作者:Stella L (stella@footprint.network)

数据来源:Footprint Analytics 公链研究数据看板

2024 年标志着公链行业的重要分水岭,行业重心从技术竞争转向实际应用落地。在这一年里,公链市值增长 105.3% 达到 2.8 万亿美元,比特币价格突破 10 万美元,并通过 ETF 实现机构级采用、以太坊 Layer 2 网络扩展至超过 200 条链、比特币 Layer 2 TVL 增长了 1,277.6%,都展示了行业从技术实验走向实用真实世界应用的转变。公链行业正经历着从以技术驱动发展为重逐步转变为以应用需求驱动发展为重的过程。

注:除非特别说明,本报告所有数据截至 2024 年 12 月 20 日。

市场动态:增长与转型

2024 年公链行业实现前所未有的增长,多个关键指标均呈现显著扩张。

公链总市值增长 105.3% 达到 2.8 万亿美元。比特币主导地位上升至 69.8%,而以太坊份额从 20.4% 降至 15.2%。BNB 链和 Solana 的份额稳定在 3.5% 和 3.3%,其他平台占比 8.1%。

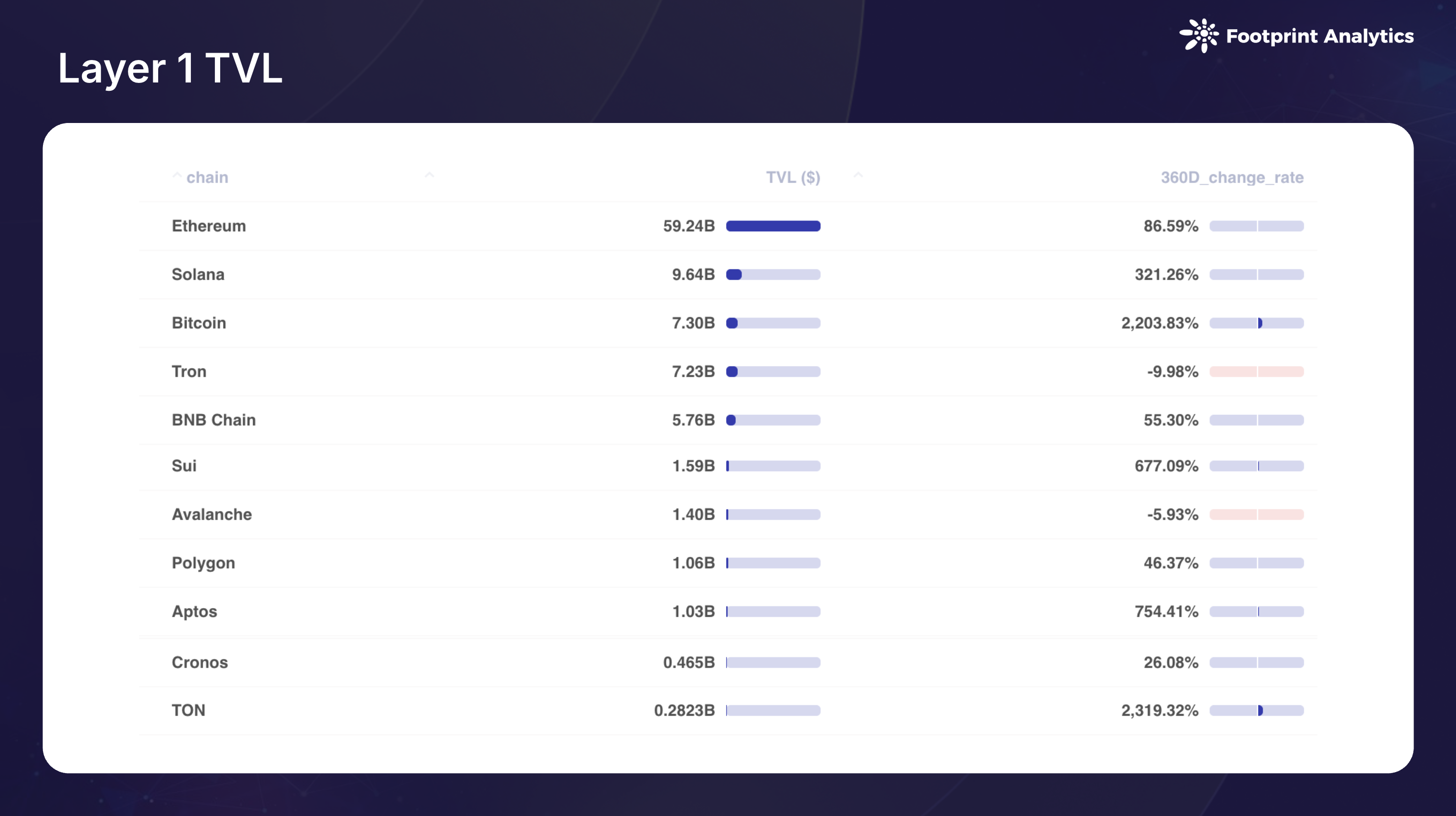

DeFi 板块在 2024 年也展现出强劲增长势头,总锁仓量 (TVL) 年末达到 1,028 亿美元,同比增长 88.6%。在 TVL 排名前 10 的公链中,比特币和 TON 的增幅最为显著,均超过 2,000%。Aptos、Sui 和 Solana 也表现亮眼,分别增长 754.4%、677.1% 和 321.3%。但 Tron 和 Avalanche 的 TVL 均出现下滑。

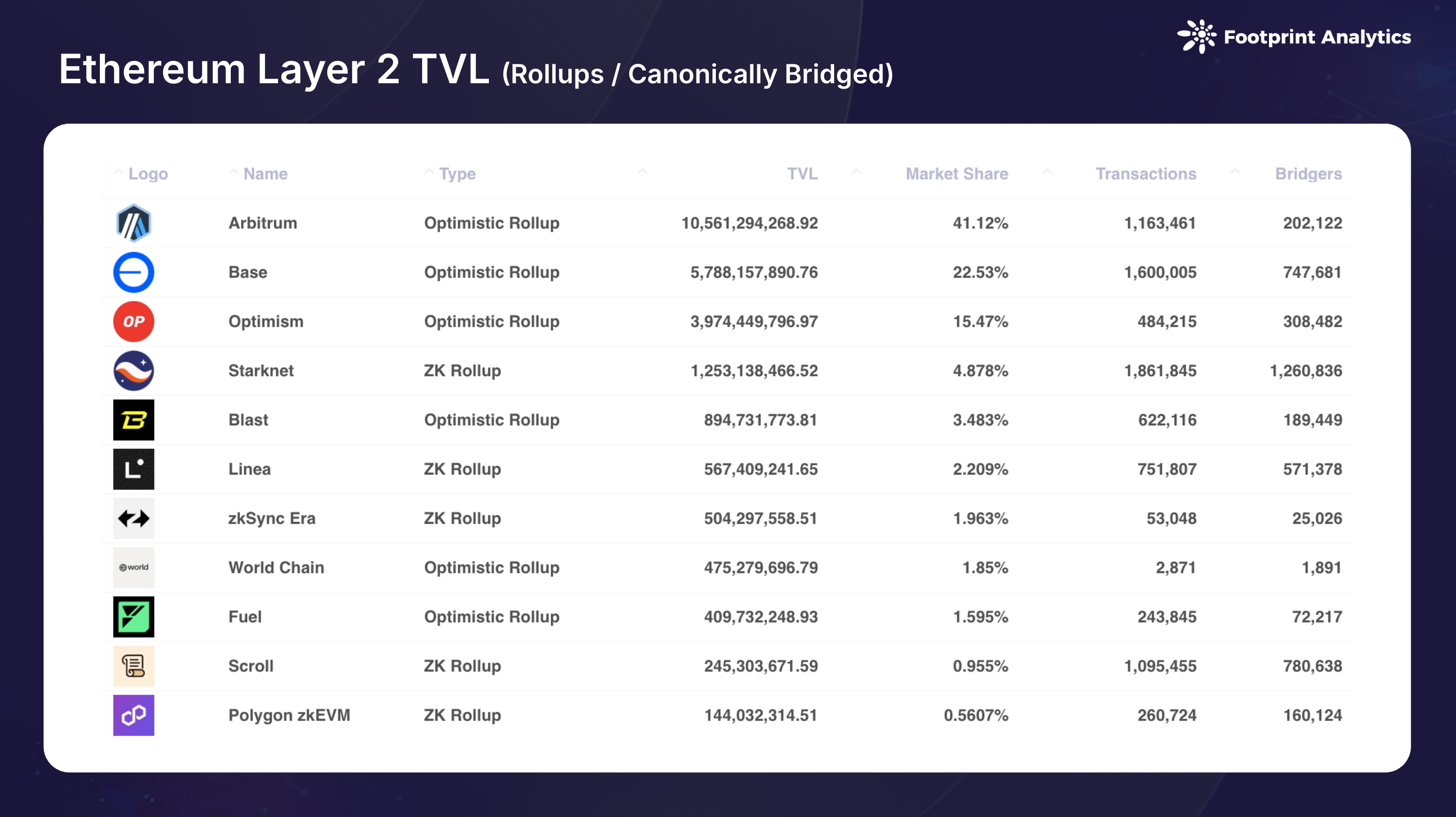

以太坊 Layer 2 生态在 2024 年经历了显著集中化态势。Arbitrum 保持领先地位,TVL为 106 亿美元,市场份额 41.1%,较 2023 年的 50.8% 有所下降。Base 成为年度黑马,以 58 亿美元 TVL (22.5%份额) 跃居第二,而 Optimism 以 40 亿美元 TVL (15.8%) 位列第三。这三大平台共同占据了以太坊 L2 DeFi TVL 的 79.1%,而此前的竞争者如 Blast、zkSync 和 Starknet 的市场份额均有所下降。

与此同时,生态系统规模持续扩张,目前已有 50 个 Rollup 和 70 个Validium & Optimium 在主网运行,加上约 90 个即将上线的链,以太坊 L2 总数超过 200 条。

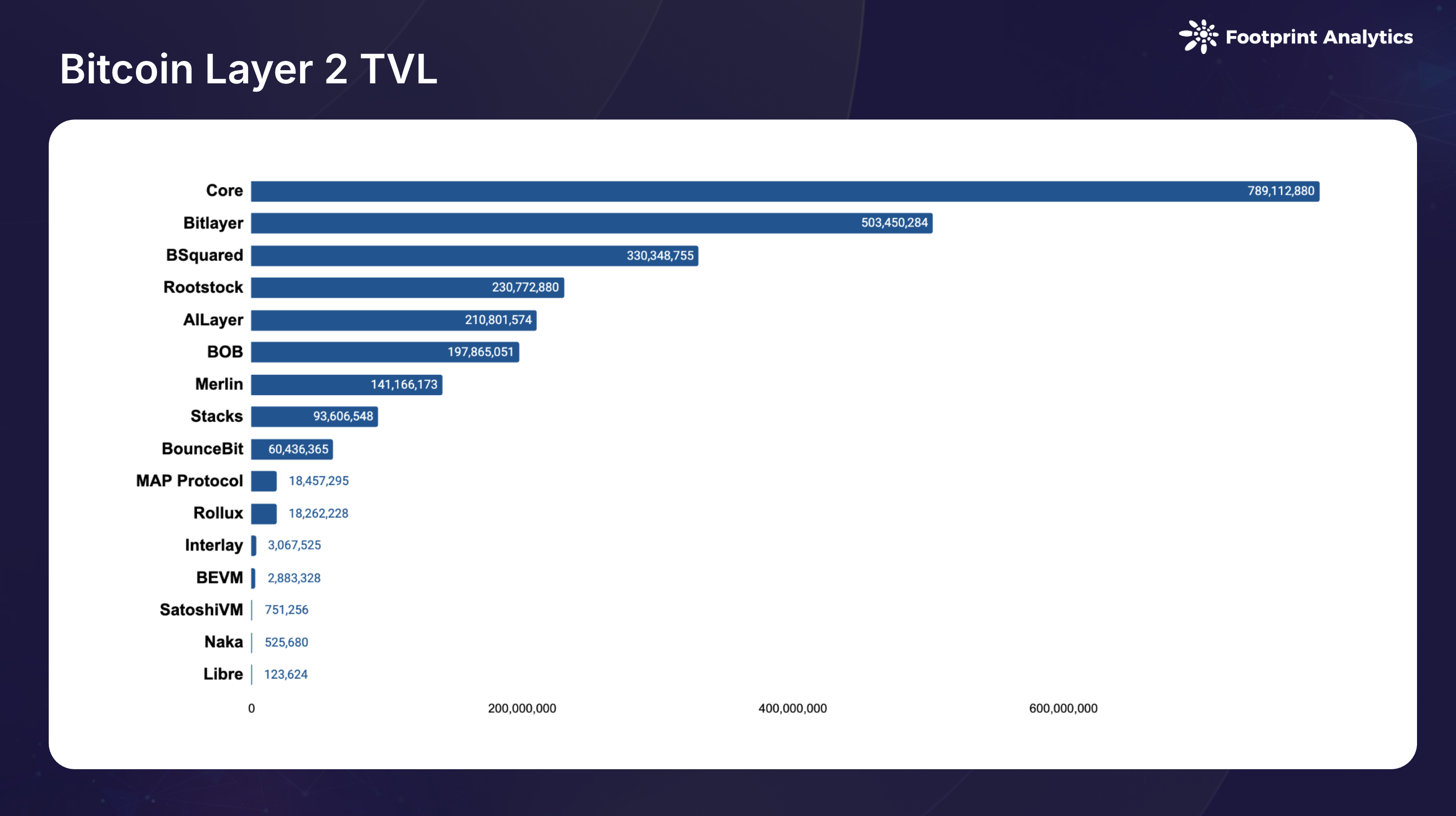

比特币 Layer 2 和侧链生态经历爆发性增长,总锁仓量达到 26 亿美元,较 2023 年大幅增长 1,277.6%。Core 以 7.9 亿美元 TVL 领跑 (30.3% 市场份额),其次是 Bitlayer (5.0 亿美元,19.4% 份额) 和 BSquared (3.3 亿美元,12.7% 份额)。这一增长不仅体现在 TVL 上,活跃链条数量在全年也增长了一倍多,现有近 20 条链。

竞争格局:领导者与挑战者

2024 年,公链生态系统的竞争格局发生显著变化,主要表现为比特币主导地位增强、Solana 的复苏以及新兴挑战者的崛起。

比特币:从价值储存到金融基础设施

比特币在 2024 年实现了卓越增长,价格上涨 129.2%,市值增长 131.7%。这一增长由现货 ETF 的机构采用、4 月减半事件以及美国大选选后积极情绪共同推动。除突破 10 万美元价格里程碑外,比特币生态系统主要有两个关键发展:

机构采用提升:1 月份现货 ETF 的成功发行彻底改变了机构准入格局,其中贝莱德的产品规模迅速达到 200 亿美元。比特币超越白银和沙特阿美,成为全球第七大资产,标志着从投机资产向公认价值储存的转变。

BTCfi 崛起:比特币生态系统通过创新金融产品实现了超越价格增长的扩展。Babylon 的比特币质押项目、Solv Protocol 的跨链解决方案以及 Core 的 Fusion 升级都展现了日益成熟的生态系统。跨链功能通过 BOB 网络与 Optimism 的整合以及 BEVM 的 “超级比特币” 框架等取得进展,尽管标准化仍面临挑战。

以太坊:Layer 2推动生态演变

2024 年是以太坊转型为 Layer 2 中心生态系统的关键一年。尽管价格上涨 55.8% 至 3,744 美元,以太坊在 Layer 2 采用增长背景下面临着重新定位角色和保持相关性的复杂挑战。7 月份现货 ETF 的成功发行获得了一定程度的机构认可,但以太坊的价格表现明显落后于比特币。

以太坊主网通过“坎昆升级”实现重要变革,成功降低了 Layer 2 交易成本并提升了可扩展性。然而,活动向 Layer 2 迁移导致以太坊本身手续费收入下降,引发了关于以太坊长期可持续性的讨论。以太坊基金会通过多个举措作出回应,包括实施 Proto-Danksharding(EIP-4844)、开发跨 L2 通信标准以及加强 Layer 2 解决方案的安全要求等。

Layer 2 生态系统全年展现出显著的增长和整合。值得注意的新进入者丰富了生态系统,包括 World Chain、Uniswap 的 Unichain 以及索尼的 Soneium。这一演变凸显了以太坊从纯执行层向多元化 Layer 2 生态系统的结算和安全提供者的转变。尽管收入模式和竞争动态仍存在疑问,但以太坊在开发者活跃度和扩展解决方案创新方面的持续发展展现了其适应能力。

Solana: 第三巨头

2024 年见证了 Solana 的强势回归,价格上涨 70.8%,市值增长 90.9%,11月币价突破 260 美元创下历史新高。这一复兴始于 1 月 Jupiter 空投,Solana 生态系统活动空前活跃。Solana 确立了自己作为散户交易中心的地位,培育了充满活力的 meme 和 DeFi 社区。除 meme 文化外,Solana 在多个领域取得进展:再质押协议、模块化 Layer 2 解决方案和稳定币创新。生态系统通过 Eclipse、Soon、Atlas 和 Sonic 等 SVM 链的扩展进一步延伸了其影响力。

新兴力量的崛起:TON, Sui 和Base

TON: 社交整合驱动平台增长

The Open Network (TON) 在 2024 年展现出显著增长,Toncoin 价格上涨 149.6%,市值增长 84.3%。TON 的成功主要源于其与 Telegram 的深度整合,有效架起传统社交网络与区块链技术之间的桥梁。该平台通过 Telegram 钱包功能和区块链整合简化加密体验,为数百万用户提供游戏、meme 和 DeFi 应用的轻松访问途径,建立了大规模采用的典范模式。

Sui: 从 Move 语言先驱到生态系统领袖

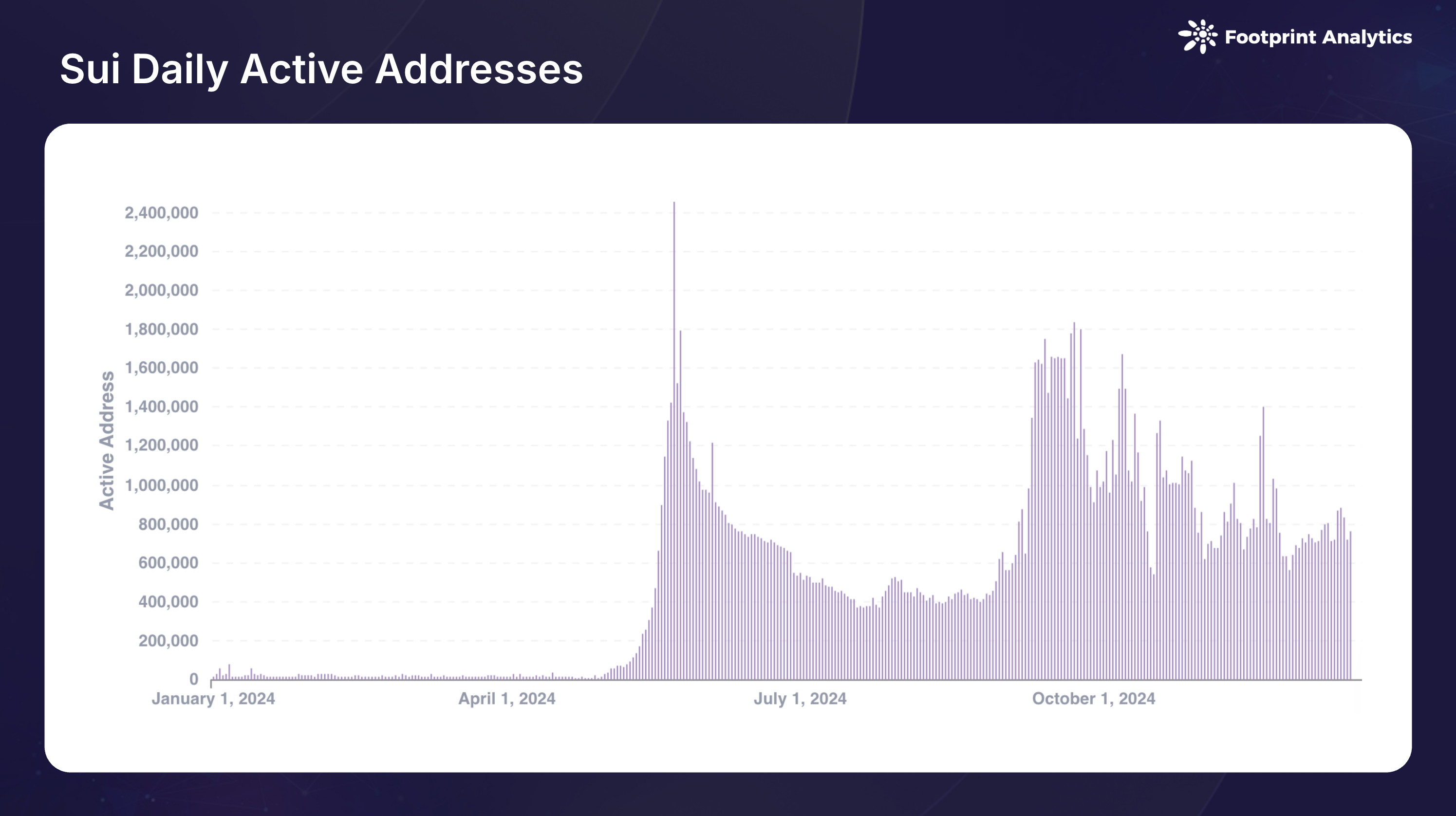

Sui 表现亮眼,代币价格飙升 461.6%,市值增长 1,363.8%。这一成功反映出市场对 Move 语言技术和生态系统发展的信心。Sui 专注于 DeFi 和游戏领域,包括 Telegram 游戏整合和创新的 SuiPlay0X1 游戏主机开发,展现了其对生态系统增长的全面布局。平台对用户体验和协议开发的重视创造了积极的网络效应,吸引了开发者和用户的共同参与。

Base: 机构背景推动快速增长

Base 的显著增长由多个关键因素推动。Coinbase 通过其用户友好的智能钱包实现显著降低了主流用户的进入门槛。平台从 friend.tech 和 Clanker 等成功的社交应用获得实质性动力,而 memecoin 的流行进一步提升了 Base 链上活动。“坎昆升级”的实施显著降低了交易费用,使 Base 对开发者和用户的吸引力不断提升。

2024 年公链行业主要趋势

新链层出不穷

2024 年,项目方纷纷推出自己的公链。DeFi 巨头 Uniswap 宣布 Unichain;游戏平台 Treasure DAO 开发基于 ZK 的 Layer 2;NFT 领域看到 Pudgy Penguins 推出 Abstract;Web3 平台 Galxe 推出了 Gravity。不仅如此,创新型新链如 Monad、Berachain 和 HyperLiquid 的进入,反映了公链行业向专业化区块链基础设施的转变。

机构采用:从探索到战略整合

机构参与方式转变

2024 年标志着机构采用从实验性区块链举措转向战略性实施的决定性转变。金融机构引领这一转型,贝莱德比特币 ETF 规模迅速达 200 亿美元,PayPal 将 PYUSD 扩展至 Solana。科技巨头通过创新方式展现更深度的参与:索尼推出面向娱乐应用的 Soneium 链,而谷歌云扩展其 Web3 门户服务。基础设施发展尤其引人注目,Circle 在 Sui 上推出原生 USDC,Visa 整合 Solana 进行结算。

机构投资范式改变

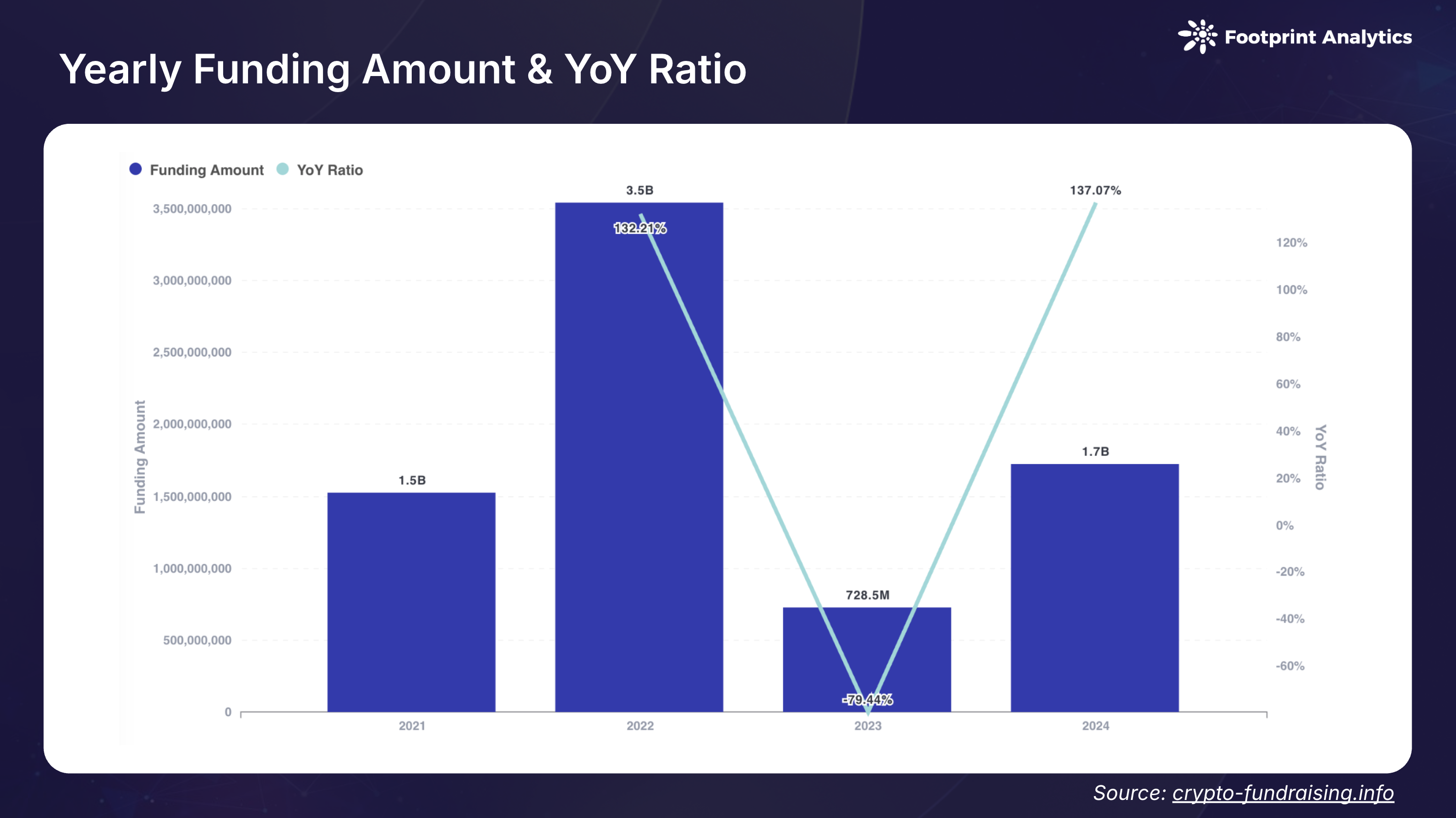

公链领域在 2024 年展现强劲复苏,174 笔融资事件共筹集 17 亿美元,较去年增长 137.1%。值得注意的是,机构投资策略从纯基础设施转向以应用为导向的创新。早期投资事件占总融资事件次数的 21.4%,而 A 轮和 B 轮占 31.8%,反映出生态系统日趋成熟。

风险投资的投资理念发生显著演变,优先考虑面向用户的应用而非传统基础设施开发。这一点体现在对面向消费者项目的大额投资上:Monad 为优化用户体验筹集 2.25 亿美元,Celestia 和 Berachain 各获得 1 亿美元用于面向应用的基础设施。

从技术竞争到应用创新

公链行业在 2024 年经历了根本性转变,从技术主导转向应用驱动策略。这一转变挑战了此前主导行业的”先建设,用户自然会来”的思维模式。尽管技术能力有显著提升,但增加的网络容量并未直接转化为相应的用户增长。比如,尽管“硬件”受限,以太坊基础层拥有高于多数 Layer 2 的“每秒处理用户数”(UOPS),凸显了技术能力与实际采用之间的复杂关系。

这一现实促使生态系统进行战略转向。区块链平台越来越注重识别具体用户需求并构建针对性解决方案,而非追求纯技术进步。这种”找到用户再建设”的方法在多个成功举措中得到体现。社交金融整合成为特别有效的策略,TON 的 Telegram 整合和 Base 的 friend.tech 展示了熟悉的社交平台如何推动区块链采用。通过账户抽象和熟悉的认证方式简化用户体验,显著降低了主流用户的进入门槛。

区块链领域中的 meme 文化的演变进一步体现了这种向应用导向开发的转变。最初纯粹的投机活动演变为有效的用户获取渠道,特别是在 Solana 和 Base 等平台上。这些网络成功利用 meme 相关举措推动生态系统增长,同时建立可持续的社区参与。这些以用户为中心的方法的成功表明,区块链领域的可持续增长越来越依赖于理解和服务用户需求,而非纯粹推进技术能力。

2025 年展望

随着区块链行业从技术实验转向实际实施,2025 年有望成为重要的转型之年。

监管清晰化

监管环境展现出显著改善的希望,特别是在美国。更清晰的监管框架预计将惠及整个行业,尤其是稳定币立法的进展。这种监管明确性将会促进机构通过受监管产品和服务的增加区块链采用,同时促进各司法管辖区之间在加密监管方面的竞争。

公链专业化

公链专业化成为主导趋势,从通用 Layer 1 竞争转向特定目的导向架构。在跨链基础设施支持下,应用专门链和优化执行环境将获得很大发展。“Rollup 即服务”(RaaS) 领域有望扩张,为企业和项目方提供更便捷的定制区块链解决方案。

技术创新与 AI整合

2025 年,技术创新将从纯粹的突破转向应用导向的基础设施升级。Proto-Danksharding 的实施将使 Blob 容量翻倍,推动 Layer 2 扩容进入新阶段;链抽象技术的发展将带来更直观的用户体验;跨链通信标准化将简化互操作性。

在基础设施层面,我们预计看到更多由实际需求驱动的发展。模块化区块链技术栈将走向成熟,为数据可用性、结算和执行层提供专业化解决方案。值得注意的是,AI 技术与区块链的深度融合将重塑基础设施形态:从改进用户界面到实现复杂的链上 AI 代理,从去中心化模型训练到支持社交金融整合,这些创新将在保持安全性和去中心化的同时,为更复杂的应用场景提供支撑,为下一轮区块链创新奠定坚实基础。

结语

过去一年证明,可持续增长不仅依赖于技术能力,更取决于有意义的用户采用和实际效用。随着监管明晰度提升、技术基础设施进步和机构参与增加,区块链技术实现有意义的大规模采用的基础已经就位。关注点从”技术上可实现什么”(”what’s technically possible”)转向”实际上有什么应用价值”(”what’s practically valuable”),这一转变将定义行业 2025 年的下一阶段增长。