development chart, which is the favorite of IQ 100 people, to analyze the various types of Agent applications as follows, drawn by ChatGPT:

In addition to the most popular Launchpad and Framework models, the directions I am more optimistic about include: Agent powered crypto exchange: agent-driven exchanges including intention trading, on-chain data analysis and smart investment advisors; fully realizing decentralized listing, decentralized asset custody, decentralized token issuance, investment and financing are all driven by agents. Different types of agent exchanges may differ in the degree of agent participation in investment decisions, risk preferences, etc.

Agent powered Stablecoin: An evolutionary version of the stablecoin that uses AI to automatically rebase and maintain pegging.

Application agentization is similar to tokenization, allowing different types of applications + agents to run, such as games, NFTs, physical assets, etc.; all applications will eventually add agent services to their core functions. (The bubble formed by excessive agentization can also be seen as an indicator of escaping the top, for example, every chain has started to do AIAgent.

To sum up in one final sentence, the era of AgentFi has just begun.