作者:Stella L (stella@footprint.network)

数据来源:Footprint Analytics 公链研究页面

2024 年 11 月,区块链行业终迎“大牛市”行情,比特币不断刷新价格新高,即将突破 10 万美金重要关口,同时其市值突破主要传统资产市值白银。同时,以太坊也实现强劲复苏,山寨币实现显著反弹。在比特币 Layer 2 保持强劲增长的同时,面对日益激烈的竞争,以太坊 Layer 2 增长相对温和。

本报告数据来源于 Footprint Analytics 的公链研究页面,该页面提供了一个易于使用的仪表板,包含了解公链领域最关键的统计数据和指标,并实时更新。

市场概览

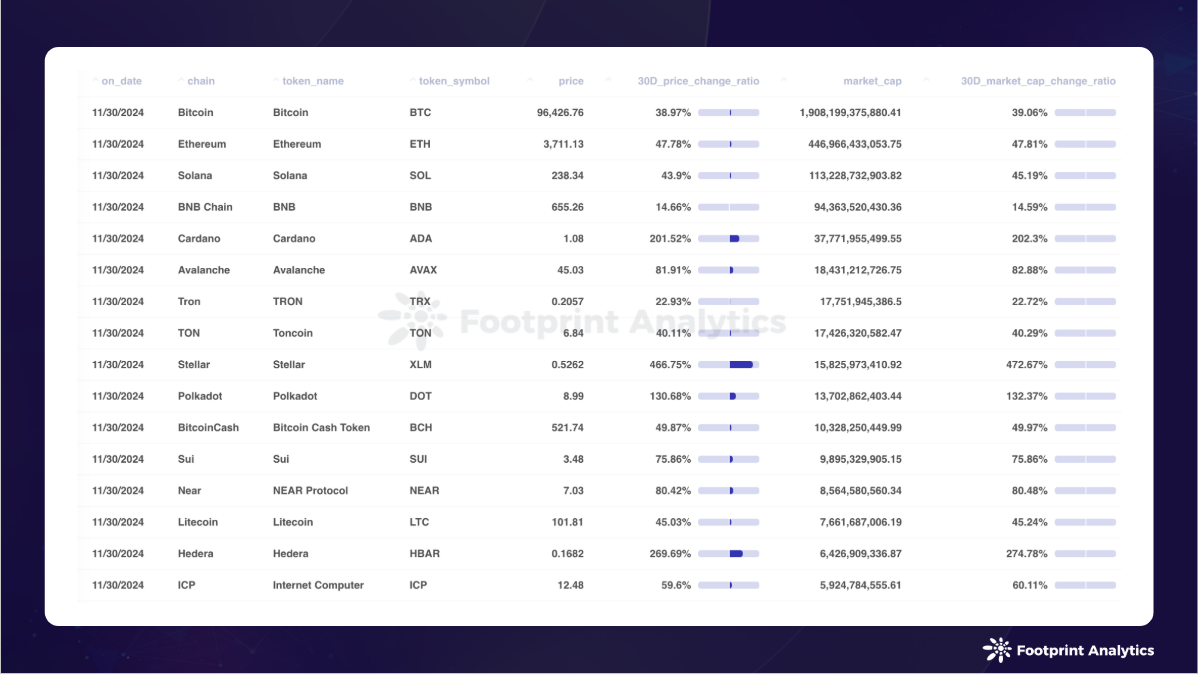

11 月加密货币市场创造历史,比特币涨幅惊人,从 69,386 美元飙升至 96,427 美元,涨幅达 39.0%。以太坊紧随其后,上涨 47.8%,从 2,511 美元攀升至 3,711 美元。比特币的卓越表现使其市值超越白银和沙特阿美,在 11 月 23 日接近 10 万美元关口后,稳居全球资产第七位。

美国大选结果成为加密市场增长的催化剂,可能对全面的加密货币立法和监管监督产生影响。市场对此反应积极,尤其体现在 memecoins、去中心化人工智能(deAI)项目和去中心化科学(DeSci)等热门板块的表现上。

更广泛的金融市场同样表现强劲。金融板块在美国税收改革和放松管制预期下领涨股市。然而,国际市场出现一定波动,人民币在美国可能增加关税的担忧下承压,而黄金价格则随着选举相关不确定性的消退而下跌。

Layer 1

2024 年 11 月,区块链总市值激增 41.1% 至 2.8 万亿美元。虽然比特币以 68.1% 的份额保持主导地位,但较 10 月的 70.1% 有所下降,因为山寨币在本月表现同样强劲。以太坊扭转下行趋势,市场份额达到 15.9%(绝对值上升 0.6%),而 Solana 超越 BNB 链,份额达到 4.0%。

在比特币持续创下价格记录的背景下,山寨币展现出卓越表现。Stellar (XLM) 以 466.8% 的涨幅领跑,其次是 Hedera (HBAR) 上涨 269.7%、Cardano (ADA) 上涨 201.5% 和 Polkadot (DOT) 上涨 130.7%。其中,Stellar 的飙升显著反映了市场对其跨境汇款基础设施和 CBDC 能力的日益关注,这可能受到美国大选后监管框架明朗化预期的影响。

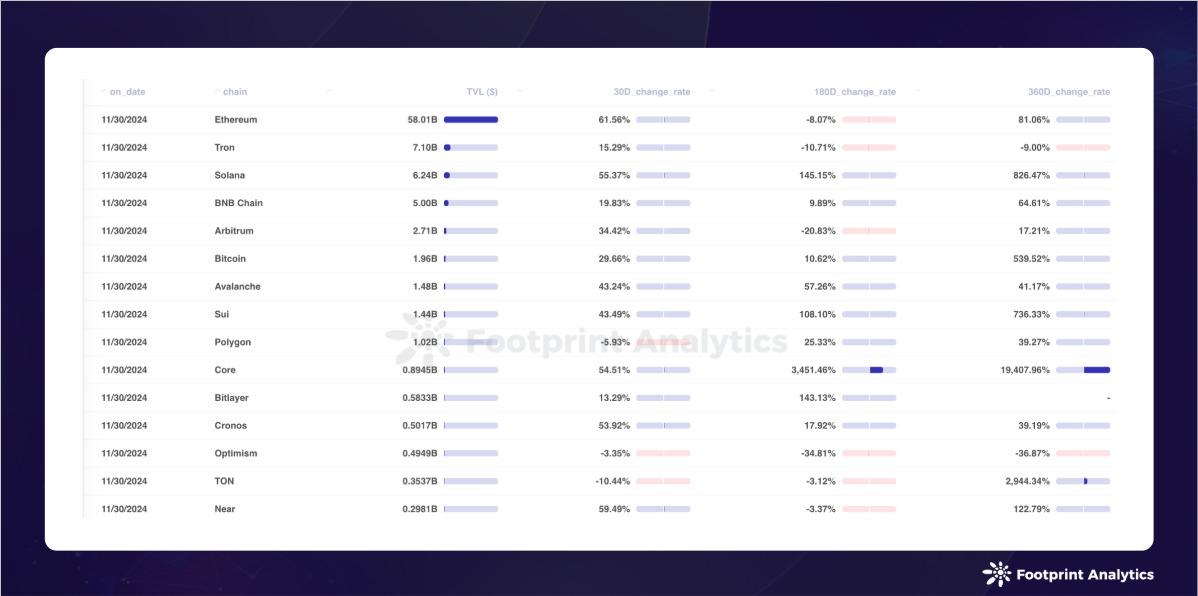

DeFi 领域的 TVL 在 11 月增长 43.0% 至 908 亿美元。以太坊以 61.6% 的增幅领跑增长,而 Tron 和 Solana 分别位居第二和第三。虽然按 TVL 排名前 15 的链多数都出现增长,但 Polygon 下降了 5.9%,因为美国总统大选结束后 Polymarket 出现资金外流。TON 自 10 月以来的下行趋势继续,这是由于 Telegram 游戏和 Meme 活动势头减弱。

Move 技术栈区块链保持强劲发展势头。Sui 在代币价格和市值方面创下新高,同时与知名金融机构富兰克林邓普顿达成战略合作。Aptos 通过其 Meme 发射平台 Emojicoin 推动链上活动增长。而 Movement 则即将推出主网,其测试网数据非常亮眼:根据 Movement Explorer 显示,已有超过 660 万个账户和 1.53 亿笔交易。

稳定币依旧是处于舞台中心之一的板块。USDS 作为首个主要的 DeFi 原生稳定币在 Solana 上线,而据报道 Ripple 即将获得纽约金融服务局(NYDFS)对 RLUSD 的批准。随着稳定币影响力不断增长,行业关注着一些公司是否会发行自己的区块链。Tether CEO Paolo Ardoino 发推称其公司将保持中立而不是推出自己的区块链,回应了行业关切。

比特币 Layer 2 &侧链

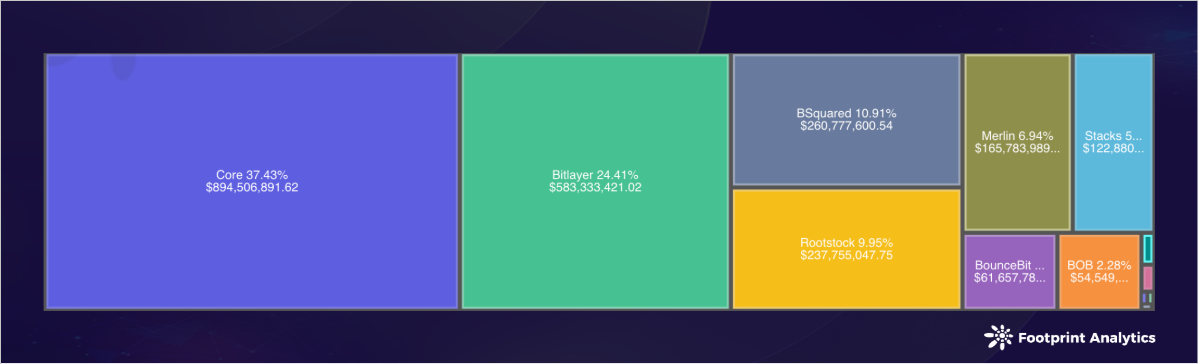

2024 年 11 月,比特币 Layer 2 和侧链实现显著增长,总 TVL 达到 24 亿美元,较 10 月增长 34.6%。主要平台之间对比特币流动性的竞争加剧。

Core 强化了其市场领导地位,TVL 增长 55.7% 至 8.9 亿美元,市场份额扩大至 37.4%。这一增长得益于 11 月的 Fusion 升级,该升级引入了双重质押和流动性比特币质押(LstBTC),使用户能够在保持 Core 的 BTCfi 平台流动性的同时获得更高收益。

Bitlayer 以 5.8 亿美元的 TVL 保持第二位置,但市场份额降至 24.4%。BSquared 继续增长,月增长 53.1% 至 2.6 亿美元的 TVL,跃升至第三位,而 Rootstock 以 2.4 亿美元的 TVL 位居第四。

在 BTCfi 项目层面,Pell Network 以 4.0 亿美元的 TVL 成为领导者,其次是 Avalon Finance(Bitlayer 和 Core)和 DeSyn(Bitlayer)在多条链上的强劲表现,它们各自有超过 2 亿美元的 TVL。

以太坊 Layer2

2024 年 11 月,以太坊 Layer 2 解决方案的总 TVL(规范桥接部分)达到 275 亿美元,较 10 月增长 2.0%,继续落后于比特币扩容解决方案的增长率。

Arbitrum One 维持其领导地位,TVL 达到 113 亿美元,市场份额为 41.0%,而 Base 超越 Optimism 夺得第二位置,TVL 达到 51 亿美元,份额为 18.6%,这得益于基于 Farcaster 的社交 meme 部署平台 Clanker 和 AI 代理创建与部署平台 Virtuals Protocol 带来的活动激增。同时,Optimism 的市场份额降至 17.3%。

Starknet TVL 增长 5.1%,超越 Blast 位居第四,而 Blast 继续下滑,下降 14.5%。Starknet 的增长得益于 11 月 26 日启动的 STRK 质押以及 CEO Eli Ben Sasson 承诺在下一季度显著提升性能。同时,World Chain 表现出色,TVL 增长 131.4% 至 5.7 亿美元。

11月,处于舆论压力中的以太坊基金会通过发布 2024 年报告强化了财务透明度,同时概述了核心价值和资金策略。Vitalik Buterin 强调了以太坊的未来发展,包括实施 DAS 以增强 Layer 2 可扩展性,以及基础设施改进以支持从 ENS 到消费者支付等多样化应用。

区块链游戏公链

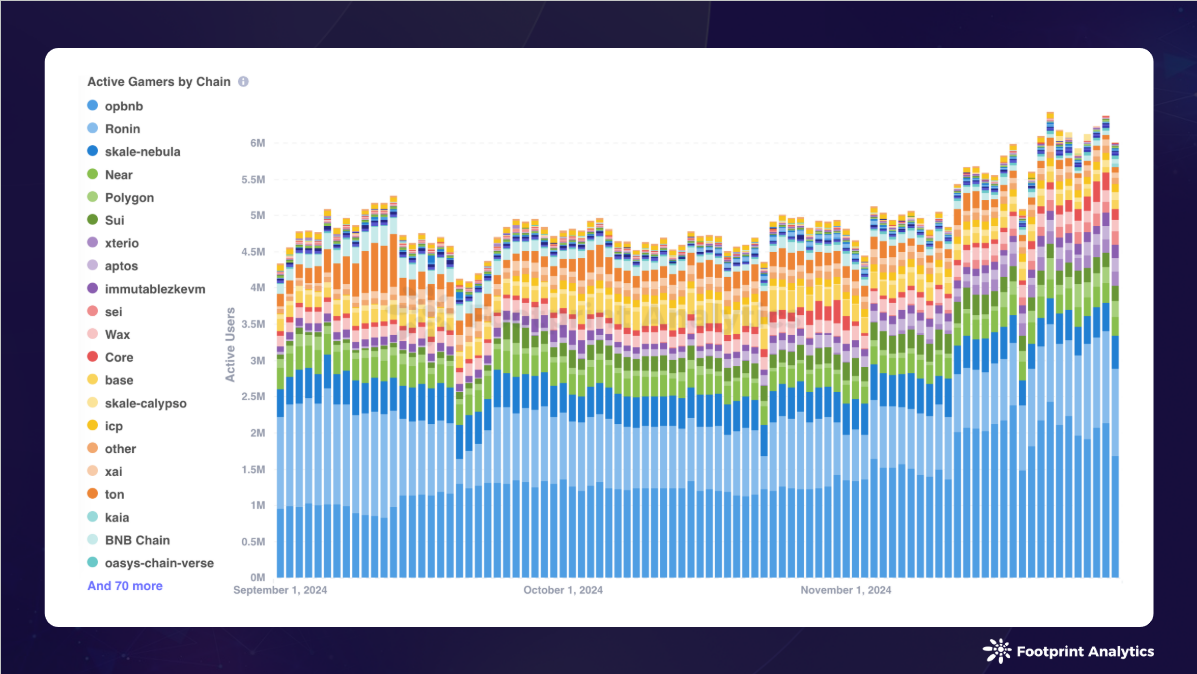

11 月,活跃区块链游戏数量增长 4.6% 至 1,696 款,BNB 链、Polygon 和以太坊在游戏分布方面保持市场领导地位,份额分别为 20.9%、15.4% 和 13.4%。

用户参与度格局出现新的变化,opBNB、Ronin 和 Nebula(SKALE)分别以 180 万、90 万和 40 万的平均日活跃用户(DAU)领跑。OpBNB 的 DAU 增长 46.1%,这得益于 SERAPH: In The Darkness 和 MEET48 的推动,以及部分游戏从 BNB 链迁移至 opBNB。同时,Ronin 展现出强劲复苏,通过新游戏 Fableborne 的推出和 Lumiterra 的重新增长。

基于 Telegram 的游戏呈现出喜忧参半的结果。虽然 TON 的生态系统在面临挑战,DAU 下降 41.9% 至 11.64 万,但 Sui 逆势而上,DAU 增长 23.1% 至 23.33 万,这主要归功于 BIRDS 的成功和显著的用户留存指标。

更多数据洞察,请参阅《2024 年 11 月区块链游戏研报:牛市加持下的 GameFi 破局之路》。

融资情况

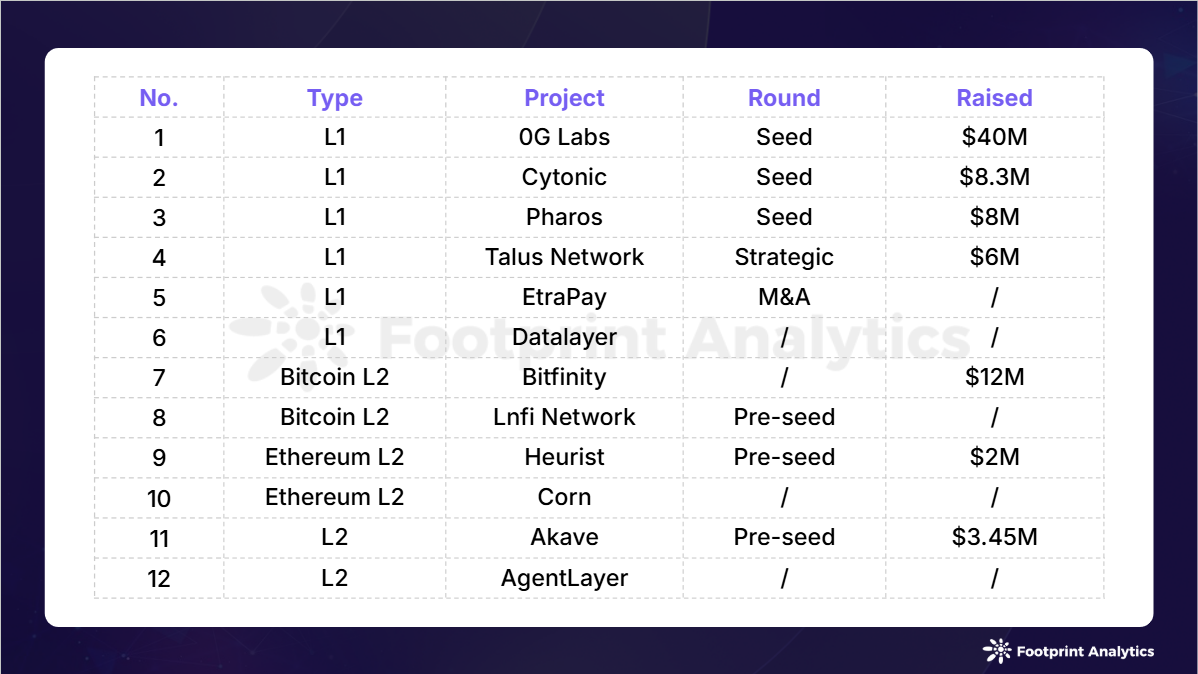

2024 年 11 月区块链领域记录了 12 起融资事件,总金额为 7,980 万美元,较 10 月下降 23.3%,为 8 月以来的最低月度数字。其中五起事件未披露具体融资金额。

Zero Gravity Labs(0G Labs)成为本月最大的融资接收方,宣布获得 4,000 万美元种子轮融资以及 2.5 亿美元的代币购买承诺。该公司已从最初作为模块化区块链提供商的定位转向定位为加密 AI 创业公司,开发用于在链上构建 AI 应用的去中心化 AI 操作系统(dAIOS)。

几条 Layer 1 区块链在本月获得融资,包括 Cytonic、Pharos、Talus Network、EtraPay 和 Datalayer。值得注意的是,由 Ava Labs 构建的托管区块链服务提供商 AvaCloud 收购了 EtraPay,获得了一个由知名隐私技术专家组成的团队以及创新的加密代币标准 Encrypted ERC(eERC)。

Layer 2 生态系统继续保持投资活跃度,六个项目获得新一轮融资,包括比特币 Layer 2 的 Bitfinity 和 Lnfi Network、以太坊 Layer 2 的 Heurist 和 Corn,以及其他 Layer 2 项目 Akave 和 AgentLayer。