作者:加密沙律

随着RWA监管框架的不断完善和发展,越来越多的RWA项目开始在海外落地。而RWA项目的核心就是将现实世界资产进行代币化。而一旦涉及到代币发行业务,由于各国法律法规对于代币发行都有很高的合规要求,因此项目方推进RWA项目时一定要“合规先行”。而发币主体的选择就是代币发行合规问题中基础但却又非常关键的一点。

近年来,由于开放的监管态度和完善的制度框架,新加坡逐渐成为加密货币行业创业者和投资人所追捧的“加密货币天堂”,选择新加坡基金会作为RWA项目的发币主体似乎也成了“理所应当”。

-

加密货币行业中常说的基金会究竟是什么,又和传统的基金有什么区别?

-

为什么RWA项目通常都会选择基金会作为发币主体,是不是只有基金会才是唯一选择?

-

为什么大家选择新加坡基金会作为主体?

-

而在2025年的当下,新加坡基金会是否还是RWA项目落地最优的发币主体,有没有其他地区或者其他类型的主体可供选择?

加密沙律团队深耕加密货币行业多年,在处理加密货币行业的复杂跨境合规问题上拥有丰富的经验,将在本文中结合各国法律框架以及团队实践经验,通过专业律师视角为大家梳理并解答以上问题。

一、基金会究竟是什么?基金会和传统基金的区别?

虽然不同国家法律对于“基金会”都有着各自不同的定义和架构,但是大多数基金会都至少具备以下特点:

-

非营利性和公益性:基金会为公益目的所设立,运营所得收入仅用于基金会再投资,不能向成员分配利益。和公司相比,基金会并没有股东(Shareholder),只有成员(Member)。

-

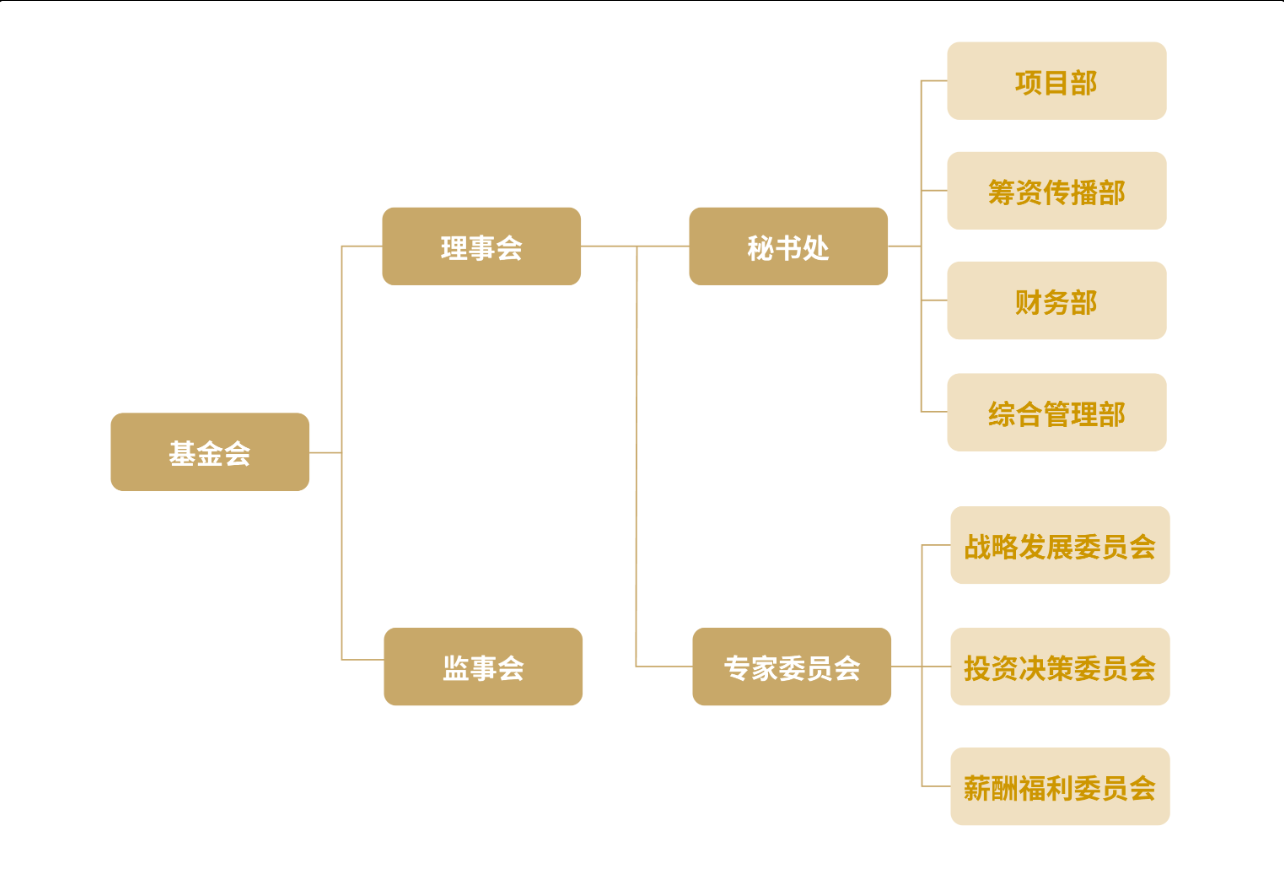

有独立的法人资格:基金会作为独立法律实体,拥有自己的资产和内部治理机构。比如,部分基金会下设理事会和监事会负责管理基金会运营的日常事项。

(上图为某一基金会的内部治理模式,仅供参考)

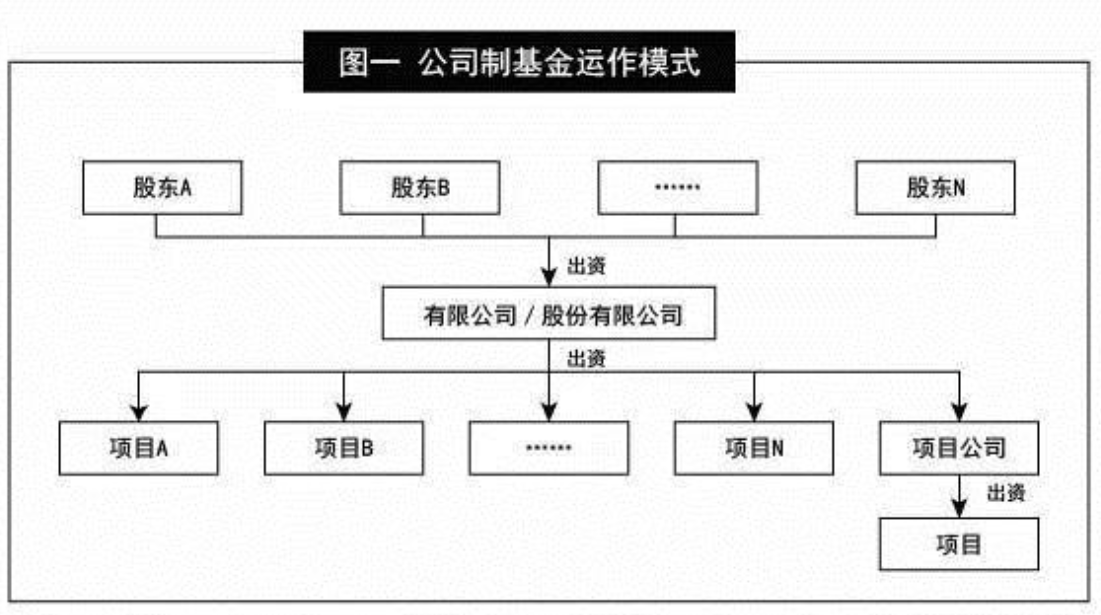

与之相对,传统意义上的“基金”本质上属于一种投资工具或资金池集合。而金融行业中常见的“基金公司”其实就是一类“基金管理人”。基金公司通过发行“基金产品”募集投资者的资金形成资金池,并且通过管理该资金池进而为投资者获取收益,最终完成基金的“募、投、管、退”,并从中收取管理费。

(上图为公司制基金的运营模式和法律架构)

由此可以看出,“基金”(Fund)、“基金会”(Foundation)虽然在日常表达层面类似,但是在法律层面所表达意义大相径庭。

二、为什么加密货币行业对基金会情有独钟?

首先,基金会通常都具有非营利性及公益性的特点,其设立目的是为了促进社会公共福祉的发展,而并非为了实现中心化机构或特定自然人的利益最大化,这正好与加密货币行业的去中心化特性相对应。且基金会并不会向组织成员进行利益分配,成员仅作为基金会的管理者参与基金会的治理。而这一特性也和加密货币行业、Web3领域所推崇的社区自治的治理框架不谋而合。因此,加密货币创业者选择基金会作为主体不仅有利于项目方对其进行包装和宣发,也更容易取得投资者以及社区参与者的信任。

其次,越来越多的项目方将基金会作为项目的实体,很大一部分原因也是因为受到了著名以太坊基金会的影响。以太坊(ETH),作为当前全球市值排名第二的主流加密货币,也选择了基金会作为其运营主体。由于以太坊在加密货币行业仅次于比特币的重要地位,以太坊基金会自然也拥有极大的影响力,所以也影响了许多新的 Web3行业的创业者和玩家去选择基金会作为实体。

最后,由于基金会本身的非营利性质,在许多国家的法律中,基金会在满足特定条件后或者得到特定审批后可以获得税收豁免的权利或者获得特定的税收优惠。所以,选择基金会作为发币主体,可以享受税收上的减免或优惠,从而降低项目的运营成本。

总而言之,基金会在国外经过长期发展,本身的制度框架就已经非常完善和成熟。且基金会本身的特性和加密货币行业的各种现实需求非常契合。而且,由于加密货币行业的从业者和参与者都呈现出非常显著的年轻化趋势,他们对于基金会这种被传统“old money”所熟知、较为严肃的主体形式也非常感兴趣。因此,这一概念在币圈中逐渐成为潮流,从而吸引了越来越多的目光和关注。

但是需要注意的是,从法律意义上看,若想要完成代币发行,并不一定需要通过基金会这一主体。其实,RWA项目方也可以选择传统的私人有限公司、股份有限公司等营利主体作为发币主体。大部分项目方选择基金会作为发币主体,可能更多是出于项目宣发、运营成本、税收筹划等商业角度综合作出的决定。因此,从业者也没有必要过于迷信基金会,它并不是RWA项目唯一的发币主体。 而且基金会作为非营利性质组织,虽然可以接收加密货币资产,但是在很多国家或地区无法在商业银行正常开设账户。所以如果以基金会作为发币主体,通常还要再设立一个私人有限公司与之搭配。

三、新加坡的基金会是什么?为什么RWA项目方倾向于选择新加坡基金会作为发币主体?

此处需要注意的是,所谓“新加坡基金会”更像是一个加密货币行业内的惯例说法。从法律意义上来看,新加坡法律中其实并没有传统意义上基金会(Foundation)的概念。而加密货币行业中常说的“新加坡基金会”其实是指按照新加坡法律被认定为“非营利性组织”(Not-for-Profit Organization)的法律实体。而许多种类的法律实体都可以被认定为非营利性质组织,比如公众担保有限公司(Public Company Limited by Guarantee)、社团或者慈善信托。而对于RWA项目方而言,通常会选择担保有限公司这一法律实体。因此,加密货币行业内所谓的“新加坡基金会”其实是被认定为“非营利性组织”的担保有限公司。

而之前加密货币行业经常选择新加坡基金会作为发币主体的主要原因有以下几点:

-

一是因为前些年新加坡当局对加密货币行业进入新加坡持较为开放包容的态度。这一点具体可以体现在新加坡当局对作为发币主体的基金会注册申请审批上。当时,许多加密货币项目都可以较为轻松地通过相关审批,并以新加坡基金会的方式完成代币发行。

-

二是因为前些年新加坡政府积极支持区块链和加密货币的发展,为代币发行活动提供了全球领先的法律框架和监管环境。加密货币不仅在新加坡被确认为合法,且任何涉及加密货币的合同都不会因其涉及加密货币被认定为非法。同时,新加坡还针对加密货币制定了完善的法律框架,相关法律法规覆盖了ICO(首次发行代币)、税收、反洗钱/反恐怖主义以及购买/交易虚拟资产等各个方面。

-

最后,新加坡当地拥有非常发达的金融和法律基础设施,长期以来吸引各种国际资本的高度关注,且拥有良好的国际美誉度。因此,在新加坡设立发币主体会让项目具有更高可信度和专业性。同时,新加坡和中国同处东八区这一时区,二者之间不存在时差,这对于币圈中数量庞大的中国华人玩家以及项目方而言也非常友好。

那在2025年,RWA项目还能否选择新加坡基金会作为项目的发币主体呢?

单纯从法律层面来看,新加坡当局并没有明文禁止新加坡基金会作为发币主体在新加坡落地。但是,加密沙律团队通过和新加坡当地的律所、会计师、公司秘书的最新沟通交流中获悉,近年来以新加坡基金会形式设立的加密货币公司出现了许多合规监管问题。至此之后,由于舆论以及政策监管的压力,以 ACRA(新加坡会计与企业管理局)为首新加坡当局,开始大幅度收紧对从事加密货行业相关基金会的审批。

基于多方消息相互印证,截至目前可以确认的是,ACRA会在基金会注册时对基金会进行详细的背景调查,一旦发现该基金会和加密货币行业存在关联可能性,基本都不会批准其注册申请。因此,RWA项目选择新加坡基金会作为发币主体虽然仍具备法律上的可行性,但是在实践层面来看基本上已经被堵死。

四、那么除了新加坡基金会,RWA项目还可以选择什么发币主体来落地?

加密沙律团队基于多年相关业务经验和成功案例,推荐以下两种选择作为发币主体:

-

第1种选择是美国基金会

其实,选择美国基金会作为发币主体的逻辑,与选择新加坡基金会作为主体的逻辑基本一致,二者的最大差异在于,目前美国监管机构对于代币发行活动的态度仍然相对开放。而且,新任总统特朗普对于加密货币行业整体上也是支持的态度。

且美国基金会注册周期相对较快,门槛要求简单限制较少。以科罗拉多州为例,在科州注册一个非营利性基金会,一般在一周之内就可以完成。

-

第2个可以考虑的选项是阿联酋基金会或者DAO组织

其中,阿联酋的基金会的整体架构也和新加坡基金会较为类似。但是需要注意的是,新加坡和阿联酋分属不同法系。新加坡属于英美法系国家,而阿联酋伊斯兰法系国家,二者在法律适用、司法体系等方面存在巨大差异。这一点在处理跨法域的复杂合规问题时非常关键。

而DAO组织(Decentralized Autonomous Organization,去中心化自治组织)作为一种基于区块链技术,通过智能合约实现自治的组织形式。针对这一新颖的组织形式,阿联酋当局已经出台了完整的规章制度(《DAO Association Regulations》)和相应的监管框架。根据相关规章制度规定,阿联酋的DAO组织拥有独立的法人人格并且同样具有非营利性的特征。

同时,根据币安交易所(Binance)官方披露的信息可知,目前币安已经正式与阿布扎比的投资机构MGX达成一项总额20亿美元投资交易,这是币安自成立以来首次引入外部的机构投资者。而该投资机构MGX的联合创始人之一正是阿联酋的阿布扎比主权基金。阿联酋主权基金和币圈最大主流交易所强强联合,预计双方将进一步推动加密货币行业在阿联酋的发展。因此,长期来看,中东的加密发展前景确实值得期待。

总而言之,阿联酋基金会或者DAO组织也是可供选择的发币主体。但是选择在阿联酋注册基金会或者DAO,成本会相对较高,因此更适合具有一定规模的项目。

五、若选择美国基金会作为RWA项目的发币主体,需要注意哪些风险和卡点?

首先,在美国以基金会形式进行代币发行需要取得相应的牌照,比如金融犯罪执法局(FinCEN)所颁发的MSB牌照。

其次,由于中美之间紧张的地缘政治关系,导致美国对于离岸公司监管态度和力度都经常变化,这会为公司的长期合规运营带来不确定性。

而且美国与金融、公司相关商法法律异常复杂,且需要系统了解联邦法律和州法律,所以完成合规的难度和复杂度较高。

最后,美国的税务机构(IRS)的税务审查非常严格,正如那句美国谚语所说:人的一生,唯有死亡和税收不可避免。所以,在美国设立基金会主体,需要有专业的税务筹划团队进行支持并处理相关税务问题,否则企业关联人都存在被美国的长臂管辖所影响的风险。

六、加密沙律解读

在全球加密货币行业监管前景仍不明朗的当下,中国项目方在落地RWA项目时,一定要坚持“合规先行”。因此,RWA项目方需要积极与专业的加密货币行业律师团队进行紧密合作,共同推进项目落地。