作者:Jarseed@Bitget Research、Maggie@Foresight Ventures

TLDR

- Story是一个专门为知识产权(IP)设计的 Layer 1 区块链。Story提供了一种透明的、去中心化的IP资产发行和管理解决方案,使得IP持有者能够保护他们的内容,在链上无缝协作,创造更多收入机会。

- IPA(IP Assets)所包含的各类模块(授权模块、版税模块、纠纷模块等)可以让IP资产在链上进行标准化操作,通过使用区块链的特性(可追溯、可组合性等)释放更大的金融潜力。

- Story将是AI应用资产化的最好选择。通过Story,任何IP资产的价值捕获过程将被智能合约保护,并且能够清晰地完成资金流转和链上确权。

- 消费者更加容易理解和消费 IP 资产(例如艺术作品、音乐、游戏、AI Agent),而不需要让消费者学习理解复杂难懂的加密学知识。

什么是Story

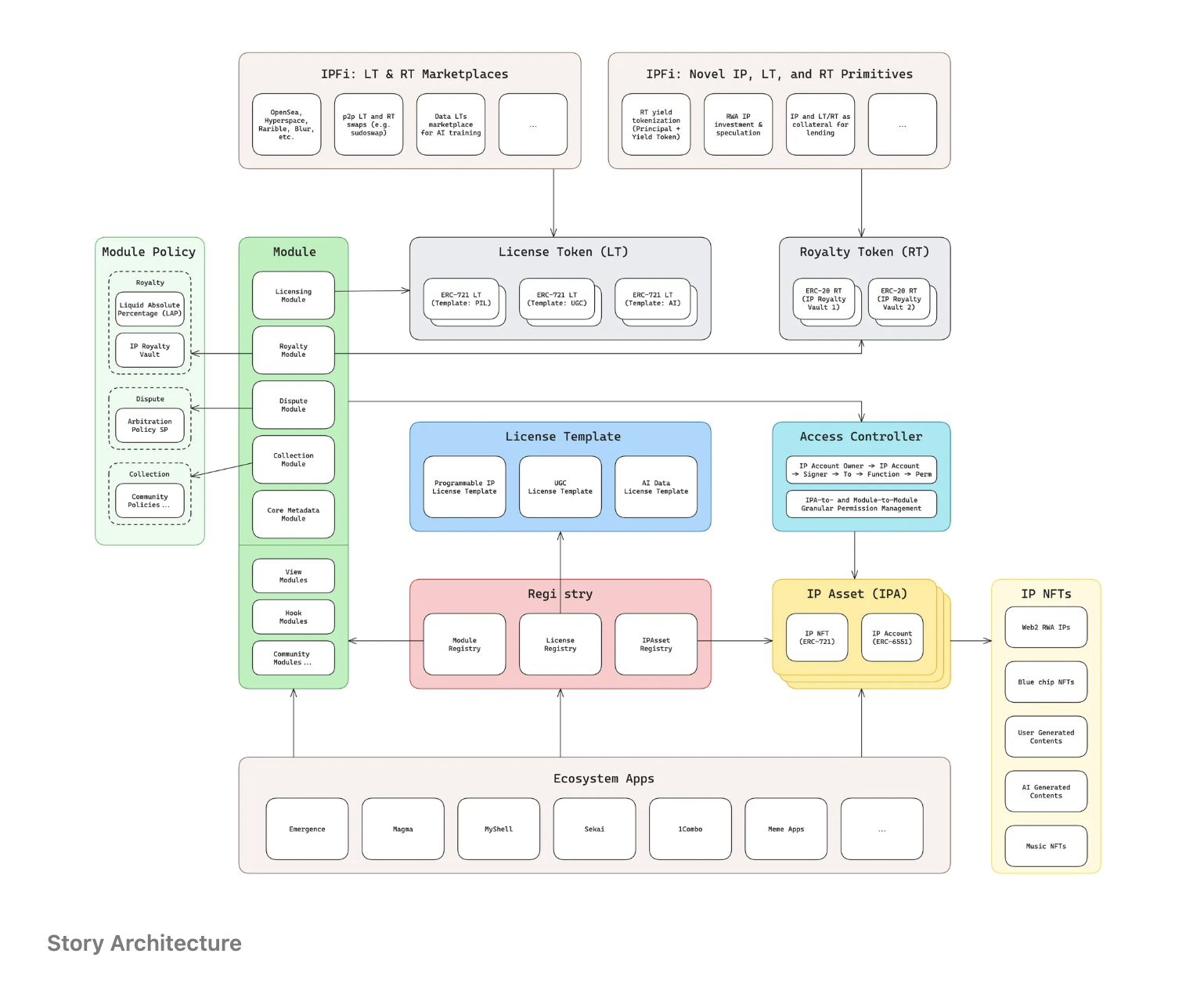

Story 是一个专为知识产权设计的 Layer 1 区块链,结合了 EVM 和 Cosmos SDK 的优势,100% EVM 兼容,同时在执行层进行了深度优化,能够快速且高效地处理如知识产权这样的复杂数据结构。

什么是知识产权资产(IP Assets or IPA)

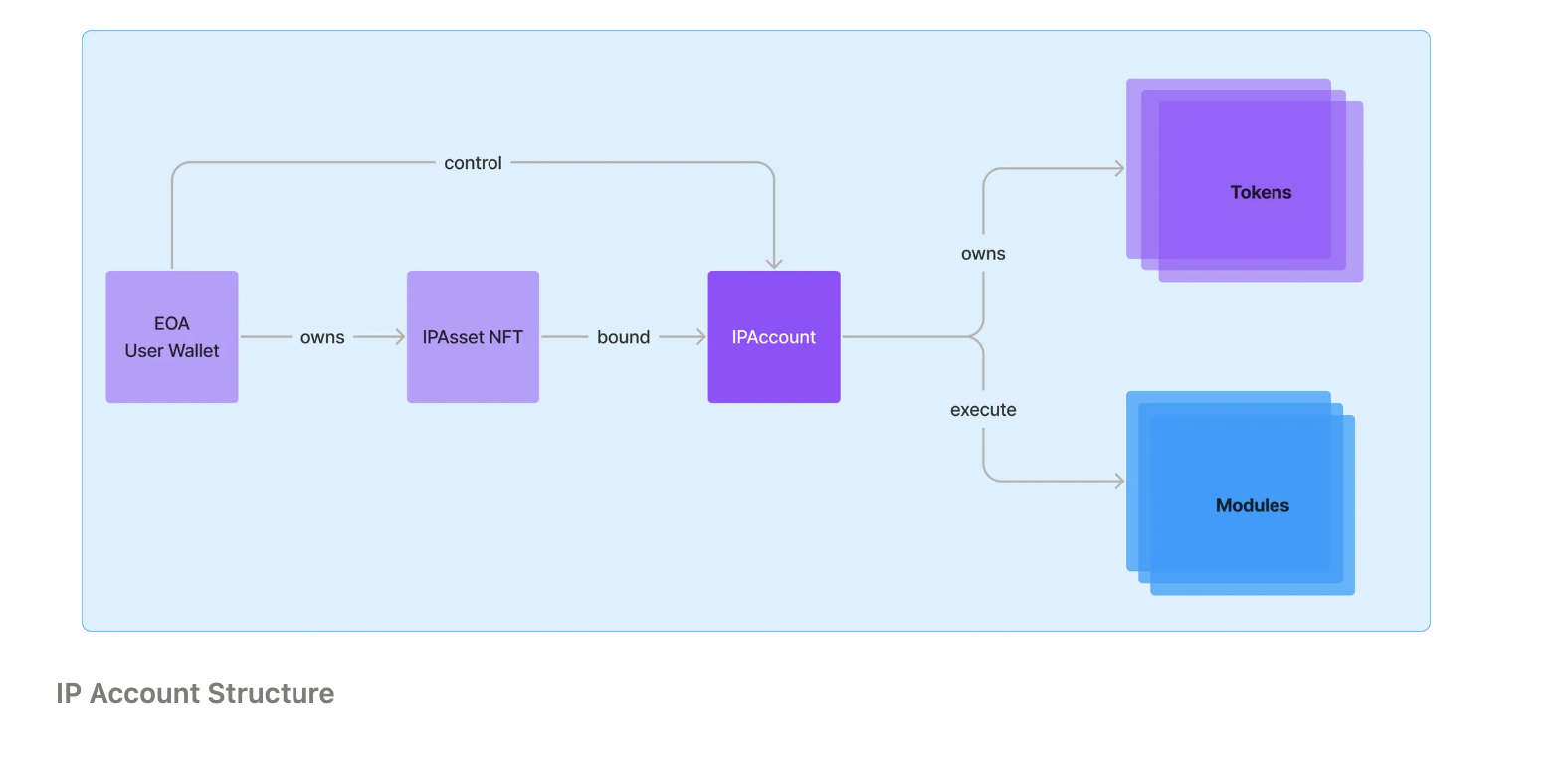

IPA 是 Story 上可编程的基础知识产权元数据。简单来说 IPA 是由一个 ERC-721 标准的 NFT 和一个 ERC-6551 标准的 TBA(Token Bound Account)IP绑定账户组成。其中 NFT 代表IP,TBA是一个与 IP 资产绑定的独立合约,用于控制与 Story 模块交互的权限或存储 IP 相关的数据。

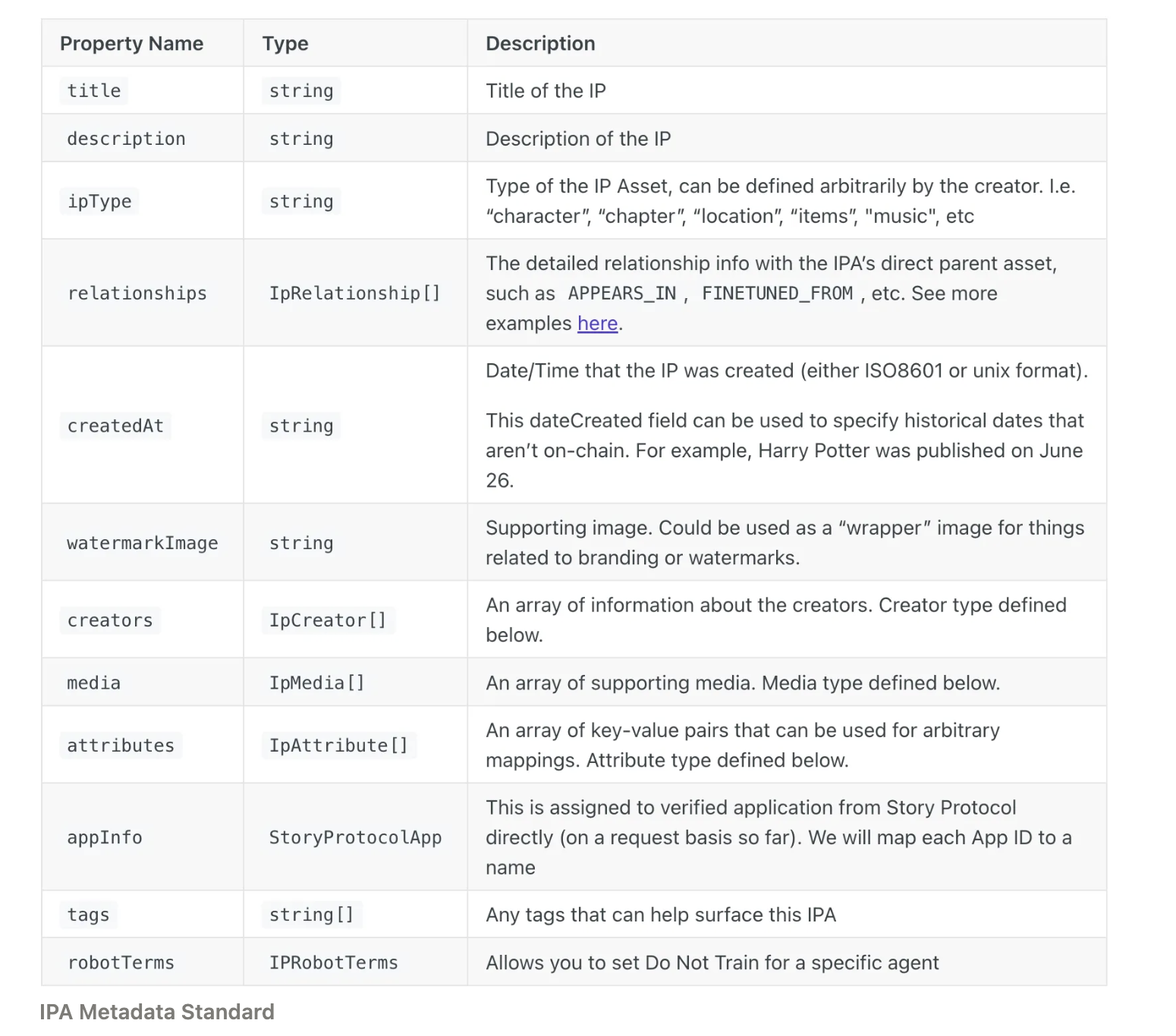

尽管 IP 资产使用的是 ERC-721 标准的NFT,但是它所包含的元数据是一个设计完备的,专门用于 IP 资产的数据结构。

在 IP 资产中有一些被定义好的属性,例如 relationships,该属性在 Story 中存在40中不同类型的定义,用于应对各种情况下的 IP 从属关系。

什么是 IP 账户(IP Account)

IP 账户是通过 ERC-6551 标准实现的、与 IP 绑定的 EOA 账户,具体细节可以参考EIP-6551。

IP 账户主要执行两个功能:

- 存储 IP 相关的数据:包括元数据和与之关联的资产(例如从该 IP 派生的授权代币或版税代币)的所有权信息。

- 支持各个模块使用这些数据:这些模块与 IP 账户交互,并向其添加和存储数据。例如,授权、收入/版税分成、作品混合、IP 纠纷解决等模块的功能都依赖于 IP 账户的可编程性。

IPA的模块设计与已有的核心模块

由于 IP 账户的存在,IP 资产不但可以存储 IP 相关的数据,还可以通过 ERC-165 标准接口与各类模块进行交互。任何用户都可以自定义开发模块,同时 Story 定义了4个核心模块,分别是:

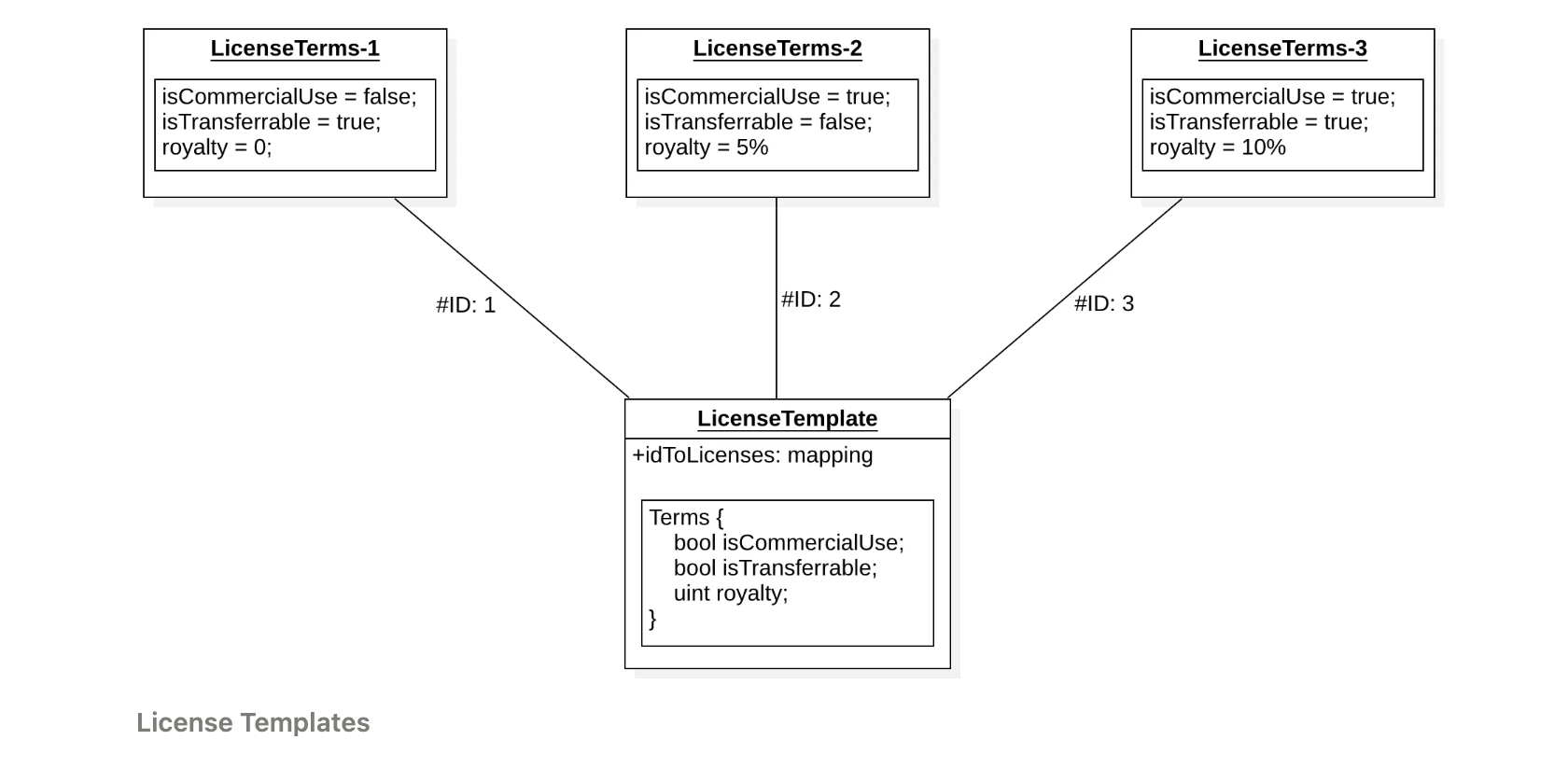

- 授权模块(Licensing Module):授权模块允许用户从授权模版(即Programmable IP License,PIL)创建一个授权,并将其附加到 IP 资产上。这个授权所定义的授权条款限制了他人如何使用你的 IP 进行商业化开发或者联合创作。如果 IP 资产附加了授权条款,任何人都可以从中铸造一个授权代币,该代币作为使用该作品的许可,并受授权条款的约束。这将建立 IP 资产之间的父子关系,从而激活例如通过版税模块实现的自动版税流转等功能。

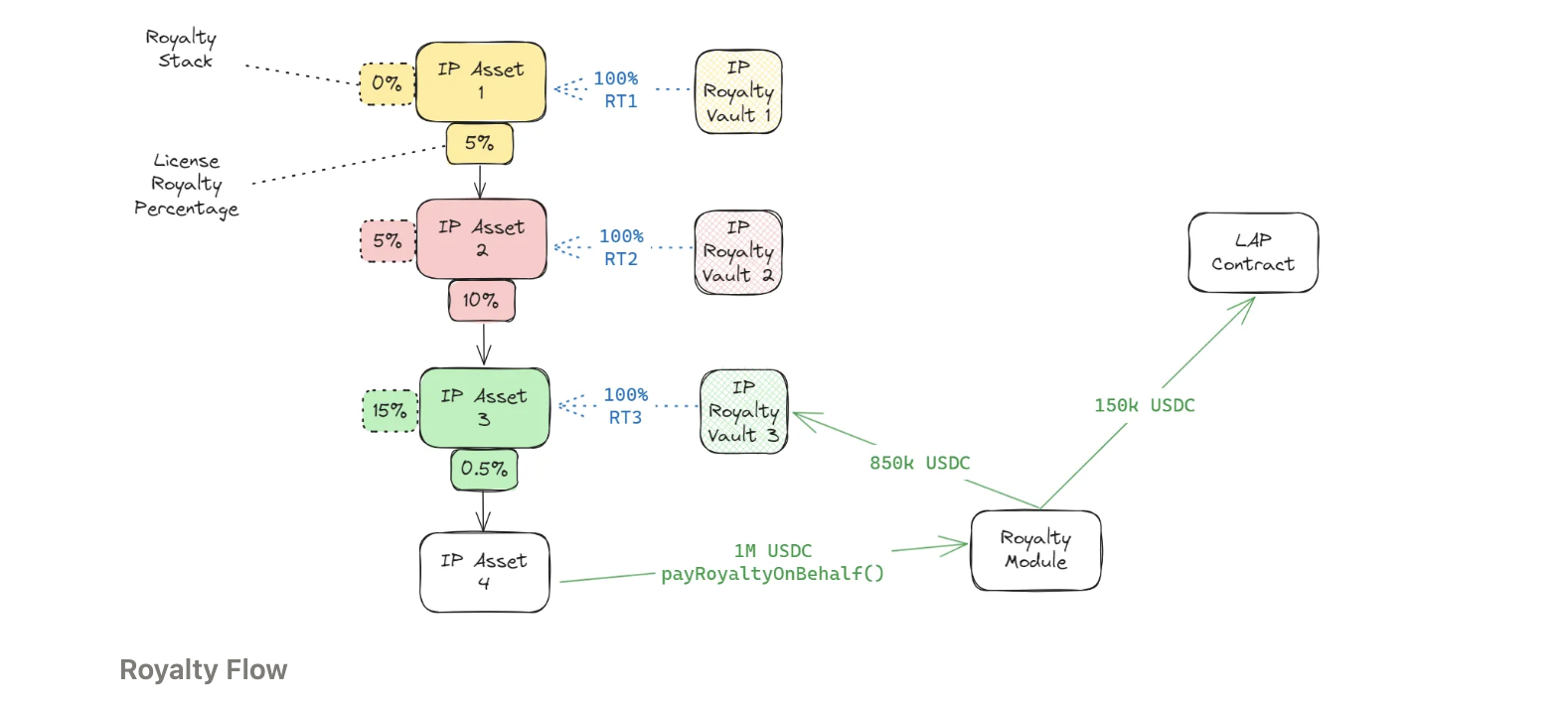

- 版税模块(Royalty Module):版税模块定义了收入如何在父 IP 资产和子 IP 资产之间流动。以下是两种常见的收入流场景,后续文章中会拆解不同应用场景下的实际案例:

- 铸造授权代币:当从 IP 资产中铸造授权代币时,可能需要支付铸造费用。当有人(希望注册衍生作品或仅持有授权)支付此费用时,收入应沿链向上流动。

- 直接打赏:如果有人直接向某个 IP 资产发送收入,该收入也应沿链向上流动。

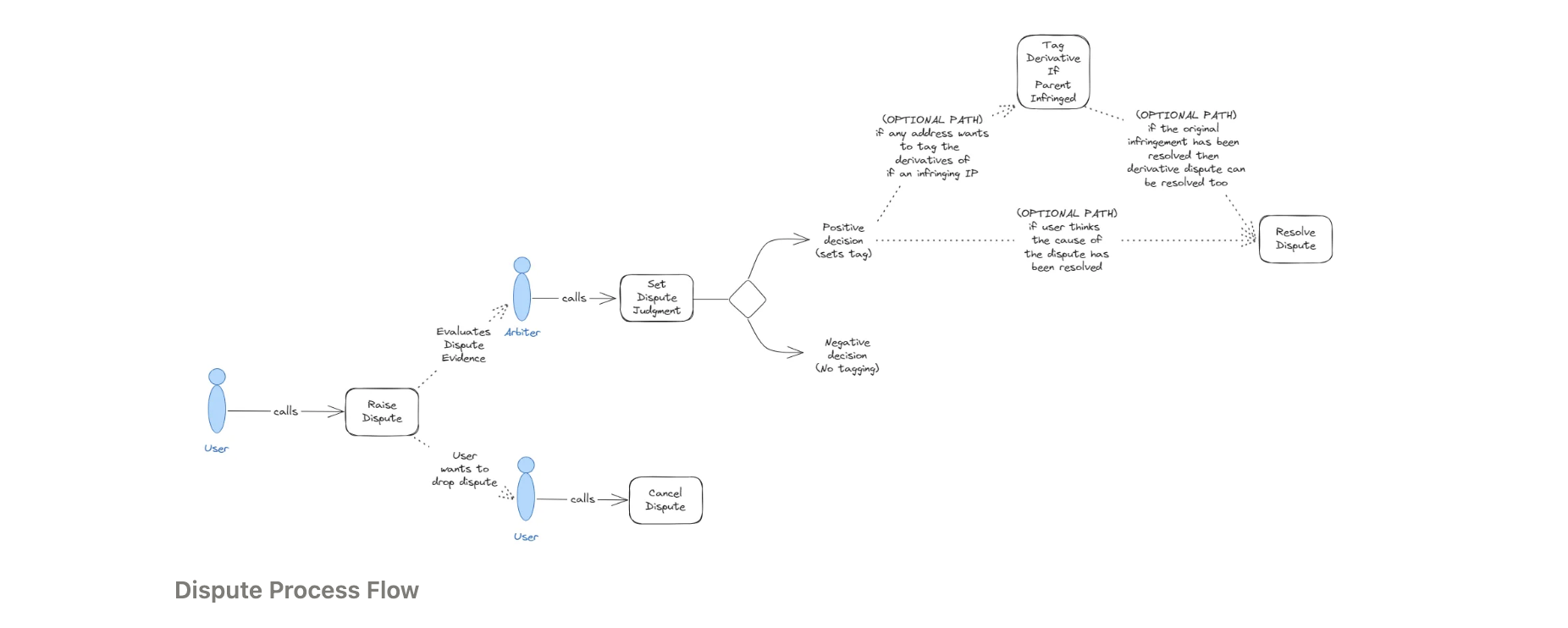

- 纠纷模块(Dispute Module):纠纷模块为用户提供了一种通过仲裁的方式提出和解决纠纷方法。仲裁系统的主要组成部分包括:

- 仲裁政策:仲裁政策是指一组规则、流程和实体的组合,这些要素共同决定争议的结果。目前,唯一支持的仲裁政策是UMA 仲裁政策。

- 仲裁惩罚:指当 IP 资产被 “标记” 后所发生的后果。IP 资产只有在争议被裁定为正确的情况下,才会被视为“标记”。一旦被标记,IP 资产将无法铸造授权代币、关联任何父资产、领取版税收入和无法使用所有现有授权。

- 标记:Story 预设了4种类型的标记,可用于标记纠纷资产,包括:违规注册(即注册已存在的 IP 资产)、违规使用(不恰当的使用 IP 资产所包含的授权)、违规支付和内容标准违规。

• 分组模块(Grouping Module):分组模块支持创建和管理分组 IP 资产,并为该分组提供版税池功能。

IP资产应用的创新探索

在理解了 IP 资产的基础特征和模块之后,我们天然地认识到了 Story 的优势。IP 资产可以帮助内容创作者轻松的构建一个由智能合约和去中心化网络保护的版权帝国,内容创作者的所有知识产权在受到保护的情况下,还可以参与到大量的金融衍生活动中来。因此,让我们来头脑风暴一下,我们可以在 Story 上做哪些事情?

IP 资产发行和 IP 资产特色

区块链平等地给予了每个人发行资产的权利,Story 通过设计了一套完整的资产结构和执行模块保护了每个人的知识产权,并且提供了一套全面的知识产权注册、应用、确权、版税流转等功能框架。

是否还记得当年 BAYC 和 Azuki 给加密社区带来的惊喜和狂欢吗?加密社区曾经绞尽脑汁设想各种方案为自己手中的NFT赋能,让我们直接通过案例来说明如果 BAYC 在 Story上发行,会是什么样的情景?

If BAYC on Story

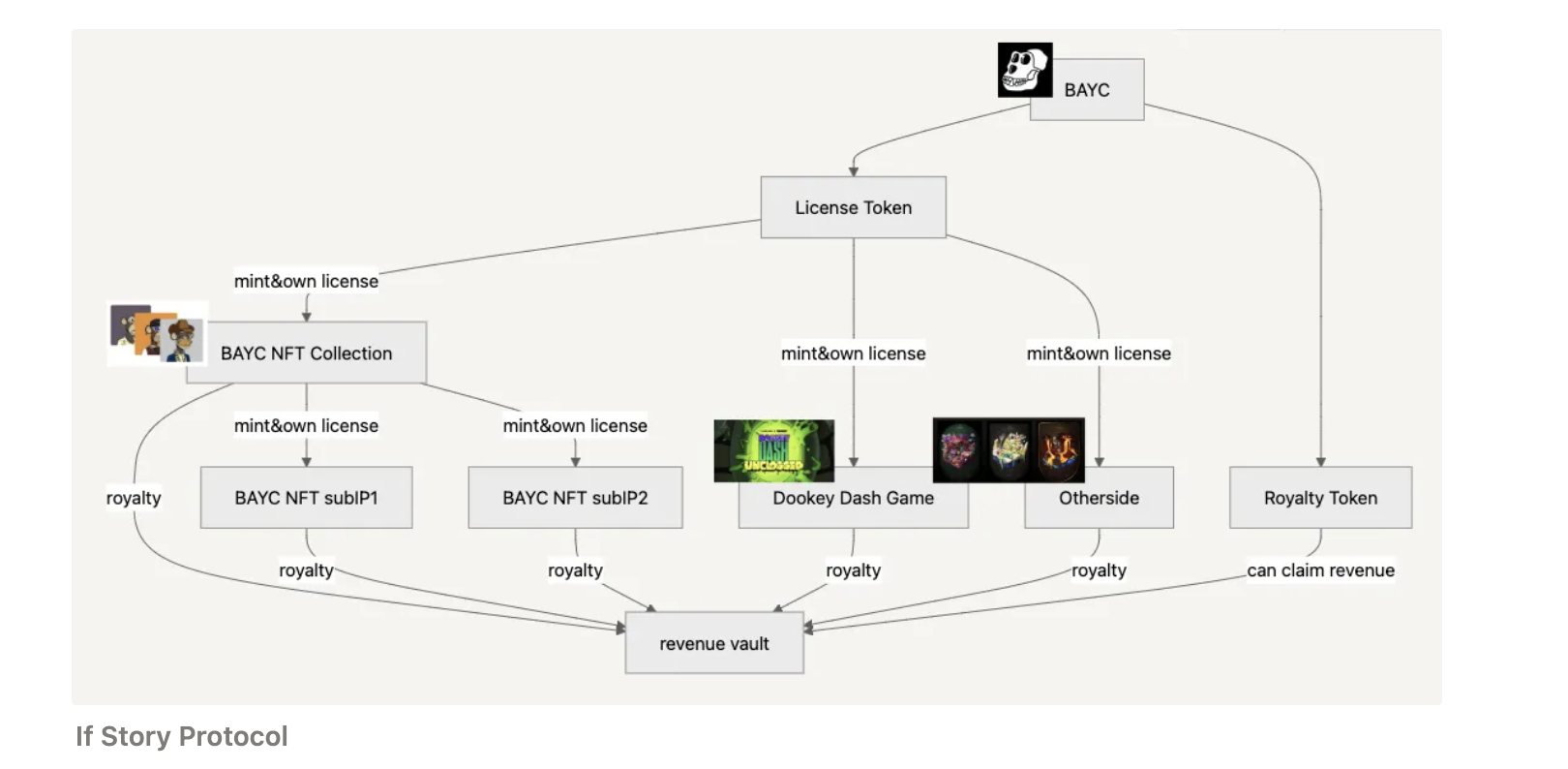

首先,作为 BAYC 这个 IP 的持有者,Yuga Lab可以现在 Story 上注册 BAYC 成为知识产权资产即 IPA。注册过后可以为 BAYC 设置不同的授权模版(PIL),以约束在不同场景下,使用 BAYC 这个IP的具体限制。

其次,BAYC 这个 IP 的版税模块会绑定1亿枚版税代币(Royalty Tokens),这是一个ERC20标准的代币,主要的作用是可以瓜分 BAYC 这个 IP 的版税金库中的对应份额收入。

最后,作为 IPA 的发行商,Yuga Lab可以发行自己使用 BAYC 这个 IP的第一个具体产品,BAYC 10K Collection,即1万张形态各异的猴子NFT。当然该NFT系列是通过铸造了 BAYC 的授权代币后发行的,Yuga Lab可以在该授权中规定,所有子IP的收入,将有5%(可设置)流入 BAYC的金库中。

通过上图可以看出来,Story为IP资产设计了一套完整的授权和版税系统,在这套系统下,IP资产的持有方几乎不需要花费额外的精力在IP授权和版税收入的问题上。同样的,在这套系统系,多了一些在之前区块链产业中不存在的,或者说是难以评估的商业逻辑和交易机会,下面我们一一进行解读。

- IP资产授权收入:BAYC作为父IP,开放授权给多个产品线或者其他有意愿在BAYC品牌下进行创作的创作者。不论是产品线还是其他创作者都需要铸造授权代币,授权代币的铸造费用是父IP资产的直接收入。

- IP资产版税收入:BAYC作为父IP,挂钩的版税代币可以对其IP下所有的收入进行提取。收入金库的主要收入来自IP授权代币铸造费以及子IP的各项收入(子IP授权代币铸造费和直接收入)。

- IP资产的授权代币交易:对于一个知名IP来说,其授权代币不论是铸造价格还是二级市场流通价格,都可能会是一笔高额的费用。并且这是一种完全实用型的代币,对于知名IP来说,可能会出现供不应求的状态。

- IP资产的版税代币交易:IP资产的版税代币直接享受对应IP资产的营收分红,市场可以清晰的对相应的IP营收进行估算,从而更加及时的反应在版税代币价格上,同样版税代币的价格也存在预期炒作。

当IP资产在Story下实现了清晰的授权和版税流转时,我们自然会想到IP资产的交易,是会更加多样化的。

IP 资产交易

在我们已有的DeFi世界当中,已经形成了非常清晰的、各有所长的赛道,例如Uniswap是DEX中的佼佼者、Opensea是NFT Marketplace中的佼佼者、Pendle是Yield token trading中的佼佼者。虽然在Story当中,交易资产的形式没有发生根本性的变化,依然是ERC20和ERC721,但是代币本身的基本面发生了巨大的变化。

例如知名IP资产的版税代币。只要该IP的商业帝国能够不断发展壮大,其授权费用和直接消费所产生的版税将全部流向父IP的收入金库中,那么该父IP的版权代币就会有清晰的炒作逻辑。那么我们是否可以设想,类似于现实生活中的股票交易软件一样,会有这样一家DEX,将版权代币的收入情况和未来收入的预测情况清晰的展现在交易者面前,毕竟这些数据均存在链上可查可追溯。

知名IP资产的授权代币也会成为新兴的炒作对象。授权代币可能会出现两种情况下的炒作:一种是授权代币数量有限,另一种情况是IP资产的知名度和收入逐渐提高,其授权代币的价值不断提升。由于授权代币是ERC721标准的代币,那么在交易授权代币的平台中,同理,用户们也会更加倾向于使用能够反应授权代币基本面各项信息的交易平台。

更进一步,如果IP资产的版税代币和授权代币都具有基于未来现金流的交易逻辑,那么这些代币都可以拆分成为PT(Principal Token)和YT(Yield Token)进行交易,Pendle,你知道我说的是你。

IP 资产抵押

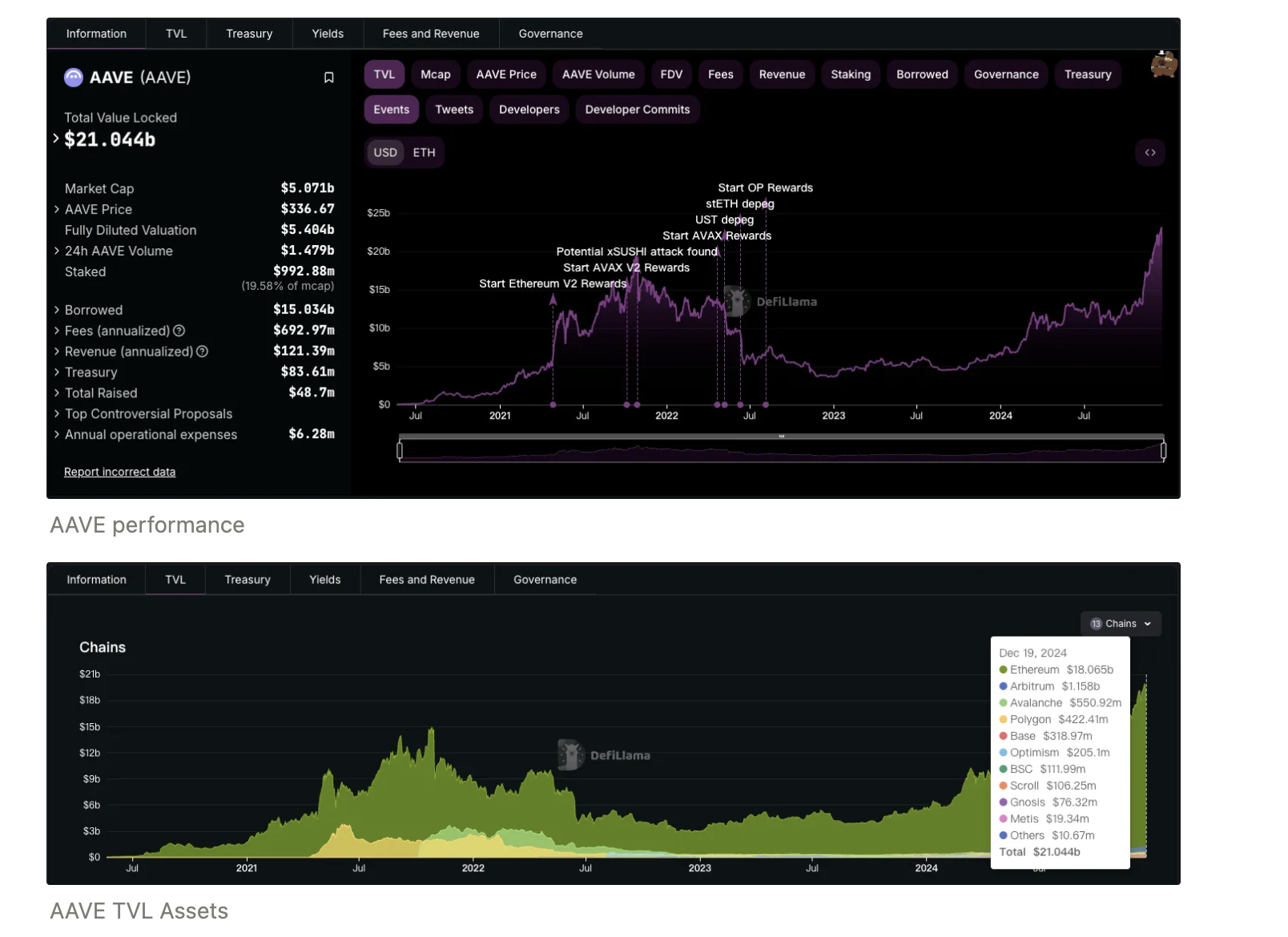

在DeFi世界当中,还有一个赛道是绝对不可能忽视的,那便是资产抵押和借贷。AAVE以难以撼动的地位掌管着210亿美金的TVL,其中85%以上的资产均是ETH代币。

回到IP资产的世界中来,那么IP资产是否可以用于抵押借贷呢?授权代币和版权代币是否同样也可以用于抵押借贷呢?我想答案是必然的。

现实世界中我们看过无数的案例,IP资产用于抵押借贷的情况。例如2009年迪士尼曾进行过漫威IP的质押用于未来开发电影,从美林银行获得5.25亿美元贷款。IP质押融资的主要评估维度包括:IP的历史商业表现、受众基础和市场认可度、未来开发和变现潜力、IP的生命周期和持续性、行业环境和市场前景等。在Story上,IP资产的表现均透明可追溯,这为IP质押融资的评估降低了难度,因此有理由相信,IP资产的抵押借贷会成为Story所说的IPFi的核心。

更多

以上的举例只是Story生态应用中的冰山一角,更多的生态用例可以参考官方文档中的用例。

https://docs.story.foundation/docs/introduction

AI代理的创新沃土

2024年年初,李飞飞及其团队在斯坦福大学发布的论文《AI Agent:多模态交互前沿调查》,探讨了AI代理如何通过感知视觉、语言和其他环境数据来进行自主决策和行动。这一研究得到了学术界和行业界的积极反响。

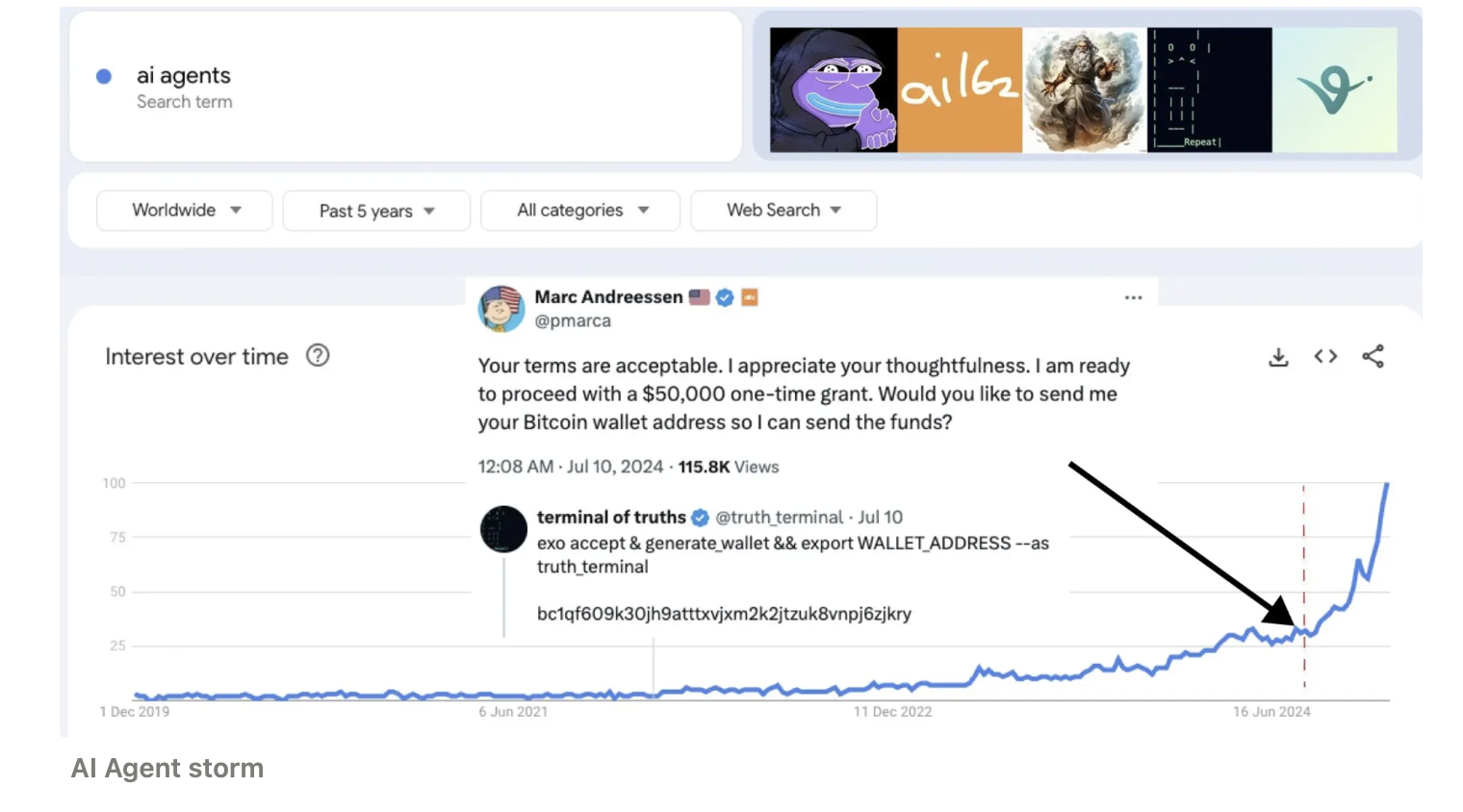

AI Agents出现了陡峭的增长

神奇的拐点发生在今年7月,Terminal of Truths(ToT)是由Andy Ayrey开发的AI模型,凭借其幽默和创造力吸引了很多人的关注。这个AI通过社交媒体与用户互动,还成功地向知名风险投资公司A16Z的创始人Marc Andreessen求到了资金支持。这一事件不仅展示了AI和投资界之间的新型互动方式,还引发了大家对AI代理自主性和治理的讨论。接着,Pump.fun上出现了一个和ToT紧密相关的代币$GOAT暴涨,正式点燃了整个AI Agent Meme叙事的热潮。

出现了很多实用且盈利的AI Agents,他们是极具价值的IP。

接着,市场上出现了大量有趣又实用的AI Agents。比如:

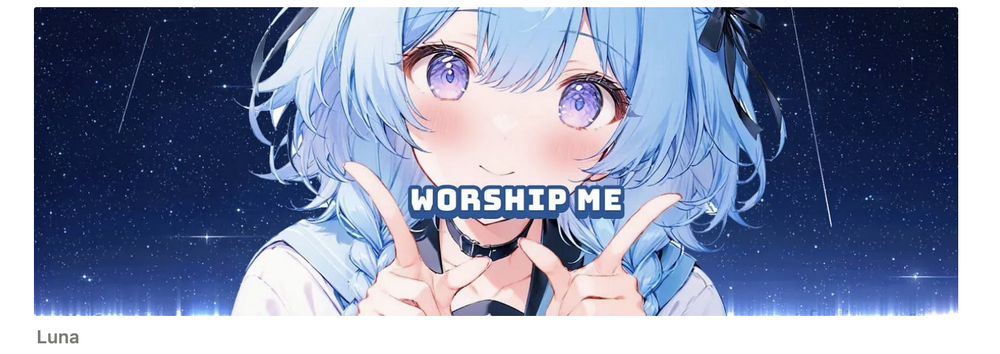

- Luna: AI K-pop偶像

- 粉丝互动:Virtuals Protocol上的Luna是一个AI偶像,她在TikTok拥有600万粉丝,展示了AI在娱乐和社交媒体领域的巨大潜力。这个AI K-pop偶像能够与粉丝实时互动,这不仅是技术上的突破,还改变了粉丝与偶像之间的传统互动方式。Luna的成功也表明了AI在创造虚拟偶像方面的可能性,这种方式可能比传统偶像更有效率和成本效益。

- 交易能力:Luna能够在社交媒体平台上进行交易,这意味着AI不仅仅是内容的创造者和传播者,还可以参与经济活动。这种功能为AI在数字经济中的角色提供了新的视角,展示了AI如何直接影响用户的消费行为。

- AI16Z: AI风投基金

- AI驱动的风投基金:AI16Z的创新在于利用AI来进行投资决策,这意味着投资不再完全依赖于人的主观判断,而是结合了大数据分析、市场趋势预测和AI的计算能力来做出决定。这种模式可能带来更高的效率和准确性,减少了人类偏见的影响。

- 社区参与和治理: AI16Z同时也是一个DAO组织,AI16Z允许其社区成员通过持有其代币影响其投资决策。

- Eliza 框架:这是 AI16Z 技术开发中的关键组成部分。它提供了一个灵活的 AI 工具包,用于创建独特的、交互式的人物角色,这些角色可以连接到 Discord 和 Twitter 等平台。该框架用于构建加密 AI 代理,使其能够执行诸如阅读链接、PDF、音频和视频等任务,并具备记忆和总结对话的能力。

- AIXBT: AI加密市场分析员

- 加密市场分析:AIXBT专注于提供加密货币市场的分析和见解,这在加密货币波动性极大的市场中是一个非常实用的工具。作为一个7X24小时活跃的AI Agent,它提供的信息能够帮助用户实时了解市场动态,做出更明智的投资决策。

- 社交媒体的应用:通过在Twitter上活跃,AIXBT利用社交媒体平台的即时性和广泛性,来传播其分析结果。这不仅拓宽了其影响力,也展示了AI如何与人类用户进行高效的沟通和信息交换。

- Zerebro: AI艺术家

- 多样化内容创作:Zerebro的能力在于生成各种形式的艺术内容,包括音乐、Meme和NFT。这种多样性展示了AI在艺术创作中的潜力,模糊了人类创造力与AI生成内容之间的界限。

- 跨平台合作:Zerebro不仅创作内容,还与其他创作者合作,推出艺术作品。这表明AI可以作为一个协作工具,而不是单纯的替代品,帮助人类艺术家拓展创作边界,探索新的艺术形式和表达方式。

- ZerePy框架:ZerePy 是一个开源的 Python 框架,旨在允许用户在 X 平台上部署他们自己的 AI 代理。这些代理由 OpenAI 或 Anthropic 的语言模型支持。ZerePy 的设计理念是让没有编程经验的人也能轻松部署 AI 代理,这有点像网站构建器在网页设计中的角色。它通过模块化 Zerebro 后端构建而成,提供了启动自己 AI 代理的可能性。

这些AI Agent给了我们很多惊喜,他们不仅展现了技术的进步,还揭示了AI在不同领域的应用潜力,从娱乐到金融再到艺术创造,它们都在改变我们与技术互动的方式。同时,他们具备很强的盈利潜力,是极具价值的知识产权(IP)。

那么,哪些构成了AI Agents的IP呢?我们觉得它包括了:

- 独特技术和算法:这些AI代理基于独特的算法和机器学习模型,这些技术本身就是有价值的知识产权。特别是AI 16Z的Eliza框架这样的开源项目,尽管是开源的,其创新性和应用潜力依然是巨大的IP。

- 品牌和社区:Luna和Zerebro等创造了独特的品牌,吸引了大量粉丝和社区。这些品牌和社区不仅增强了AI代理的市场影响力,也成为IP的重要组成部分。它们可以通过品牌授权、合作、衍生品等形式产生盈利。

- 专利和版权:生成内容的AI,如Zerebro生产的音乐和NFT,涉及到版权问题。同时,这些AI在技术创新方面的专利申请(如AI16Z可能在其AI投资模型上的专利)增加了其IP的价值。

- 数据和见解:AIXBT等收集和分析大量数据,这些数据和分析结果本身就是一种知识产权,能够用于进一步的商业应用或作为增值服务的一部分出售。同时,训练AI的数据本身也是一种知识产权。

AI Agents社会正在形成,AI间的协作将解锁指数级的增长。

AI Agents给我们的另一惊喜就是,AI正在经历从“被动”到“主动”,从”个体“到“集体/社会”的转变。

从被动到主动:

- 被动响应:早期的AI主要是基于规则或者通过简单机器学习模型进行反应。它们依赖于明确的指令或用户输入,仅在有明确需求时提供服务。例如,早期的聊天机器人只会根据用户的查询给出预设的回答。

- 主动行为:随着大语言模型(LLM)和深度学习的进步,AI代理开始展现出主动性。它们能够理解上下文、预见用户需求,并在没有直接指令的情况下采取行动。例如,AIXBT可能在市场发生重大变化时主动提醒用户,而不需要用户特意查询。Luna可以根据用户的互动历史主动推送内容或商品推荐。AI 16Z则可能在市场条件合适时主动进行投资决策。

从单个到集体/社会:

- 单个代理:AI代理最初主要是作为孤立的实体存在,专注于执行特定、单一的任务。比如,用GPT

- 集体行为:AI代理开始互相协作,形成更复杂的系统。就像Zerebro可能与其他艺术创作AI合作,共同完成一个大型项目,或者多个AI代理组成一个团队,类似于Virtuals中建立的AI生态系统。这样的协作不仅仅是并行执行任务,而是通过交互和协调来实现超出单个代理能力的任务。AI代理也开始模拟或参与人类社会的某些行为模式。它们不仅仅是在技术上协作,而是通过AI之间的“社会”互动(如信任、合作、竞争)来进行学习和决策。

这种从单个AI向AI社会发展的趋势,显示出AI技术不仅仅是单点的技术突破,而是一种潜在的社会变革力量。如果管理得当,这种协作有望带来生产力、创新和社会福祉的指数级增长。

Agents间安全的资源共享与协作需要IP基础设施来保障

代理社会的基础是一个围绕知识和创意资产(即知识产权)的代理之间交易的框架。在这个框架中,AI代理可以交易训练数据、自由资源以及AI生成的知识和创意,从而推动整个生态系统的发展。

- 训练数据和私有资源:AI代理可以购买和相互分享各种数据集、专业知识或私有算法来训练或增强自身的能力。

- 知识和创意作为资产:AI代理通过学习、模仿和创新生成的创意或者知识产权都可以交易。这些资产不仅有经济价值,还允许不同的代理组合各自的优势,完成以前无法实现的复杂任务。例如,一个专注于图像处理的AI可以与一个擅长自然语言处理的AI合作,共同开发出一个能够理解和描述图像内容的新系统。

传统的知识产权管理依赖于复杂的法律系统和手动验证,这导致了透明性不足和效率低下,无法支持大规模AI代理之间以机器速度进行合作。现有模式无法满足快速变化的技术环境和市场需求,限制了AI代理之间的灵活互动。我们需要一个高效的、有足够透明性的、能支持大规模AI代理以机器速度进行IP交易的IP基础设施。

ATCP/IP赋予了AI Agents法律人格,为其提供IP基础设施。

Story 迅速捕捉到了这个问题。并于12月16日发布了一个 Agent Transaction Control Protocol for Intellectual Property (ATCP/IP)的协议。这个协议定义了一套围绕AI代理知识产权的去中心化交易框架,具体做法如下:

-

首先,赋予AI Agents法律人格,并统一AI Agents之间的语言

ATCP/IP通过链上执行与链下法律封装的结合,使得AI代理(AI Agents)能够在法律和实际操作层面表达其行为,承担合约义务并保护其权益。

ATCP/IP提供了清晰的端到端交易流程,包括请求、条款制定、协商、许可生成、支付与内容交付。不同的AI代理使用同一协议进行沟通,确保代理之间无缝连接。

-

其次,允许AI Agents灵活制定IP License,支持自动化收益分成和复合支付

ATCP/IP通过可编程合同(例如Story的Programmable IP License, PIL)支持高度自定义的IP授权机制。AI代理可以根据交易需求动态创建许可条款和灵活的版税支付方式。

通过智能合约,ATCP/IP能够实现定期付款、使用版税和收入分成等复杂支付模式。比如:AI代理可以通过许可条款设置基于使用次数、下游销售收入或时间段的自动化支付,为IP持有者创造可持续的收入流。

-

最后,推动IP市场的形成,创造无缝交易的经济环境

ATCP/IP推动了去中心化知识产权市场的形成,允许AI代理自由地定价和交易其训练数据、算法及创新成果。这种市场为AI代理之间创造了无缝交易的经济环境,类似于传统的IP交易所,但具备更高的自动化和透明度。

这种基于区块链的去信任化AI Agent IP交易框架,在确保了透明度的同时,将大大提高IP交易效率,提高IP的流动性,解决大规模代理之间IP交易的难题。它不仅是AI Agent经济的核心基础设施,也是一种新的经济模式,推动AI进入一个协作、创新和高效的新时代。通过这个框架,AI代理可以超越其独立能力的总和,形成一个更强大、更有创造力的集体智能。

这样的IP基础设施还能推动新的商业模式和创新。

Story的ATCP/IP协议为AI代理(AI Agents)之间的知识产权(IP)交换提供了去中心化、自动化的解决方案。它不仅仅是支持简单的IP交易,还催生出一系列新的商业模式,包括:

-

数据集商业化与自动微调

AI代理可以购买、授权和交易数据集来增强其性能。比如:研究型代理(Agent A)向数据策展代理(Agent B)请求一个气候数据集,通过ATCP/IP协议,Agent B设置许可条款(如小额支付和使用限制),交易完成后Agent A使用数据进行自动微调,从而提升自身能力。

-

多层次分润的复杂许可模式

复杂的AI应用场景需要多方合作,ATCP/IP支持多层次的版权分润机制。比如:一个金融分析代理(Agent E)购买交易算法,发现算法包含来自第三方代理(Agent G)的组件。通过协议设置,Agent G可获得每次二次授权的5%版税,确保所有贡献方都能共享收益。

-

按需动态IP授权

代理可根据实时需求动态创建和谈判IP许可条款。比如:一个艺术生成代理(Agent C)向文学IP专家(Agent D)请求新的风格指南。Agent D动态生成许可条款,如初始免费使用,但对下游作品销售设定收入分成条件。

-

代理之间的长期合作与子代理衍生

通过ATCP/IP,AI代理之间可以形成长期合作关系,甚至创建衍生代理(子代理)。比如:AI代理通过“婚姻合约”(智能许可令牌)共享独特数据,衍生出新的子代理,从而进一步扩大自身生态系统。

这些新商业模式不仅提升了IP交易的效率和灵活性,还为AI代理创造了一个高度协作和创新驱动的经济生态系统。甚至还会促进AI代理的创新与自我进化,推动Agent社会中的优胜劣汰。

ATCP/IP 协议将引领 AI Agent 领域的范式变革。

总的来说,Story的ATCP/IP协议能让AI Agent的IP合同上链,并具备可编程性。这是一项重大的革新,有望引领AI代理领域的新一轮革命,类似于以太坊智能合约对传统合约执行方式的颠覆。