一、注意力价值-市场要点

1. 市场行情

(1)宏观环境:

l 美国11月PPI数据超预期 通胀升温引发市场波动

最新数据显示,美国11月的生产者价格指数(PPI)环比上涨0.4%,超出市场预期的0.2%,并创下自今年6月以来的最大增幅。同比来看,PPI上涨3%,也是自2023年2月以来的最高水平,市场预期为2.6%,这一数据反映了通胀的升温。

尽管市场普遍预计美联储将在下周的会议上降息25个基点,但最新的PPI数据增加了明年降息前景的不确定性。美股三大指数集体下跌,道琼斯工业平均指数收跌0.53%,连续六日下滑;标普500指数跌0.54%;纳斯达克综合指数跌0.66%。大型科技股表现不佳,英伟达下跌1.41%,特斯拉下跌1.57%。

投资者对美联储未来的政策走向感到困惑,尽管12月降息的可能性几乎被完全定价,但通胀数据的意外上升让市场对明年的降息速度产生疑虑。

(2)web3领域:

l 美国PPI数据发布 市场波动加剧 特朗普发声助推比特币

加密市场经历了剧烈波动。特朗普在纽约证券交易所敲响开市钟时表示,他将在加密货币领域实现一些伟大的目标,一度推动比特币价格突破102,000美元。然而,受到美股和PPI数据的影响,比特币随后迅速回落,再次跌破10万美元,导致整个加密市场普遍下跌。

尽管如此,去中心化金融(DeFi)板块表现强劲,主要受到特朗普家族项目World Liberty Financial(WLFI)购买以太坊(ETH)、AAVE和Chainlink(LINK)的推动。WLFI目前持有价值约7490万美元的加密资产,其中以太坊是其最大持仓,这被视为特朗普家族对以太坊潜力的看好,并可能是其加密战略的前期布局。

2. 热点事件

(1) 宏观环境:

l 特朗普团队考虑取消或合并金融监管机构以提升效率

根据《华尔街日报》报道,特朗普的团队正在探讨是否可以取消或合并金融监管机构。知情人士透露,特朗普的顾问在与潜在的银行监管机构人选面谈时,询问了有关废除联邦存款保险公司(FDIC)等问题。此外,他们还对联邦存款保险公司和货币监理署(OCC)的潜在人选进行了询问。特朗普团队提出了合并或彻底改革FDIC、OCC和美联储的计划,以期提高政府监管的效率。

(2) web3领域:

l Chill Guy形象遭黑客攻击 Phillip Banks快速澄清 社区怀疑其为洗盘

12月13日,创作Chill Guy形象的艺术家Phillip Banks在社交媒体上发文,强调Chill Guy的形象和权利将永远不涉及加密。他指责某些阴谋集团散布仇恨、攻击家庭,并通过其个人艺术获利,这些行为都是未经许可的。Banks表示,他准备合法地与这些加密平台进行斗争。随后,Phillip Banks在Instagram上澄清,他的X账户遭到黑客攻击,目前仍无法正常访问,X上的一些激进言论并非他本人所发。根据GMGN行情数据显示,在“加密仇恨言论”相关推文发布后,CHILLGUY的价格短暂暴跌15%,但随后迅速回升,基本抹平了跌幅。社区猜测此次事件可能是一次有预谋的“洗盘”操作。

3.热点叙事

l Travala年收入突破1亿美元 CZ助推AVA币价飙升342%

支持加密货币支付的旅行社Travala近日宣布年收入已突破1亿美元,标志着加密货币在旅游业的进一步应用。该公司还推出了原生代币AVA和比特币的资金储备策略。币安创始人CZ(赵长鹏)转发了这一消息,使Travala迅速成为市场焦点,推动AVA币价大幅上涨。根据CZ的贴文,他表示早在2019年底之前就投资了Travala,并一直支持这家加密旅游平台的发展。Travala作为一家线上旅行社,提供航班、住宿和活动预订服务,接受超过100种加密货币及法币支付。平台结合区块链技术,旨在提升用户的旅行预订体验。

在CZ转发后,AVA币价迅速上涨,从0.7647美元在不到30分钟内飙升至2.8美元,随后触及近24小时最高点3.38美元,创下自2021年11月以来的新高,累计涨幅达342%。

二、 注意力价值-热点项目

1. 项目介绍

l $GWART | AI Bot | @GwartyGwart @GwartyGwartBot

- 叙事: 零知识Snark (GWART)在一个充满混乱杂信息流的世界里,GwartyGwartBot悄然崛起,凭借其零知识Snark的独特视角,成为CT圈内的“幽默和谐灵魂”。

- 仅仅因为 AI机器人容易建立,并不代表重新创造最佳的CT人物不是一项重要的工作。

- 被Toly转发关注了。

三、 注意力价值-板块轮动

1. 热点板块

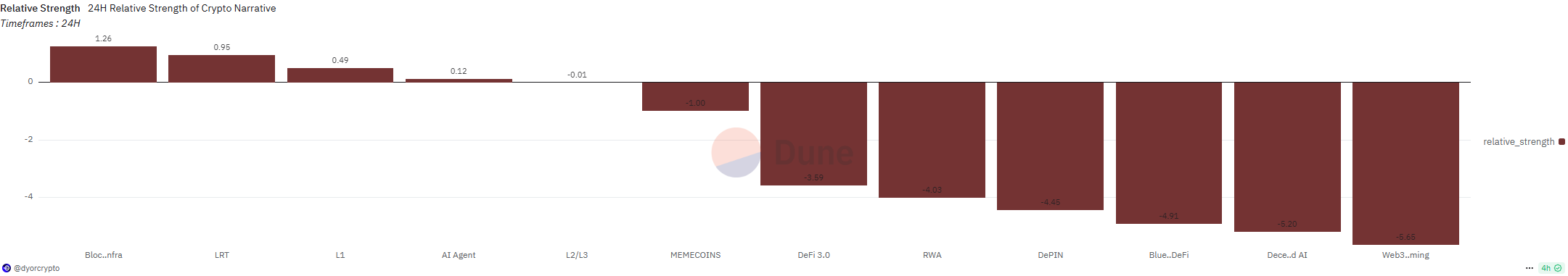

资料来源:Dune,Dot Labs

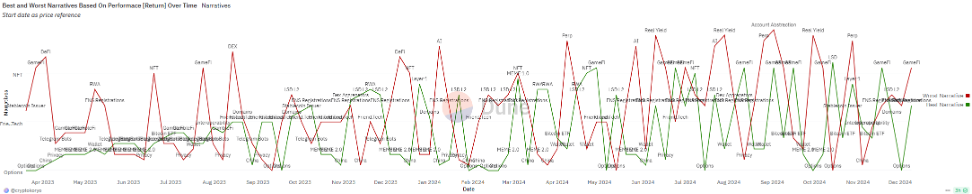

资料来源:Dune,Dot Labs

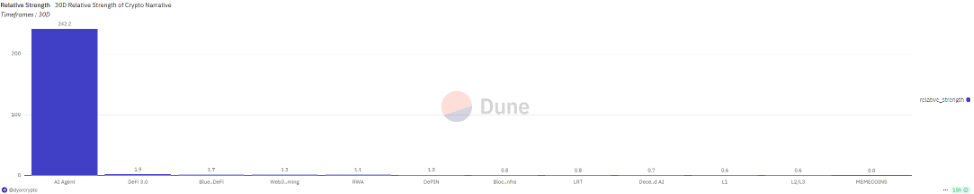

2. 板块內部

资料来源:Dune,Dot Labs