央视新闻最近报道[1]了一个案例,某女子与一名自称在保密单位工作的男子“网恋”,结果被骗投资虚拟币,涉案人员已被逮捕。

作者 |邵诗巍律师

01

虚拟货币+线下交易”——电信诈骗手段升级2.0版本

该案当中,被害人被诈骗的方式其实并不新鲜,和我们经常在新闻中看到的“缅北杀猪盘电信诈骗”的模式是一致的:犯罪分子利用网络交友的方式,先在网上筛选符合条件的被害人(一般以具有一定经济能力,单身或情感受挫的女性为主),以情感需求为诱饵,诱骗被害人产生情感依赖并建立信任,通过"找猪-喂猪-养猪-杀猪"四步骤,将被害人的钱款骗走。

随着公安机关对于电信诈骗的打击力度加大,以及多年来不断进行的“断卡行动”,犯罪分子的诈骗手段也被破进行升级,所以本案当中,犯罪分子采用了“虚拟货币+线下交易”的方式,将受害者资金进行转移,显然,这相比于银行转账,更为隐蔽。足以看出涉案人员极强的反侦查能力。

02

U商为什么会卷入“杀猪盘”案件?

该案当中,犯罪分子向被害人展示了其在理财平台的投资收益,再加之被害人已经对其积累了一段时间的信任,于是自己也有了投资意愿。此时,“杀猪”的环节就开始了:犯罪分子告知被害人,这类投资需要使用USDT虚拟货币,且购买U币只能通过线下现金方式找U商进行交易。

因为是被害人自己开户(不是在诈骗者控制的账户),自己去银行取现(不是由被害人把钱转给诈骗者,由诈骗者为其兑换U币),所以被害人对这一环节一般不会起疑心。并且,当被害人将现金交给U商之后,也确实收到了相应的虚拟货币。

此后,被害人将虚拟货币转入理财平台之后,最开始可能可以取出小额利息,但存入一定数量的钱款之后,就会发现平台无法提现了,且网恋对象也消失了。于是只能报警。

该报道中提到“今年7月以来,该团伙打着所谓“U商”的旗号,在天津及其周边省市跑分作案10余起,涉案金额50余万元”。

诈骗分子必然是有刑事责任的,但为什么U商也牵扯其中呢?

虽说新闻报道中称此类作案方式成为“投资新骗局”,但这类作案手法已经有一段时间了。邵律师在数月前代理的一个U商,就是因为被卷入此类案件当中,被当地公安以掩隐罪被刑拘。

03

被害人被诈骗,与之正常交易的U商也构成犯罪?

首先说结论,如果U商是正常的做买卖虚拟货币赚差价的生意,且收到的款项不涉及赃款和外汇,当然不构成犯罪。此类杀猪盘诈骗案当中,被害人的钱款一般是自己的积蓄,自然也不涉及赃款。那问题出在哪里了呢?——是介绍人有问题。

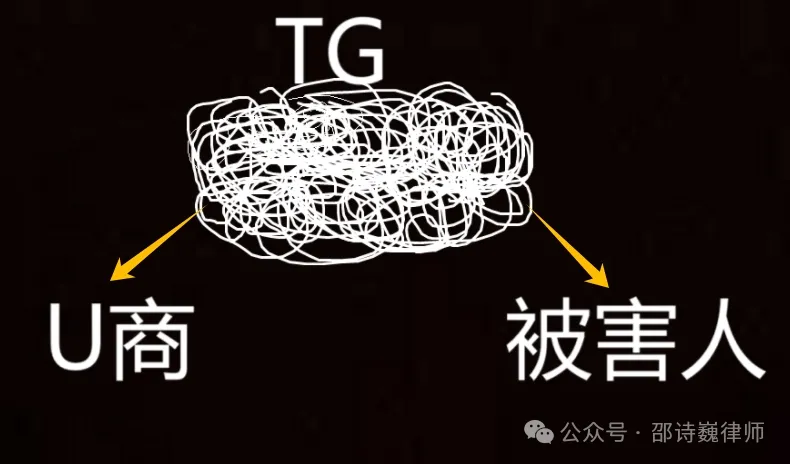

U商怎么找到这些客户的?想要专门做赚差价的生意,拓宽客户渠道是少不了的。TG群往往是U商找客源的主要方式之一。TG群里的介绍人,或者说上线,放出单子,联系U商说有买家想要线下买U,U商与买家交易的方式,要么是线下当面一手交钱一手交U,要么是买家通过现金存款的方式,转至理财平台客服提供的指定收款账号当中(这个收款账号其实就是U商为卖U提供给上线的)。

U商往往会辩称自己确实主观不明知他人诈骗被害人钱款,自己只是卖U赚个差价。此前邵律师也多次提到,U商和司法机关视角下的主观不明知,不是一个概念。

在司法机关看来,telegram就是一个充斥着黑灰产、电信诈骗、网络赌博等违法犯罪的通讯软件,他们本身对于使用该软件沟通的嫌疑人就存有负面印象。就本文提到的案例而言,司法机关会认定:与U商在TG上联系的上线,大概率与同被害人联系的“杀猪盘”团队是一伙儿的。

(telegram是个大染缸!)

基于这个结论,司法机关会认为,那么U商为被害人提供U,就是为电信诈骗的犯罪分子骗取被害人款项起到了帮助作用。因而U商同样构成犯罪。

若U商被卷入此类案件,相关的辩护思路此前邵律师曾写过多篇文章进行分析,本文就不再赘述,可戳文末链接进行阅读。

04

写在最后

很多U商朋友会问邵律师,怎样做好KYC?但从本文案例可以看出,U商涉嫌洗钱犯罪(的共犯)已经远远超过了KYC能解决的范围。

作为刑事律师,根据我们的办案经验来看,可以说,U商们已经沦为了杀猪盘诈骗犯的“背锅侠”。

没经历过的,会觉得律师在散布焦虑,经历过的,才会知道本文的分析多真实。

【1】 [第一时间]反诈第1线 天津:女子“网恋”被骗10万多元“投资虚拟币” https://tv.cctv.cn/2024/12/01/VIDEIxJCqHjAFkQeHA2wfAgL241201.shtml