尽管94号公告、924号公告等政策将虚拟货币相关业务认定为“非法金融活动”,但在实践中,涉及到虚拟货币委托理财引发的法律纠纷却屡见不鲜。早在2013年,五部委就已明确指出,比特币等虚拟货币不具备与法定货币等同的法律地位,但政策规定依然挡不住热情高涨的投资者们。本着“风险越大,收益越高”的投资理念,不少人还是会对币圈投资期待满满。

但进入币圈本身具有一定的门槛,很多普通投资者并不熟悉如何操作交易平台,也不清楚如何购买代币。特别是一些国际平台对中国用户的访问和使用有技术限制,这使得普通投资者难以直接参与交易,代投成为他们的捷径。因此,虚拟货币投资变成了委托人与代投方之间的“相爱相杀”。

在国内政策的影响下,代投方与委托人之间的法律关系变得十分微妙。如果投资盈利,双方都将受益,委托人可以获得丰厚的回报,赚的盆满钵满,代投方也能收取一笔可观的服务费;而一旦投资亏损,委托人就会选择通过法律手段来维护自己的权益,通常会以虚拟货币违反国家政策或投资协议无效为由,要求代投方返还投资款或其所投入的虚拟货币。并且,委托人往往会第一时间会选择刑事报案,试图通过警方将代投方抓获,以便于后续的赔偿谈判。如果报案这条路走不通,他们再退而求其次选择提起民事诉讼。

当昔日的委托人摇身一变,成为了刑事案件的被害人或民事诉讼的原告时,代投方该如何应对呢?

作者 |邵诗巍律师

01、常见场景

在日常的工作中,邵律师会遇到来自代投方的各类法律咨询:

代投方是个人的情况下,常会遇到的法律问题:

为他人(可能是亲戚、朋友)投资虚拟货币,自己收取了一定的服务费(或者有的是好心帮忙,分文不收),但此后所投入的资产亏损了,亲友要求其返还投资款,但代投方认为投资有风险,投资人理应知晓风险自担,自己无需承担相关赔偿责任。此时双方产生争议,委托人就去公安报案或法院起诉了,现在自己不知道该如何应对;

代投方是机构的情况下,常会遇到的法律问题:

某基金公司主做全球市场的股票期权和加密货币的投资交易,并在国内雇佣了投研人员、程序员、交易员等,通过加密货币交易所API进行套利和量化交易,资金来源于投资者;或者某链游团队(主体在境外,实际由国人运营)通过销售Token的形式,从多家VC、个人投资者处筹集资金;

但由于各种因素,投资出现亏损,代投方因此面临众多投资人的维权压力,陷入困境。

02、代投方可能面临的法律风险有哪些?

代投方的法律风险,可以大体分为刑事和民事两大类,所以相应的不利法律后果也是分为两大类,要么赔钱,要么判刑。所以代投方在咨询律师时,就是往往最为关心的,就是了解案件的法律性质,到底是民事纠纷还是涉嫌刑事犯罪。如果是民事纠纷,那就要对于将来可能的法律诉讼,提前做好应诉准备,收集相关证据;如果是涉嫌刑事犯罪,则需要做好刑事法律风险防控相关工作,将潜在的法律风险降到最低。

鉴于每个案件都有其不同,且为保护客户隐私,本文不会针对我们团队曾办理的具体个案进行讨论,仅对目前公开可查的案例及法律规定展开分析。

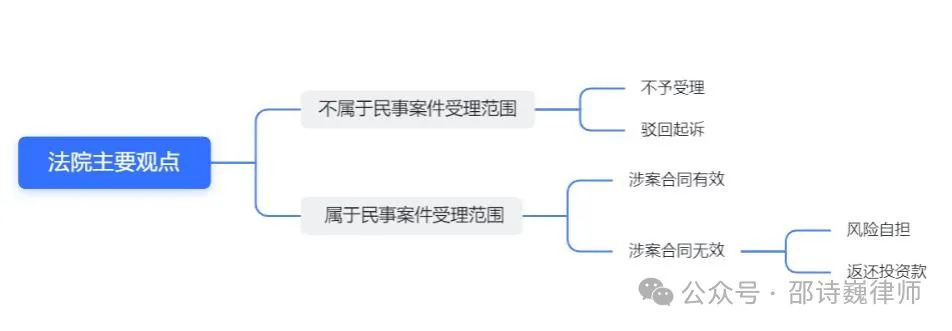

虚拟货币委托投资类民事诉讼案件,在司法实践当中,各地法院的处理方式、裁判口径不尽相同,总体可以分为如下几类:

-

法院认为投资虚拟货币引发的纠纷因违反政策规定,不属于民事诉讼范围,不予受理;

-

法院认为此类纠纷可能涉嫌犯罪,因此裁定驳回起诉,将案件移送公安机关;

-

法院认为因投资行为违反政策规定,投资方应自担风险,因此对于投资方的诉请不予支持;

-

法院认为虽然投资行为违反政策规定,也要合理划分双方过错责任,进而判定代投方的赔偿比例;

限于篇幅,民事类纠纷(感兴趣的朋友可以划到文末查看相关文章)不作为本文讲述的重点,我们主要探讨代投方首要关心的问题——面对投资者的民事起诉/刑事控告类维权,代投方可能面临哪些刑事风险?

第一、法院认为民事案件因涉嫌犯罪,移送公安机关

例如,上海虹口法院曾审理了一起虚拟货币委托代投纠纷案件,原告赵某于2017年通过上海分布式投资管理公司员工许某投资投资700枚以太坊参与波卡币投资,但之后未收到对应的DOT代币。公司称许某已于2018年离职,其代投行为与BLOCKASSET公司有关。第三人孙某表示,许某与BLOCKASSET达成协议,将赵某的700枚以太坊视为借款,已退回。虹口法院认为案件存在犯罪嫌疑,裁定驳回起诉,并将有关材料移送公安机关或检察机关,涉案金额超过9000万元。

第二、投资者至公安机关报案,代投方可能涉嫌的刑事罪名

实践中,在民事诉讼中,案件性质由民转刑相对来说还是比较少见的,更为多见的是投资者直接前往公安机关报案。基于报案人朴素的认知,往往会以自己投资亏损为由,认为代投方涉嫌诈骗。但具体到案件本身的定性,以诈骗罪、非法经营罪、非法吸收公众存款罪和组织、领导传销活动罪这几个罪名较为高频出现。

所以,代投方此时要做的就是对刑事罪名有所了解,并第一时间排查自身是否存在相关行为,提前做好法律风险防控。例如:

-

诈骗罪:代投方对于所投的项目是否了解,项目是否真实存在?在向投资者介绍时,宣传内容、宣传方式是怎样的?投资者自身对于所投项目的认知能力如何?

-

非法经营罪:比如现在的虚拟货币量化交易投资,代投方吸引投资者投入虚拟货币,通过收取手续费获利,如果代投方的经营行为是在内地所开展,有没有可能会被司法机关视为违反国家法律规定,从事非法经营活动?

-

非法吸收公众存款罪:本罪名的特征为“非法性、公开性、利诱性、社会性”,代投方需要比照这四个特征,对自身行为进行逐一排查。

-

组织、领导传销活动罪:代投方所投的项目或产品是否具有如下图中刑法意义上的传销特征?

03、写在最后

事先预防往往比事后应对更有意义。

在政策红线之下,代投方在国内开展委托代投业务必然会面临法律风险。对于机构类代投方来说,此类风险并不是说,“我们可以保证投资者不可能亏损”,风险就不会存在。由于政策规定“虚拟货币相关业务属于非法金融活动”,所以,刑事风险可能源于客户的报案,也可能来自同行或亲友的举报。因此,我们不建议在国内开展此类业务。

个人代投方相较于机构投资方来讲,由于和投资者是一对一的法律关系,并且实践中大多以亲友为主,法律风险相对较小,但仍建议与委托人签署明确的协议,详细规定双方的权利和责任,务必向委托人说明相关风险。确保他们对投资的高风险性质有清晰认识,并妥善保存与委托人的沟通记录和投资相关文件,这在发生争议时会成为重要的证据。