2024 年,Web3 游戏行业呈现复杂态势,在取得重大进展的同时也面临诸多挑战。虽然日活跃用户数激增超 300%,传统游戏公司也开始具体布局该领域,但从市场表现来看,该板块市值仅增长 60.5%,显著落后于 Meme 币和 AI 板块。随着比特币刷新历史新高,各个加密板块蓬勃发展,一个关键问题浮现:“Web3 游戏在这轮牛市中是否错失了最好的发展时机?”

然而在这些表面数据背后,2024 年标志着该行业的重要转型期。行业已从纯投机阶段迈向成熟。本报告将分析 Web3 游戏在 2024 年的市场周期中如何演进,探讨该板块的关键指标、技术进步和战略转变。从基础设施发展到用户参与模式,我们将探索该行业如何在应对主流采用挑战的同时,构建可持续增长。

注:除非特别说明,本报告所有数据截至 2024 年 12 月 15 日。数据来源为 Footprint Analytics 和 CoinMarketCap。

年度关键指标概览

-

市值:达到 318 亿美元,增长 60.5%;

-

交易量:52 亿美元,增长 18.5%

-

交易笔数:53 亿笔,下降 30.3%

-

日活跃用户:年末达 660 万,对比年初增长 308.6%;

-

活跃游戏:3,602 款游戏中 1,361 款保持活跃(37.8%);

-

年度融资:220 笔融资事件,总额 9.1 亿美元;

-

领先公链:

-

-

交易量占比:BNB 链 (23.1%)、以太坊 (17.6%)、Blast (9.2%);

-

交易笔数占比:WAX (33.6%)、Aptos (11.6%)、Ronin (6.1%);

-

日活跃用户:opBNB (220 万)、Ronin (110 万)、Nebula (45.8 万)(12 月日均)。

-

市场表现分析

市值表现

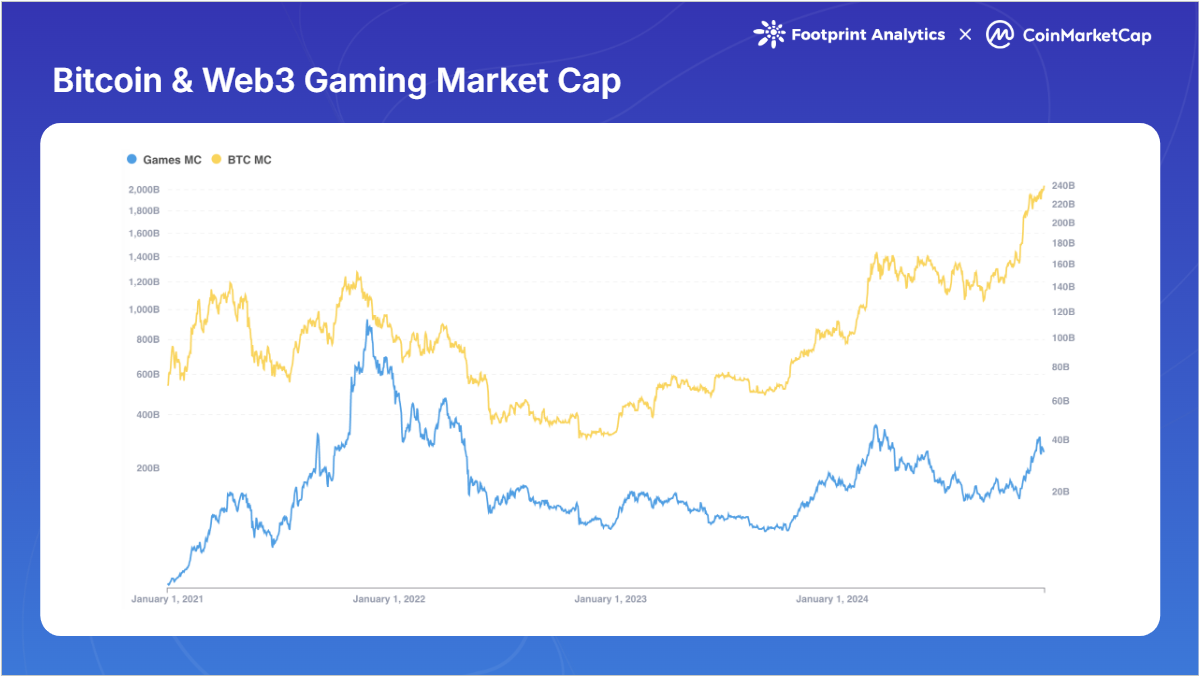

Web3 游戏板块在 2024 年实现强劲增长,但相较其他加密板块表现逊色。根据 Footprint Analytics 数据,游戏代币市值年末达到 318 亿美元,较上年增长 60.5%。虽然该板块在 3 月创下 474 亿美元的年内高点,但仍显著低于 2021 年 11 月创下的 1,141 亿美元历史高位。

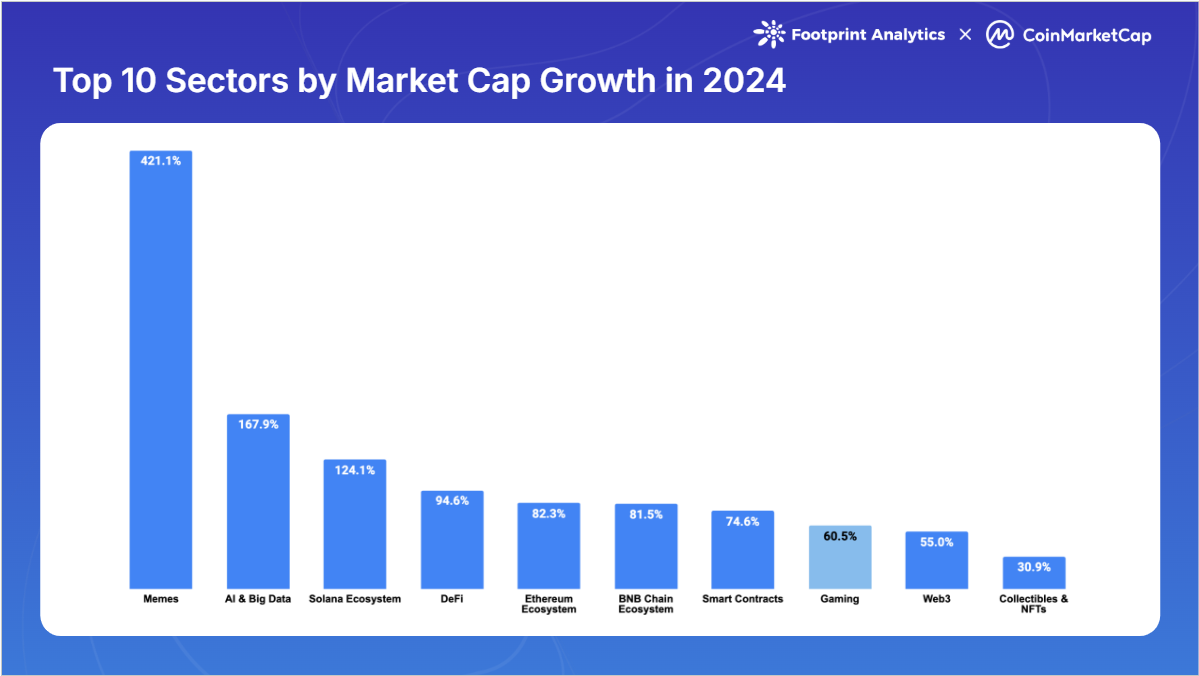

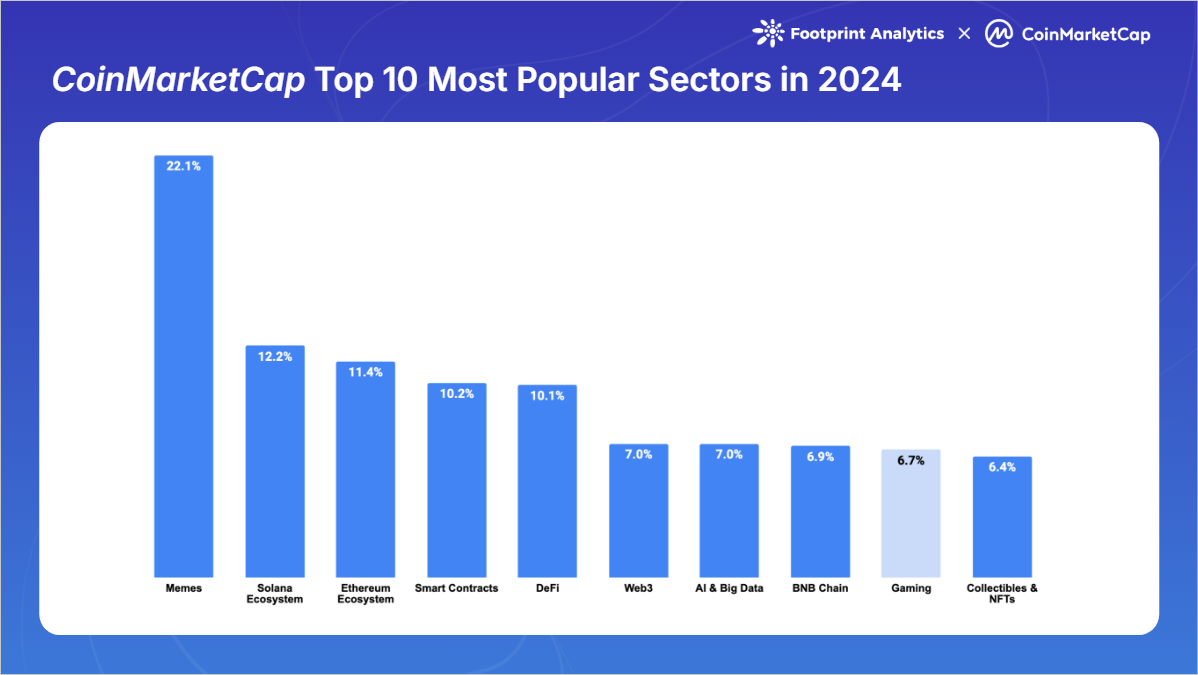

尽管整体加密市场在 2024 年下半年表现强劲,尤其是比特币带动的年末两个月,但游戏代币表现落后于其他板块。CoinMarketCap 数据显示,Web3 游戏在市值增长排名中位列前十板块第八位,显著落后于领先板块:Meme 币 (421.1%)、AI 与大数据 (168.0%) 和 Solana 生态 (124.1%)。

这种表现不佳也延伸至社区关注度。在 CoinMarketCap 最受关注的板块中,Web3 游戏仅占据前十板块 6.7% 的浏览量,排名第九,因为全年关注焦点主要集中在 Meme 币相关项目上。

交易量分析

Web3 游戏板块在 2024 年的关键指标表现参差不齐,交易量实现增长,但交易笔数持续下降。

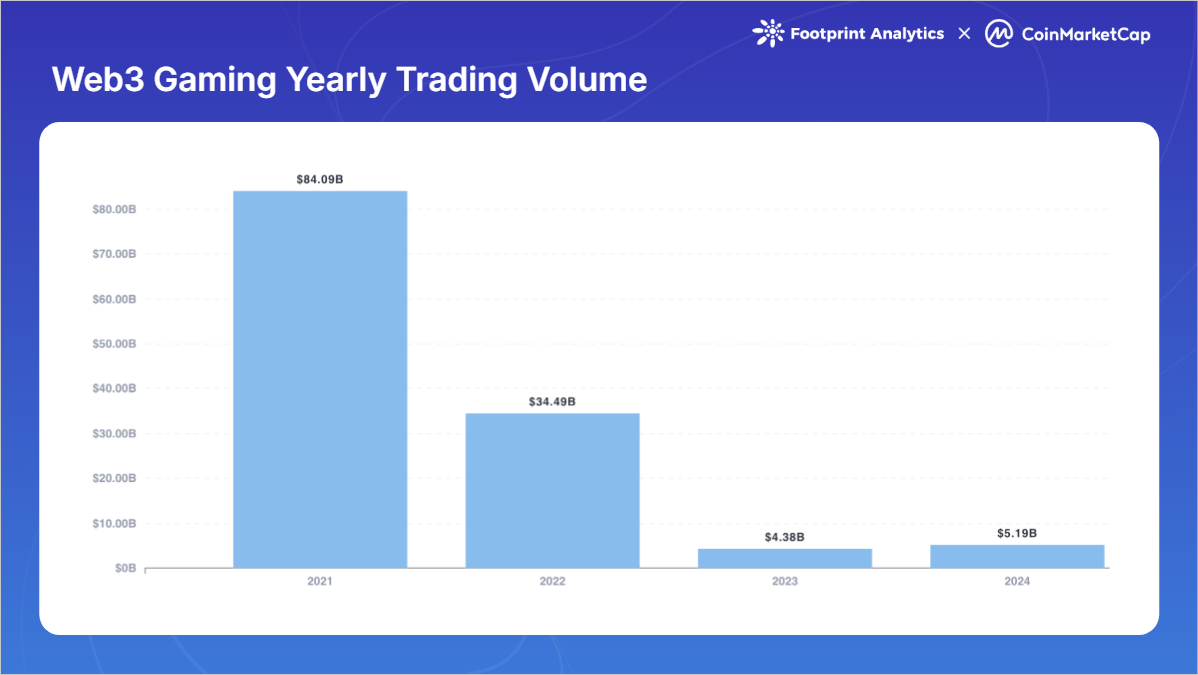

交易量趋势

2024 年 Web3 游戏总交易量达 52 亿美元,较 2023 年增长 18.5%。虽然扭转了自 2021 年以来的下降趋势,但交易量仍显著低于上一周期高点。2024 年的数据仅为 2021 年峰值 (841 亿美元) 的 6.2%,以及 2022 年交易量 (345 亿美元) 的 15.1%。

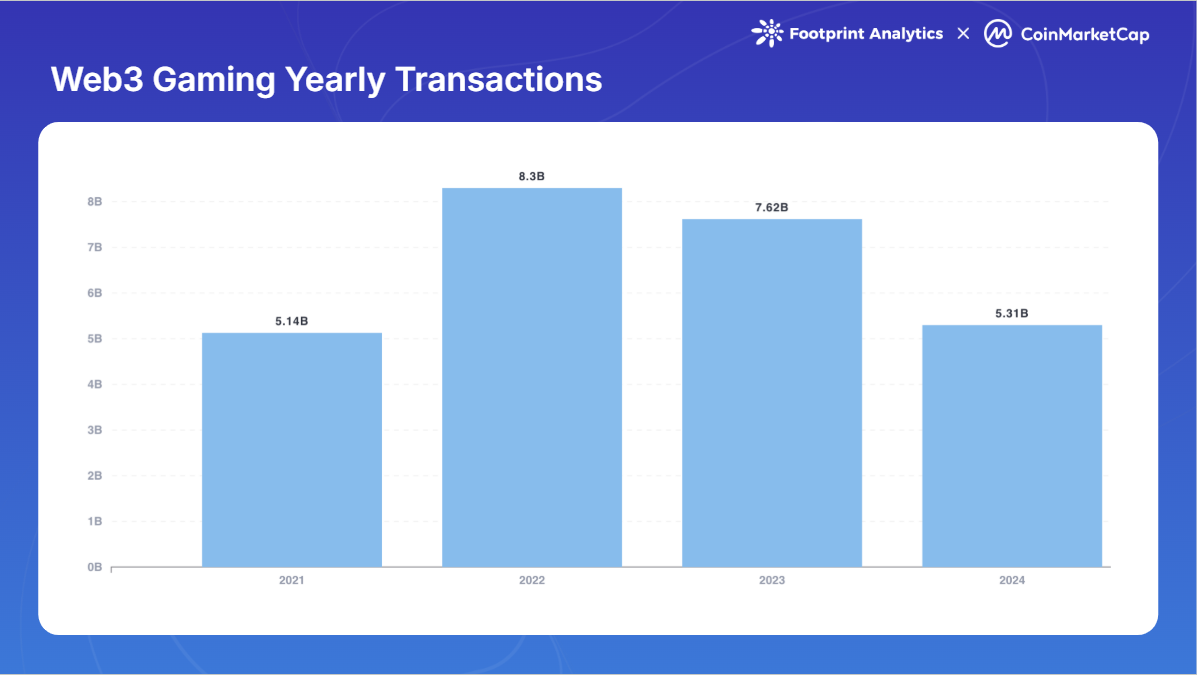

交易笔数趋势

2024 年总交易笔数达 53 亿笔,较上年下降 30.3%。这一水平虽与 2021 年的 51 亿笔交易相当,但未能扭转自 2022 年开始的下降趋势。

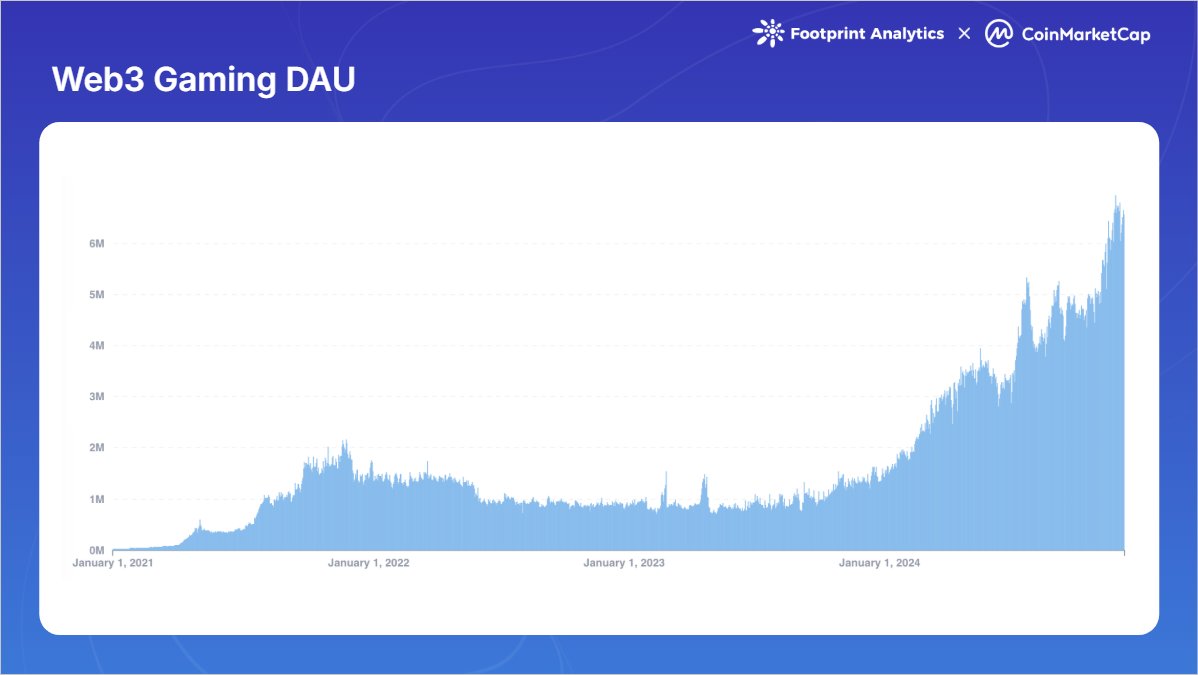

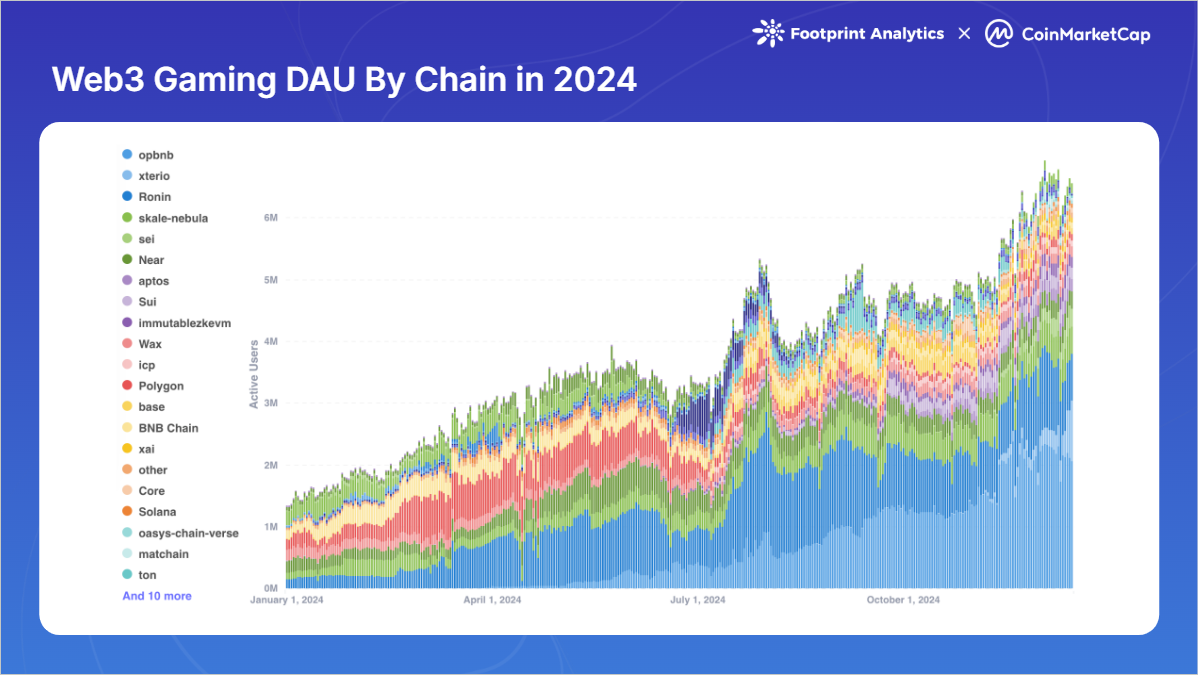

用户参与度

日活跃用户 (DAU) 在 2024 年全年实现显著增长,从 1 月的日均 160 万增长至 12 月的 660 万,年内增长 308.6%。这一增长超越了 2021 年 11 月创造的 180 万 DAU 的上一个周期峰值。尽管这些数据可能包含一些机器人活动,但这一增长仍然展示了该行业的显著用户参与度。

生态系统发展

公链竞争与演进

主要公链表现分析

2024 年 Web3 游戏不同公链间的主导地位出现显著变化,各链在交易量、交易笔数和用户参与度方面呈现不同的优势。

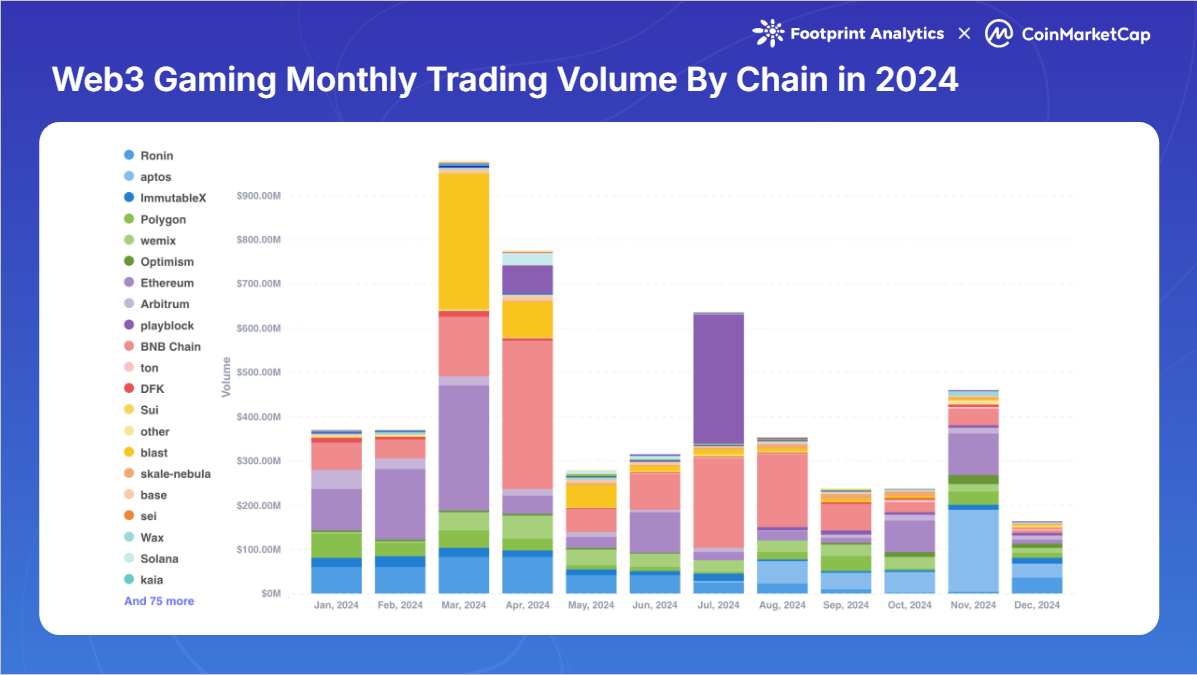

各链交易量分布

BNB 链在交易量方面保持主导地位,实现 12 亿美元交易量 (23.1% 市场份额),其次是以太坊的 9.2 亿美元 (17.6%)。Blast 和 Ronin 分别占据 9.2% 和 9.0% 的市场份额。

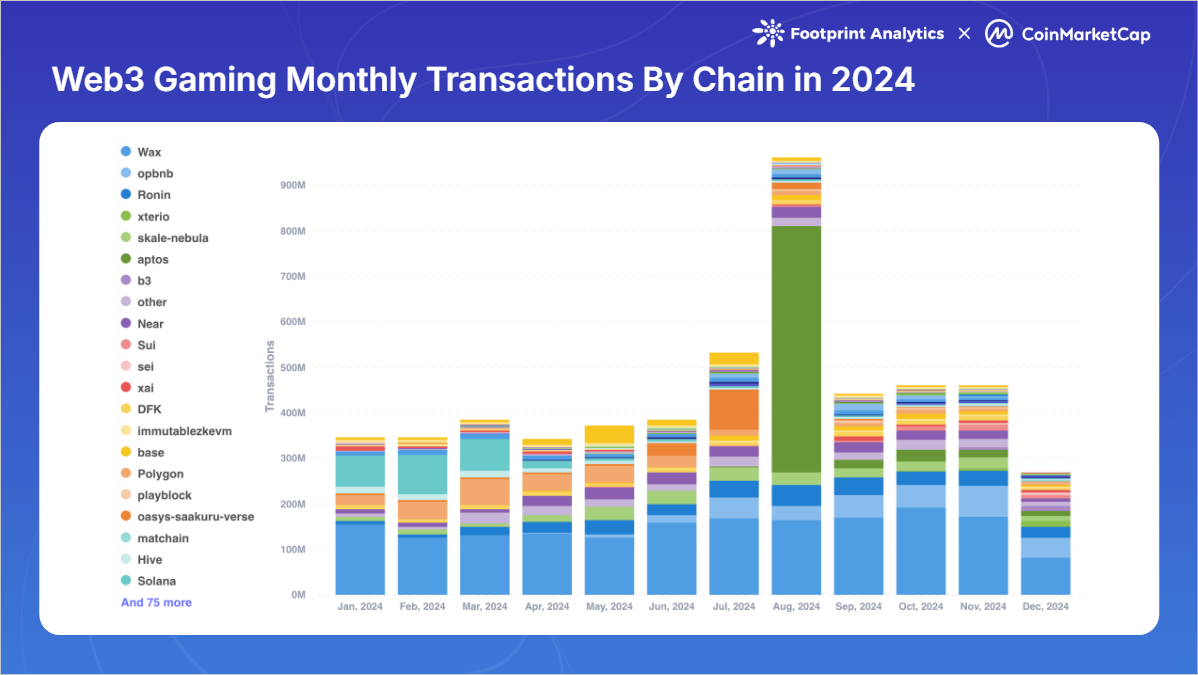

各链交易笔数

尽管行业整体交易笔数下降 30.3%,但某些公链展现出强劲表现。WAX 以 18 亿笔交易领跑 (占总量 33.6%)。Aptos 凭借其“点赚”("tap-to-earn")模式的 Telegram 游戏 Tapos 异军突起,达到 6.2 亿笔交易 (11.6%),其中仅在 8 月就产生 5.40 亿笔交易。Ronin 和 opBNB 分别保持 3.21 亿和 3.18 亿笔的交易笔数。

各链用户数

各链用户活跃度展现出显著增长,特别是在 2024 年下半年。opBNB 在用户参与度方面异军突起,12 月平均日活跃用户达到 220 万,超越了长期领导者 Ronin (110 万)。作为 SKALE Layer 2 的 Nebula 以 45.8 万平均 DAU 排名第三。NEAR、Sui 和 Sei 等公链跻身 DAU 前十,展示了生态系统竞争格局的扩大以及用户愿意尝试新平台的态度。

各链使用的多样化趋势表明生态系统日趋成熟,不同公链正在为各类游戏体验和用户偏好找到各自的定位。主要网络已不再仅仅提供基础区块链设施,而是发展成为游戏开发者的综合平台。Arbitrum 基金会的 20 亿 ARB 游戏催化剂计划、Starknet 基金会的 5,000 万 STRK 代币分发计划,以及来自 Sui 和 Xai 的重要 Grant 计划,都展示了各链如何通过战略性激励来吸引和留住优质游戏项目。

技术基础设施改进

容量提升

区块链处理能力显著提升,目前网络的每秒交易处理量较四年前提高了 50 倍以上。这一增长得益于以太坊 Layer 2 和 Layer 3 网络的兴起,包括 Immutable zkEVM、基于 Avalanche L1、Oasys、SKALE、Arbitrum Orbit 的游戏链,以及其他高吞吐量区块链如 Solana、Sui 和 Aptos。

游戏专门链也取得重大进展。Ronin 在 2024 年 6 月宣布其 Layer 2 计划 Ronin zkEVM,使 Ronin 开发者能够创建自己的 zkEVM Layer 2。Immutable zkEVM 通过移除部署白名单并启用无许可部署,朝着更大的可访问性迈出了战略性一步。此外,Avalanche 完成了自 2020 年主网上线以来最重要的 “Avalanche9000” 升级,重点解决了定制化 L1 构建的障碍并改善了互操作性。

Gas 费用降低

2024 年 3 月以太坊的“坎昆”升级(也称 "Proto-Danksharding" 或 "EIP-4844")是一个重要里程碑,显著降低了 L2 网络的费用。影响非常显著,Gas 费从几美元降至几美分甚至更低,消除了区块链游戏开发者和玩家面临的最大摩擦点之一。

跨链互操作性提升

Chainlink 跨链互操作性协议 (CCIP) 在 2024 年获得显著发展,使开发者能够创建可与多链资产交互的游戏。这一改进显著提升了游戏内物品的互操作性。

数字资产标准化格式的采用,特别是 ERC-721 和 ERC-1155,变得更加普及。这些标准确保游戏内 NFT 可以在各种游戏和平台间得到认可和使用,简化了资产转移和交互。

2024 年还见证了支持跨链游戏的去中心化平台的显著崛起。Portal、Fractal ID 和Web3Games 等平台为不同区块链生态系统之间的无缝资产转移和交互提供了必要的基础设施。

项目发展

2024 年是 Web3 游戏发展的重要一年。除传统游戏公司入局外,生态系统还见证了几个重要游戏发布。备受期待的游戏如 Off The Grid 和 MapleStory Universe 进入早期访问阶段,而 Illuvium 终于正式上线。Pirate Nation 成功完成了代币生成事件(TGE),推出了成功的"玩赢空投"( “play-to-airdrop”) 活动。

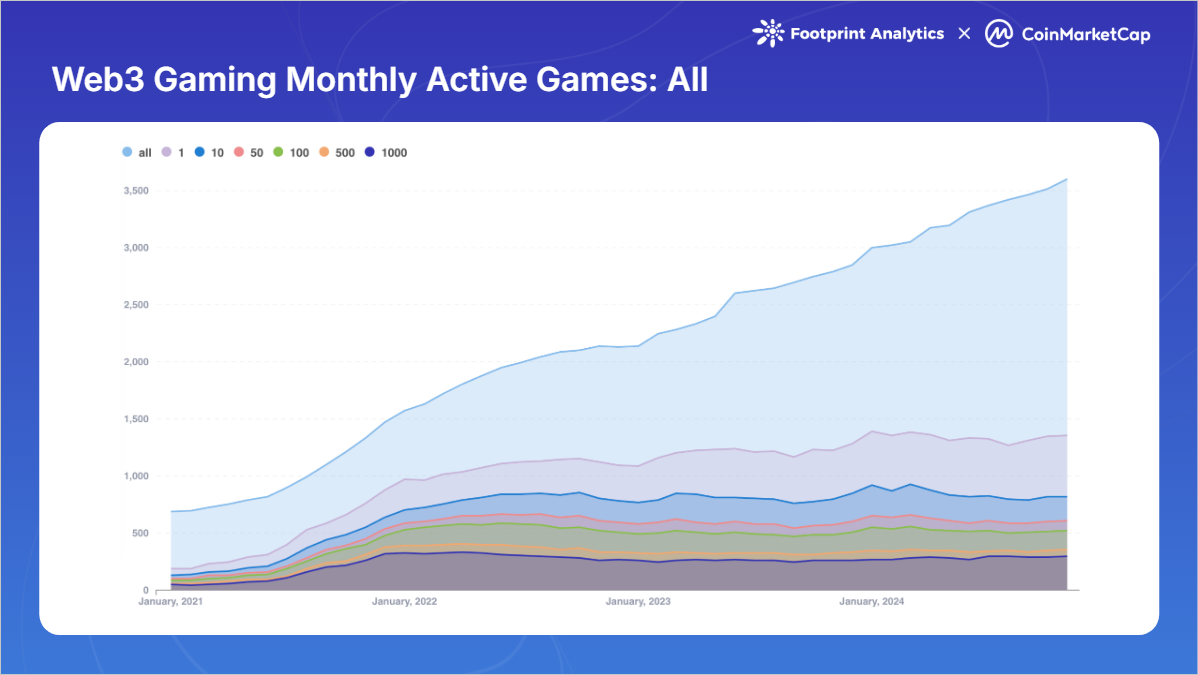

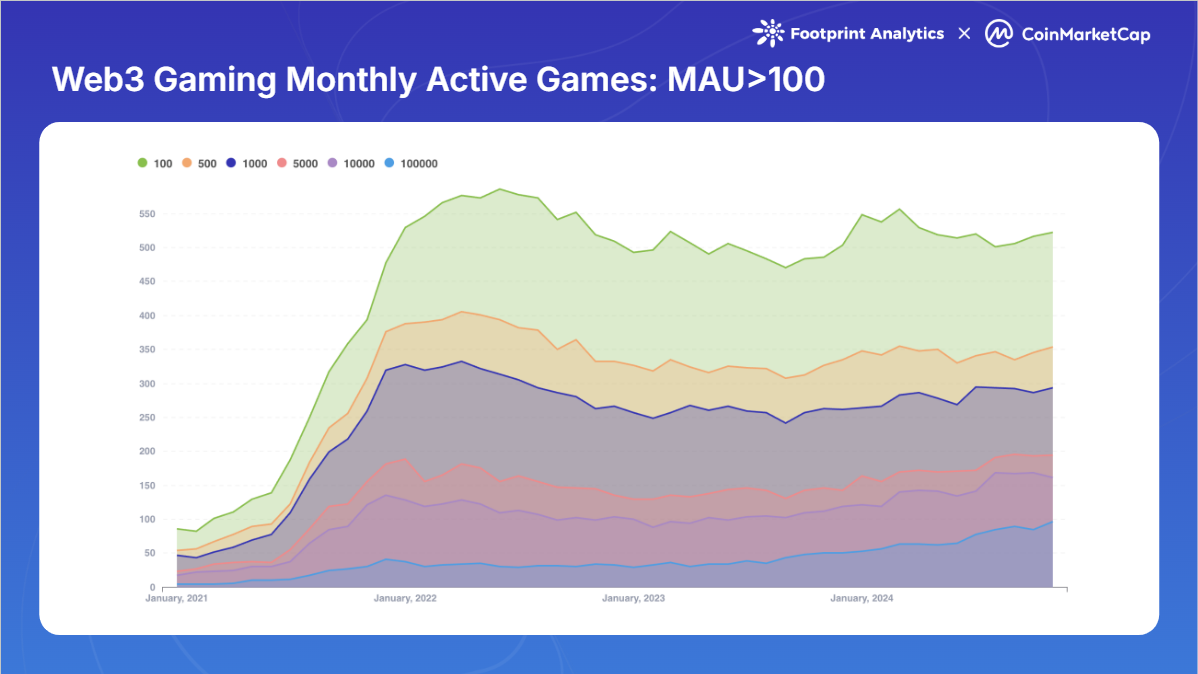

活跃游戏分析

截至 2024 年 11 月 30 日,区块链游戏总数达到 3,602 款,较 1 月的 2,997 款有所增长。然而,活跃游戏指标显示出一些挑战性趋势。在总游戏数中,仅 1,361 款 (37.8%)维持链上活跃,即 2,241 款(62.2%)处于不活跃状态。此外,尽管总游戏数增长,活跃游戏数量反而对比从 1 月的 1,387 款有所下降。

深入分析用户参与度指标显示市场进一步集中。拥有超过 100 个月活跃用户(MAU)的游戏数量从 2022 年 6 月的 586 款下降至 2024 年底的 522 款。在 2024 年 11 月,161 款游戏(占总数4.5%)实现超过 1 万 MAU,其中 96 款游戏(占总数 2.7%)突破 10 万 MAU。

这种用户集中趋势表明市场正趋于成熟,成功的游戏正在吸引更大的受众群体。这一现象受到多个因素影响,包括激烈的竞争、快速迭代策略,以及头部游戏在生态系统中形成的“头部效应”。

创新格局

跨平台游戏趋势

移动游戏强调可访问性和无缝用户体验,在 2024 年确立了其作为 Web3 游戏主要平台的地位。移动优先的方法已经影响了开发者设计区块链游戏的方式,专注于直观的界面和简化的入门流程。在 2024 年新发布的 Web3 游戏中,移动游戏占 29.4%。

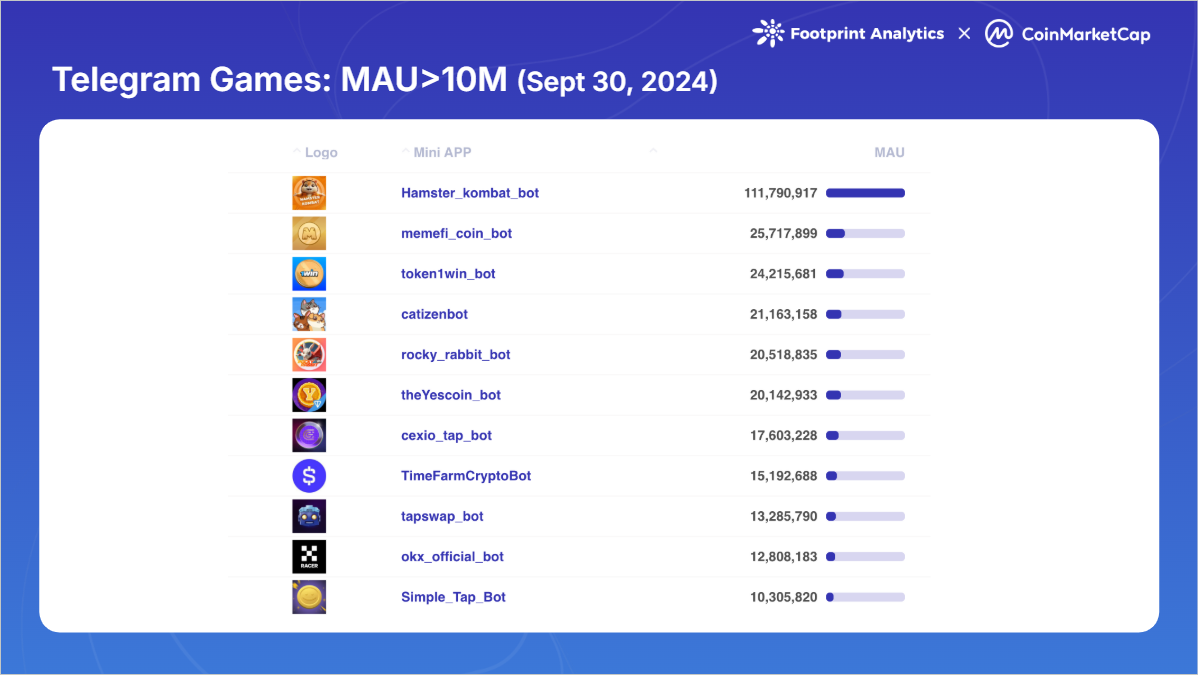

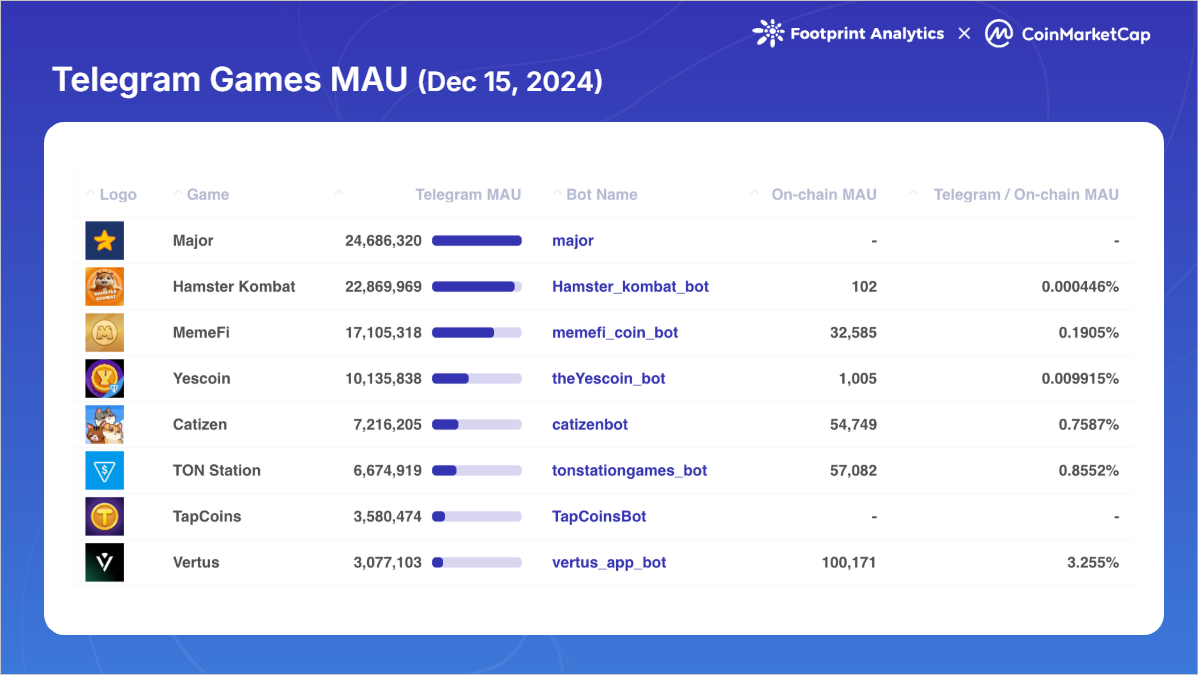

社交平台,尤其是 Telegram,已成为 Web3 游戏采用的强大催化剂,占新发布 Web3 游戏的 20.9%。Telegram 的成功源于其庞大的用户基础、简化的应用内体验,以及绕过传统应用商店限制的能力。该平台的影响力在 2024 年第三季度达到顶峰,11 款游戏突破 1,000 万 MAU。值得注意的是,TON 成功将这一庞大的用户基础转化为链上参与者,在 Web3 游戏、Meme 币和 DeFi 板块产生溢出效应。这一成功促使 TON 以外的多个区块链网络竞相争夺 Telegram 流量,Aptos、Sui、Core 等纷纷推出或者支持基于 Telegram 的游戏。

类似地,Line 在 2024 年 12 月宣布推出 20 个迷你 dApps 的计划,标志着主流消息平台对区块链游戏整合的兴趣日增。

主机游戏领域在 Web3 游戏中仍相对未被开发,主要制造商微软和索尼保持谨慎立场。然而,新的方法开始出现以弥合这一差距。一些开发者,如 Gunzilla Games 的 Off The Grid,选择将核心游戏玩法与区块链功能分离,以符合传统主机游戏的预期。同时,区块链平台开始开发自己的 Web3 游戏掌机,如 Sui 的 SuiPlay0X1 和 Solana 的 Play Solana Gen1 (PSG1) ,可能创造出一个专门的 Web3 游戏设备新品类。

传统游戏公司的入局

2024 年标志着传统游戏公司对区块链游戏态度的重大转变,主要游戏工作室从试验性动作转向战略性发展。

育碧(Ubisoft)10 月在 Oasys Layer 2 HOME Verse 上发布 Champions Tactics: Grimoria Chronicles。这款战术 RPG 在保持传统游戏元素的同时实现了一系列基于 NFT 的功能。

Square Enix 通过战略投资和合作强化其区块链板块的发展。除了投资游戏平台 Elixir Games 和 HyperPlay 外,该公司还宣布将其 Symbiogenesis 游戏带到 HyperPlay。

索尼集团的参与标志着向区块链游戏的重大推进,既通过投资的方式,又通过基础设施开发。在支持 double jump.tokyo Inc.1,000 万美元 D 轮融资的同时,索尼还宣布推出 Soneium,这是一个旨在将 Web3 创新与游戏和娱乐领域消费者应用相连接的 Layer 2 网络。

AI 整合到游戏开发

随着人工智能在 2024 年革新各个行业,Web3 游戏领域成为 AI 创新的重要受益者,为游戏开发和玩家体验开辟了新机遇。

AI 已经革新了游戏内互动和内容生成。游戏工作室正在利用 AI 创造更复杂的非玩家角色(NPC),这些角色能够适应玩家行为并基于个人游戏历史和偏好生成个性化任务。这种个性化通过使游戏体验更加相关和个性化来增强玩家参与度。

在开发方面,AI 显著简化了创作过程。开发者正在利用 AI 工具自动生成游戏环境和资产,大幅减少了制作时间和成本。这使得小团队有机会创造出可与大型工作室竞争的高质量游戏。

AI 还增强了 Web3 游戏的运营方面。该技术被用于自动化游戏测试流程和监控链上交易以防范潜在欺诈或作弊行为,这在具有复杂经济系统的游戏中尤为重要。此外,AI 算法正在帮助优化游戏经济和代币模型,解决 Web3 游戏设计中的主要挑战之一。

投资格局

年度融资事件概览

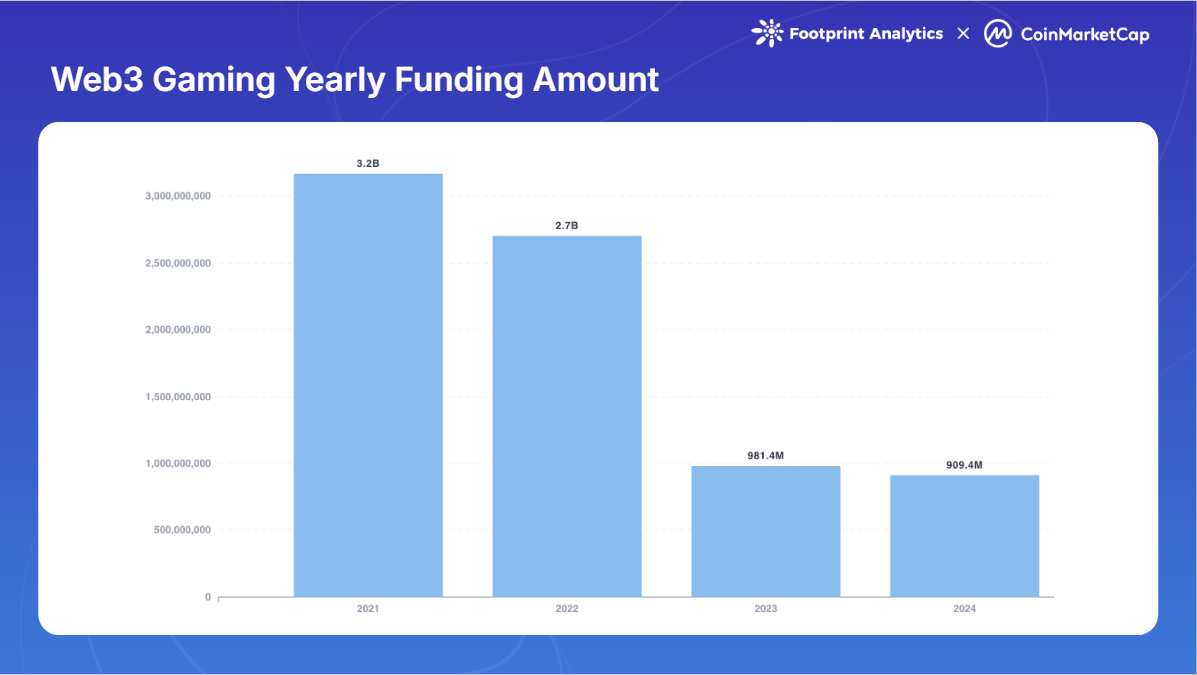

Web3 游戏在 2024 年通过 220 笔融资事件筹集了 9.1 亿美元。虽然融资金额较 2023 年下降 7.3%,且显著低于 2021-2022 年繁荣期(分别为 32 亿美元和 27 亿美元),但融资事件数量较 2023 年增长 48.7%,表明投资者兴趣持续,尽管单笔交易规模减小。

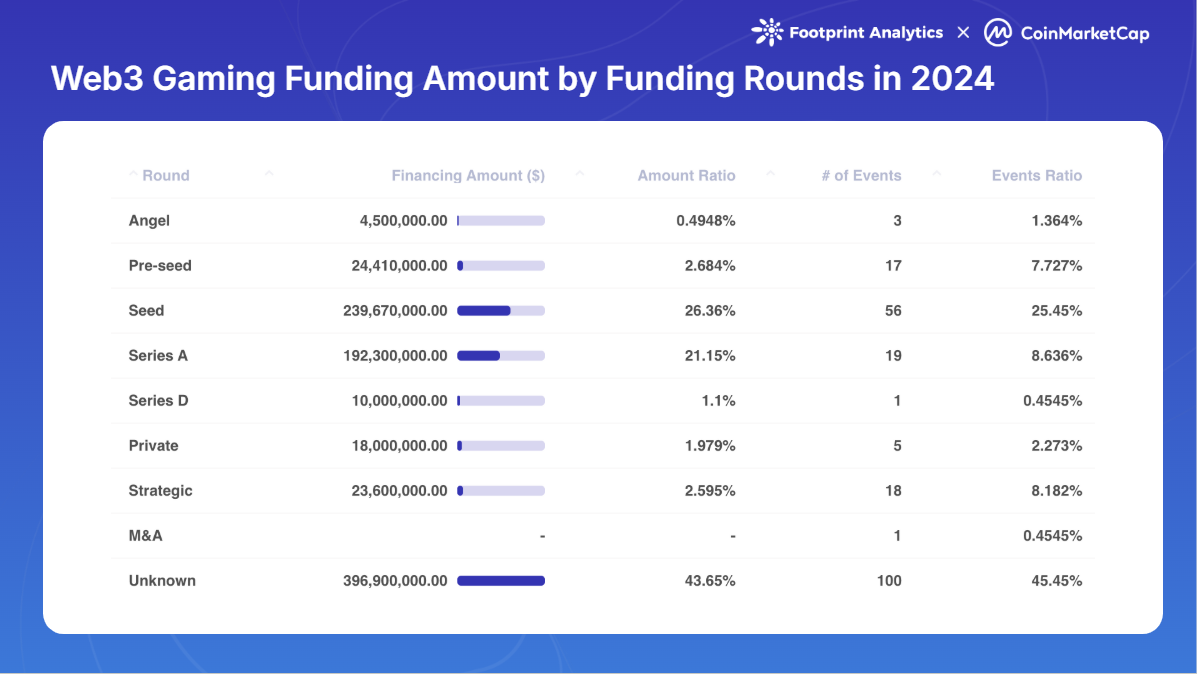

今年呈现出明显向早期投资倾斜的趋势,76 笔早期交易(占总事件 34.6%)相比仅 20 笔 A 轮或更后期融资(占 9.1%)。这一趋势表明,虽然新项目继续吸引初始资金,但 2021-2022 年繁荣期的许多项目在获取后续融资方面面临挑战。

在投资者中,Animoca Brands 保持领先地位,完成 38 笔投资,较 2023 年增长 192.3%,参与了 2024 年所有融资事件的 17.3%。Spartan Group 和 Big Brain Holdings 分别以 22 笔和 15 笔投资紧随其后,前十大投资者共计完成 152 笔投资。

主要融资事件

2024 年七个项目在单笔事件中筹集超过 2,000 万美元。Azra Games 以 4,270 万美元 A 轮融资领跑,专注于将主机级游戏体验带入移动平台。

从累计融资来看,Monkey Tilt 通过两轮融资筹集 5,100 万美元,他们是“游戏-娱乐-博彩”混合模式的平台。Gunzilla Games 从 包括 VanEck、Coinbase Ventures、Delphi Ventures 和 Avalanche's Blizzard Fund 在内的知名投资者获得四轮融资,展示出强劲的投资者信心。

战略投资趋势

随着行业从 2021-2022 年的狂热期走向成熟,重点已转向更少但更高质量的项目,投资者在方法上变得更加有选择性。

融资越来越多地针对游戏基础设施和开发工具,而不仅仅是游戏本身。显著的例子包括 NPC Labs 为在 Base 上构建 Web3 游戏筹集的 1,800 万美元种子轮,以及 Alliance Games 为 AI 驱动的去中心化基础设施筹集的 500 万美元A轮。这一趋势反映了投资者对能够支持多个游戏和平台的基础技术的日益兴趣。

平台和多链开发吸引了大量关注,特别是构建跨链游戏生态系统的项目。Seeds Labs 为其在 Solana 上的旗舰产品 Bladerite 筹集 1,200 万美元,而 B3 推出 Open Gaming Layer 展示了投资者对扩展跨链游戏能力的兴趣。

此外,新的游戏品类在 2024 年获得显著投资者关注,尤其是基于 Telegram 的游戏和博彩游戏项目,尽管面临监管挑战。

行业演进与未来展望

Web3 游戏行业在 2024 年经历了游戏模式的显著演进。此前周期主导的 "玩赚"(play-to-earn)模式让位给更可持续的方法。基于 Telegram 的"点赚"(tap-to-earn)游戏展示出前所未有的用户获取能力,而 Pirate Nation 和 Pixels 的"玩赢空投"(play-to-airdrop)策略提供了新的用户获取方法。同时,成熟项目转向"玩即赚"(play-and-earn)模式,将游戏性置于财务激励之上。

然而,该领域仍面临持续的挑战。技术障碍仍然显著,特别是在实现无缝区块链整合而不影响游戏体验方面。监管不确定性,尤其是围绕博彩特性和代币分类的问题,继续影响开发决策。

最关键的是,维持链上参与度成为一个根本性问题。这在 Telegram 游戏的表现中尤为明显:Hamster Kombat 的月活跃用户从 9 月的超过 1 亿下降至 12 月中旬的 2,290 万,仅 0.0004% 的用户参与链上游戏活动。虽然其他 Telegram 游戏显示出更高的转化率,但大多数仍低于 1%。值得注意的是,这些指标特别反映链上游戏活动,因为大多数 Telegram 游戏的核心玩法保持在链下,用户可能在 Meme 币或 DeFi 等其他板块更加活跃。这凸显了将平台用户转化为活跃区块链游戏玩家的持续挑战。

2025年展望:重塑相关性

当 Web3 游戏寻求重新确立其在加密格局中的地位时,几个关键趋势浮现为潜在的转型催化剂:

社交平台整合站在通向主流相关性的最有希望的道路上。Telegram 游戏的惊人成功展示了在用户所在之处与之相遇的力量,Line 和 TikTok 等平台蓄势待发。这种方法可能最终解决该领域的用户获取挑战,通过利用现有社交网络而非从零开始建立社区。

AI 整合将从营销特性演变为创新的根本驱动力。除了增强游戏开发和 NPC 互动外,AI 可能解决该领域在经济设计和用户留存方面的核心挑战。这些是Web3游戏传统上难以与传统游戏体验竞争的领域。

通过整合实现可持续增长可能最终决定该领域的相关性。成功可能不是来自于与传统游戏或其他加密板块竞争,而是与它们无缝融合。这意味着专注于区块链如何增强而非定义游戏体验,开发更复杂的代币经济学,并将用户体验置于加密原生特性之上。

综上,Web3 游戏在加密生态系统中的角色可能不是关于主导性,而是关于整合。通过巧妙连接传统游戏、社交平台和区块链技术,Web3 游戏有望创造出真正的创新价值。这种演进不仅将帮助行业突破当前"又一个加密垂直领域"的限制,更有可能成为重塑游戏产业未来的关键力量。

本报告为 Footprint Analytics 与 CoinMarketCap Research 联合推出的年度报告。