作者: Kevin, the Researcher at BlockBooster

TLDR:

-

Bittensor通过dTAO将子网奖励分配从固定比例转为质押权重决定,50%注入流动性池,旨在通过去中心化评估促进优质子网发展。

-

早期高波动性、APY陷阱与逆向选择并存,需平衡矿工质量筛选、用户认知门槛与市场热度错配三大矛盾。

-

当前TOP10子网中仅1家要求矿工提交开源模型,其余子网普遍存在匿名团队、产品锚定缺失等缺陷,暴露Web3 AI基础设施瓶颈。

-

最终验证取决于TAO价格与子网实用价值的正反馈建立,失败则可能引发Web3 AI赛道持续向轻量化方向转型。

背景回顾

dTAO的引入重塑Bittensor每日释放的规则:

-

此前的规则:子网奖励按固定比例分配——41%给验证者,41%给矿工,18%给子网所有者。子网的tao释放量由验证投票决定。

-

dTAO后的规则:现在,50%的新发行dTAO代币将被添加到流动性池中,其余50%根据子网参与者的决策,在验证者、矿工和子网所有者之间分配。子网的TAO释放量由子网质押权重决定。

dTAO的设计目标:

dTAO的主要目标是促进具有实际收入潜力的子网发展,刺激真实用例应用的诞生,并让这类应用被正确评价。

-

去中心化的子网评估:不再依赖少数验证者,dTAO池的动态定价将决定TAO发行量的分配。TAO持有者可以通过质押TAO来支持他们相信的子网。

-

增加子网容量:取消子网上限促进生态系统中的竞争与创新。

-

鼓励早期参与:能够激励用户关注新子网,激励整个生态去评价新子网。因为较早迁移到新子网的验证者可能会获得更高的奖励。早期迁移到新子网意味着以较低的价格购买该子网的dTAO,增加了未来获得更多 TAO 的可能性。

-

推动矿工和验证者关注高质量子网:进一步刺激矿工,验证者去寻找高质量新子网。矿工的模型放在链下,验证者的验证也在链下,Bittensor网络仅根据验证者的评价去给矿工奖励。因此,对于不同类型抑或是所有类型的ai应用,只要符合矿工-验证者架构的应用,Bittensor都可以正确评估。Bittensor对AI应用拥有极高的包容性,让每个阶段的参与方都可以获得激励,并以此反哺Bittensor的价值。

影响dTAO价格走势的三种情景分析

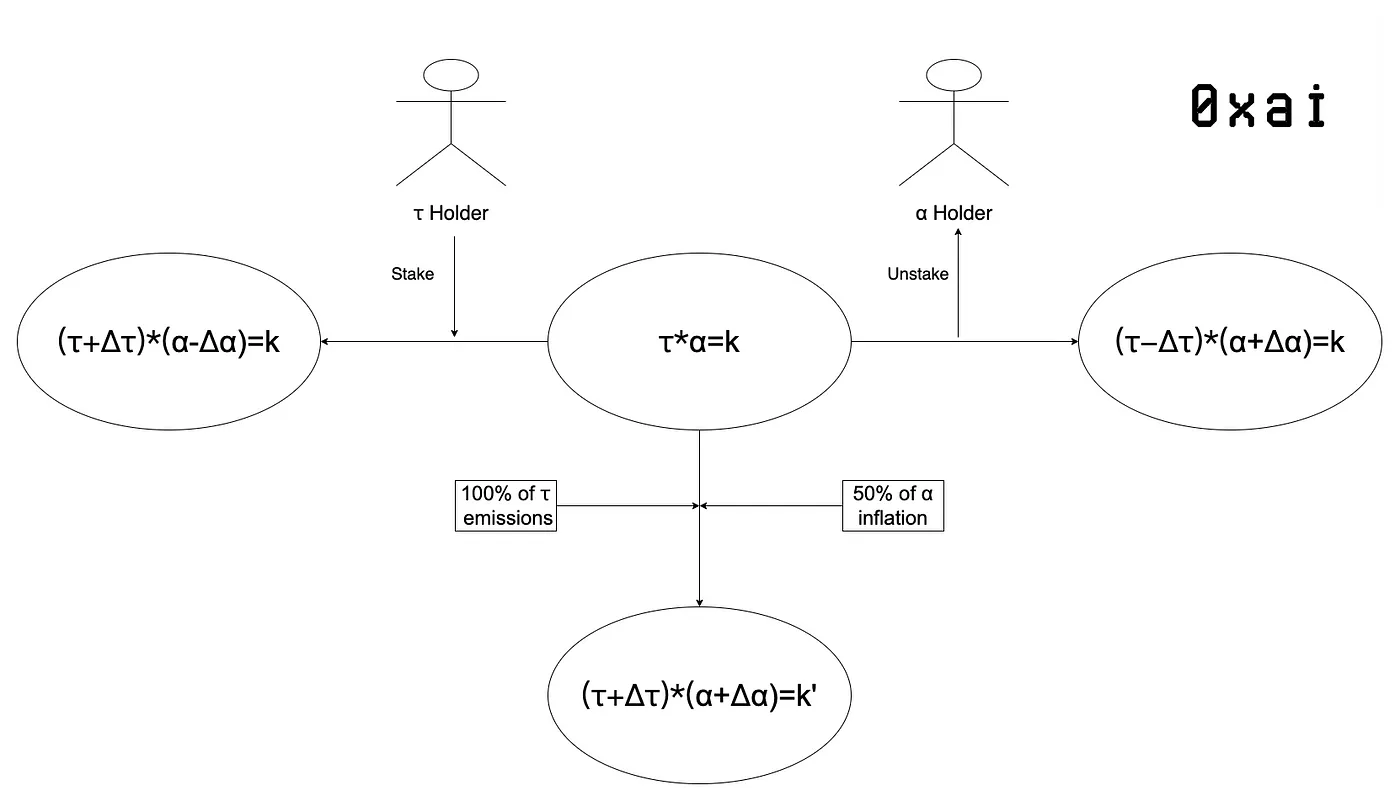

基础机制回顾

每日固定释放的TAO与等量dTAO注入流动性池,构成新的流动性池参数(k值)。其中50%的dTAO进入流动性池,剩余50%按权重分配给子网所有者、验证者和矿工。权重越高的子网获得的TAO分配比例越大。

情景一:质押量增长的正向循环

当委托给验证者的TAO持续增加时,子网权重随之提升,矿工奖励分配比例同步扩大。验证者大量购入子网代币的动因可分为两类:

-

短期套利行为

子网所有者作为验证者通过质押TAO推高币价(延续旧释放模式)。但dTAO机制削弱了这种策略的确定性:

-

当非理性质押用户占比高于质量关注型用户时,短期套利可持续

-

反之将导致早期囤积的代币快速贬值,叠加匀速释放机制限制筹码获取,长期可能被优质子网淘汰

-

价值捕获逻辑

具备实际应用场景的子网通过真实收益吸引用户,质押者既获得杠杆化的dTAO收益,又获取额外质押回报,形成可持续增长闭环。

情景二:相对增长停滞的困境

当子网质押量保持增长但落后于头部项目时,市值虽稳步上升却难以实现收益最大化。此时应重点考察:

-

矿工质量决定上限:TAO作为开源模型激励平台(非训练平台),其价值源于优质模型的产出与应用。子网所有者的战略方向选择与矿工提交的模型质量共同构成发展天花板

-

团队能力映射:顶级矿工多来自子网开发团队,矿工质量实质上反映团队的技术实力

情景三:质押流失的死亡螺旋

当子网质押量出现下降时,极易触发恶性循环(质押减少→收益下降→进一步流失)。具体诱因包括:

-

竞争性淘汰

子网虽具实用价值但产品质量落后,权重下降导致出局。此为生态健康发展的理想状态,但目前尚未出现TAO作为"Web3应用孵化铲子"的价值显性化迹象

-

预期崩塌效应

市场看衰子网前景导致投机性质押撤离。当每日释放量开始下降,非核心矿工加速流失,最终形成不可逆的衰退趋势

潜在风险与投资策略

早期释放期的波动性风险

-

高波动性窗口期:dTAO初期释放总量大但日均释放恒定,导致前几周价格可能产生剧烈波动。此时根网络质押成为风险缓释策略,可稳定获取基础收益

-

APY陷阱:高APY的短期诱惑可能掩盖流动性不足与子网竞争力缺失的长期风险

-

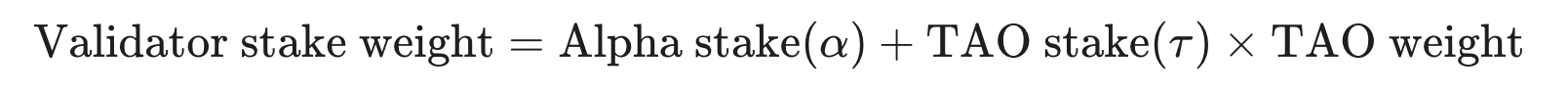

权重博弈机制:验证者权重由子网dTAO价值+根网络TAO质押共同决定(复合权重模型)。在子网上线前100天,根网络质押仍具备收益确定性优势

-

类Meme交易特征:当前阶段子网质押行为与Memecoin投机存在相似风险属性

价值投资与市场错配

-

生态建设悖论:dTAO机制旨在培育实用型子网,但价值投资特性导致:

-

市场教育成本高:需持续评估矿工质量/应用场景/团队背景/盈利模式,对非AI专业投资者构成认知门槛

-

热度转化滞后:与Agent代币形成鲜明对比的是,子网代币尚未形成同等规模的市场共识

非理性质押的系统性风险

-

历史困境重演:若用户持续盲从释放量指标,将导致:

-

验证者权力寻租:重复旧机制下子网自投票弊端

-

机制升级失效:违背dTAO设计初衷的质量筛选功能

-

认知门槛要求:投资者需具备子网质量评估能力,当前市场成熟度与机制要求存在差距

投资时机的博弈论困境

-

最佳介入窗口:投资窗口应后移至子网上线数月后(团队能力/网络潜力可视阶段),但面临:

-

市场关注度衰减风险

-

早期投机者离场导致的流动性萎缩

-

成功标志双重验证:

-

TAO价格与子网实用价值形成正反馈

-

验证者为获取持续收益选择TAO持仓而非抛售

矿工质量失控风险

-

逆向选择难题:

-

质量筛选机制缺失:当前模型难以有效区分矿工贡献质量

-

激励环境失衡:低质量矿工套利行为挤压优质开发者生存空间

-

生态建设瓶颈:开源模型孵化环境尚未成熟,可能陷入"劣币驱逐良币"困境

投资dTAO子网的三重矛盾:

核心矛盾:

-

子网能否吸引优质矿工资源

-

用户评价体系是否具备有效性

次要矛盾:

-

子网是否存在真实商业应用场景

潜在风险点:

-

开发团队信息公开透明度

-

盈利模式设计合理性

-

市场营销执行能力

-

外部资本介入可能性

-

代币发行机制设计

观察与期望

-

开源模型虽为技术演进主流方向,但在去中心化领域可能难以突破发展瓶颈。

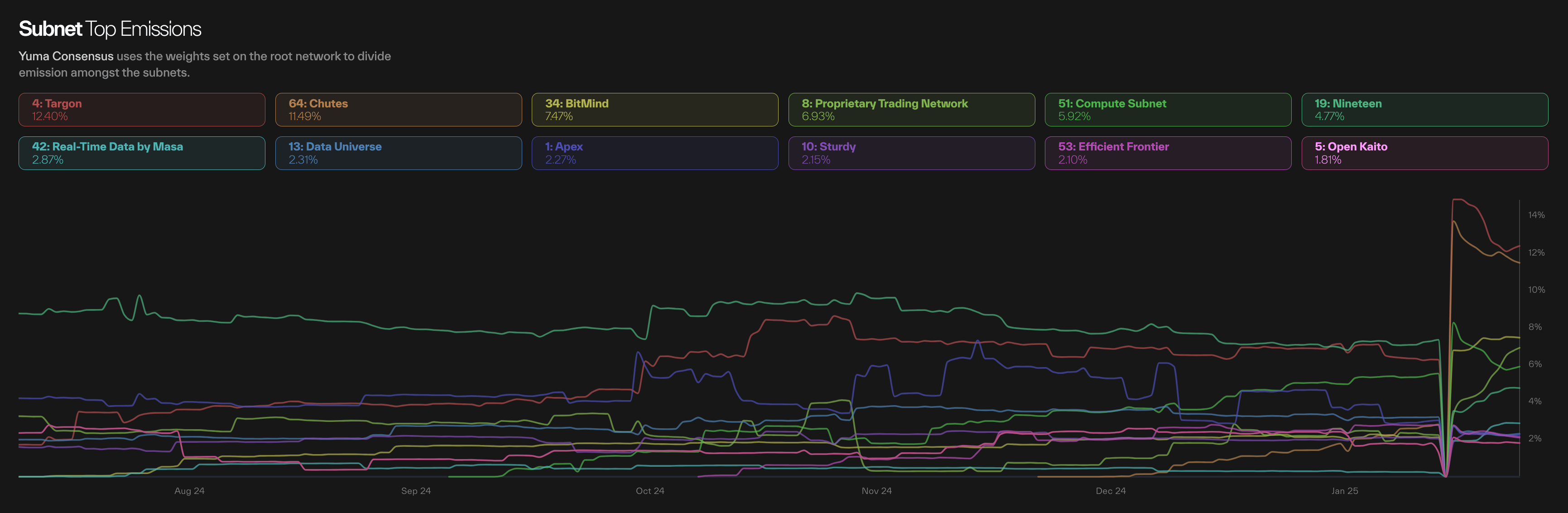

当前Bittensor作为行业领跑者,其dTAO子网生态仍存在显著质量缺陷,分析上图TAO奖励释放量排名前十的子网可知:TOP10子网中仅1家要求矿工提交开源模型,其余子网的矿工群体与模型开发关联性较弱。

-

开源模型训练存在极高技术门槛,这对Web3开发者构成重大挑战。多数子网为维持矿工基数,主动降低技术准入门槛,回避模型开源要求以确保代币激励池供给。

-

即使非强制开源模型的子网,其生态质量同样堪忧。TOP10子网中普遍存在以下问题:

-

缺乏可验证的落地产品

-

匿名开发团队占比过高

-

dTAO代币与产品价值缺乏有效锚定

-

收益模式缺乏市场说服力

-

dTAO的底层设计理念具有前瞻性,但现行Web3基础设施尚不足以支撑其理想生态构建。这种理想与现实的错位可能引发两方面后果:

-

dTAO子网估值体系需进行向下修正

-

若Bittensor开源模型平台验证失败,Web3 AI赛道或将转向Agent应用及中间件开发等轻量化方向