🔍 你知道吗?95% 的项目最终都会归零!

🔹 只有 5% 的加密项目能存活,并带来 10-100 倍的回报。

🔹 区别就在于「Token 经济学」!

作为一名天使投资人,我每天都会分析不同项目的 Token 经济模型。

今天,我将分享 **终极 Token 经济学指南,帮助你避坑并找到 真正有潜力的币种!👇

📊 为什么 Token 经济学如此重要?

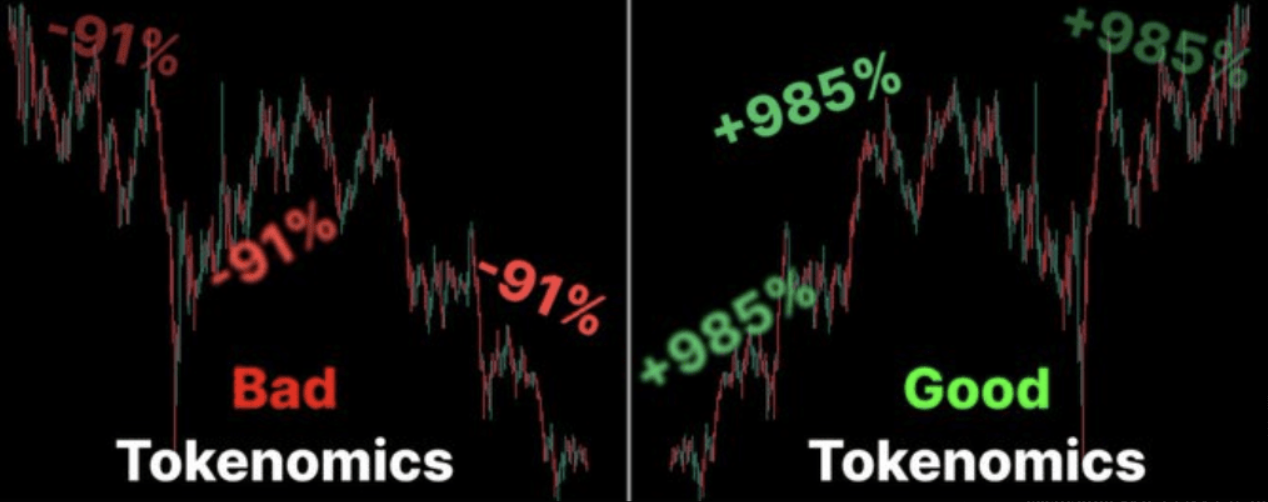

✅ 优秀的 Token 经济学 = 100x 机会

❌ 糟糕的 Token 经济学 = 资产一年内贬值 90%

🔹 理解 Token 经济学,是你在加密市场中做出明智决策的关键!

🔹 如果不了解 Token 经济学,你的投资就只是赌博。

📌 那么,如何分析一个项目的 Token 经济学?

我们从基础指标开始👇

📌 关键指标解析

当你在 CoinMarketCap 上查看一个代币时,你会看到这些数据:

📍 流通供应量(Circulating Supply) - 当前市场上的代币数量

📍 总供应量(Total Supply) - 该代币的最大供应量

📍 市值(Market Cap) - 现有流通代币的总价值

📍 完全稀释估值(FDV) - 假设所有代币流通后的总价值

🔹 这些指标影响 Token 价格的走势,了解它们至关重要!

🔥 通胀 vs. 通缩代币:哪个更有价值?

💡 通胀型 Token:供应量不断增加,可能导致价格下降。

💡 通缩型 Token:通过回购和销毁减少供应,理论上能推高价格。

📌 但现实中,价格受需求和市场情绪影响,不能仅看供应机制!

📌 关键在于 Token 如何实施通缩,是否有足够的市场需求!

代币发行 & 投资者分配

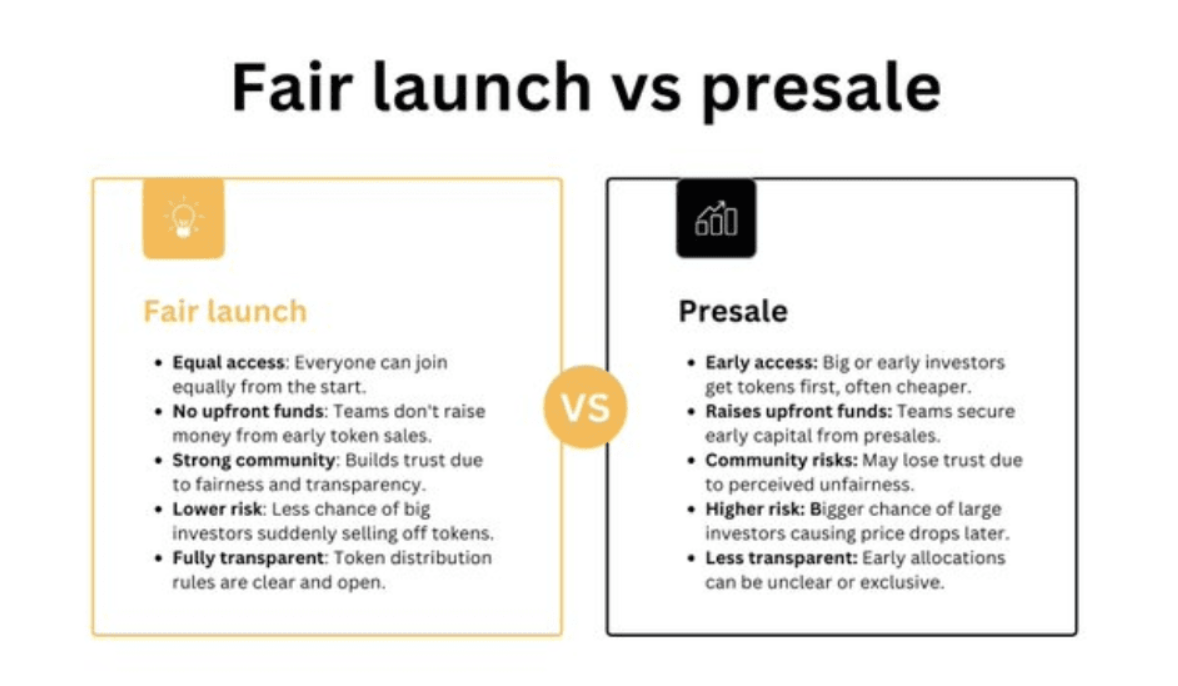

🔍 项目代币如何分配?有两个模式:

1️⃣ 预挖(Pre-mining):部分 Token 分配给早期投资者和团队(⚠️ 高抛压风险!)

2️⃣ 公平启动(Fair Launch):所有人同时获取代币(⚡ 更去中心化)

📌 关键问题:

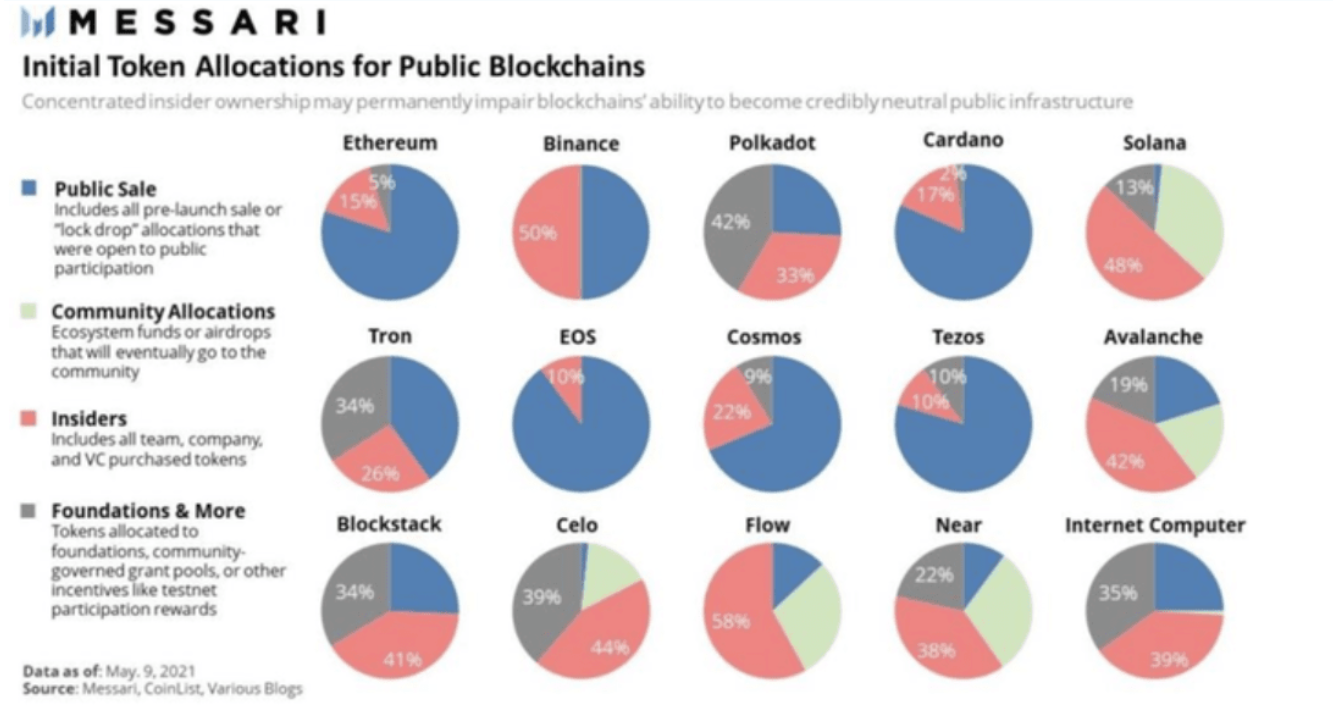

✔️ 早期投资者是否占比过高?

✔️ 代币分配是否合理?

✔️ 私募投资者是否有长时间锁仓?

如果代币大部分都给了投资者,而他们在上线后抛售,你就可能成为「接盘侠」。

如何判断项目的长期稳定性?

🔹查看 TGE(代币生成事件)分配:通常 10-20% 代币在 TGE 解锁,其余通过「锁仓 + 线性释放」分发。

🔹Vesting(归属期)和 Cliff(锁仓期):如果项目代币释放过快,价格会迅速崩盘!

🔥 Token 价值如何增长?四大核心驱动力

1️⃣ 价值存储(Store of Value) - 比特币因稀缺性被视为「数字黄金」,有长期投资价值。

2️⃣ 社区力量(Community)- 许多 Meme 币因社区支持而大涨,活跃度决定市场热度。

3️⃣ 实际用途(Utility) - 代币可用于支付、质押、治理等功能,决定长期需求。

4️⃣ 价值回流(Value Accrual) - 质押、收益分红、锁仓奖励等,能稳定代币价格。

📌 项目必须具备至少 2-3 个核心驱动力,才可能长期增长!

🚀 结论:

如何筛选 100x 代币?

✅ 检查总供应量、流通量(供应是否合理?)

✅ 分析 Token 分配 & 归属期(早期投资者会不会砸盘?)

✅ 研究代币释放机制(通缩 or 通胀?)

✅ 评估市场需求 & 社区活跃度(用户愿意长期持有吗?)

💡 想在加密市场赚大钱?从理解 Token 经济学开始! 🔥