一、注意力价值-市场要点

1. 市场行情

(1)宏观环境:

l 美联储评估特朗普新政府对经济与通胀的影响 降息前景不确定性加剧

著名记者尼克·蒂米劳斯在《华尔街日报》上指出美联储正在重新评估特朗普新政府对美国经济和通胀的潜在影响。知情人士透露,美联储主席鲍威尔对部分官员的公开发言表示不满,认为他们过于直接将美联储的政策与特朗普的政策变化联系在一起。目前市场普遍预期美联储未来的降息步伐将更加缓慢、谨慎。分析人士指出,2025年美联储降息的前景充满不确定性,投资者需要应对特朗普政府可能带来的经济动荡。根据CME数据,明年1月,美联储维持利率不变的概率为87.2%,降息25个基点的概率为12.8%。到明年3月,维持当前利率不变的概率为50.6%,降息25个基点的概率为44.1%,而降息50个基点的概率则为5.4%。

(2)web3领域:

l 比特币再度跌破95000美元 市场情绪低迷与资金流出加剧

加密市场持续震荡下行,比特币昨晚开启新一轮下跌,最低触及93,000美元,创下近一周的新低。根据Coinglass数据,主流中心化交易所(CEX)和去中心化交易所(DEX)的资金费率显示市场普遍看跌。同时,比特币现货ETF在周五再次出现净流出,金额达到2.87亿美元,上周累计净流出3.76亿美元。在市场调整期间,CEX平台的代币表现相对较好,而AI Agent的炒作热潮仍在持续,资金流入显著。

2. 热点事件

(1) 宏观环境:

l a16z Crypto反对美国财政部新规 称其威胁DeFi创新未来

a16z Crypto的监管负责人Michele Korver在社交媒体上发文,表达了公司对DeFi的信心,认为DeFi将使金融服务和数字经济更加便捷、高效、可互操作、可靠且以消费者为中心。然而,Korver指出,美国财政部最近发布的新经纪商报告规则对这一愿景构成了直接威胁,并可能阻碍美国DeFi创新的未来。a16z Crypto支持由区块链协会、DeFi教育基金和德克萨斯州区块链委员会提起的诉讼,认为美国国税局和财政部超越了法定权限,违反了《行政程序法》(APA),并且可能违宪。Korver强调,a16z将继续在法庭、国会及新一届行政部门的支持下,为维护DeFi的未来而战。

(2) web3领域:

l 马来西亚证券委员会出手整治:Bybit因未注册被勒令停止运营

马来西亚证券委员会对加密货币交易平台Bybit及其首席执行官采取了严格的执法行动,原因在于该平台未经过适当注册便在当地运营加密资产交易业务。监管机构在周五的声明中指出,Bybit必须立即停止其网站、移动应用程序及其他数字平台在马来西亚的运营,并要求其在12月11日起的14个工作日内完成整改。此外,Bybit还被要求终止所有面向马来西亚投资者的广告活动,并关闭为当地用户提供支持的Telegram群组。

监管机构表示,此决定是基于对该平台是否符合当地法规要求以及保护投资者权益的担忧。根据《2007年资本市场与服务法》第7(1)条,未获得证券委员会认可市场运营商(RMO)注册而运营数字资产交易平台(DAX)属于违法行为。早在2021年7月,Bybit及其首席执行官就因类似违规行为被列入马来西亚证券委员会的投资者警示名单。

3.热点叙事

l AI代理市场逆势上涨 ai16z市值创历史新高

AI agent再次引起广泛关注,根据SoSoValue数据,尽管加密市场整体回调,但AI agent板块逆势上涨,24小时涨幅达到1.54%。ai16z近日发布了代币经济学更新提案,重点内容包括在2025年第一季度的Launchpad阶段,通过收购成熟技术和团队,专注于Eliza框架的创新,并实现多链整合,以增加启动费用、质押等价值捕获机制。第二阶段则着眼于生态增长与激励协同,旨在让多个产品互增价值,增强ai16z代币之间的联系,并通过回购和生态基金等方式激励开发者。随后,ai16z的市值一度飙升至15亿美元,创下历史新高,反映了市场对AI agent潜力的认可。

二、 注意力价值-热点项目

1. 项目介绍

l $SLINKY | ZK | @Slinky_Sol

- 敘事: SOL最大规模的一次空投,代表了Solana代币技术的突破。

- $SLINKY昨日发币后半小时市值突破1000万美元,随后回调至700万美元,现报1100万美元。

- 将总供应量的10%分配给在8月30日快照期间持有超过0.006 SOL的钱包,共计27775857个钱包,利用ZK Compression实现真正的大规模分发。传统的空投方法需要55550SOL作手续费,而利用Slinky的技术只需22.2个SOL。

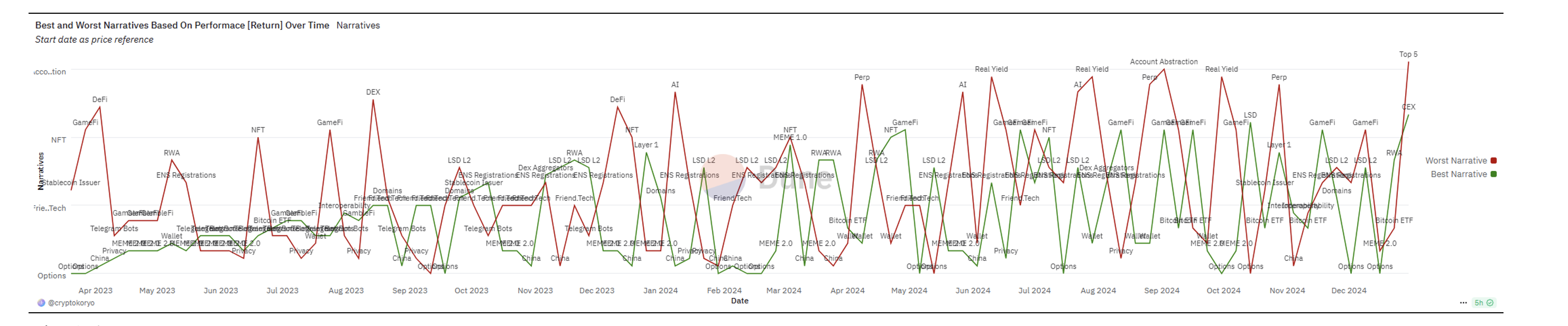

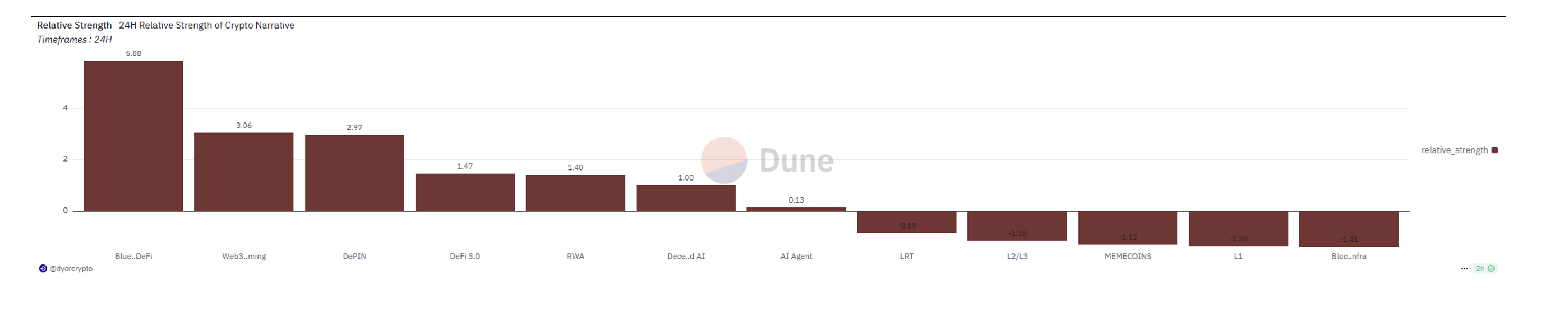

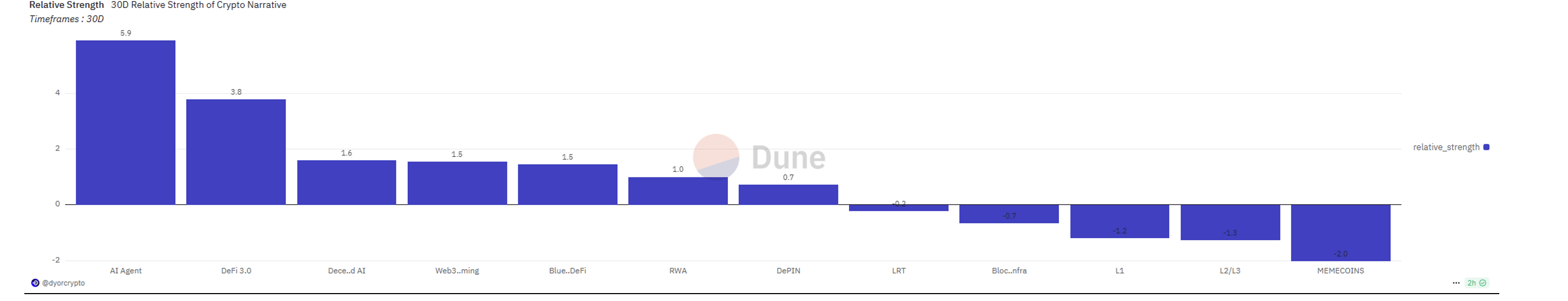

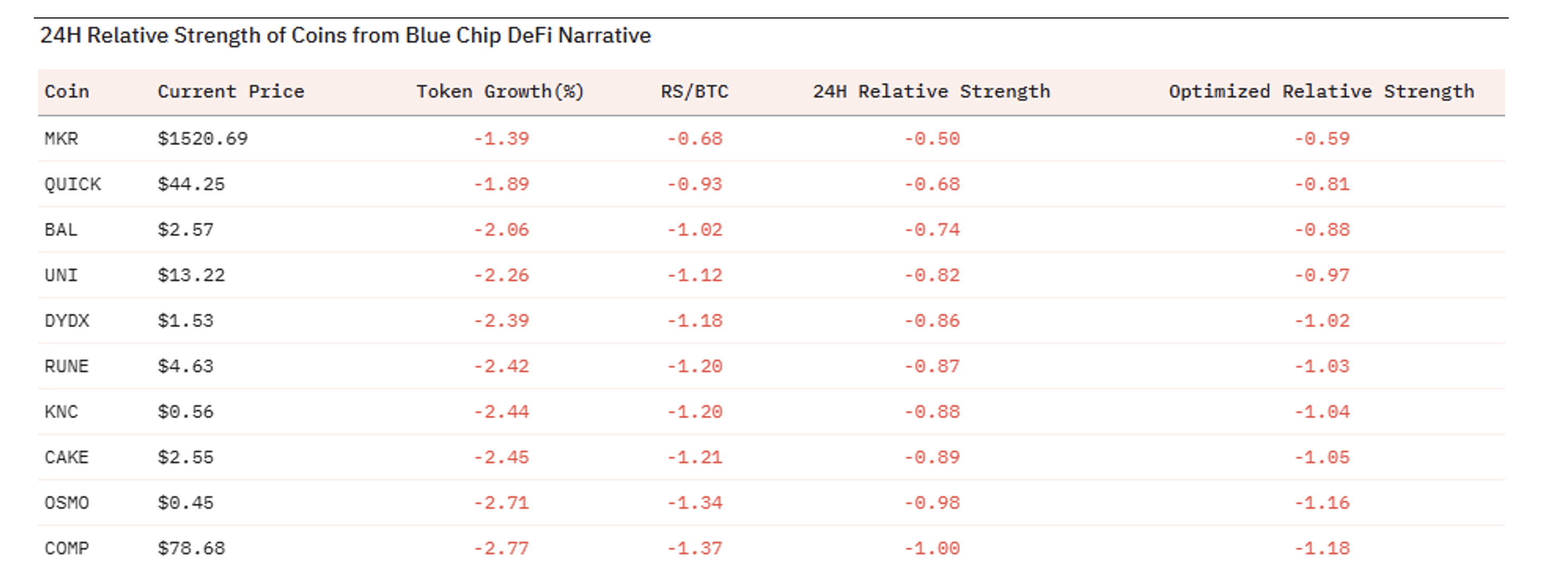

三、 注意力价值-板块轮动

1. 热点板块

资料来源:Dune,Dot Labs

资料来源:Dune,Dot Labs

2. 板块內部

资料来源:Dune,Dot Labs