引言:

所谓的“车手”,又名“职业取款人”,是指专门负责实施取款、转移赃款的中间人,为赚取佣金而帮助犯罪团伙将赃款“洗白”。

由于USDT虚拟货币的匿名性特征,洗钱团队会招募车手以U商买卖USDT的手段(下图),将资金“洗白”。

那么车手的套现、转移赃款的行为,是与其上家一同构成诈骗罪的共同犯罪,还是掩饰、隐瞒犯罪所得、犯罪所得收益罪(以下简称掩隐罪)?

作者 |邵诗巍律师

01

主观明知:行为人是否明知是涉诈资金?

在电信网络诈骗、跑分、洗钱类案件当中,对于罪名选择的重要判定因素之一,就是行为人的“主观明知”程度,即:行为人是否明知或应当知道其行为性质。这里又分为两层概念:

①行为人是否明知其帮助转移的款项是上游犯罪所得;

②行为人是否明知其帮助转移的款项是上游诈骗犯罪所得;

没有行为人会在审讯时主动告知公安,自己明知上游款项是犯罪所得款而帮助转移,所以一般是根据在案证据推定行为人“知道或应当知道”。

首先,如果行为人没有任何认知,是完全在被欺骗的情况下(例如大学生找兼职)帮助转移款项的,那么其不符合上述第一层概念,不构成犯罪。

其次,若根据行为人供述及在案证据,可以推定其明知或应当知道是犯罪所得款,但没有足够的证据证实其知道是电信诈骗所得款,不能认定为诈骗罪的共同犯罪。

因为对于车手等帮助洗钱的人员,如果他们在同一时间对接多个上家,那么其帮助转移的赃款可能来源于诈骗犯罪、网络赌博、传播淫秽物品等,另外,车手与实施电信网络诈骗分子中间可能还隔着“水房”,“跑分平台”,“车手组织者”,“二道”,“三道”,取现车手与上游这些人员存在着事实上的信息不对称。很难证明在上游犯罪分子实施诈骗行为时,行为人就与上游达成了转移赃款的合意,由此,也就很难证明行为人明知上游款项的具体性质。

但对于车手的组织者,如果其长期为某个电信诈骗团伙服务,那么根据其参与程度,可能会认定其“主观明知”(但其“主观明知”是否均能认定为诈骗罪的共同犯罪?这个放在后面讲)。

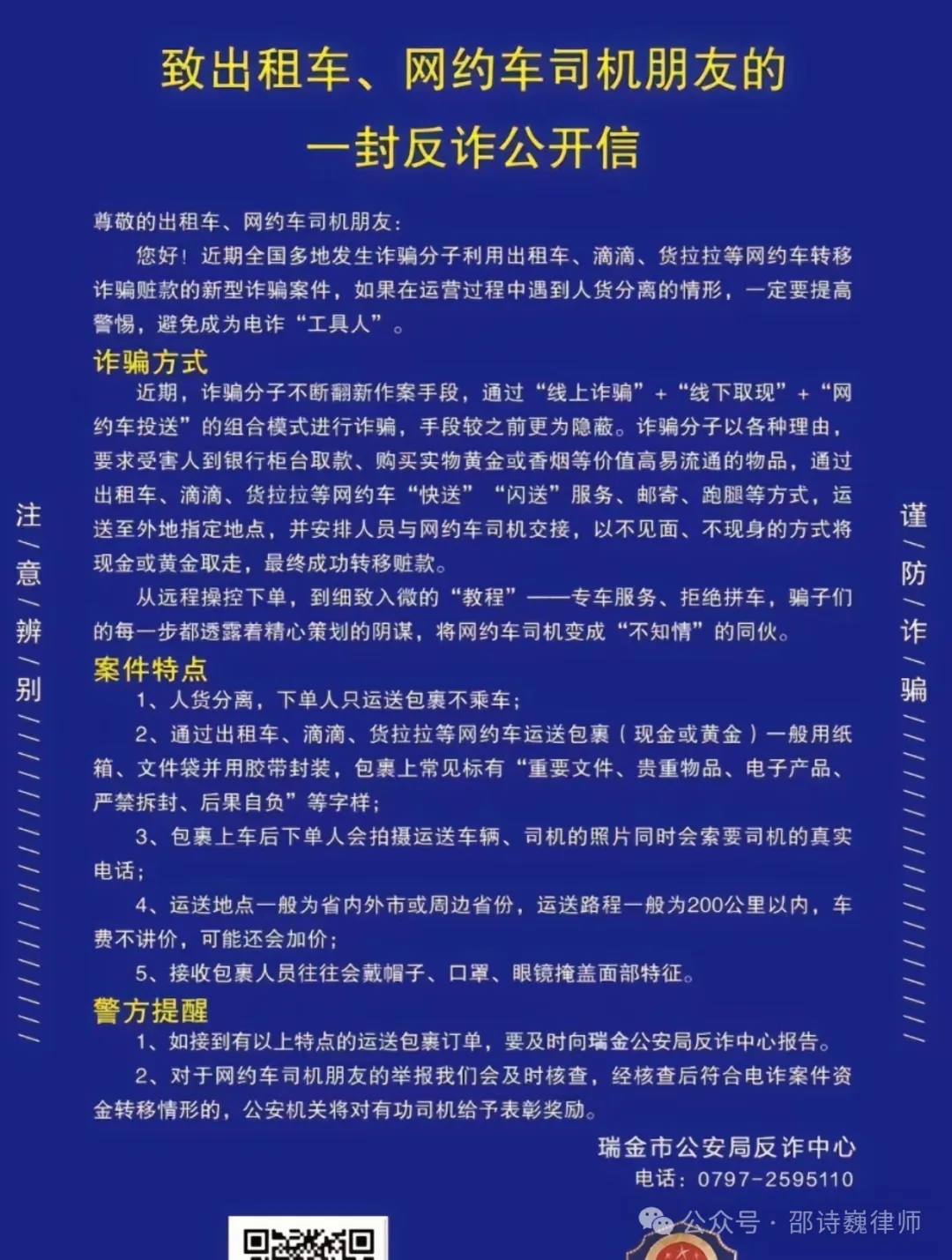

实践中,车手可能知晓上游的款项是犯罪所得,因此为了让自己帮助转移赃款的行为更安全,会采取很多躲避侦查的手段,例如最近高发的利用网约车搬运黄金、现金的方式转移赃款(下图)、制定很多应对“帽子叔叔”的话术模版等等。

这些手段的目的是为了躲避公安机关的打击,但如果要认定车手们知道或应当知道其帮助转移的资金是电信诈骗所得款,还需要结合其他的证据来综合认定(如同案犯口供,电报群聊天记录,行为人既往经历等)。

所以,在上下游事前无通谋的情况下,且车手是在上游犯罪既遂之后才加入的,只是概括的知道款项性质是犯罪所得,那么只能以掩隐罪定罪。

最后,若根据行为人供述及在案证据,可以推定其明知或应当知道是电信诈骗款项,这时候是构成诈骗罪还是掩隐罪?这就是接下来要讨论的问题。

02

明知是涉诈资金,帮助转移款项的行为构成什么罪名?

2015年版-最高人民法院关于审理掩饰、隐瞒犯罪所得、犯罪所得收益刑事案件适用法律若干问题的解释

第五条事前与盗窃、抢劫、诈骗、抢夺等犯罪分子通谋,掩饰、隐瞒犯罪所得及其产生的收益的,以盗窃、抢劫、诈骗、抢夺等犯罪的共犯论处。

2016年-最高人民法院、最高人民检察院、公安部关于办理电信网络诈骗等刑事案件适用法律若干问题的意见

三、全面惩处关联犯罪

明知是电信网络诈骗犯罪所得及其产生的收益,以下列方式之一予以转账、套现、取现的,依照刑法第三百一十二条第一款的规定,以掩饰、隐瞒犯罪所得、犯罪所得收益罪追究刑事责任。但有证据证明确实不知道的除外:

1.通过使用销售点终端机具(POS机)刷卡套现等非法途径,协助转换或者转移财物的;

2.帮助他人将巨额现金散存于多个银行账户,或在不同银行账户之间频繁划转的;

3.多次使用或者使用多个非本人身份证明开设的信用卡、资金支付结算账户或者多次采用遮蔽摄像头、伪装等异常手段,帮助他人转账、套现、取现的;

4.为他人提供非本人身份证明开设的信用卡、资金支付结算账户后,又帮助他人转账、套现、取现的;

5.以明显异于市场的价格,通过手机充值、交易游戏点卡等方式套现的。

实施上述行为,事前通谋的,以共同犯罪论处。

2018年-关于印发《检察机关办理电信网络诈骗案件指引的通知》

(二)犯罪形态的审查

1.可以查证诈骗数额的未遂

电信网络诈骗应以被害人失去对被骗钱款的实际控制为既遂认定标准。

(五)关联犯罪事前通谋的审查

根据《意见》规定,明知是电信网络诈骗犯罪所得及其产生的收益,通过使用销售点终端机具(POS机)刷卡套现等非法途径,协助转换或者转移财物等五种方式转账、套现、取现的,需要与直接实施电信网络诈骗犯罪嫌疑人事前通谋的才以共同犯罪论处。因此,应当重点审查帮助转换或者转移财物行为人是否在诈骗犯罪既遂之前 与实施诈骗犯罪嫌疑人共谋或者虽无共谋但明知他人实施犯罪而提供帮助。

2021年-最高人民法院 最高人民检察院 公安部关于办理电信网络诈骗等刑事案件适用法律若干问题的意见(二)

十一、明知是电信网络诈骗犯罪所得及其产生的收益,以下列方式之一予以转账、套现、取现,符合刑法第三百一十二条第一款规定的,以掩饰、隐瞒犯罪所得、犯罪所得收益罪追究刑事责任。但有证据证明确实不知道的除外。

(一)多次使用或者使用多个非本人身份证明开设的收款码、网络支付接口等,帮助他人转账、套现、取现的;

(二)以明显异于市场的价格,通过电商平台预付卡、虚拟货币、手机充值卡、游戏点卡、游戏装备等转换财物、套现的;

(三)协助转换或者转移财物,收取明显高于市场的 “手续费”的。

实施上述行为,事前通谋的,以共同犯罪论处;同时构成其他犯罪的,依照处罚较重的规定定罪处罚。法律和司法解释另有规定的除外。

2022年-关于“断卡”行动中有关法律适用问题的会议纪要

五、关于正确区分帮助信息网络犯罪活动罪、掩饰、隐瞒犯罪所得、犯罪所得收益罪与诈骗罪的界限。

在办理涉“两卡”犯罪案件中,存在准确界定前述三个罪名之间界限的问题。应当根据行为人的主观明知内容和实施的具体犯罪行为,确定其行为性质。以信用卡为例:

(1)明知他人实施电信网络诈骗犯罪,参加诈骗团伙或者与诈骗团伙之间形成较为稳定的配合关系,长期为他人提供信用卡或者转账取现的,可以诈骗罪论处。

(2)行为人向他人出租、出售信用卡后,在明知是犯罪所得及其收益的情况下,又代为转账、套现、取现等,或者为配合他人转账、套现、取现而提供刷脸等验证服务的,可以掩饰、隐瞒犯罪所得、犯罪所得收益罪论处。

关于该问题,根据上述法律规定,可以总结概括为三类情形:

-

明知电诈款+既遂后帮助转移+事前无通谋➡️掩隐罪

-

明知电诈款+既遂后帮助转移+事前有通谋➡️诈骗罪共同犯罪

-

明知电诈款+既遂前即参与➡️诈骗罪共同犯罪

具体阐述如下:

1、车手明知上游是诈骗款项,在上游犯罪既遂后帮助转移赃款,且事前也未与上游犯罪通谋的,应以掩隐罪认定

2、车手明知上游是诈骗款项,虽然在上游犯罪既遂后帮助转移赃款,但事前与上游犯罪有通谋的,应以诈骗罪的共同犯罪认定

关于上述两类情形,有下列问题点需要注意:

-

如何认定行为人“主观明知”是电诈款?

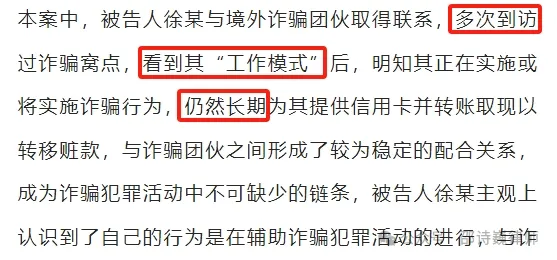

上海铁路运输法院于2024年7月在其公众号发布过一则案例(下图):徐某为牟利,通过telegram组织他人为境外诈骗团伙取现赃款,并转换成虚拟货币或存款、转账等方式转移至境外。

该文当中对于其帮助上游电诈团伙转移涉诈资金的行为定性进行了分析:

(文章➡️《长期组织他人替境外诈骗团伙非法取现、转账近千万,法院判了!》)

该案例可说明,若认定帮助转移赃款的行为人构成诈骗罪,需要有证据证实行为人明知其转移的赃款的性质为诈骗资金。

-

在行为人主观明知,且上游犯罪既遂的前提下,区分两罪的关键要看车手与上游犯罪是否有通谋。

那么什么叫“事前通谋,事后转移赃款”呢?

根据张明楷[i]的观点,“反复帮助特定同一电信诈骗正犯者套现、取款的行为人,即使表面上没有语言、文字的事前通谋,也能够成立诈骗罪的共犯。换言之,虽然第一次取款行为仅成立掩饰、隐瞒犯罪所得罪,但在事实上形成心理默契的情况下,后面的取款行为应当成立诈骗罪的共犯。”

即,张明楷认为,取款人第一次实施的取款行为构成掩隐罪。第一次帮助取款之后,取款人就知道了上游犯罪行为的性质,之后再建立长期合作关系,给上游犯罪者增强了实施电信诈骗的信心,取款人的第一次取款行为成为了下一次与诈骗者的事前通谋行为,与上游诈骗者后来的诈骗结果之间存在心理上的因果性。所以,取款者应以诈骗罪的共犯论处。

并且,实务当中的司法案例,如黄星辉、钟旭恒、杨金雄、邵宜才诈骗案,吴瑞康诈骗案(2016)冀08刑终97号,黄柱英犯诈骗案(2018)辽08刑终130号,也支持该观点。

3、车手参与到上游诈骗行为实施过程中,那么车手构成诈骗罪的共同犯罪。

如果帮助取款者是在被害人转账之前参与到了电信诈骗中(例如明知他人实施电信诈骗,提前将自己的银行卡号、虚拟货币钱包地址等告知上游人员,以便接收诈骗款项),由于电信诈骗行为还未达既遂,此时帮助取款者的行为可认定为诈骗罪承继的共犯。如果是在上游诈骗既遂之后帮助取款的,则构成掩隐罪。

但是,关于犯罪既遂时间节点的认定,法律规定的较为模糊。

在2018年关于印发《检察机关办理电信网络诈骗案件指引的通知》中,仅规定“电信网络诈骗应以被害人失去对被骗钱款的实际控制为既遂认定标准”。该规定并未明确被害人失去对钱款控制是时间点——是被害人将钱款转至加害人账户之时,还是被害人将钱款转至加害人指定账户之时。例如多级卡诈骗模式中,被害人是将款项汇至加害人指定账户(这也就是为什么那么多买卖U被冻卡的),如果既遂的时间节点是钱款转至加害人账户才认定既遂,那么帮助取款者都会被认定为诈骗罪的共同犯罪。

另外,2011年《最高人民法院、最高人民检察院关于办理诈骗刑事案件具体应用法律若干问题的解释》第七条规定,“明知他人实施诈骗犯罪,为其提供信用卡、手机卡、通讯工具、通讯传输通道、网络技术支持、费用结算等帮助的,以共同犯罪论处”。

但该规定当中,“费用结算”包括帮助取款行为?即便包括帮助取款行为,是否包括既遂后的帮助取款行为?有学者认为,正是由于该规定的不清晰造成相关判决存在诈骗罪与掩隐罪的分歧[ii]。

03

结语

最高人民检察院发布的《检察机关打击治理电信网络诈骗及其关联犯罪工作情况(2023年)》[iii]提到,检察机关起诉电信网络诈骗犯罪案件同比呈明显上升趋势,掩隐罪成仅次帮信罪第二大电诈关联犯罪。司法实务中,由于真正实施诈骗的人反侦查能力较强,且一般都在境外,很难抓到人,所以帮助取现、转移赃款等中间环节的主体成为了重点打击对象。

从律师辩护的角度来看,两罪名的准确界定不仅关系到被告人的刑期,也涉及到需要退赔的金额,因此有关此罪彼罪的准确界定对于辩护工作来说,具有重要意义。

[i]张明楷《电信诈骗中取款人(转移赃款)的刑事责任》

[ii]俞小海:《电信诈骗犯罪中帮助取款行为的罪名判定》,《人民司法》2015年第19期。李会彬:《电信诈骗取款人“车手”行为如何定性?》,《国家检察官学院学报》2017年第1期。

[iii] 最高检:掩隐罪成仅次帮信罪第二大电诈关联犯罪,2023年前10月共起诉10.4万人,1.8万人大专以上文化 - 反诈宣传 - 广西河池公安局网站 http://gaj.hechi.gov.cn/ztzl/fzxc/t17554963.shtml