文章原名 |VanEck’s 10 Crypto Predictions for 2025

翻译 | IRIS

在我们进入2025年的预测之前,让我们先回顾一下我们2024年的预测表现如何。自2023年12月提出15个预测以来,我们给自己打8.5/15分。0.566的击球率虽然不是完美的,但足以让我们继续参与。随着比特币(BTC)突破10万美元,以太坊(ETH)突破4000美元,即使我们有些预测未中,这也是值得纪念的一年。

2024年加密货币预测回顾

比特币现货ETP首次亮相 - (得1分)

比特币减半顺利进行 - (得1分)

比特币在2024年第四季度达到历史最高点 - (得1分)

以太坊保持在比特币之后排名第二 - (得1分)

二层协议(L2s)主导以太坊活动(但L2的总锁定价值仍低于以太坊) - (得0.5分)

稳定币市值达到历史新高 - (得1分)

去中心化交易所获得历史最高份额的现货交易量 - (得1分)

Solana表现优于以太坊 - (得1分)

DePIN网络采用增长 - (得1分)

现在,让我们进入主要事件:2025年的加密货币预测。

2025年十大加密货币预测

第一季度加密牛市达到中期高峰,第四季度创下新高

美国通过战略储备接纳比特币,并增加加密货币的采用

代币化证券的价值超过500亿美元

稳定币的日结算额达到3000亿美元

AI代理的链上活动超过100万个代理

比特币L2达到100,000 BTC的总锁定价值(TVL)

以太坊blob空间产生10亿美元的费用

DeFi达到历史最高,DEX交易量达到4万亿美元,总锁定价值达到2000亿美元

NFT市场复苏,交易量达到300亿美元

DApp代币缩小与L1代币的表现差距

1. 加密牛市在第一季度触及中期高点,第四季度再创新高

我们认为2025年的加密牛市将持续发展,并在第一季度迎来首个高峰。在这一周期的顶点,我们预计比特币(BTC)价格将达到约18万美元,以太坊(ETH)价格将超过6000美元。其他备受瞩目的项目,如Solana(SOL)和Sui(SUI),价格可能分别超过500美元和10美元。

在经历这一首个高峰后,我们预测比特币价格将回调约30%,而山寨币可能面临高达60%的更大跌幅,市场将在夏季进入整固期。然而,秋季可能迎来复苏,主要代币重新获得动能,并在年底前重回或刷新历史高点。

为判断市场是否接近顶部,我们关注以下关键信号:

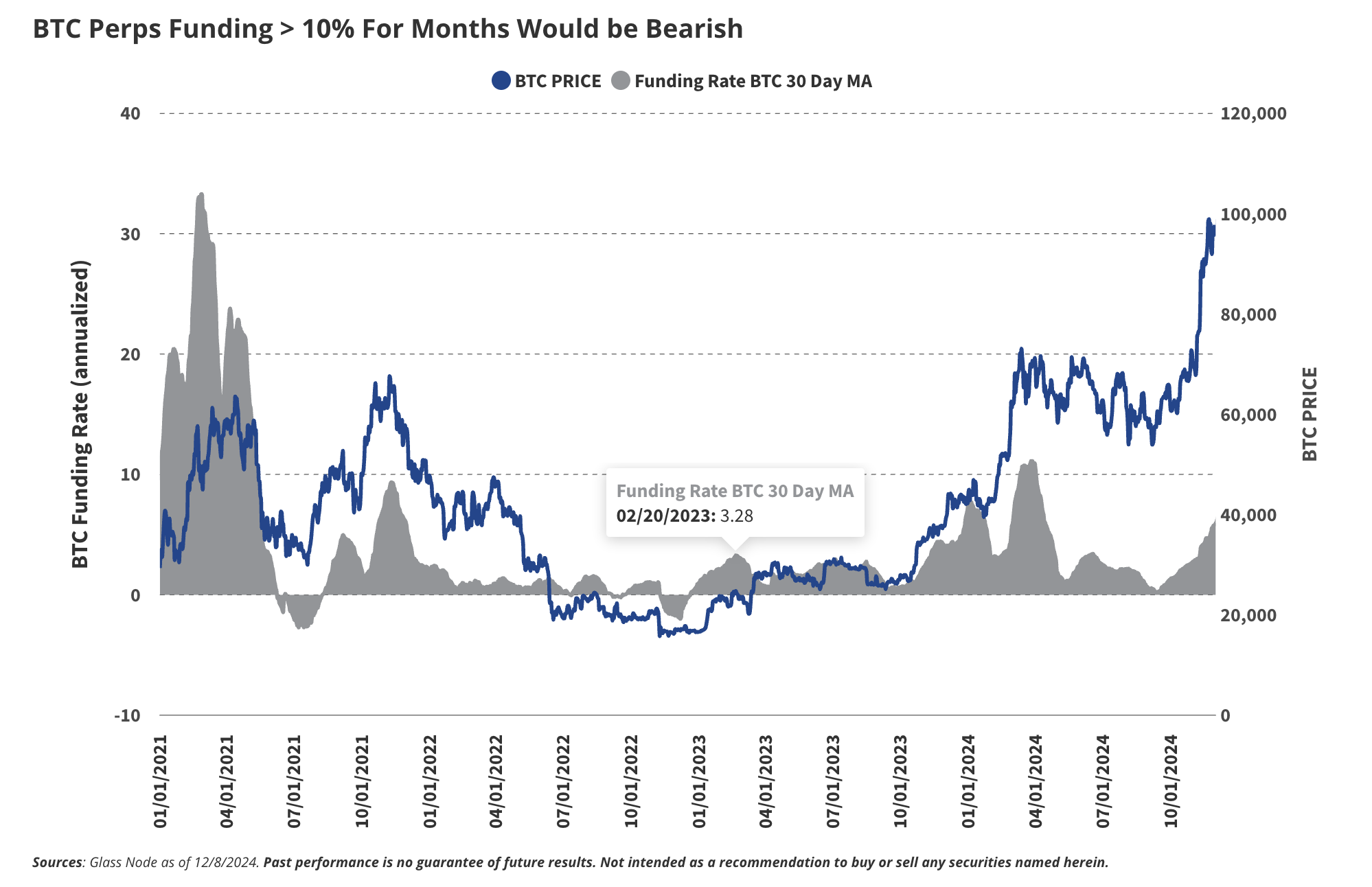

持续的高资金费率:当交易者借入资金押注比特币价格上涨,并愿意支付超过10%的资金费率持续三个月或更长时间时,这表明市场投机情绪过于高涨。

BTC永续合约资金费率超过10%持续数月将是看跌信号

-

过高的未实现利润:如果持有比特币的投资者中,拥有显著账面利润的比例(利润与成本的比率达到或超过70%)趋于稳定,这通常意味着市场处于狂热状态。

-

市值相较于已实现价值的过高估值:当MVRV(市值与已实现价值的比率)超过5时,这表明比特币的价格远高于平均买入成本,往往预示着市场过热。

-

比特币主导地位下降:当比特币在整个加密市场中的占比降至40%以下时,表明资金向更高风险的山寨币转移,这是典型的市场周期后期现象。

-

主流投机行为:当非加密领域的朋友纷纷发来信息询问一些可疑项目时,这通常是投机狂潮接近顶峰的可靠信号。

这些指标历来是衡量市场过热的可靠信号,并将在我们应对2025年预期的市场周期时,为我们的市场前景提供重要参考。

2. 美国拥抱比特币:建立战略储备并推动加密资产普及

唐纳德·特朗普的当选已经为加密市场注入了显著动力,其政府任命了一批支持加密的领导者担任关键职位,包括副总统JD Vance、国家安全顾问Michael Waltz、商务部长Howard Lutnick、财政部长Mary Bessent、证券交易委员会(SEC)主席Paul Atkins、联邦存款保险公司(FDIC)主席Jelena McWilliams,以及卫生与公众服务部长RFK Jr等。这些任命不仅标志着反加密政策的终结,例如对加密公司及其创始人的系统性银行服务限制,还表明了一个将比特币视为战略资产的新政策框架的开启。

加密ETP:实物创设、质押功能与新现货审批

新的美国证券交易委员会(SEC)领导层或商品期货交易委员会(CFTC)预计将批准多个新的现货加密资产交易产品(ETP),包括VanEck的Solana产品。以太坊ETP功能将扩展至支持质押,为持有者提供更高的实用性,而比特币和以太坊ETP都将支持实物创设与赎回。此外,SEC或国会可能废除SEC规则SAB 121,这将为银行和经纪商托管现货加密资产打开大门,进一步推动数字资产与传统金融基础设施的深度融合。

主权比特币采纳:联邦、州政府及矿业扩张

预计到2025年,美国联邦政府或至少一个州(如宾夕法尼亚州、佛罗里达州或德克萨斯州)将建立比特币储备。联邦层面,这一举措更可能通过行政命令以财政部的外汇稳定基金(ESF)实施,尽管两党合作立法仍是潜在的变数。同时,部分州政府可能会单独采取行动,将比特币视为对抗财政不确定性的对冲工具,或用作吸引加密投资与创新的手段。

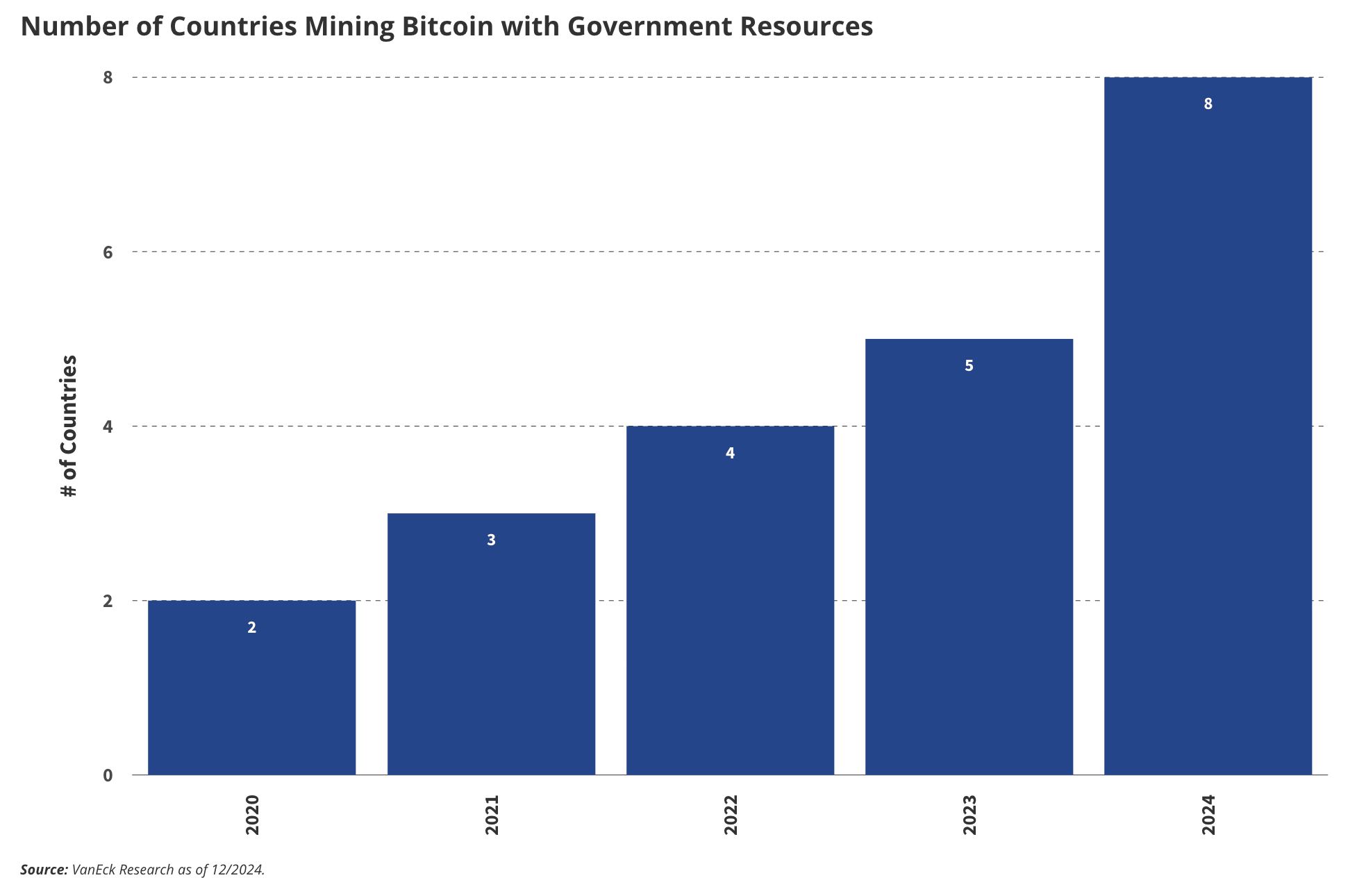

在比特币挖矿方面,使用政府资源参与挖矿的国家数量预计将达到两位数(当前为7个)。这一趋势受到金砖国家(BRICS)采纳热潮的推动,尤其是俄罗斯已表示意图以加密货币结算国际贸易,进一步凸显比特币在全球经济战略中的重要性。

利用政府资源挖掘比特币的国家数量

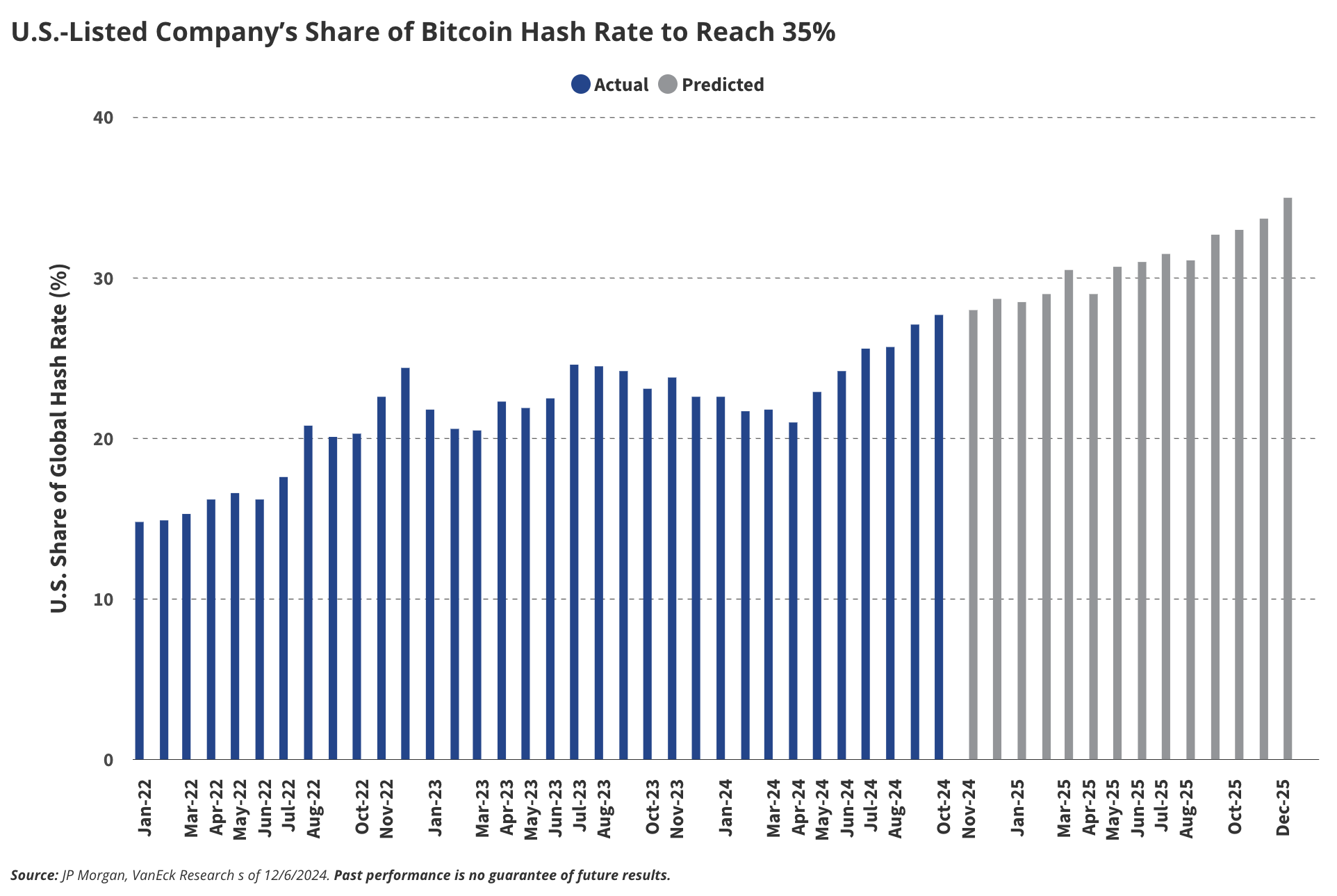

我们预计这一支持比特币的政策立场将在更广泛的美国加密生态系统中产生连锁效应。由于监管的明晰性和激励措施,全球加密开发者中位于美国的比例将从19%上升至25%,吸引更多人才和企业回归。同时,美国的比特币挖矿业将蓬勃发展,全球挖矿算力中由美国贡献的份额将从2024年的28%增长至2025年底的35%。这一增长得益于廉价能源和可能的税收优惠政策。这些趋势将共同巩固美国在全球比特币经济中的领导地位。

美国上市公司的比特币算力占比预计达到35%

企业比特币持有量:预计增长43%

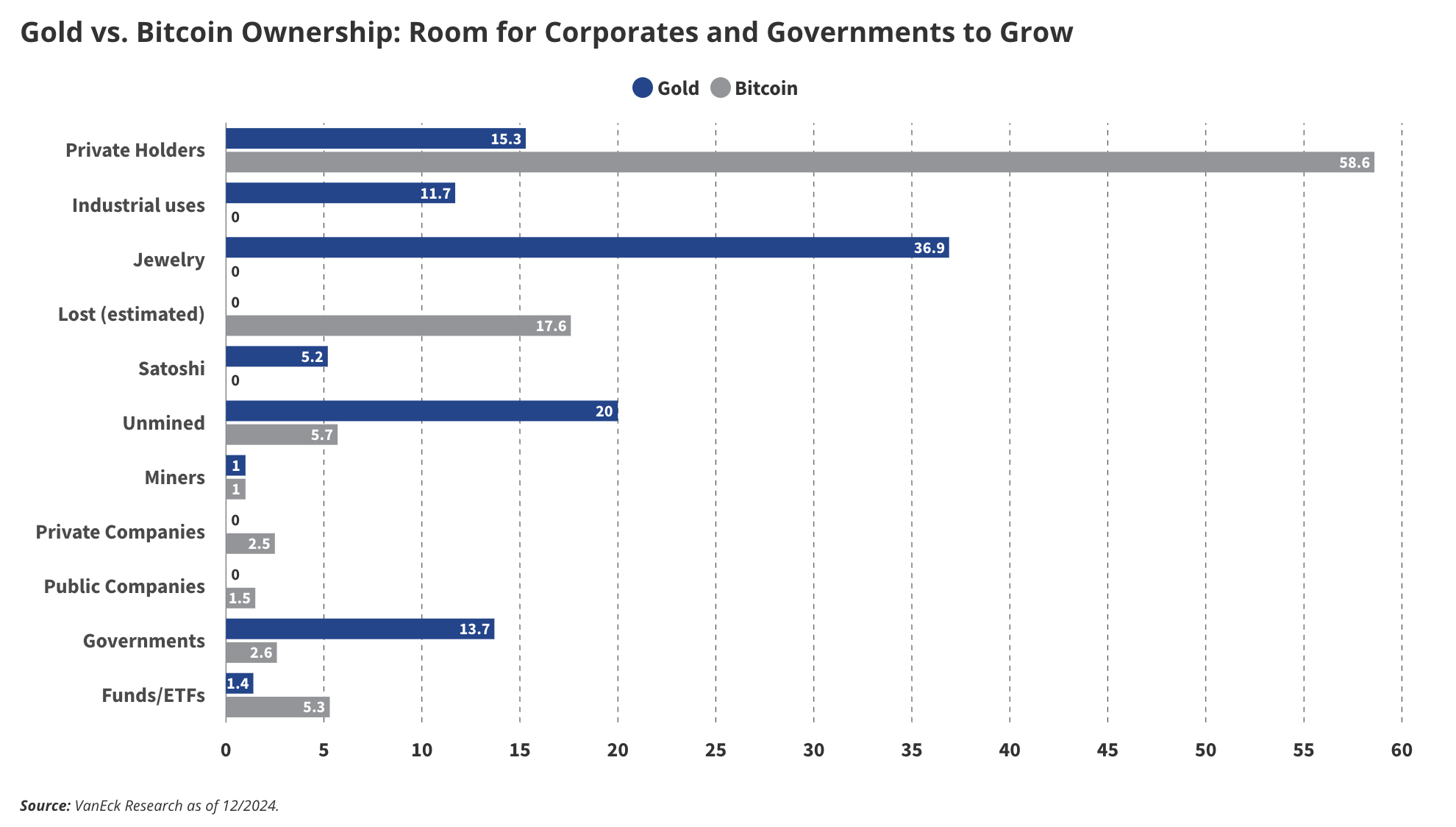

在企业采用方面,我们预计公司将继续从散户持有者手中积累比特币。目前,有68家上市公司在其资产负债表中持有比特币,而这一数字预计将在2025年增至100家。值得注意的是,我们大胆预测,私营和上市公司持有的比特币总量(目前为76.5万BTC)将在明年超过中本聪的持有量(110万BTC)。这意味着企业比特币持有量将在未来一年内实现43%的显著增长。

黄金 vs. 比特币持有量:企业和政府仍有增长空间

3. 证券代币化价值突破 500 亿美元

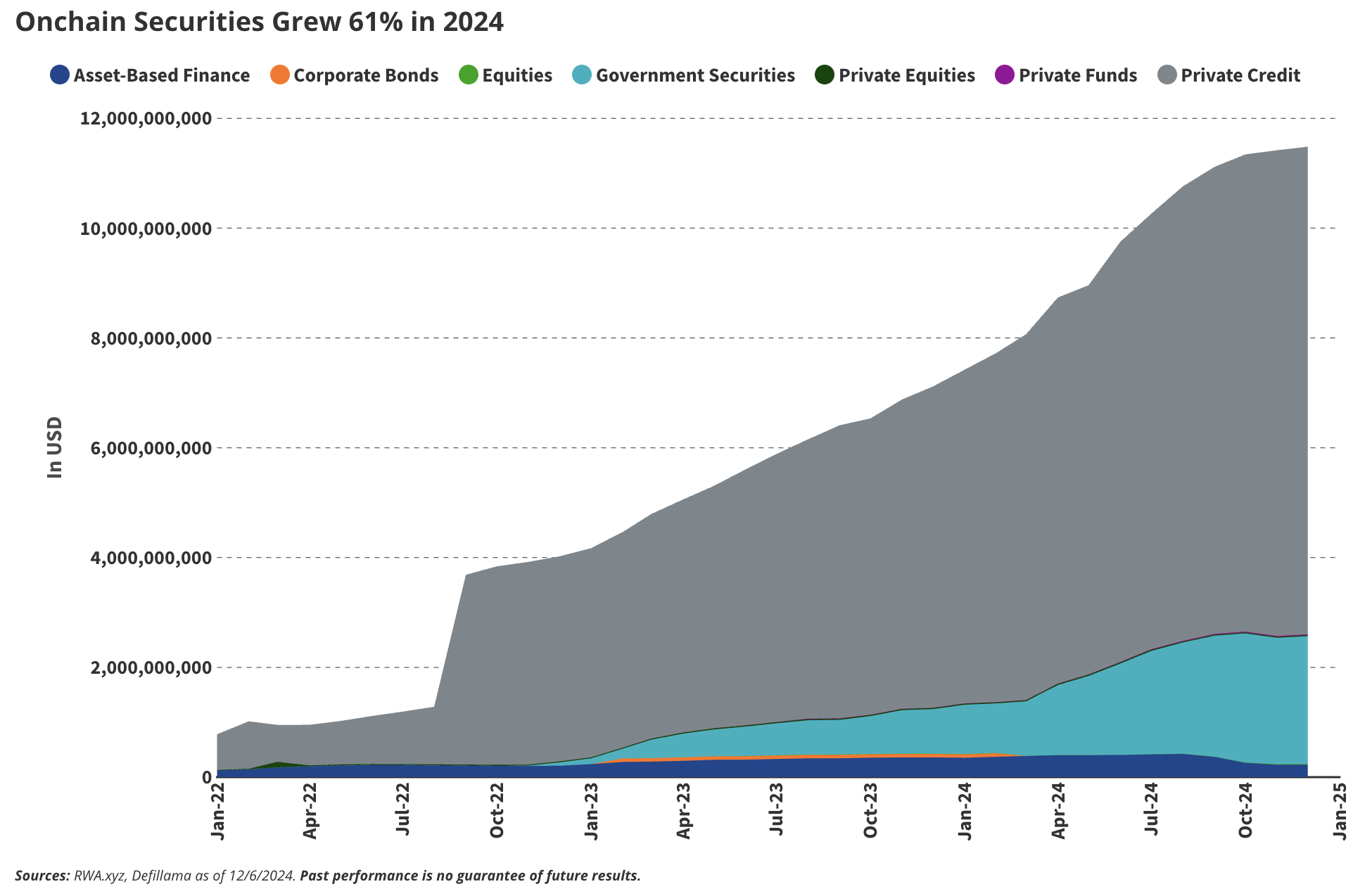

2024 年链上证券增长 61%

加密轨道承诺通过提高效率、去中心化和更大的透明性来打造更好的金融体系。我们认为,2025 年将成为证券代币化的爆发之年。目前,区块链上已有约 120 亿美元的证券代币,其中大多数(95 亿美元)是通过 Figure 的半许可区块链 Provenance 发行的私募信贷证券。

未来,我们看到在公共链上发行证券代币的巨大潜力。我们推测,投资者将有许多动力推动仅在链上发行的股票或债务证券。明年,我们预计像美国存托信托与结算公司(DTCC)这样的实体将支持代币化资产在公共区块链和私有封闭基础设施之间无缝过渡。这一动态将促使针对链上投资者的反洗钱(AML)和了解你的客户(KYC)标准的形成。作为一个大胆的预测,我们预期 Coinbase 将采取前所未有的举措,将其股票(COIN)代币化并部署到其 BASE 区块链上。

4. 稳定币每日结算量将达到 3000 亿美元

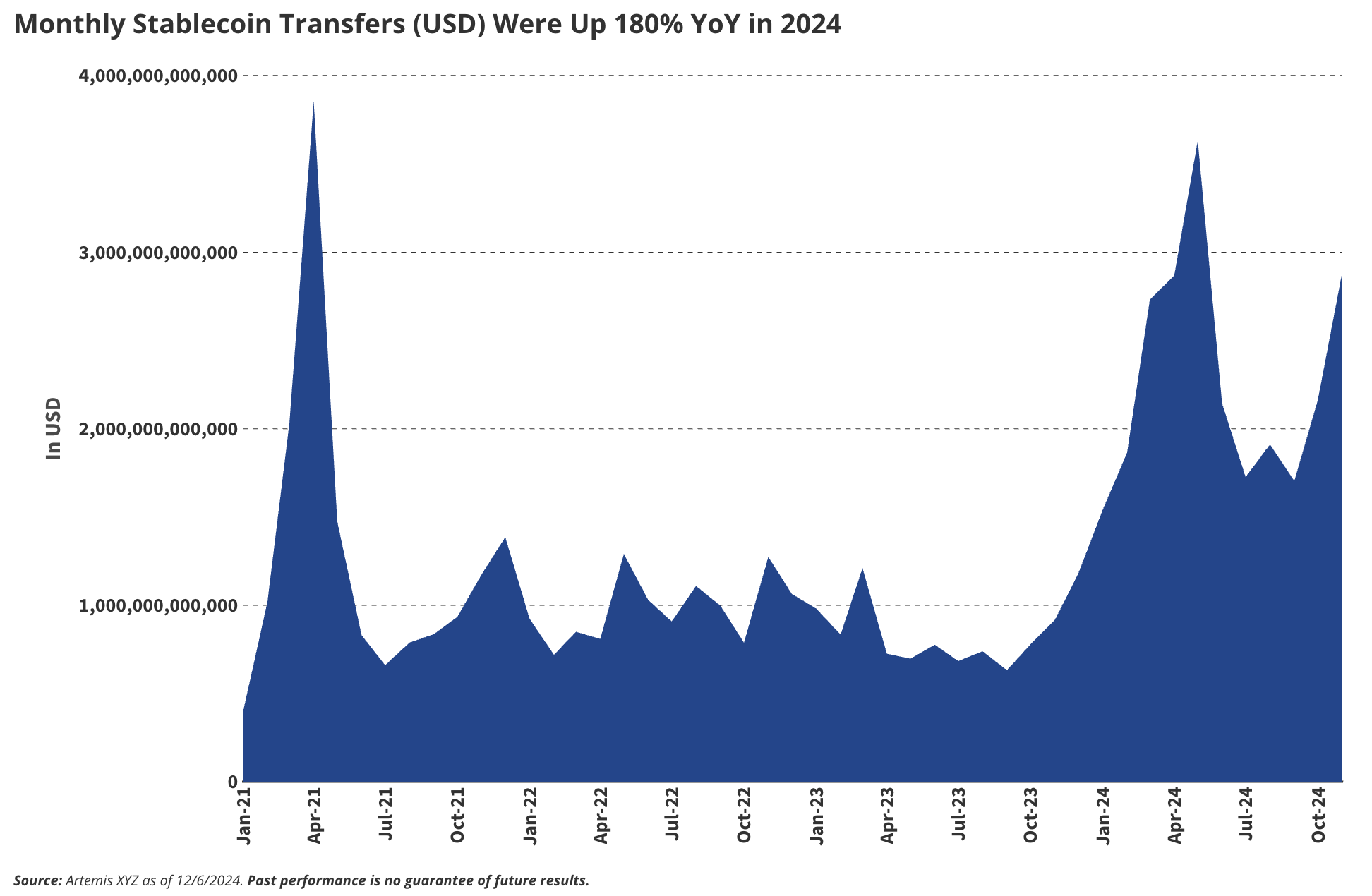

2024 年稳定币月度交易量同比增长 180%

稳定币将从加密交易中的小众角色跃升为全球商业的重要组成部分。到 2025 年底,我们预计稳定币每日结算量将达到 3000 亿美元,相当于美国存托信托与结算公司(DTCC)当前交易量的 5%,相比 2024 年 11 月的约 1000 亿美元日均交易量增长了三倍。其被主要科技公司(如苹果和谷歌)以及支付网络(Visa、Mastercard)采用,将重新定义支付的经济模式。

除了交易之外,汇款市场也将迎来爆发式增长。例如,美墨之间的稳定币转账可能增长 5 倍,从每月 8000 万美元增至 4 亿美元。原因何在?快速交易、成本节约,以及数百万用户对稳定币从实验工具到实用工具转变的信任。尽管区块链技术的采用仍在讨论中,稳定币正在成为推动其发展的“特洛伊木马”。

5. AI代理的链上活动将超过100万个

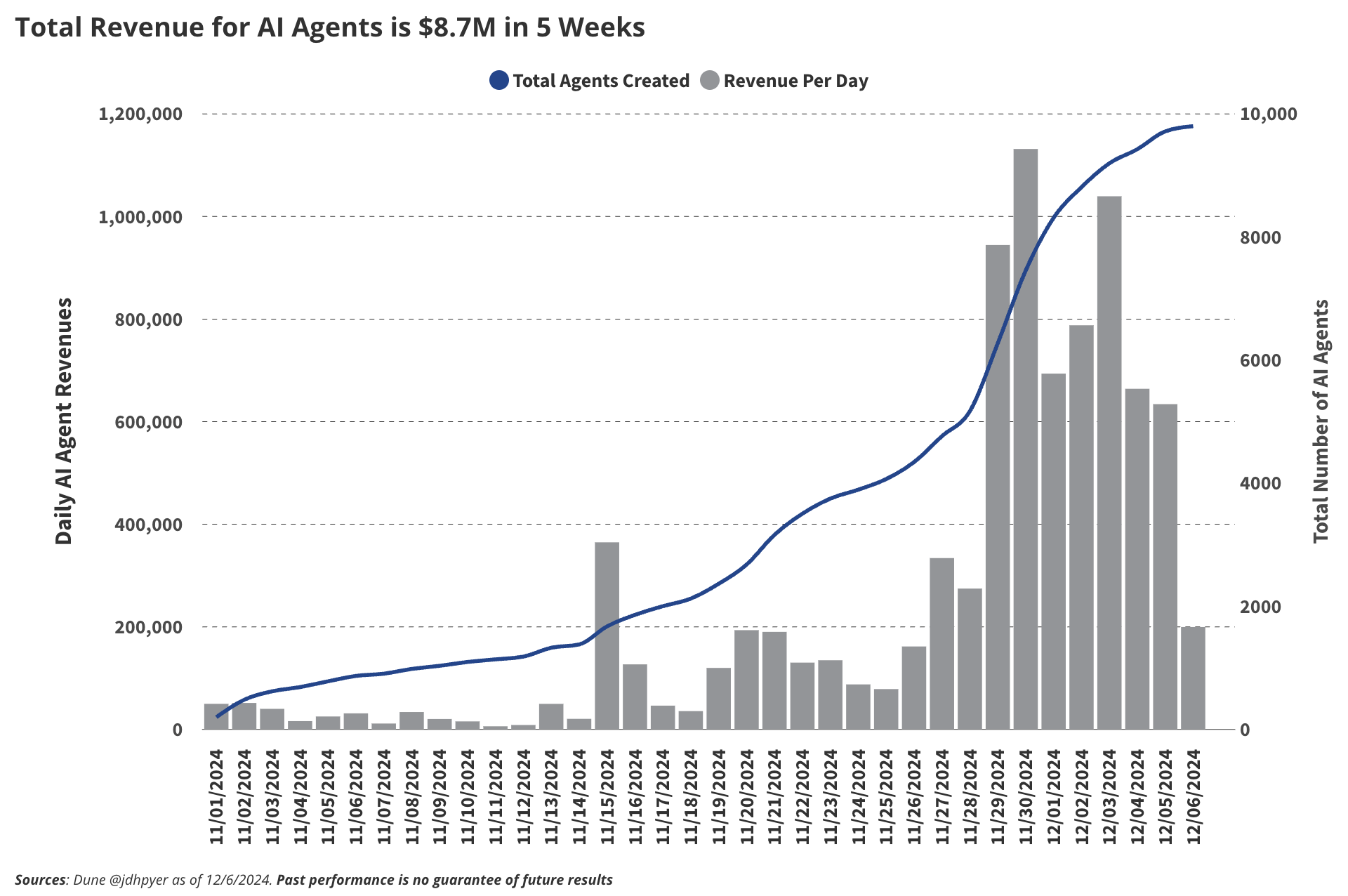

AI代理在5周内总收入达到870万美元

我们认为,2025年最具吸引力且有望引发大规模应用的叙事之一是AI代理(AI Agents)。AI代理是专门化的人工智能机器人,旨在帮助用户实现特定目标,例如“最大化收益”或“提升X/Twitter的互动率”。这些代理通过自主调整策略来优化结果。AI代理通常被输入大量数据并训练以专注于某一领域。目前,像Virtuals这样的协议为任何人提供了创建执行链上任务的AI代理的工具。通过Virtuals,即使是非技术背景的人也可以利用去中心化的AI代理贡献者,如微调人员、数据集提供者和模型开发者,来创建自己的AI代理。这种模式将催生大量代理,这些代理的创造者可以通过租赁代理产生收入。

目前,代理开发的主要方向集中在DeFi领域,但我们相信,AI代理的应用将超越金融活动。它们可以作为社交媒体影响者、游戏中的电脑玩家以及消费者应用中的互动伴侣或助手。已有一些代理成为重要的X/Twitter影响者,例如Bixby和Terminal of Truths,其粉丝数量分别达到了92,000和197,000。因此,我们相信,代理的巨大潜力将推动2025年新增超过100万个新代理的诞生。

6.比特币Layer2的总锁仓价值(TVL)将达到100,000 BTC

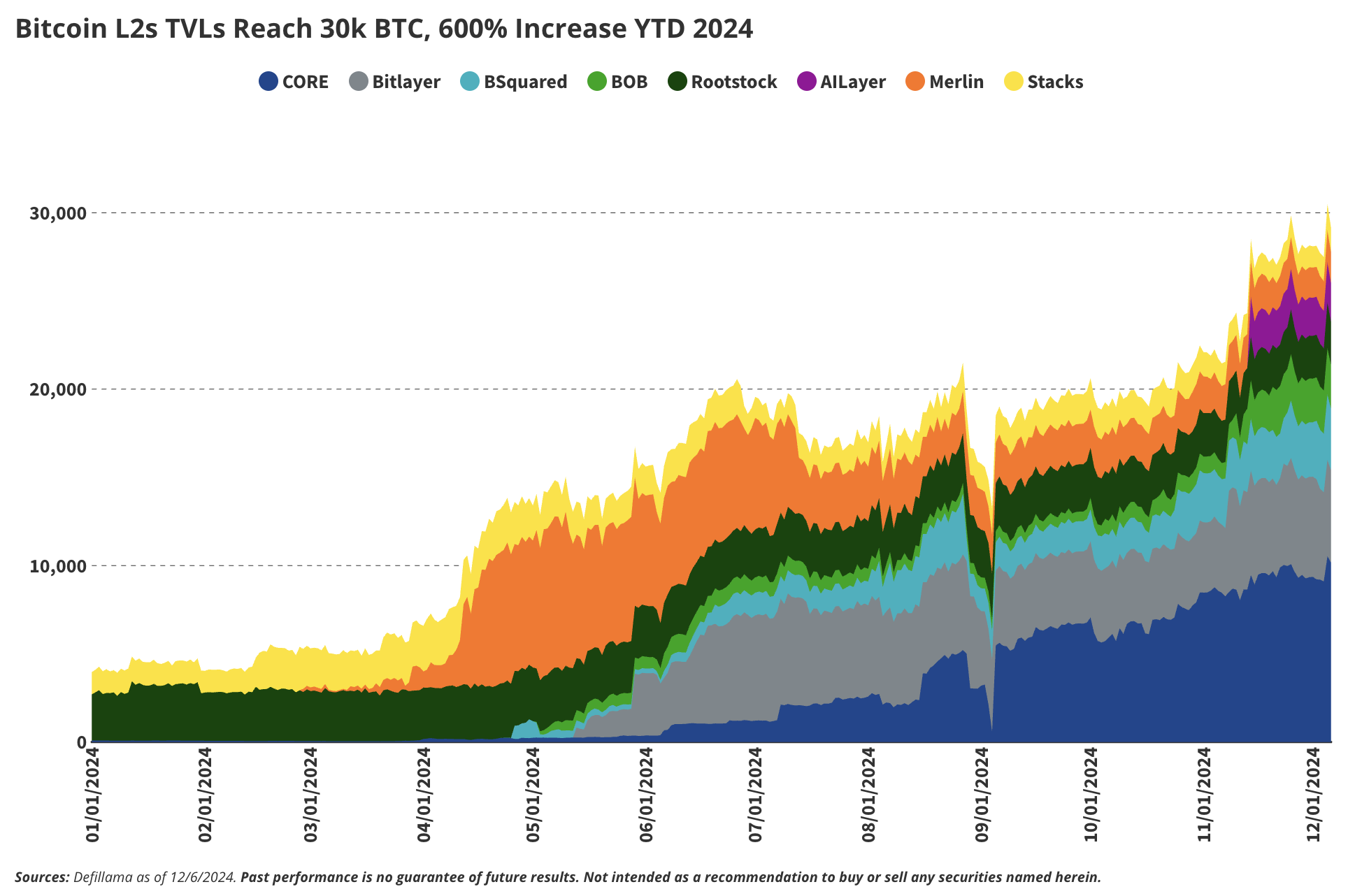

比特币Layer2的TVL在2024年同比增长600%,达到30,000 BTC

我们正在密切关注比特币二层网络(Layer-2,L2)区块链的崛起,这些技术有潜力彻底改变比特币生态系统。通过扩展比特币网络的能力,这些L2解决方案能够显著降低延迟并提高交易吞吐量,从而解决比特币基础层的局限性。此外,比特币L2还通过引入智能合约功能进一步拓展比特币的应用潜力,这将推动围绕比特币构建的强大去中心化金融(DeFi)生态系统。

目前,比特币可以通过桥接或包装的形式从比特币区块链转移到智能合约平台,但这些方式依赖于第三方系统,容易受到黑客攻击和安全漏洞的威胁。比特币L2解决方案旨在通过直接与比特币基础层集成的框架来解决这些风险,从而减少对中心化中介的依赖。尽管流动性限制和采用障碍仍然存在,但比特币L2承诺提升安全性和去中心化,为比特币持有者提供更大的信心,积极参与去中心化生态系统的使用和发展。

如图所示,比特币Layer2解决方案在2024年经历了爆炸式增长,总锁仓价值(TVL)超过30,000 BTC,同比增幅达到600%,约合30亿美元。目前已有超过75个比特币Layer-2项目正在开发,但只有少数项目可能在长期内实现大规模采用。

这一迅猛增长反映了BTC持有者对资产收益生成和更广泛用途的强烈需求。随着链抽象技术和比特币Layer2逐渐成熟为适合终端用户的可用产品,比特币也将成为DeFi的重要组成部分。例如,Sui上的Ika平台或Near的链抽象技术(由Infinex使用)展示了创新的多链解决方案如何增强比特币与其他生态系统的互操作性。

通过支持安全高效的链上借贷及其他无需许可的DeFi解决方案,比特币Layer2和抽象技术将比特币从被动的价值储存转变为去中心化生态系统中的活跃参与者。随着采用规模的扩大,这些技术将为链上流动性、跨链创新以及更综合的金融未来释放巨大的潜力。

7. 以太坊区块空间费用收入达到10亿美元

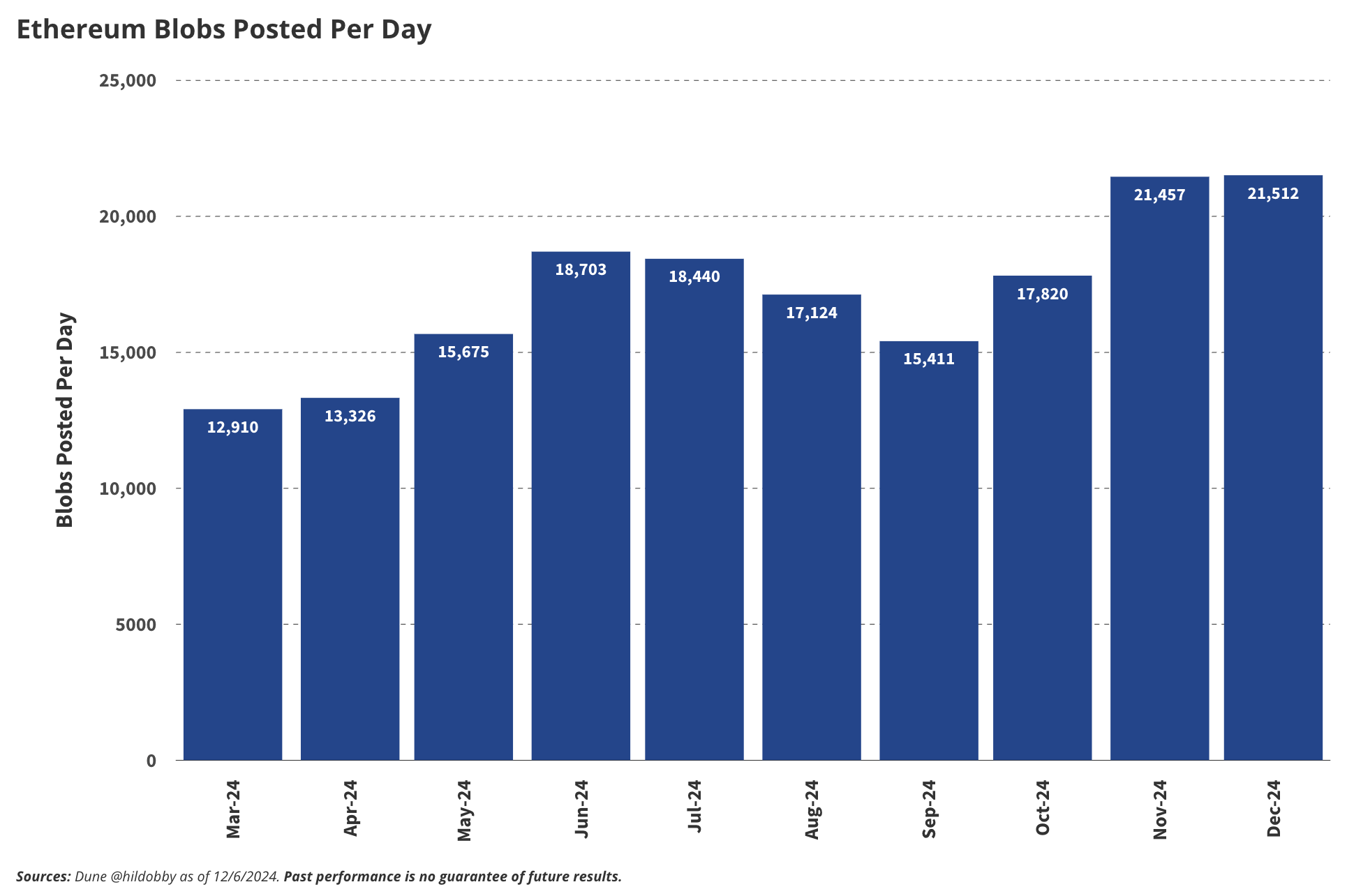

每天发布的以太坊区块数据

以太坊社区正在积极讨论其通过区块空间(Blob Space)从二层网络(L2)获取的价值是否足够。区块空间是以太坊扩展计划中的关键组件,作为一个专门的数据层,L2网络会将其交易历史压缩后提交到以太坊主网,并以每个区块为单位支付ETH费用。虽然这一架构支撑了以太坊的可扩展性,但目前L2对主网的回馈价值有限,其毛利率约为90%。这一现象引发了人们的担忧,认为以太坊的经济价值可能过多地向L2网络倾斜,从而导致基础层资源未被充分利用。

尽管最近区块空间的增长有所放缓,但我们预计到2025年其使用量将大幅增长,主要受到以下三个关键因素的推动:

-

二层网络(L2)的爆炸性增长:以太坊L2的交易量正以超过300%的年化增长率快速增长,用户为追求更低成本、更高吞吐量的环境,纷纷将DeFi、游戏和社交应用迁移至L2。随着面向消费者的去中心化应用(dApps)在L2上的广泛普及,更多交易回流至以太坊主网进行最终结算,这将显著增加对区块空间的需求。

-

Rollup技术优化:Rollup技术的进步,例如更高效的数据压缩和更低的区块空间数据提交成本,将鼓励L2在以太坊上存储更多的交易数据,从而在不牺牲去中心化的情况下实现更高的吞吐量。

-

高费用用例的引入:企业级应用程序、zk-rollup支持的金融解决方案以及现实世界资产的通证化将推动高价值交易的发展。这些用例对安全性和不可篡改性的优先需求将增加市场对支付区块空间费用的接受度。

到2025年底,我们预计区块空间费用将超过10亿美元,而当前几乎微不足道的水平相比是一次巨大的飞跃。这一增长将巩固以太坊作为去中心化应用最终结算层的核心地位,同时增强其从快速扩展的L2生态中捕获价值的能力。以太坊的区块空间将推动网络扩展,并成为一条关键的收入来源,平衡主网与L2之间的经济关系。

8. DeFi创下历史新高:去中心化交易所交易量达4万亿美元,总锁仓量2000亿美元

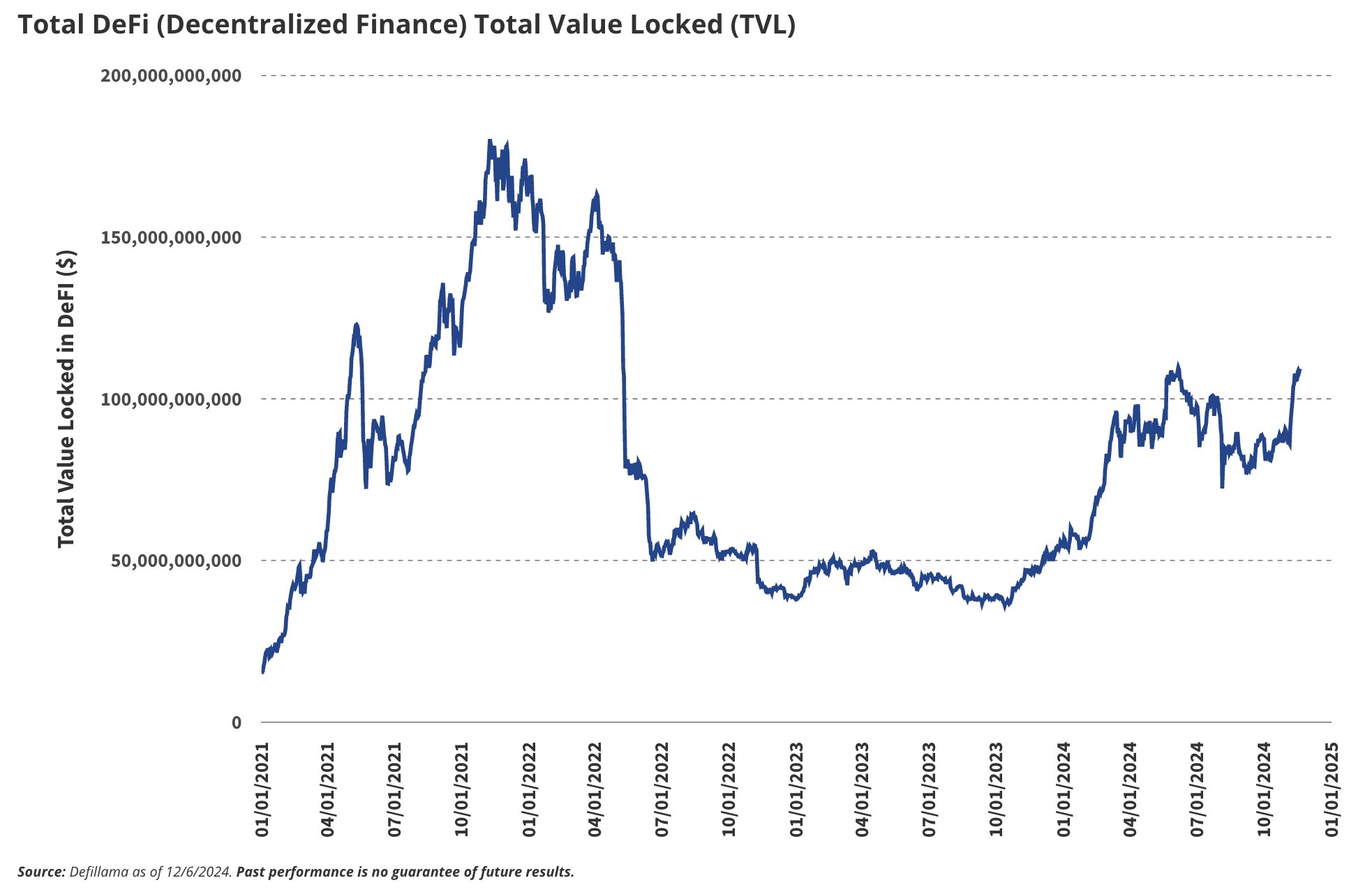

DeFi(去中心化金融)总锁仓量(TVL)

尽管去中心化交易所(DEX)的交易量已创下历史新高,无论是绝对值还是相较于中心化交易所(CEX)的占比,但去中心化金融(DeFi)的总锁仓量(TVL)仍比历史峰值低24%。我们预计,到2025年,DEX交易量将超过4万亿美元,占CEX现货交易量的20%,主要受AI相关代币的兴起和新型面向消费者的dApp的推动。

此外,证券通证化及高价值资产的涌入将进一步推动DeFi的发展,为其提供全新的流动性和更广泛的应用场景。因此,我们预计,到2025年底,DeFi的TVL将反弹至超过2000亿美元,这反映了去中心化金融基础设施在不断发展的数字经济中的日益需求。

9. NFT市场复苏,交易量达300亿美元

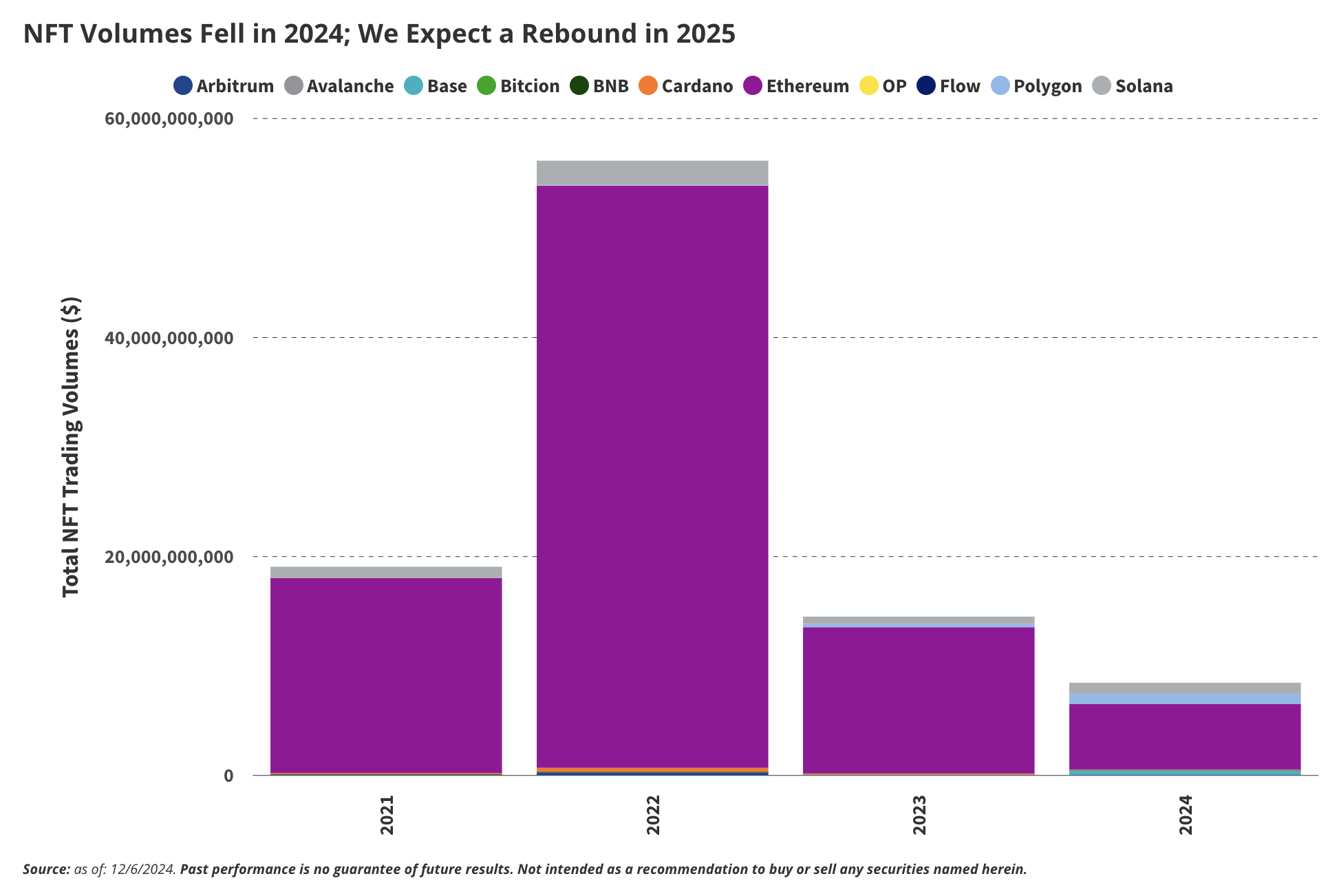

NFT交易量在2024年有所下滑;我们预计2025年将出现反弹

2022–2023年的熊市对NFT行业造成了严重冲击,交易量自2023年以来暴跌39%,较2022年更是锐减84%。虽然可替代代币(fungible token)的价格在2024年有所回升,但大多数NFT却表现落后,价格疲软、交易活动低迷,直到11月迎来了一个转折点。尽管面临这些挑战,少数优秀项目通过强大的社区纽带,超越了纯粹的投机价值,逆势而上。

例如,Pudgy Penguins 成功转型为消费品牌,通过收藏玩具打开市场;而 Miladys 则在讽刺性网络文化中获得了文化影响力。同样,无聊猿游艇俱乐部(Bored Ape Yacht Club,BAYC) 继续作为主导文化力量发展,吸引了品牌、名人以及主流媒体的广泛关注。

随着加密财富的复苏,我们预计新一代富裕用户将不再仅将NFT视为投机性投资,而是作为具有持久文化和历史意义的资产进行多元化配置。像 CryptoPunks 和 BAYC 这样的成熟系列,由于其强大的文化价值和相关性,将从这一趋势中受益。尽管 BAYC 和 CryptoPunks 的交易量仍远低于其历史峰值(以ETH计价分别下降约90%和66%),但其他项目如 Pudgy Penguins 和 Miladys 已超越了其先前的价格高点。

以太坊继续在NFT领域占据主导地位,承载了大多数重要的NFT系列。2024年,以太坊占据了71%的NFT交易量,我们预计这一比例将在2025年上升至85%。这种主导地位也体现在市场市值排名中,以太坊NFT占据了前10名中的全部席位以及前20名中的16个位置,突显了以太坊在NFT生态系统中的核心作用。

尽管NFT交易量可能无法重现先前周期中的狂热高点,但随着市场逐步向可持续性和文化价值倾斜,而非单纯的投机热潮,我们认为年交易额达到300亿美元是可行的,这相当于2021年峰值的约55%。

10. 去中心化应用(DApp)代币逐步缩小与L1代币的表现差距

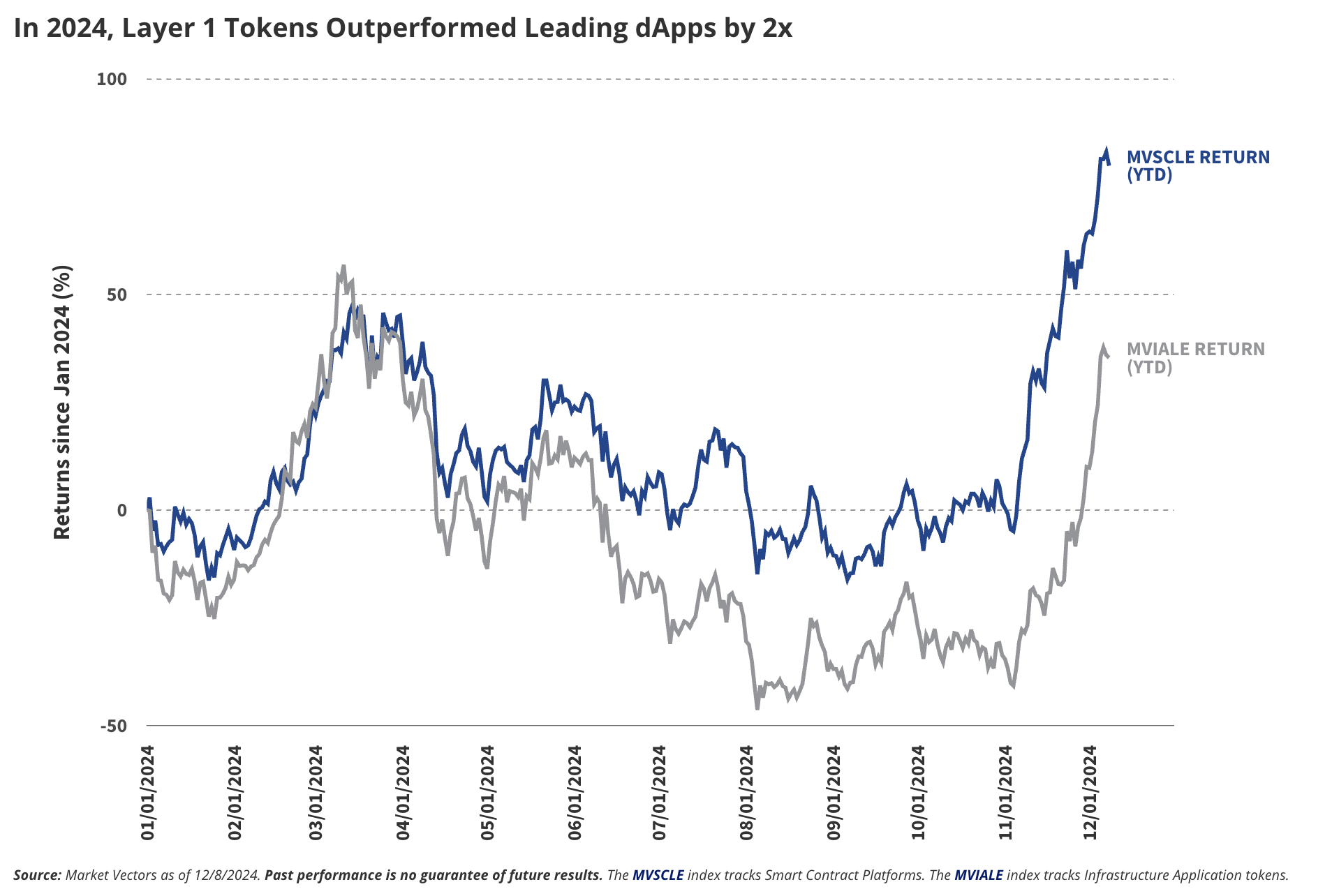

2024年,Layer 1(L1)区块链代币的表现是领先DApp代币的两倍

2024年牛市的一个显著特点是,与去中心化应用(dApp)代币相比,Layer-1(L1)区块链代币表现优异。例如,追踪智能合约平台的MVSCLE指数年初至今已上涨80%,而应用代币的MVIALE指数同期仅上涨35%。

然而,我们预计这一趋势将在2024年下半年发生转变。一系列全新dApp的推出将带来创新且实用的产品,为其代币注入更多价值。在主要主题趋势中,人工智能(AI)成为dApp创新的突出领域。此外,去中心化物理基础设施网络(DePIN)项目也具有巨大的吸引力,有望吸引投资者和用户的兴趣,推动L1代币与dApp代币之间的表现差距逐步缩小。

这一转变强调了在不断演变的加密市场中,应用代币的成功越来越依赖于其实用性和产品与市场的契合度。