作者:hitesh.eth

编译:Tim,PANews

当我在2017年初理解比特币的真正潜力时,那种震撼如同在数字纪元中发现了新火种。这不是一种新的另类资产,而它是一种全新的范式,一种对钱重新定义的技术。

一个不受政府和中央银行任意干预的去中心化系统,为任何选择参与的人提供金融自主权。它不仅仅是一种投资行为,更是一场金融革命。我希望周围所有人都能理解我所看到的。

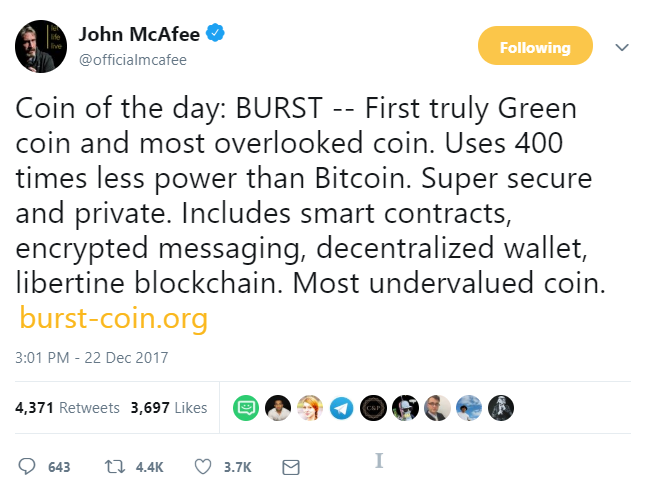

我准备了一条很长的信息,通过WhatsApp群发给了100个人,建议大家都买入比特币,同时还推荐了一个能够帮助他们增加比特币持仓的咨询服务。虽然当时我在山寨币投资上取得了一些初步成功,自以为在几个月内让所有人的比特币资产翻倍并非难事。但那时我对市场的理解仍处于萌芽阶段,未能完全明白在这个年轻市场中叙事逻辑和情绪变化是如何驱动价格走势的。

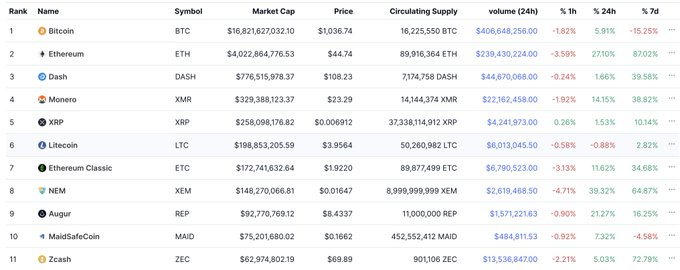

我根据当时有限的可用数据,我逐渐形成了对市场的认知。大多数在2015至2017年间推出的山寨币大多数都没有很长的缺少交易历史周期可以借鉴记录。它们的价格图表图表呈现着看似永远永续的上涨趋势,其间的小幅回调就像开启新一轮上涨前的“暂停键”。

买入、持有、等待,然后看着你的持仓价值不断上涨,这种模式令人陶醉。加密货币市场的"设计"理念仿佛是只涨不跌的,这种想法在我心中悄然扎根。当时的市场波动并未吓到我,我觉得这只是必须经历的一部分。

理论上,我曾坚信自己能够以平常心应对那些市场回调,但2017年第二季度的首次重大调整彻底击碎了这种幻想。这不是单纯回调,而是一次崩盘。第一季度表现排在前列的代币创下新低,跌幅达到70-80%,我们的信念瞬间崩塌。

眼看持仓资产日渐缩水,兴奋化为恐慌,乐观转为怀疑。但我仍继续坚持,坚信这只是下一轮上涨前的煎熬。但后来我没有将让我的比特币仓位翻倍,反而减持了70-80%的仓位,回到了最初的原点。

市场的不确定性接踵而至。比特币从1万美元飙升至2万美元,而山寨币却艰难挣扎着复苏。围绕比特币的市场情绪一片混乱,今天它还被奉为货币的未来,明天就有铺天盖地的"死亡"报道就会充斥媒体:中国禁令、监管打击、黑客攻击。每一个负面消息都会在市场中掀起惊涛骇浪。我最初的那份坚定信念开始动摇。我们真的处于金融革命的边缘吗?或者这不过是又一个注定会破裂的投机泡沫?

然后时间到来2018年1月,这个彻底刷新了我彻底刷新了对市场认知的月份。山寨币不仅迎来反弹,更是发生了爆发式增长。TRX在短短几周内翻了100倍,无数曾被口诛笔伐的项目强势回归,有的暴涨十倍,有的涨幅更多。市场陷入一片狂热,每个人都觉得自己是投资天才。

过去数月的焦虑,随着一根绿色阳线绿色蜡烛的浮现烟消云散。就像那样,我心中形成了新的认知:或许这就是市场的运作规律。经历灾难性回调之后,它的回归将更加猛烈。

这种信念在我们眼前蒙上了一层欺骗的面纱。我们试图用“新常态”,认为每一次暴跌都只是为下一次暴涨埋下的伏笔。我们等着"绿色月份"回归,坚信耐心终将获得回报。但到目前,这一切这一切始终未曾到来。市场持续失血,曾经令人兴奋的资本游戏,逐渐演变成缓慢而痛苦的现实:原来我们早已被自己的高预期所困。这个周期玩弄了我们。

每个周期都会出现极度狂热的时刻,在上一个周期中,我们看到同样的情景在NFT领域发生。某些NFT系列在短时间内暴涨100倍,这样的“疯狂30天”连续出现了三次。这感觉就像是在2018年。炒作、坚信“这只是开始”的心态、FOMO,一切是惊人地相似。当市场经历两次回调后仍持续上涨时,我们想:“这也许就是市场的运作”,并选择HODLing。然而结局再次上演:我们输得精光。我在NFT上的损失惨重,如往常一样。

人们常说“吃一堑长一智”,但市场总有办法让你遗忘。你的心智会欺骗你,让你相信这次真的不一样了。"我现在知道这个游戏怎么回事了,不会再犯同样的错误。"但看不见的陷阱永远存在。那种自以为掌控全局、破解了财富密码的幻觉,让你在市场中参与的时间过长。最终,市场才是赢家。随着时间推移,你或许能学会减少损失,但结果一定是输的。

最近,我们又一次目睹了历史重演。这次是AI Agent赛道。公开发射后不久便暴涨100倍,IC0似乎突然卷土重来。这一切仿佛昨日重现,只不过换了层外衣。我们再次相信,这场狂欢的周期或许能延续数周甚至数月。

我们在不断犯错,不断摔跟头,我们知道我们在干什么,但无法阻止这一切发生,实际上,我们无法控制我们的情绪。

也许现在,你正情绪化地认为一切都已结束,只有少数币种会反弹。但市场总是与预期相反,这次它仍会故技重施。你可能会被迫上桌或出局,而在我看来,这就是当下大多数散户注定面临的结局。

唯一能帮你在这场资本游戏中获胜的方法是:上桌时最大化收益,出局时最小化损失。当然,说起来容易做起来难。