一、宏觀影響

- 利好:

- 服務業PMI(58.5)與零售銷售(+0.7%)強勁,提振經濟信心,短期利多風險資產。

- GDP(+3.1%)與就業穩定(初請失業金22萬)顯示經濟韌性,為加密市場提供潛在支撐。

- 利空:

- 製造業PMI(48.3)萎縮,新屋開工低迷、耐久財訂單下降(-1.1%),顯示成長疲軟,或打壓市場風險偏好。

- 消費者信心指數下滑(104.7),顯示消費驅動可能減弱。

政策關注點:

- 經濟擴張與聯準會政策的平衡

- 經濟數據超預期可能導緻聯準會維持較長時間的緊縮貨幣政策(「higher for longer」),這對比特幣等風險資產可能構成壓力。

- 反之,如果經濟數據疲軟或下行趨勢顯現,聯準會可能傾向寬鬆,利好比特幣價格。

- 關注比特幣的屬性切換

- 在強經濟環境下,比特幣可能被視為風險資產,受益於風險偏好的提升。

- 如果經濟衰退風險加劇,比特幣的避險屬性可能被市場重估,成為資金的避風港。

- 長期視角的因應策略

- 儘管短期經濟數據波動會影響市場情緒,但長期需關注宏觀流動性(如聯準會資產負債表、財政流動性)對比特幣價格的深遠影響。

二、鏈上資金動態

- 穩定幣增發疲軟:本週穩定幣淨減少3.67億美元,日均通縮0.31億,資金流入力道顯著減弱,或限制BTC上漲空間。

- ETF資金持續流出:本週淨流出3.78億美元,流通量佔比僅0.021% ,反映機構入場意願疲軟。

三、BTC市場數據

- 交易量下降:本週日均交易量181.7億美元,季減8.36%,假期效應和巫日清算後市場活躍度降低。

- 價格疲軟: BTC價格從96,430美元回落至94,876美元,資金流動性不足對價格支撐有限。

四、BTC市佔率與山寨幣趨勢

- BTC市佔率下降:從59.92%降至58.07% ,資金逐步流出BTC並分散至山寨幣領域。

- 山寨市場接近爆發:山寨幣市佔率(OTHERS.D)在週期三角末端震盪,結合歷史週期,山寨牛市可能即將開啟。

五、巫日效應與市場波動

- 高波動性:巫日前後觸發選擇權清算,BTC交易量短期回升至192.5億美元。方向性突破仍需觀察關鍵支撐(92,000美元)。

- 資金再配置:巫日結束後短線資金或流向高風險資產(山寨幣),進一步壓縮BTC佔比。

六、下週展望

- 關鍵支撐: BTC需守住9.2萬美元,若資金流入無改善,可能加劇市場調整。

- 熱門重點: Layer2與DeFi板塊有望吸引資金,山寨市場或迎短期輪動機會。

宏觀

一、利好因素:支持加密貨幣市場的潛在利多訊號

利好因素:經濟數據超預期

服務業與消費數據亮眼

- 服務業PMI初值58.5 :顯示經濟擴張,服務業的活躍可能推動整體經濟信心。

- 零售銷售月率+0.7% :消費數據強勁,顯示消費者信心旺盛。

- 實質GDP年化季率+3.1%、個人消費支出+3.7% :經濟成長強勁,家庭消費對經濟成長的支撐效果顯著。

- 領先指標月率+0.3% :經濟成長的預期增強,有助於改善市場情緒。

數據分析:

- 經濟強勁成長可能提升風險偏好,但也可能加劇聯準會的緊縮政策預期,對比特幣價格形成雙重影響。

- 短期看,樂觀的經濟數據可能為市場注入信心,尤其當比特幣被視為風險資產時,這種情緒利好其價格。

勞動市場穩健

- 初請失業金人數穩定(22萬左右) :勞動市場依然強勁。

- 穩定的就業數據減緩經濟衰退的擔憂,有利於支撐比特幣的風險資產邏輯。

二、利空因素:經濟數據低於預期

- 製造業PMI疲軟

- 製造業PMI初值48.3 :製造業萎縮訊號,可能影響整體經濟預期。

- 製造業作為經濟晴雨表,疲軟可能削弱投資者信心。

- 住宅市場與耐久財訂單表現不佳

- 新屋開工和銷售數據低迷:反映房地產市場仍受高利率影響。

- 耐久財訂單月率-1.1% :企業投資意願下降,可能表示未來經濟活動減弱。

- 消費者信心回落

- 贅商會消費者信心指數104.7 :低於市場預期,可能削弱消費驅動的成長預期。

- 消費者信心不足會壓制市場風險偏好,可能不利於比特幣等資產。

三、巫日效應對加密市場的深度影響

2024年12月27日是本年度最後一個「巫日」 (選擇權、合約到期日)。選擇權和合約到期對市場的短期波動和長期趨勢有顯著影響。以下是巫日效應結合宏觀經濟數據的分析:

1. 短期波動:高波動性與方向性選擇

- 關鍵數據:根據Deribit數據,本週五有接近200億美元的比特幣和以太坊選擇權到期,佔總未平倉量的近50%。

- 潛在影響:

- 高波動性:巫日的到來通常會引發市場的波動率大幅上升,尤其是當市場接近關鍵價格區間。例如,BTC目前在$95,000-$100,000的關鍵區間震盪,如果價格突破,可能引發連鎖反應(如清算觸發或交易量激增)。

- Gamma壓制與突破:大量選擇權集中在$95,000-$100,000和$105,000的關鍵行使價上,選擇權到期後,市場可能出現方向性突破。

2. 投資者行為與資金流動

- 獲利回吐壓力:大規模選擇權到期可能導致短期內的獲利回吐,特別是市場目前缺乏強勁資金流入(如ETF與穩定幣增發放緩)。

- 合約市場清算效應:若價格突破關鍵支撐或阻力位,將觸發合約市場的清算行為,進一步放大波動幅度。

3. 長期趨勢的指引

- 市場結構調整:隨著年度巫日的結束,市場未平倉量可能下降,為市場提供喘息機會。但同時,資金流入與ETF的動態將成為市場長期趨勢的關鍵。

- 風險偏好的轉變:若巫日後BTC未能突破關鍵阻力,市場可能逐漸轉向山寨幣領域(尤其是Layer2與DeFi板塊)。

2. 產業分析

本週鏈上數據對BTC的影響解讀

結合本週的鏈上數據,以下從資金流動、價格指標以及交易量等方面解析這些數據對BTC市場的影響,並評估未來走勢中的關鍵風險與機會。

2.1 資金流向

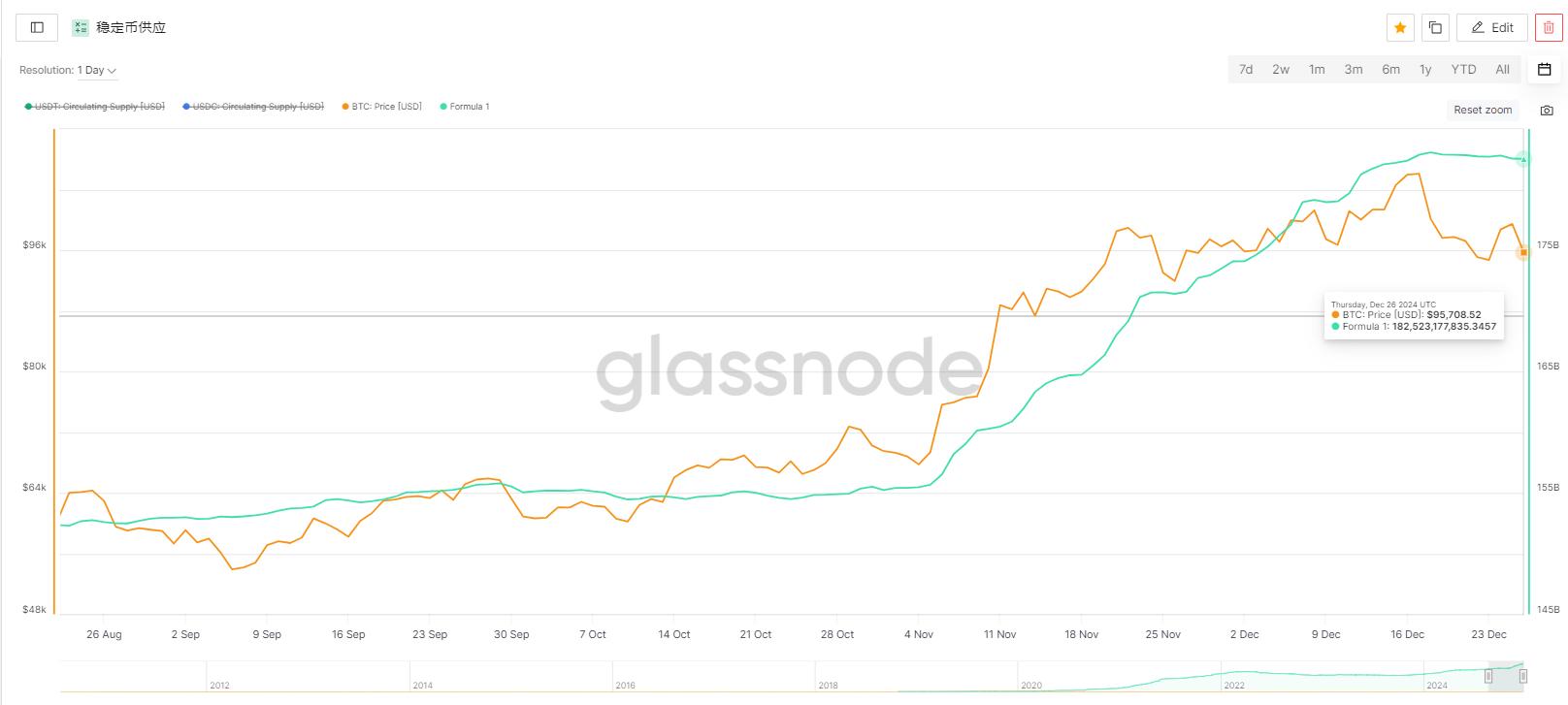

2.1.1 穩定幣資金流動狀況

數據解讀:

- 增發趨勢逐漸放緩:

- 從11月29日-12月5日的35.11億和12月6日-12月12日的50.13億的高增發量,到12月13日-12月27日兩週分別只有16.399億億,增發規模顯著減少。

- 日均增發量同樣下降,從最高的7.16億(12月6日-12月12日)下降到最近一周的-0.31億。

- 資金流入力道不足:

- 日均增發量跌破2億,顯示市場中的新增流動性顯著減弱。這可能限制比特幣和整體加密市場的反彈空間。

- 市場可能面臨的壓力:

- 隨著穩定幣增發放緩,市場資金支持力道減弱,投資者應關注潛在的拋售壓力以及價格波動可能帶來的影響。

2.1.2 ETF資金流動狀況

數據解讀:

1. ETF資金流入整體趨勢:

- 波動明顯,整體下降:

- ETF資金流入在11月中旬達到高峰(11月18日-11月22日,33.35億),隨後逐漸下降,尤其是12月16日-12月27日兩週的周流入量分別為5.20億和-3.78億,處於低水平。

- 近兩週連續減速:12月16日-12月20日與12月23日-12月27日的流入量均明顯低於11月及12月初,反映機構資金的入場熱情減弱。

- ETF資金與BTC價格關係密切:

- 11月中旬資金流入高峰對應BTC價格的快速上漲(76,069美元→ 93,018美元)。

- 12月的資金流入逐步萎縮對應BTC價格逐漸回落(101,680美元→ 94,876美元)。

2. 與上月增幅對比:

- 劇烈波動的特徵:

- 11月18日-11月22日出現最高單週增幅(+16.75億),顯示機構資金在價格突破階段集中入場。

- 11月25日-11月29日出現單週最大負增幅(-34.73億),顯示價格高位階段出現明顯獲利了結和資金流出。

- 近期持續減少:

- 12月16日-12月27日,ETF資金連續兩週下降(-16.50億和-8.98億),反映市場情緒趨於謹慎。

3. ETF流入數量佔BTC流通量百分比:

- 高點與流通量佔比:

- 在11月18日-11月22日,ETF資金流入佔BTC流通量0.181% ,達到高峰。

- 近兩週(12月16日-12月27日)佔比僅0.02255%和0.021% ,顯示新增資金的市場影響顯著降低。

- 資金流入對價格的支撐力減弱:

- ETF資金流入比例持續下降,顯示對BTC價格的支撐減弱;而資金流出階段對市場的下行壓力較大。

市場影響與分析:

1. 對BTC價格的利多:

- 資金流入高峰階段:

- 11月的資金大幅流入為BTC提供了上漲動能,機構資金助推價格突破關鍵阻力位。

- ETF流入的持續性在當時強化了市場信心,推動BTC價格一度突破10萬美元。

2. 對市場的利空:

- 資金流入趨緩與價格回檔:

- 12月資金流入逐漸減少,同時BTC價格從12月初的高點101,680美元回調至12月27日的94,876美元。

- 資金流入的放緩反映市場對當前價格區間的分歧,短期內可能對價格上漲構成壓制。

- 市場波動風險:

- ETF資金流入比例下降,可能降低市場流動性,加劇價格波動性。

3. 綜合影響分析:

- 短期波動壓力:

- 資金流入不足疊加價格處於調整期,短期內BTC可能在94,000美元附近震盪,需警惕關鍵支撐位的失守。

- 長期支撐潛力:

- 儘管近期資金流入不足,但ETF產品對機構資金的吸引力仍在,若資金重新流入,可能成為推動BTC價格上漲的關鍵變數。

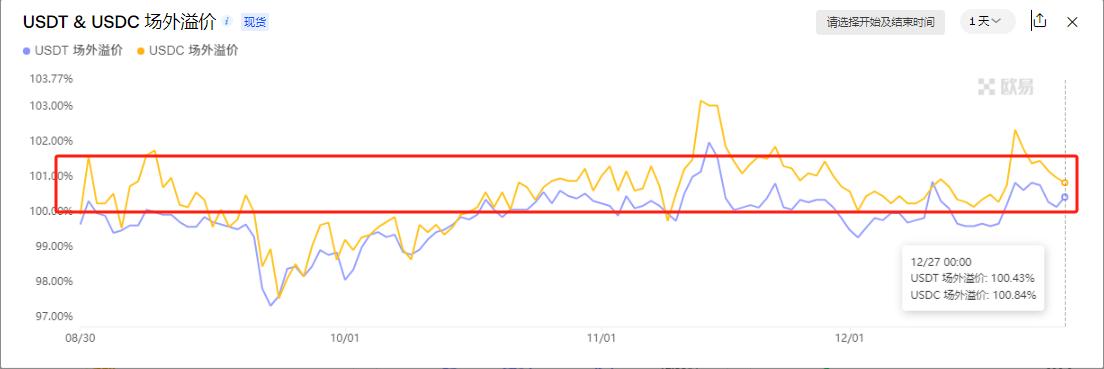

2.1.3 場外交易的溢價或折價

1. USDT vs. USDC溢價

- USDT溢價低於USDC:

- 本週USDT溢價(100.43%)低於USDC溢價(100.84%),但USDT呈現回升趨勢,USDC呈現下降趨勢,可能顯示USDT在短期資金流動中佔優勢。

2. 短期資金流向趨勢

- USDT回升:

- 溢價的回升說明USDT更受市場交易需求的支持,可能反映出更多資金透過USDT流入加密市場。

- 巫日效應:12月27日巫日的清算推動市場短期活躍度上升,增加了對USDT的需求。

- 避險需求:BTC價格近期的震盪調整(在93,000-96,000美元區間)可能促使投資者透過USDT持股以避免短期波動。

- USDC需求疲弱:

- 溢價下降可能表示USDC的機構資金需求有所放緩,但仍在100%以上的溢價區間,顯示整體市場對穩定幣需求仍保持強勁。

- 機構偏好:USDC通常被視為更偏向機構的穩定幣,溢價下降可能反映近期機構資金的交易熱情減弱。

- 減持壓力:部分機構可能在年底對穩定幣進行重新配置,導致USDC需求下降。

2.2 相關價格指標

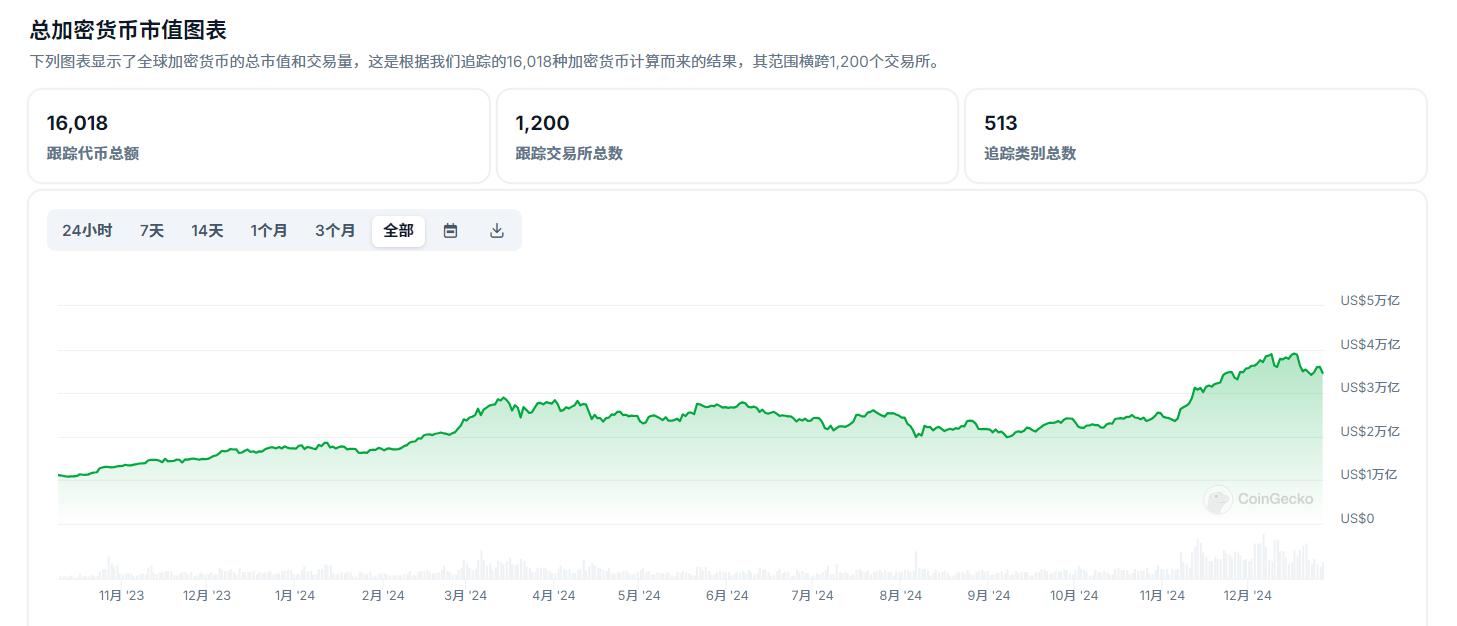

2.2.1 加密貨幣市值與BTC市佔有率

數據統計

- 加密貨幣總市值

- 12月20日(周初): 3.5兆美元

- 12月27日(週末): 3.46兆美元

- 本週變動:總市值下降400億美元,週跌幅約1.14%

- BTC市佔率

- 12月20日(周初): 59.92%

- 12月27日(週末): 58.07%

- 本週變動: BTC市佔有率-1.85%

資料解析

1. 加密貨幣總市值下降

- 市場情緒趨於謹慎:

- 本週加密市場總市值的微幅下降,主要受到以下幾個因素的影響:

- 選擇權到期日效應: 12月27日是加密市場選擇權的巫日,名目價值近200億美元的BTC和ETH選擇權到期,市場在此期間波動較大,投資人更傾向於減倉觀望。

- 宏觀環境因素:聯準會持續鷹派語調使市場對未來流動性前景仍有擔憂,同時經濟數據未完全證實寬鬆預期,這對風險資產構成一定壓力。

- 交易量不足:穩定幣增發放緩,本週資金流入加密市場的力度有限,加上假期前後交易量通常較低,限制了市場的進一步上行。

- 本週加密市場總市值的微幅下降,主要受到以下幾個因素的影響:

- 多資產板塊承壓:

- 本周山寨幣和小市值專案表現普遍弱於BTC,導致加密市場總市值下降。資金較多流向BTC和ETH等主流資產避險,顯示投資人對高風險資產的興趣減弱。

2. BTC市佔率下降

- 「資金從BTC流出」現象:本週BTC市佔率從59.92%下降至58.07%,顯示市場資金在短期內流出BTC,轉向其他資產,這一趨勢可能與以下因素有關:

- 巫日後市場再配置:

- 12月27日巫日結束後,短期投機資金減少了對BTC的集中押注,部分資金可能分散至高風險、高回報的資產(如小市值代幣或山寨幣)。

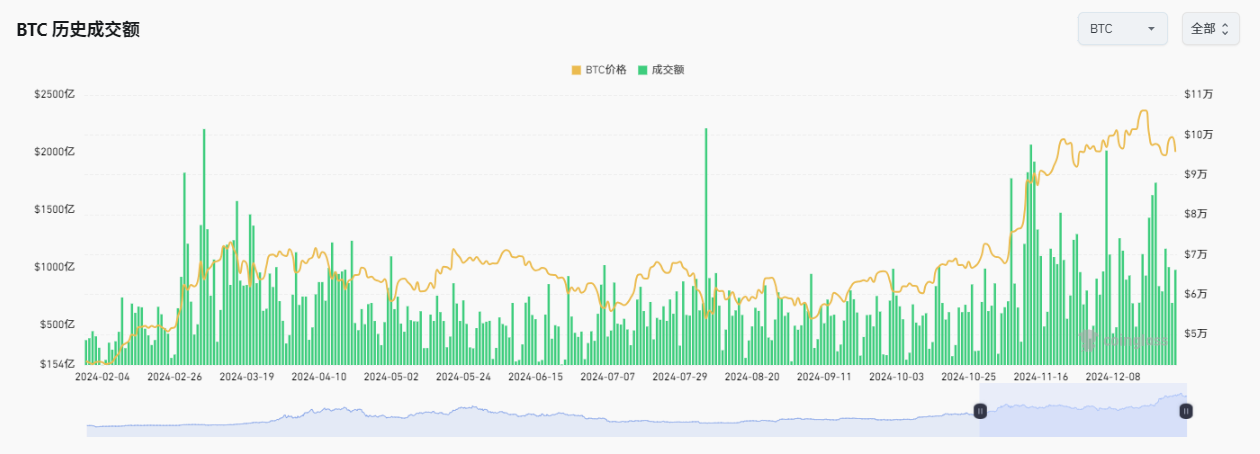

2.2.2 BTC整體交易量

本週整體交易量變動:

- 本週BTC總交易量約1,453.7億美元。

- 週環比:較上週(1,586.4億美元)下降約8.36% 。

- 日均交易量: 181.7億美元,低於前兩週的每日平均水準(約210億美元)。

2. 資料解析:交易量變化的趨勢

1. 整體趨勢:交易量呈現「下降—反彈」模式

- 周初至聖誕節期間(12月20日-12月25日):交易量下降

- 逐步下降:本週前5天,BTC交易量持續萎縮,累計下滑約15.9% 。

- 原因:

- 市場謹慎情緒:隨著12月27日巫日臨近,投資人普遍觀望,降低操作頻率,市場資金流動性不足。

- 假期效應:聖誕假期期間,市場交易活躍度普遍下降,交易量萎縮較明顯。

- 市場謹慎情緒:隨著12月27日巫日臨近,投資人普遍觀望,降低操作頻率,市場資金流動性不足。

- 巫日前後(12月26日-12月27日):交易量回升

- 短期反彈: 12月27日交易量達192.5億美元,較12月26日大幅成長16.09% ,重回聖誕節前水準。

- 原因:

- 巫日清算效應: 12月27日是BTC選擇權的巫日,近200億美元名目價值的選擇權到期,導致市場波動加劇,交易量顯著上升。

- 短線博弈:巫日後的價格劇烈波動吸引了部分短線資金入場,推動交易量反彈。

2. 交易量變動與價格關係

- 交易量下降與價格疲軟

- 價格疲軟階段: 12月20日到12月26日,BTC價格從96,430美元緩慢回落至94,500美元,累計跌幅約2% 。

- 交易量減少:此期間交易量逐漸萎縮,市場買盤力道不足,對價格支撐有限。

- 交易量回升與價格穩定

- 巫日後反彈: 12月27日交易量快速回升,與價格短線反彈至94,876美元形成正向連動,顯示資金開始試探性回流市場。

- 波動性增強:巫日後交易量的回升,較多與選擇權到期相關,可能並未形成可持續的上漲動能。

3. 對比前期交易量

- 較歷史高峰萎縮:

- 11月中旬,BTC價格突破10萬美元時,每日平均交易量超過300億美元。目前日均交易量僅181.7億美元,顯示市場活躍度明顯下降。

- 量能不足限制價格:

- 目前交易量的不足直接影響BTC價格的上漲潛力,說明市場缺乏強勁的增量資金。

未來關注方向:

- ETF資金流入回升訊號:需觀察ETF週流入量是否能恢復至20億以上,以判斷機構資金是否重拾信心。

- 市場情緒變化:結合BTC交易量與穩定幣增發數據,分析市場資金整體流動性水準。如果穩定幣增發持續低迷,市場可能會進一步承壓,特別是BTC的關鍵支撐位可能面臨測試。

- 關鍵價格支撐:關注BTC在92,000-94,000美元區間的支撐強度。

風神輪動

本週總結與展望

1. 短期總結

- 山寨幣反彈:本周山寨市場反彈,部分代幣表現良好。

- 資金流出壓力:30日淨流出規模擴大,7日淨流出速度放緩。

- BTC市佔率與USDT市佔率:在關鍵點位博弈嚴重,短期可能會繼續往上。

2. 中長期展望

- 山寨市佔率:除前10以外全代幣市佔率即將結束震盪三角,結合歷史週期規律,中期上看好山寨牛市回歸。

3. 風險與建議

- 風險:若BTC跌破90000山寨市場或進一步惡化。

- 策略建議:關注BSC生態,可能受到幣安扶持後能夠回暖

結合本週宏觀指標與市場數據分析,山寨幣市場正經歷持續的調整與資金流出壓力。以下從山寨季指標、資金流向、BTC市佔率、OTHERS市佔率、 USDT市佔率等多維度解析本週的山寨市場表現,並展望後續可能的發展路徑。

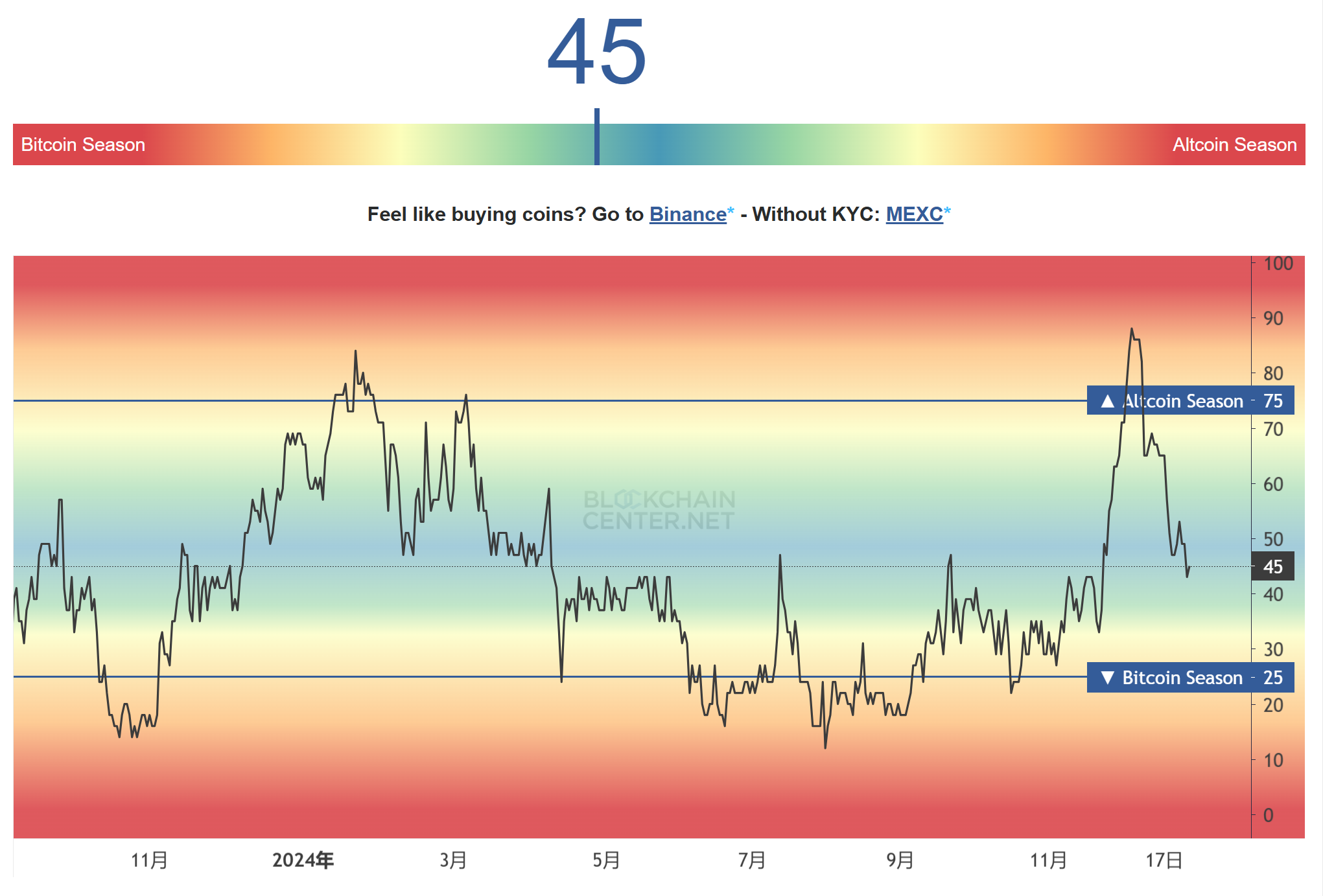

山寨季指標

本週五山寨指數從上週47下跌至45,指數整體跌幅放緩。

好的方面是,本週許多山寨幣都有所反彈,短期上許多山寨也許已經階段性觸底,但是如果BTC失守90000可能會再次引起山寨的集體回撤,請各位務必注意風險。

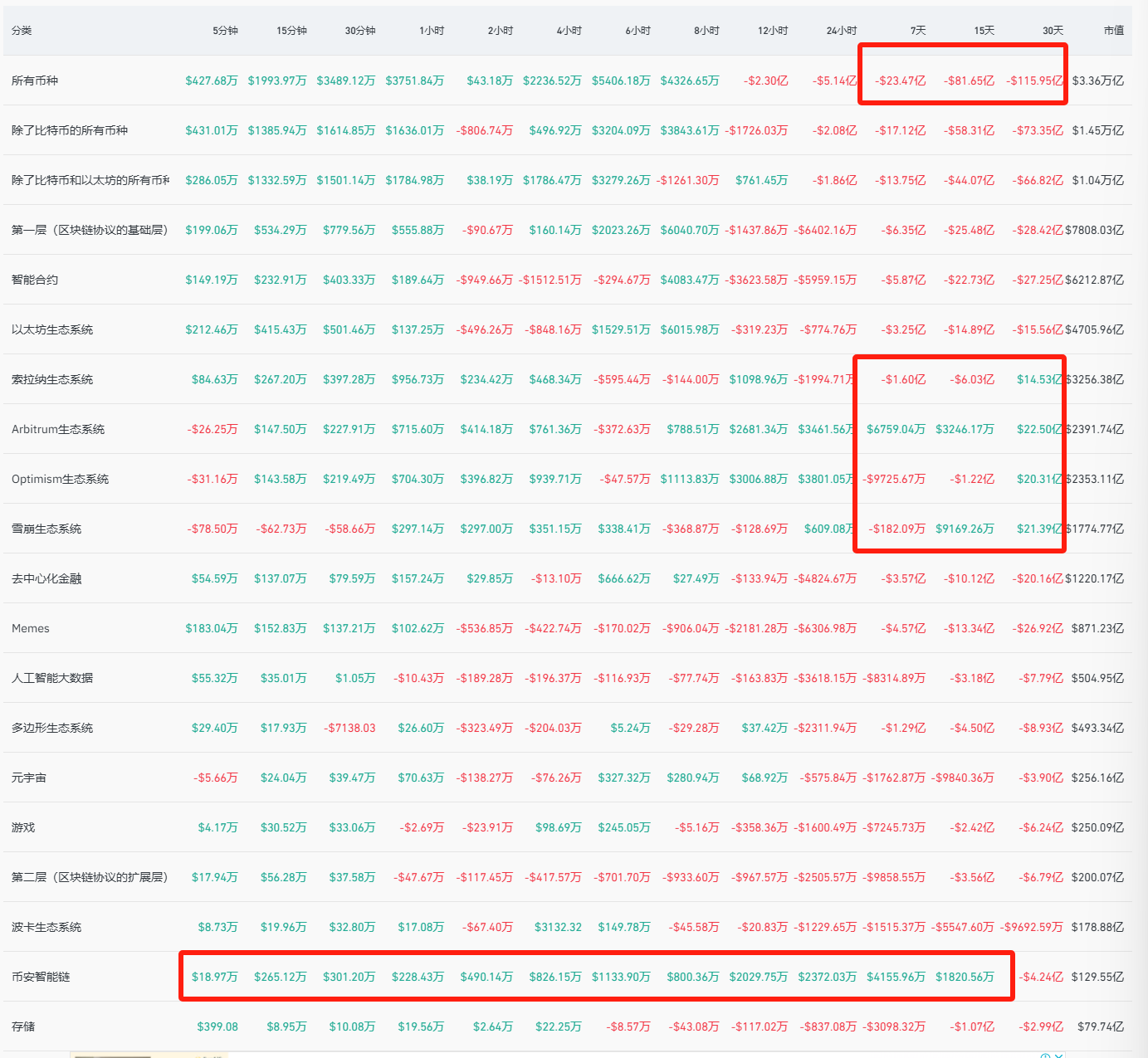

山寨流入量

本周山寨的小幅反彈並未能很好的反映在各板塊中的流入數據中來,不過好在本周全幣種淨流出23.47億美元,環比上週淨流出速度下降了48%,但總體30天淨流出仍在增加,已經達到了116億美元。

月線上,所有板塊仍只有我們這幾週提到的SOL、ARB、OP、AVAX生態保持淨流入,週線上本週僅剩ARB、AVAX、BSC生態淨流入。

值得我們注意的是BSC生態已經逐漸呈現回暖跡象,15天流入水平回到了水上,不過月線上還是有巨大的流出缺口需要慢慢填補。

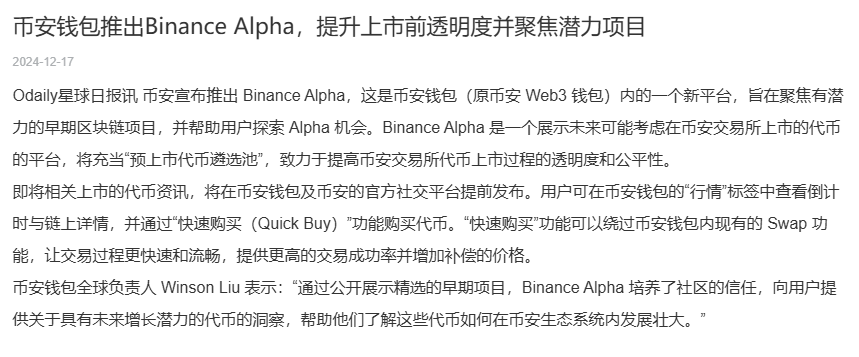

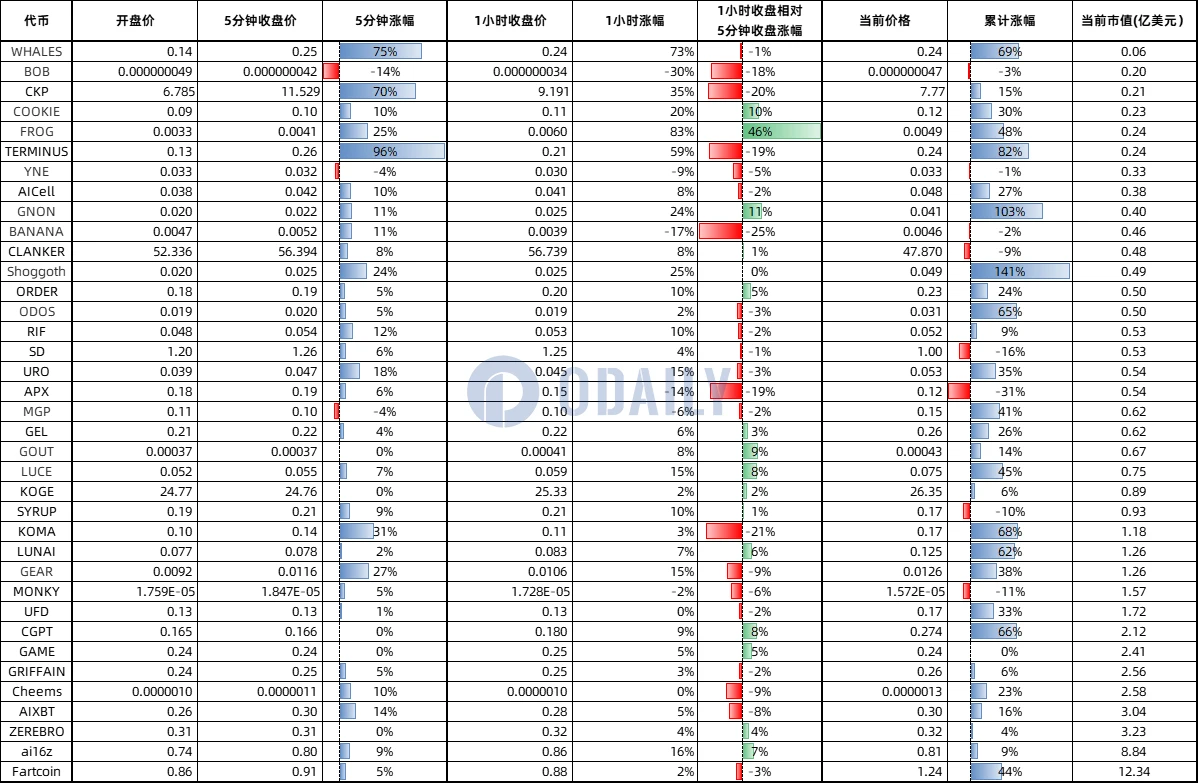

這個短期的回暖我們推測是由於幣安在上週二12月17日發起的Binance Alpha的帶動作用,Alpha池每期都會上數個潛力代幣,其中BSC生態代幣會佔大頭,因此市場資金可能會從投機角度流入BSC進行一些潛力標的的左側埋伏。

根據ODAILY現有的研究,Alpha池的財富效應還是多聚焦在超短期,但是我們認為在中期上,結合幣安的扶持,BSC生態仍然擁有大幅回暖的預期,我們也在之前對BSC的幾個標的進行了佈局,會持續進行關注。

BTC市佔率(比率、增幅)

BTC市佔率方面,週線上我們仍在上週提到的阻力區間中震盪,我們的結論仍保持不變,BTC的強勢地位即將在三角收束末端附近跌破,並迎接山寨季的到來。但我們暫不明確三角上軌是否會被測試還是會直接跌破,需要關注短線上的BTC強弱情況。

4h級別上還是顯現出了一定的支撐,目前我們看到了這次BTC強勢階段建立了三個更高的低點,但是在前幾日從衝破阻力區間後又迅速回落,即將測試短線支撐。在山寨普遍較弱的情況下看,我們更傾向於BTC市佔率仍會持續一段時間的強勢地位。

OTHERS.D

前十以外代幣全市值市佔率仍在震盪三角的末端糾結,結合我們上週提到的周期規律和放量形式來看,我們距離山寨季非常接近,結論與上周保持一致。

週期規律總結:

- 紅色區域:牛頂後的下跌

- 藍色區域:觸底後第一次反彈

- 黃色區域:反彈後再下殺,製造市場恐慌

- 綠色區域:山寨牛市,牛頂區間

需要注意的是,自16年以來我們都在不斷建立更高的低點與更高的高點,因此,現在處於黃色區域中的我們之後大概率會進入山寨牛市,OTHERS.D迅速上升到更高的高點區間中(斐波那契1~1.618區間)。

USDT市佔有率

最後我們再來關注USDT市佔率情況,也能反映山寨市場的強弱情況。

與上週一樣,本週USDT市佔有率回抽到了長期支撐線上,並在線附近來回博弈。

4小時級別上不斷試探支撐線,已經被多次拒絕,但仍在不斷試探。因此對於USDT市佔率的關注需要聚焦在日線層級或以上才能夠更加明晰,我們之後也會持續關注。

特別鳴謝

創作不易,如需轉載、引用可事先聯絡作者授權或說明出處來源,再次感謝讀者朋友們的支持;

撰稿:Sylvia / Jim / Mat / Cage / WolfDAO

編輯:Punko / Nora

感謝以上小夥伴對本期週報的傑出貢獻,本週報由WolfDAO 協作發布,僅供學習交流、研究或欣賞;