特朗普赢得大选后,所有人都预期美国政府将加速拥抱加密货币,令比特币市场热度高居不下。11 月21日,比特币价格触及历史新高,逼近9.5万美元大关。

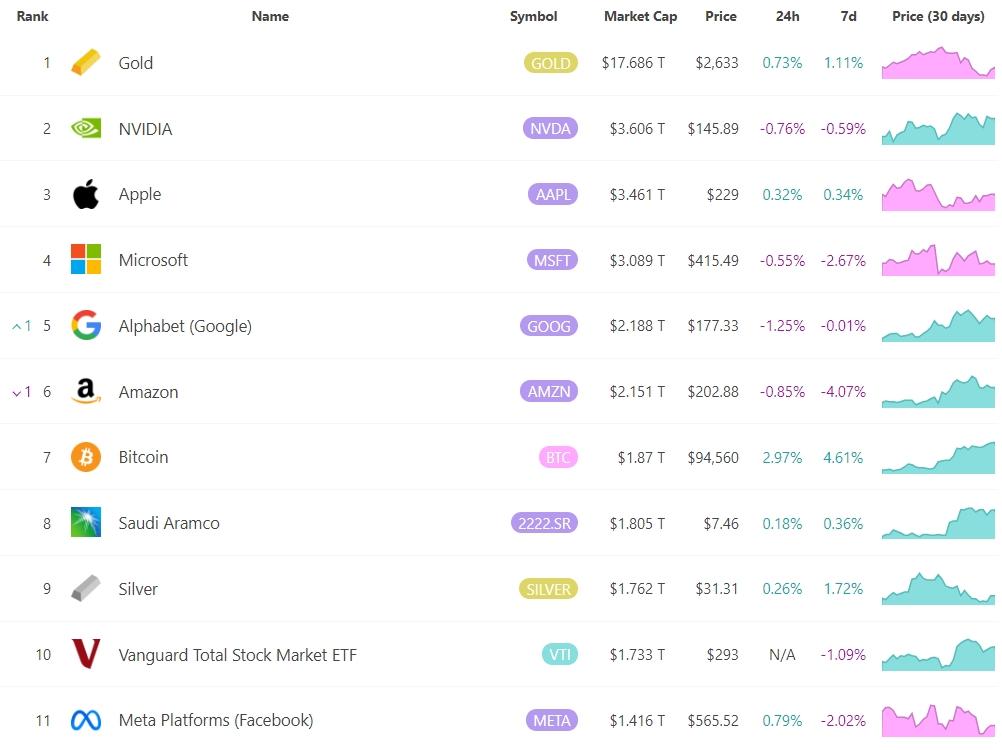

作为全球最大的加密货币,比特币在这场“特朗普行情”中扮演了核心角色,自选举日以来其价格已上涨超过35%。今年以来,比特币价格已经翻了一番。目前,比特币市值 1.87 万亿,是黄金市值的大约10%,已超越白银、沙特阿美等传统巨头,跻身全球第7大资产。

明确的政策预期令比特币加速上涨

作为美国第一位对于加密货币非常友好的总统,特朗普在竞选期间,承诺了多项支持加密货币的措施,如将比特币纳入国家储备、把美国打造为世界加密货币之都、放宽监管等。随着特朗普胜选,叠加共和党横扫参众两院,白宫和国会两院三连胜让特朗普明年1月20日就任后,将享有很大权力推行他的议程。较为明确的政策预期,加速了传统人群对比特币的拥抱。

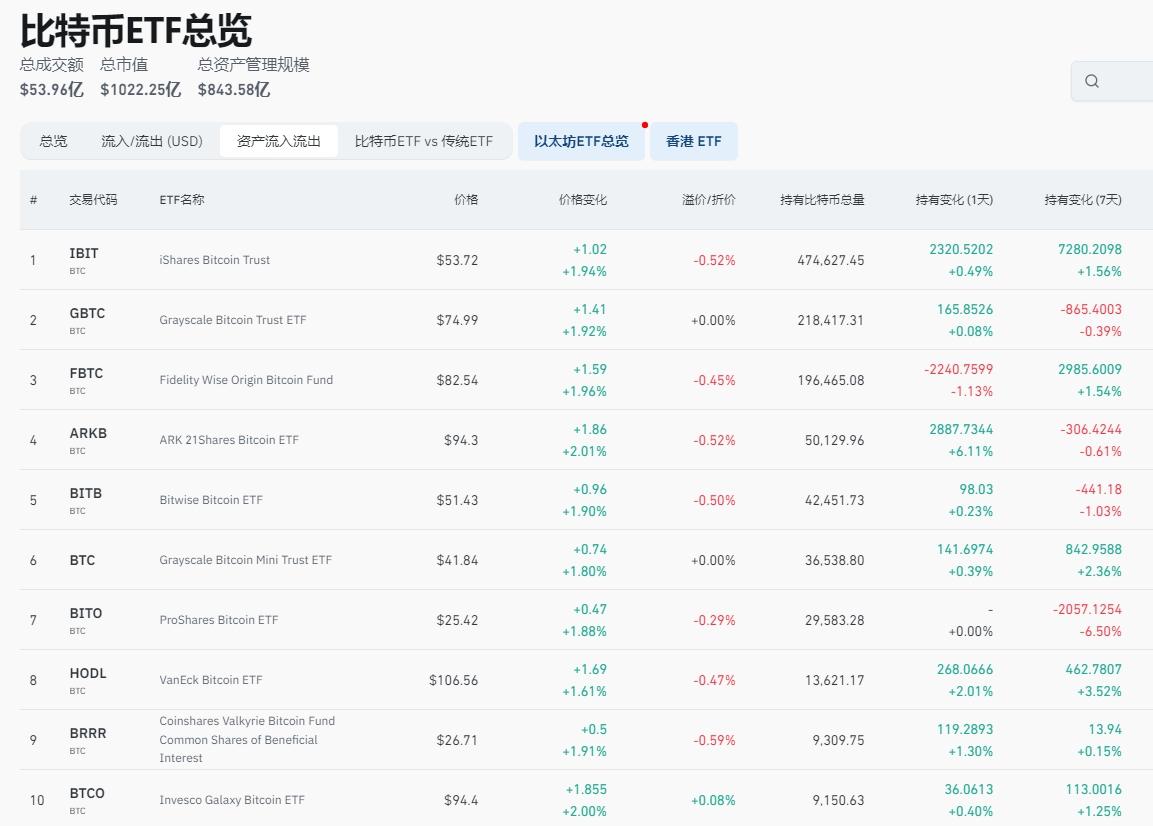

比特币现货ETF成为了美股投资者最方便渠道。数据显示,BTC现货ETF持续出现大量的资金流入,前十大 ETF 的总体流入量在 7 天内持续增加,当前比特币现货ETF已持有超100万枚比特币。

除ETF外,多家机构也在不断买进。“比特币大户”MicroStrategy在10月31日至11月10日期间,筹集了约20亿美元,新购了27.2万枚比特币,11月16日,再次以约46亿美元的价格收购了51780个比特币,管理层计划在2025年至2027年间筹集420亿美元,进一步增持比特币。目前,MicroStrategy拥有约全球流通比特币的1.67%。此外,还有其他美股、港股、日股等上市公司,也都在最新的财报中披露了持仓比特币的情况,越来越多上市公司正计划将比特币作为国库储备资产。

特朗普的加密友好立场不仅对美国政策产生影响,还推动了全球各国的加密资产布局。目前萨尔瓦多仍在每日持续购买1枚 BTC,其比特币持仓达到约5900枚BTC。不丹政府持有12000多枚比特币,占其GDP的34%。市场消息显示,沙特阿拉伯、阿联酋和卡塔尔等海湾产油国可能正在主权层面投资比特币。

还有上涨空间?细数历届大选后BTC走势

在这一轮周期中,由于特朗普的站台,市场反应尤为热烈,如今其价格直逼10w,这是否意味着大选之后的政策利好已经完全包含在价格内了,比特币的上涨空间是否已经有限了?

从历史周期来看,历届美国大选对比特币价格都有长远的影响。2012年大选(11月5日)期间,比特币价格从大选前的11美元左右,飙升到次年11月的周期峰值1,100美元以上,涨幅近12,000%。2016年11月初特朗普当选美国总统后,比特币价格从700美元左右起步,到次年12月达到近18,000美元的峰值,增幅约3,600%。2020年11月的选举恰逢新冠疫情期间,一年内比特币暴涨478%,达到约69,000美元的高位。

数据上看,前三次选举后,比特币始终保持上涨势头,虽涨幅呈现逐步递减的趋势,但从未跌回选举日的价格,最终都在隔年达到峰值。如果这种趋势再次出现,比特币的价格应该会在大约一年后达到顶峰。

需要注意的是,美国总统选举与比特币的减半周期时间一致,在过去比特币是一个小众的另类投资市场,相比大选,减半对价格的影响更为直接。但本轮周期中,比特币已经融入美国金融体系,也成为了政策的一部分,因此这次大选对其价格的影响更为直接,无疑为比特币价格的上涨提供了新的动力。

当前所有迹象都表明,美国大选已成为加密货币发展的关键节点,比特币在2024年或将以压倒性的积极势头结束,而 2025 年将更加乐观。