引言:

根据近年来邵律师所承办的案件以及日常工作中接到的大量咨询发现,国内警方(特别是在湖南地区)针对虚拟货币交易平台涉及的永续合约业务,以涉嫌开设赌场罪对相关人员采取刑事强制措施的情况屡见不鲜。

这些相关人员有:虚拟货币交易平台股东、实控人、高管、合约模块的业务负责人、技术人员、运营人员、KOL,以及平台代理(为交易所带单返佣)。

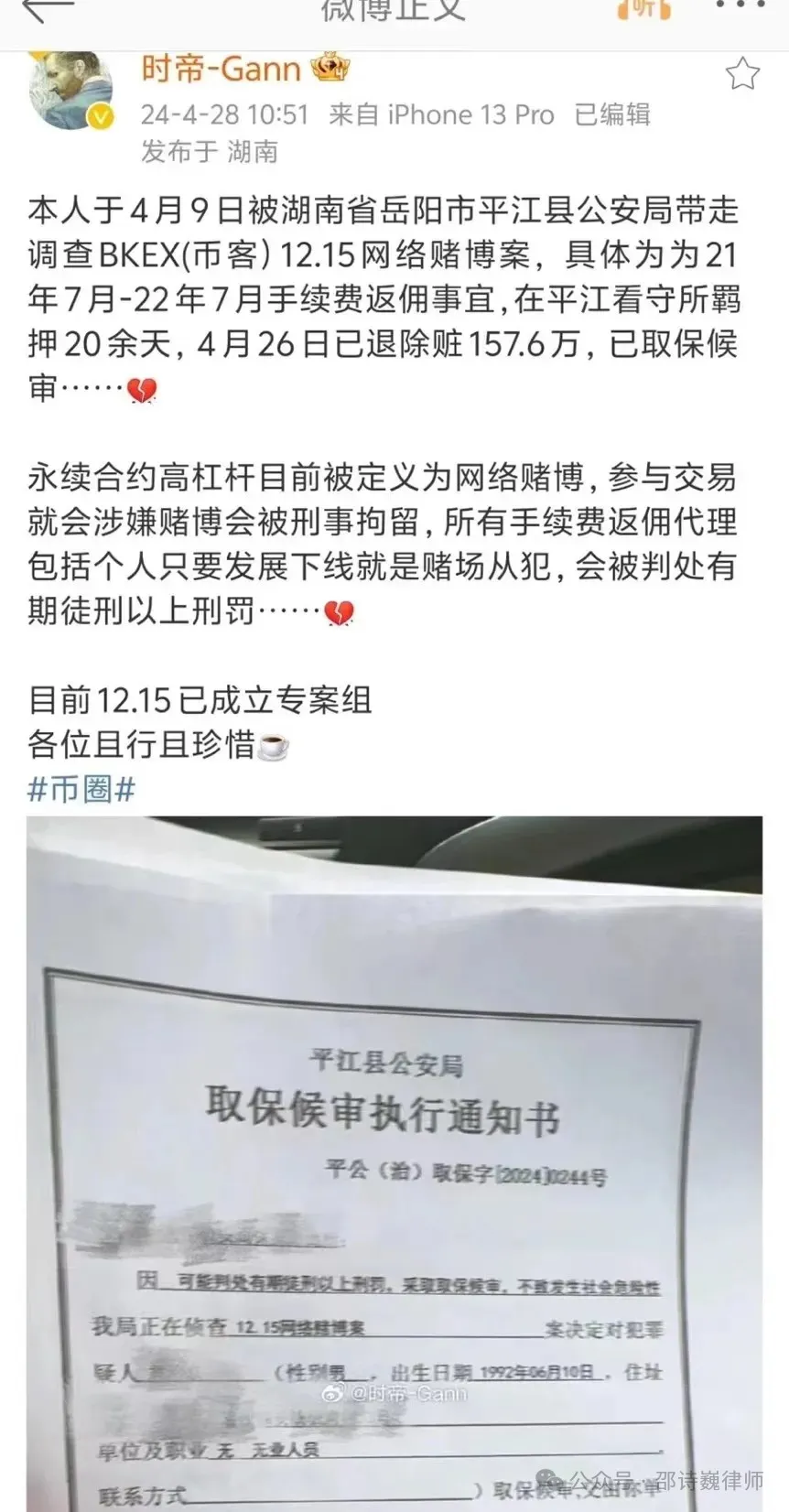

根据实务中的办案情况来看,司法机关似乎认定,只要虚拟货币交易平台经营“永续合约”业务,即等于平台行为应认定为开设赌场罪。在2024年4月9日,某用户也曾在社交平台上发布消息,称永续合约高杠杆目前被定义为网络赌博,手续费返佣代理包括个人发展下线可能涉嫌赌场从犯。

本人近期所承办的一起开设赌场案,同样是因为某虚拟货币交易所开展永续合约业务,导致平台相关工作人员被公安机关跨省抓捕。

所以,虚拟货币交易平台所开展的永续合约业务,究竟是否构成开设赌场罪?

作者 |邵诗巍律师

01、什么是“永续合约”?

永续合约(Perpetual Futures)全名「永续期货合约」,由期货合约演变而来,是一种币圈独有且常见的投资工具,它允许投资者在加密货币市场上进行杠杆交易。加密货币衍生品交易平台BitMEX在其官网中提到,永续合约最早是由该平台创设。

永续合约与期货合约不同之处在于。期货合约有结算日(交割日),而永续合约没有到期日。这意味着只要用户的资金(保证金)足够,就可以永久持有该合约,自由选择何时结算。

永续合约有以下特点:

-

高杠杆。大部分交易所的永续合约都支持100倍,甚至200倍的杠杆;

-

不需要实物资产即可交易。用户的交易标的是基于现货价格的指数,所以用户不需要实际拥有现货即可进行双向交易;

-

没有到期日,无需交割。用户只要不爆仓,就可以一直持有,避免了经常交割而调仓的麻烦;

-

没有利息。只需要支付较低的手续费和潜在的资金费率(但资金费率是双向的,可能是一笔支出或收益)

如果用户经分析判断某币种此后会上涨或下跌,可以通过永续合约做多(看涨)或做空(看跌)该币种。通过放大杠杆倍率,用户在获得更高的潜在利润的同时,风险也会成倍增加。因此,永续合约是一种高风险投资策略。

02、永续合约是否等于赌博?

办案单位认为永续合约即赌博的逻辑在于,赌博的特征之一是以小博大,而永续合约就是猜涨跌,赌大小。表面上看,永续合约似乎就是用户通过以猜币价涨跌的方式,意图获得更高的收益,但实际是否是这样?我们展开分析。

什么是赌博?我国法律中对此并未有明确定义,但通过以下最高院指导案例,我们可以总结出会被认定为赌博的特征情形。

最高法2020年12月31日最高法《关于发布第26批指导性案例的通知》(指导案例146号.陈庆豪、陈淑娟、赵延海开设赌场案),以“二元期权”交易的名义,在法定期货交易场所之外利用互联网招揽“投资者”。

在该案当中,法院认为,“会员选择外汇品种和时间段,点击“买涨”或“买跌”按钮完成交易,买对涨跌方向即可盈利交易金额的76%-78%,买错涨跌方向则本金即归网站(庄家)所有,盈亏结果与外汇交易品种涨跌幅度无关,交易价格与盈亏幅度事前确定,盈亏结果与价格实际涨跌幅度不挂钩,交易者没有权利行使和转移环节,交易结果具有偶然性、投机性和射幸性。因此,龙汇“二元期权”与“押大小、赌输赢”的赌博行为本质相同,实为网络平台与投资者之间的对赌,是披着期权外衣的赌博行为”。

我们通过分析给案例中法院观点,再对比永续合约的交易模式,可以看出,永续合约并非是赌博行为,主要原因有以下几点:

1、上述案例中,用户选择“买涨”或“买跌”,一旦方向选错,则用户亏损,这也就是赌博中的“买定离手”的概念,一旦做出选择,就不能够再更改。但永续合约模式中,用户在买入后,可以根据行情涨跌,随时选择平仓卖出。

2、上述案例中,交易价格与盈亏幅度事前确定。永续合约业务中,交易价格指的是平仓价格或卖出合约的价格,这是由用户指定或市场价决定的。而平仓价、开仓价,选定的交易时间等均可能影响用户的盈亏与否。

3、上述案例中,用户的盈亏结果与价格实际涨跌幅不挂钩,也就是说,在赌博的模式中,赌客的盈亏金额可以通过概率预估。邵律师曾在《炒币合约带单让你飞,是天使还是魔鬼?》一文当中提到过一则案例,习某作为星币全球代理,引导客户购买虚拟币以买涨买跌的方式进行赌博,进而从参赌者手中赚取手续费和盈亏金额。该平台的模式被法院认定为开设赌场的原因在于,用户通过投注USDT来买卖虚拟币的涨跌,买对赚钱,买错亏钱,该模式和本文上述案例中的模式一致。

在永续合约业务中,用户的盈亏与否,虽然与虚拟货币的涨跌幅有关。用户盈亏的多少,取决于其买入卖出的价差,且具体盈亏数额是不确定的。

4、上述案例中,交易者没有权利行使和转移环节。永续合约业务中,用户可以根据自身对于市场行情的判断,自行决定是否在某时间节点终止交易或追加交易,可以随时撤单、取消交易,另外,用户可以通过“反手交易”的功能,一键点击后,就可以将做空单与做多单进行更换。

5、上述案例中,网络平台与投资者之间进行对赌。永续合约业务当中,交易所赚取的是手续费收益,并非是根据用户的输赢从中进行“抽水。

6、上述案例中,认定平台模式为“押大小、赌输赢”,但永续合约作为一种币圈独有的金融衍生品,需要投资者综合多种因素,对于币价走势、涨跌进行专业分析和研究之后,制定投资策略,合理配置资金。币价的涨跌是由诸多因素推动下的综合作用造成的,如:宏观经济趋势,货币政策,市场供需,机构投资者的参与,市场情绪和事件影响等。

综上,邵诗巍律师认为,开设赌场罪当中的赌博是完全的赌概率,赌客的输赢与否是偶然因素。

在永续合约业务当中,需要用户通过专业性的技术分析、行情分析,来自主选择操作策略,并且可以根据交易中的行情走势变化,来判断是平仓、减仓还是加仓。所以,虚拟货币交易平台经营永续合约业务,并不构成开设赌场罪。

03、律师提示

虚拟货币交易平台的永续合约作为一种金融衍生品,从其模式及法理上分析,目前被部分办案单位认定为开设赌场罪,本律师认为存在极大争议。

尽管未有直接的政策法规将虚拟货币衍生品交易模式定性为刑事犯罪,但在2017年发布的《关于防范代币发行融资风险的公告》中已明确指出,涉及虚拟货币的相关业务属于非法经营活动。因此,对于那些涉足加密货币行业的创业者和从业人员而言,从规避刑事风险的角度考虑,远离永续合约业务,至少可以在一定程度上降低潜在的法律风险。