撰文:Iris,曼昆律师事务所

作为国内乃至全球性关键命题,RWA(现实资产通证化)以及跨境RWA自然成为活动期间不可或缺的主题。与此同时,在全球范围内,RWA(现实资产通证化)正日益成为资产管理和资本市场的重要创新领域。根据全球咨询公司波士顿咨询集团(BCG)的一篇论文,预计2030年,RWA领域的管理资产将超过6000亿美元。

不过,你真的知道什么是RWA吗?你真的知道RWA的落地逻辑是什么吗?

在近2个月内,曼昆律师发现:自从蚂蚁链与朗新集团合作推出首个新能源充电桩RWA项目,并成功入选香港Ensemble沙盒后,RWA便在圈里圈外被推崇备至,但对于具体的落地方式,却鲜有清晰的讨论。甚至有些项目借RWA之名,行发币之实,延续着旧模式。此前曼昆律师就多次写文《Web3律师:合规低配版RWA,谨防非法集资风险》《Web3律师:哪些项目更适合RWA融资?》,分析过RWA的方向以及法律风险提示,大家可以参考。

不过归根结底,大家还是需要了解RWA的模式以及底层价值逻辑。正巧,本次香港金融科技周上,蚂蚁链公开了自己的“两链一桥”平台,致力于为国内新能源资产落地跨境RWA。曼昆律师就基于蚂蚁链RWA平台的逻辑,来讲讲“国内RWA到底玩,是不是万物皆可RWA?”

AntDigital RWA

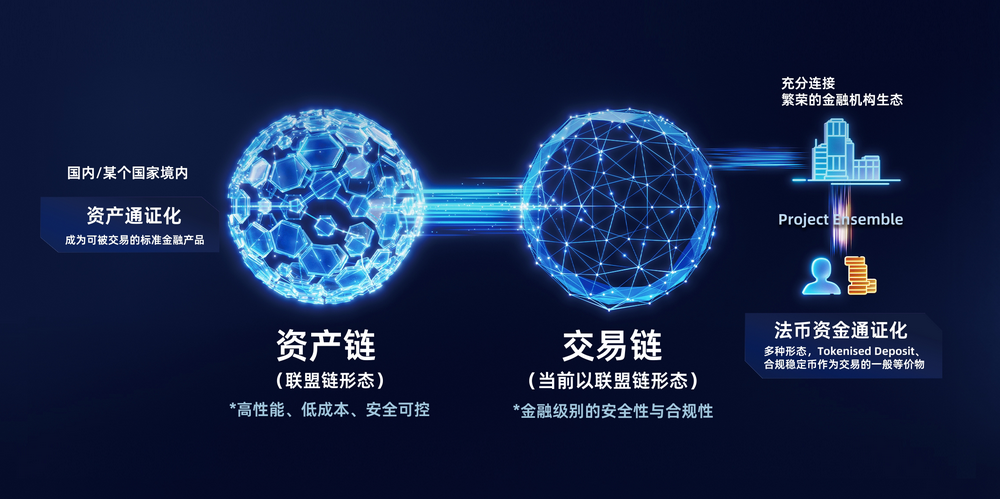

综合有关蚂蚁链相关的新闻,蚂蚁链推出的“两链一桥”平台包含:

-

资产链

资产链负责将实体资产进行通证化,将其转化为链上的可交易资产。这个过程首先采集并验证资产的核心信息,如资产的实际价值、市场状况和所有权归属,确保其真实可信。完成验证后,资产信息被上传至区块链上,生成与之对应的通证(Token)。在此阶段,资产链确保所有通证化的资产符合标准化和结构化的要求,以便后续能够安全、高效地进行市场流转。通过这种方式,资产链实现了从资产到通证的标准化转换,使得传统资产可以更便捷地融入数字化的跨境市场。

-

交易链

交易链的设计不仅能够有效支持通证化资产的市场化流转,还能够大幅提升资金募集的效率。交易链上的通证化使得全球投资者可以随时加入资产的融资过程,从而在传统融资渠道之外提供了新的流动性来源。此外,交易链具有开放性,支持用户之间的实时交易和流转,增加了二级市场的活跃度,使资产的市场化定价更加透明合理。

-

蚂蚁链可信跨链桥

桥接资产链和交易链,确保两链之间的数据和资产流通的合规与安全。在跨境RWA的应用中,合规性是各方关注的重点,蚂蚁链的可信跨链桥在此提供了重要的支持。该桥不仅能够确保内地资产链和香港交易链之间的无缝对接,还通过多重身份验证和数据加密技术确保资产和资金的跨境合规。通过区块链技术对数据的可信记录,跨链桥实现了资金和资产的安全合规流转,为跨境RWA提供了强有力的监管保障。

*图源:蚂蚁链官方网站资料

基础设施搞清楚了,那资产方或者融资方要怎么上链,怎么去做通证化呢?曼昆律师通过研究蚂蚁链官方的示例以及对朗新新能源电桩RWA项目

总结来说,常规的融资模式可分为几个环节:

-

资产评估,融资方将特定资产的信息提交评估,确保该资产的财务状况和市场价值得到第三方或合格评估机构的认证;

-

通证化,在资产评估完成后,将相关的融资信息和估值证明以数字化的形式上链,并根据融资需求创建合规的通证。这些通证在资产链上生成,并通过智能合约设定融资目标和使用规则,确保后续投资者的权益清晰;

-

跨境融资,全球用户可以在交易链上购买通证,成为该资产的投资者。交易链支持用户之间的通证流转和交易,从而使投资者能够在二级市场中获得收益。

与此同时,蚂蚁链在其官网展示的RWA参考案例,也提供了另一个全新RWA模式——跨境商务中的融资。假设,当香港买家A向内地卖家B购买货物但短期内缺乏流动资金且无法从银行获得贷款时,A可以通过RWA模式进行快速融资。具体流程如下:

-

货单估值,买家A向香港第三方权威金融机构C提出融资请求,卖家B协助A提供相应的电子提货凭证,确保凭证的真实性。金融机构C根据凭证信息进行估值,为后续的通证化和融资流程奠定基础。

-

通证化,估值完成后,C将该凭证信息和估值结果上链,并创建合规的通证。C利用智能合约为通证设定使用规则,包括本息结构、还款期限和结算条件,以确保该融资交易的合规性和透明度。

-

融资打款,全球用户可以在交易链上购买该通证,从而实现对该订单的融资。融资款将直接转入卖家B的账户,无需经过买家A的中转,而C则持有提货凭证以确保交易顺利进行。

-

本息还款与交割,根据智能合约规定的还款期限,买家A需按期将本息支付给C。在A完成本息支付后,C将提货凭证交给A,A则可凭该凭证完成货物交割。同时,C按合约规定将融资收益分配给参与融资的用户。

通过“两链一桥”平台,蚂蚁链为RWA领域提供了一种高效、安全的解决方案,使得传统资产在跨境场景中实现了标准化和数字化流通。这一模式为国内资产跨境融资创造了新的可能,也为投资者提供了参与实体资产的数字化投资途径。随着RWA需求的不断增长,这一平台无疑将推动RWA的进一步落地,为下一阶段的实际应用提供了技术支持和可行性示范。

然而,尽管RWA概念备受推崇,我们不禁要问:是否所有资产都适合RWA?在各类项目纷纷打着RWA旗号的背景下,我们需要探讨RWA的适用边界,识别哪些资产真正具备通证化的价值及可行性,厘清RWA的实际落地逻辑。这也是RWA作为创新工具,需要面对和解答的关键问题。

万物皆可RWA?

以蚂蚁链的“两链一桥”平台案例为参考,曼昆律师提炼出市场上合规RWA的几个关键特征,希望为RWA在现实落地提供有效判断与参考。

-

价值基础

从字面理解,RWA的价值来源就是现实世界资产,因此,合规RWA的前提是资产具有真实的物理或金融基础,而非虚构或无形的价值。蚂蚁链平台中的新能源充电桩项目便是一个典型案例,该项目有明确的资产实体作为锚定,为后续的价值评估和通证化提供了现实基础。对RWA而言,所有通证化的价值都需基于现实资产,无论是地产、设备还是债务,必须有明确的资产支持,以保障通证的真实和可靠。

-

价值生成

从蚂蚁链的介绍和参考案例看,RWA落地过程中,资产价值都需要进行评估,且一般由三方权威机构进行,以确保市场的信任和合规性。评估需要对资产的当前市场价值、未来收益潜力和风险状况进行全面分析。例如,在蚂蚁链的案例中,新能源充电桩的评估数据经过认证,能够让投资者清晰地了解其潜在收益和风险。这也意味着,在RWA化中,数据的真实性和可验证性至关重要,确保投资者能够基于透明的信息做出决策。

-

市场需求与流动性

合规RWA,需要具备一定的市场需求,以支持通证化后的流动性。试想一下,一个没有市场需求的资产,即使估值很高,通证化后用户不买账,那也实现不了融资,更不会有市场流通。只有满足市场需求的资产,才能确保通证化后能获得市场的广泛认可,从而保障其价值实现。

-

法律合规性与跨境适用性

合规RWA的资产必须符合监管要求,尤其是在跨境场景中更是如此。蚂蚁链在自己的底层架构中,不管是通证化还是跨链桥设计,都有提到确保资产在内地与香港之间的合规。另外,由于RWA往往会涉及跨境,这不仅意味着资产在国内和国际上的合规性,还涉及数据透明、信息披露等合规要求,以确保投资者在不同区域的合法权益。

-

长期收益的稳定性

在RWA过程中,资产的长期收益预期是投资者决策的重要因素。以新能源充电桩为例,其租金或使用费收入稳定,为投资者提供了明确的回报预期。对于其他类型的RWA资产,同样也需具备稳定且可持续的收益特征,以增加对投资者的吸引力,从而推动RWA资产的市场化发展。高波动性或无长期收益的资产,可能会影响其通证化后的市场表现。

回到最初的问题,万物皆可RWA?基于以上特征来看,显然答案是:NO。

曼昆律师总结

通过对蚂蚁链“两链一桥”平台的分析,我们可以看到RWA作为创新金融工具的巨大潜力,也意识到其适用边界的实际局限。RWA并非适用于所有资产,成功的RWA项目需具备现实资产的锚定性、透明且权威的价值评估、市场需求的支撑、法律合规的保障以及稳定的长期收益。这些要素不仅是RWA化的基础,更是保障投资者权益和项目长期价值的重要前提。

在RWA的快速发展下,我们必须保持清醒认识,区分出真正符合条件的资产,防范项目滥用RWA概念进行不合规融资。未来,RWA将在跨境金融和资产管理中扮演更为重要的角色,而市场的成熟与监管的完善,将是RWA真正赋能实体经济的关键所在。