撰文:Tyler

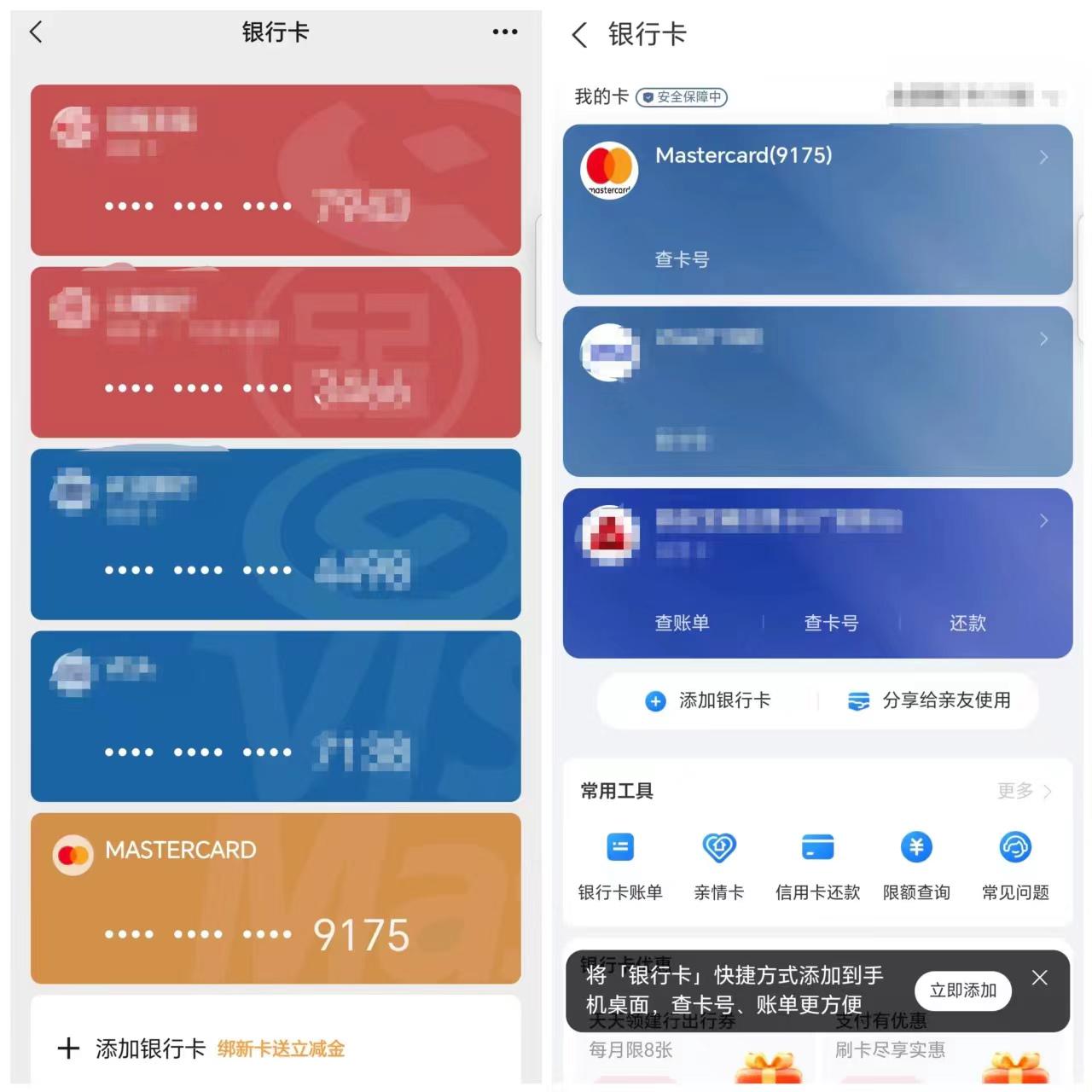

作为早在 2018 年就获币安投资的老牌钱包项目,SafePal 向国内开放了与瑞士 Fiat 24 银行合作发行的万事达卡(Mastercard)内测,用户在 SafePal APP 内即可完成个人瑞士银行账户及联名万事达卡的开户申领。

该万事达卡支持直接使用稳定币 USDC(Arbitrum)进行充值,并在国内绑定支付宝、微信进行线下 / 线上场景的日常消费,还可用于 Twitter、Telegram 等海外热门平台的会员订阅服务。

一、SafePal 及万事达卡介绍

1.什么是 SafePal 银行账户及万事达卡

SafePal 是币安最早孵化的硬件钱包项目,也是目前唯一被其投资且上过 Launchpad 的钱包项目,现在也拓展为覆盖硬件钱包(S 1、S 1 Pro 和 X 1)、软件钱包、浏览器插件钱包和合规银行服务的全栈钱包品牌。

SafePal 深度集成了瑞士银行 Fiat 24 的合规金融服务,支持用户建立个人银行账户。其中 Fiat 24 由瑞典注册公司 SR Saphirstein AG(CHE-256.014.995)运营,并根据瑞士银行法第 1 b 条获得金融科技公司许可,受瑞士金融市场监管局(FINMA)监管,用户可以在 FINMA官网查询 Fiat 24 的持牌记录,确保其金融服务的合法性与安全性。

目前 SafePal 银行服务主要分为两部分:瑞士银行账户(全球可申请)及联名万事达卡(首批已向国内开放):

- 瑞士银行账户(Fiat 24 银行账户):每位用户将获得一个独立的瑞士 IBAN 账户,和中行、农行、建行一样支持法币出入金、银行汇款、换汇等常规银行账户服务;

- 联名万事达卡(虚拟储蓄卡):16 位数的万事达卡,在非欧盟地区统一使用,可用于绑定支付宝 / 微信等渠道进行线上 / 线下消费,首批已面向国内地区开放;

2.SafePal 万事达卡使用场景

对国内用户,过去若想将加密货币兑换为法币用于日常消费,或购买不支持中国银行卡的境外服务,都存在一定门槛和合规问题,而基于 SafePal 万事达卡服务,用户足不出户即可拥有合规的瑞士银行账户,在支付宝、微信直接进行绑定,通过支付宝、微信进行线下 / 线上场景的日常消费:

- 线上包括淘宝、美团、京东、拼多多等主流电商平台;

- 线下包括商家二维码、个人二维码等;

目前暂不支持 PayPal、ApplePay、Google Pay、Samsung Pay 等,但后续会陆续开放。

SafePal 万事达卡充值费率为 0.6% -1% ,目前处于免费活动期,官方表示未来也将长期活动免费,而换汇费 1% 则可通过开启 USD/RMB/EUR/CHF 账户并消费对应货币来避免:譬如在国内消费用 RMB 账户,开通 GPT、Twitter 会员用美元等账户,免去 1% 换汇费。

SafePal 银行账户交易限额(汇款、换汇、消费)在国内地区为 10 万 USD/ 月;绑定支付宝 / 微信用于日常消费的话(他们各自对国际卡的限额):

- 微信是 3000 元 / 笔, 3000 元 / 日, 15000 元 / 年;

- 支付宝单笔支付最低限额为 0.1 元人民币,单笔支付最高不超过 3000 元,年累计支付金额最高不超过等值 10000 美元(约 70000 元人民币)

值得注意的是,单笔 200 元以上万事达卡会收 3% 手续费,这是所有国际卡的统一规则(200 元以内微信和支付宝补贴手续费)。

相比目前上市面上其他的加密 U 卡,SafePal 万事达卡的区别和优势在于:

- 低门槛注册:无需复杂流程,用户可在 SafePal 钱包 APP 内轻松注册瑞士银行账户及申请万事达卡。

- 绑定钱包地址:不使用手机号或邮箱,完全使用链上钱包地址,申请开户时银行会为用户铸造一个 NFT,用户钱包持有此 NFT 代表拥有该银行账户所有权;

- 便捷线上线下消费:通过绑定支付宝和微信,用户可以在淘宝、美团、京东、拼多多等主流平台以及线下商家二维码、个人二维码进行便捷消费。

- 多货币账户,免换汇费:支持美元(USD)/ 人民币(RMB)/ 欧元(EUR)/ 瑞士法郎(CHF)四种货币,可以开启 USD/RMB/EUR/CHF 账户并充值资金,消费这些货币无需换汇费;

- 受监管的合规银行账户:用户在 SafePal 所创建的银行账户实际上是瑞士 Fiat 24 银行名下的个人银行账户,拥有独立 IBAN,与传统欧洲银行账户无异,资金安全与操作透明度更高(全程链上可查,见下文),相比之下,其他加密 U 卡往往只是提供预付卡或由发卡机构代管资产,潜在风险与合规性问题难以评估,存在中介第三方风险;

- 日常银行业务功能:SafePal 银行拥有与常规银行相同的基础业务能力,不仅可在境外消费、支付国际服务费,还能进行日常银行业务操作,为用户资金流转和跨境支付提供了便捷的通道;

![]()

注意:银行账户交易需要 Gas(Arbitrum 网络),万事达卡消费不需要。

二、SafePal 万事达卡开户 / 申领教程

由于 SafePal 银行账户和万事达卡服务都在 SafePal 钱包 APP 内,故用户需首先下载 SafePal 钱包 APP(有无 SafePal 硬件钱包均可使用),全程在 SafePal APP 内操作。

只有在完成银行账户开户后才可申请万事达卡,用户需提前准备好个人 ID 或护照(安卓手机用户可以使用 ID,苹果手机用户建议使用护照)。

注意:一定要是 v4.8.3 及以上版本,可从官网链接下载 APP(iOS、Google Play、Android APK)。

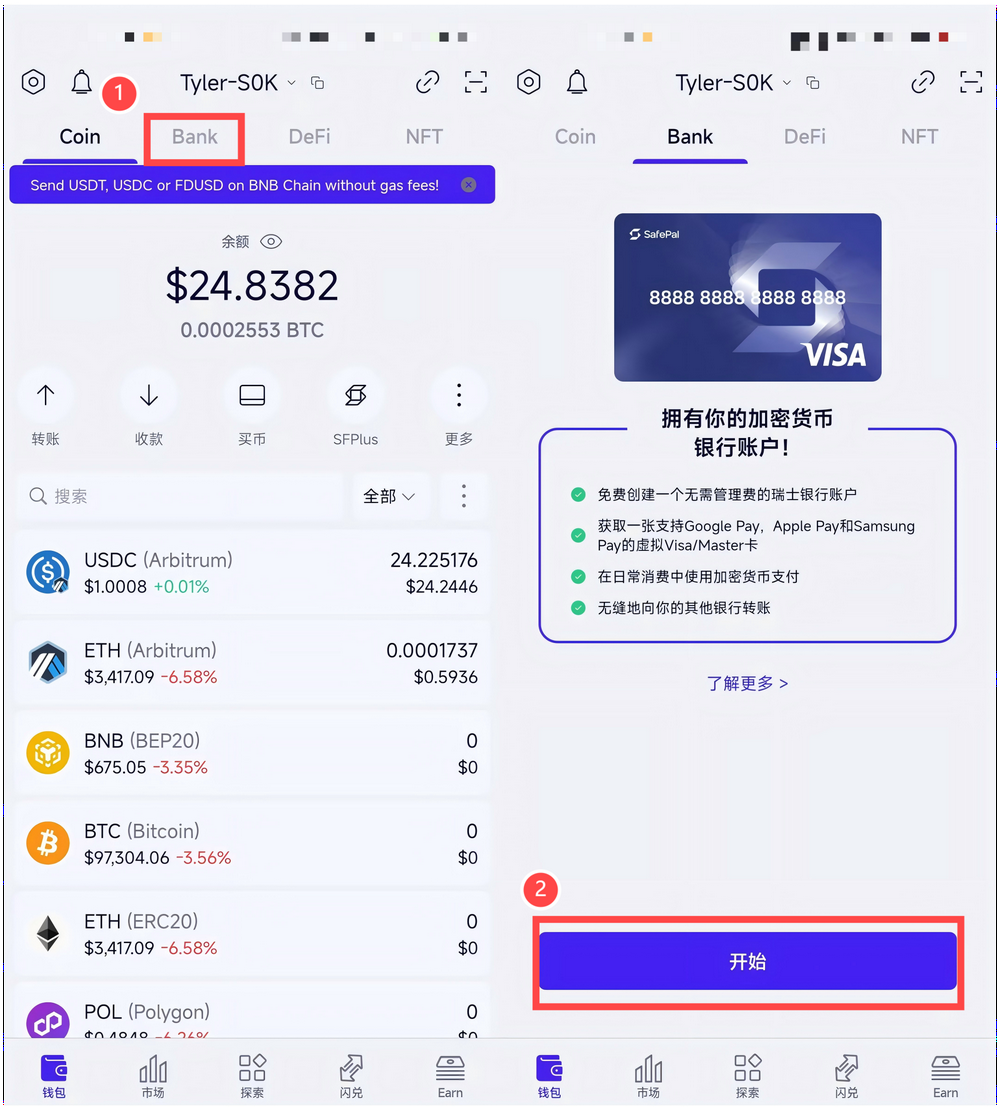

1.SafePal 银行账户开户

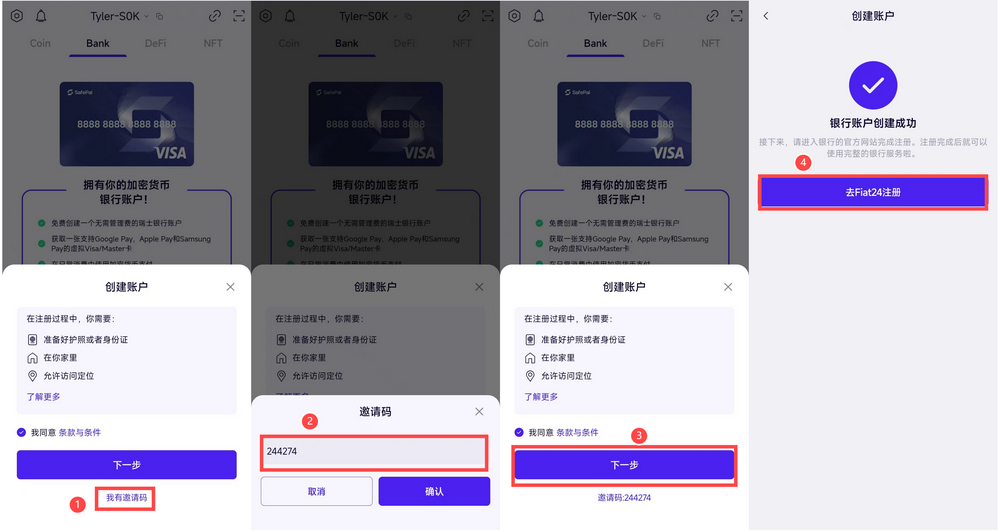

下载 SafePal 钱包 APP 并安装成功后,打开 APP,点击上方「Bank」选项,然后点击「开始」。

随后点击下方的「我有邀请码」,输入内测邀请码「 244274 」,然后点击下一步,成功创建银行账户,再点击「去 Fiat 24 注册」,进入注册页面。

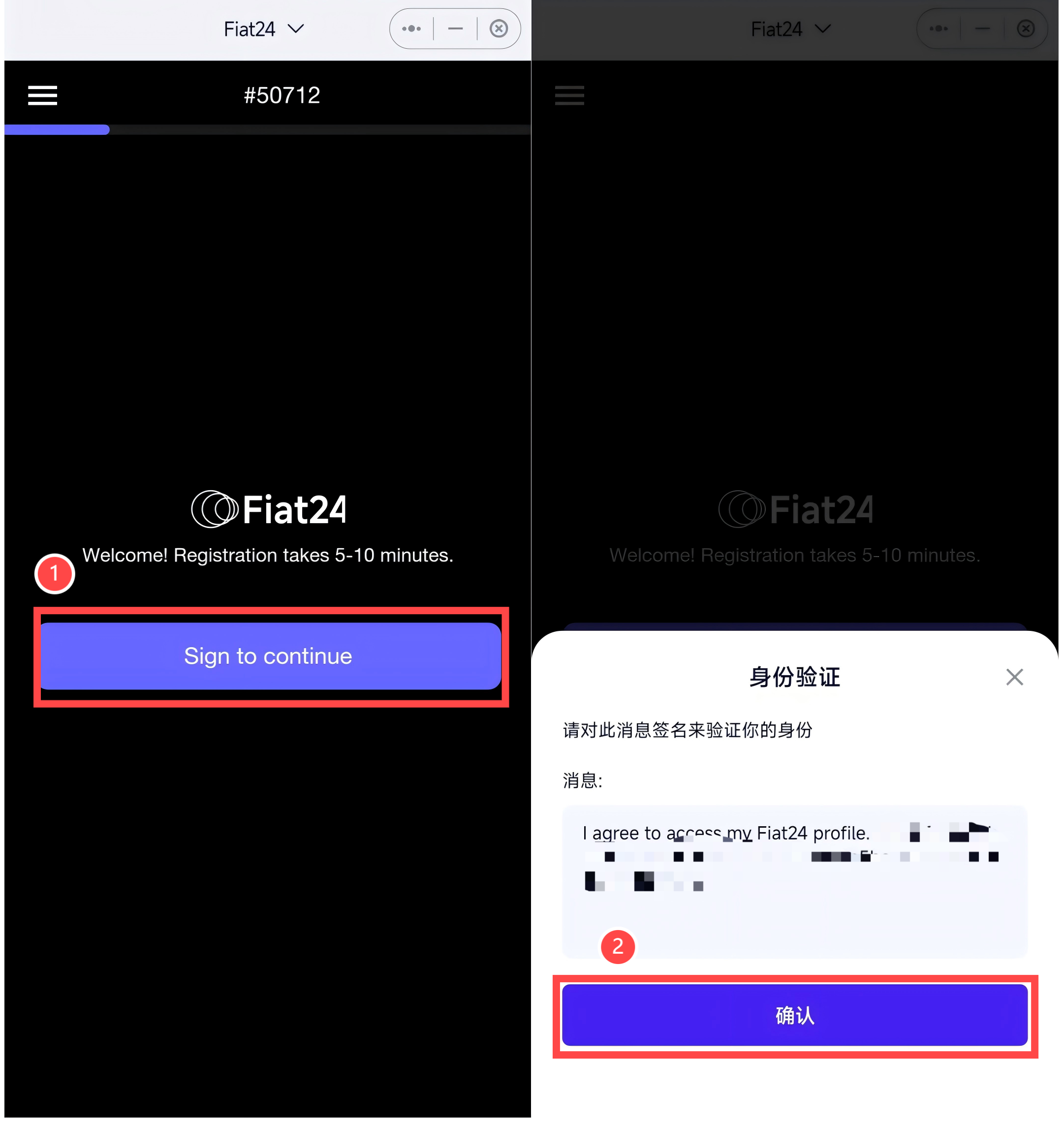

点击「Sign to continue」,然后在身份验证弹出窗口点击「确认」,完成钱包签名。

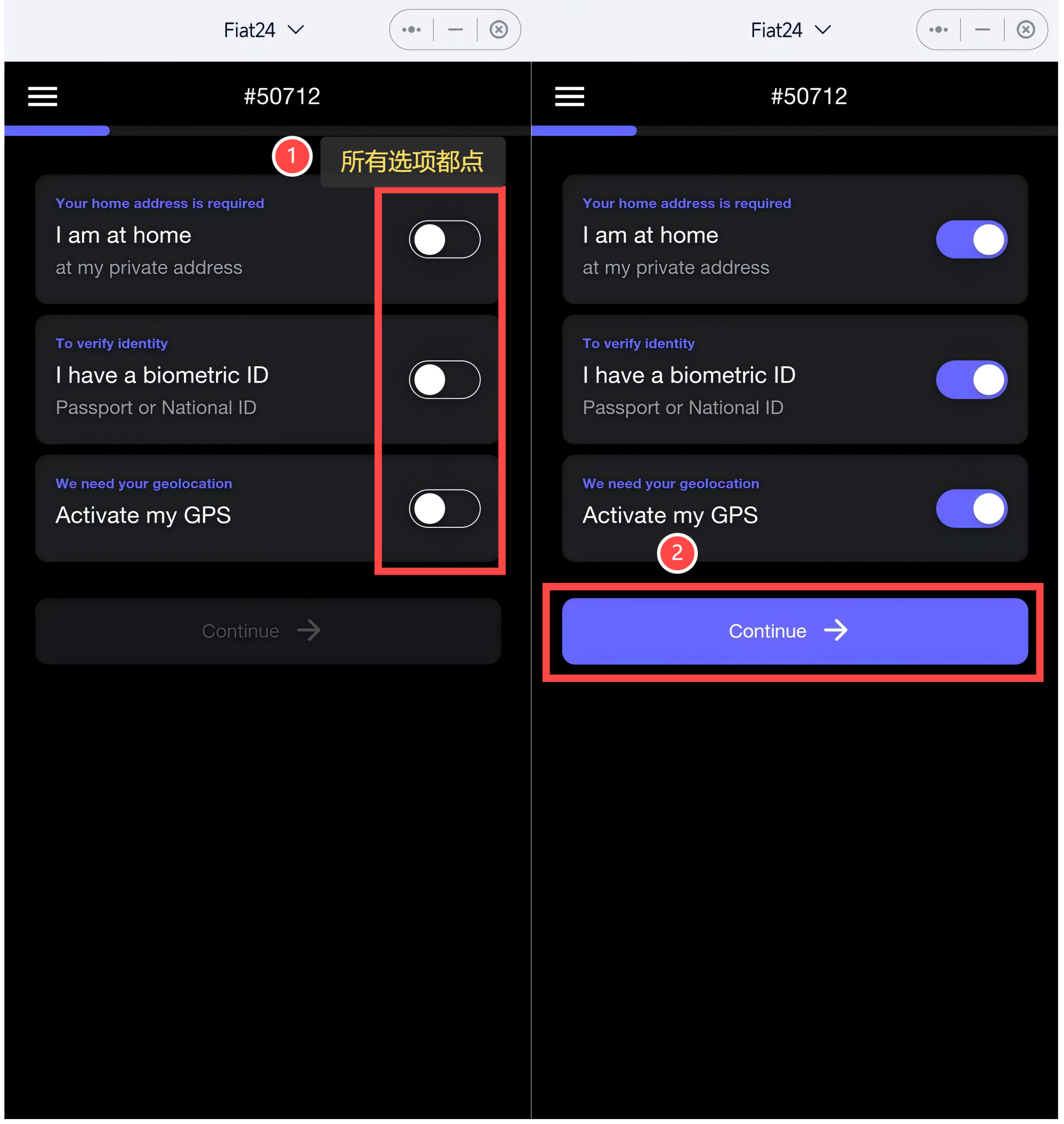

关于所在地址、ID、GPS(打开手机 GPS 定位)的 3 个选项,全部点亮——从此处开始,后面所有按钮全部都点击亮起,然后点击「Continue」进入下一页面。

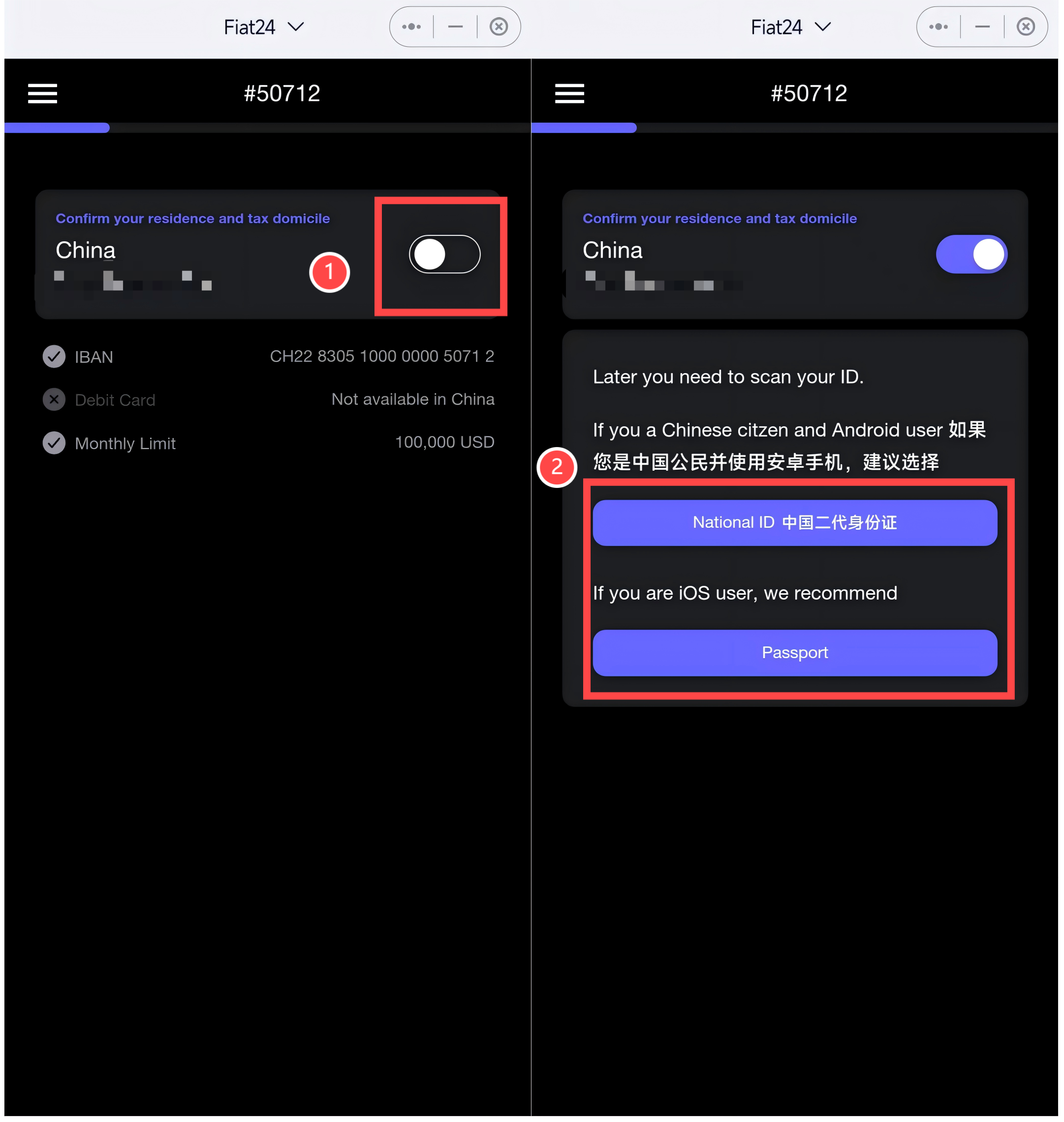

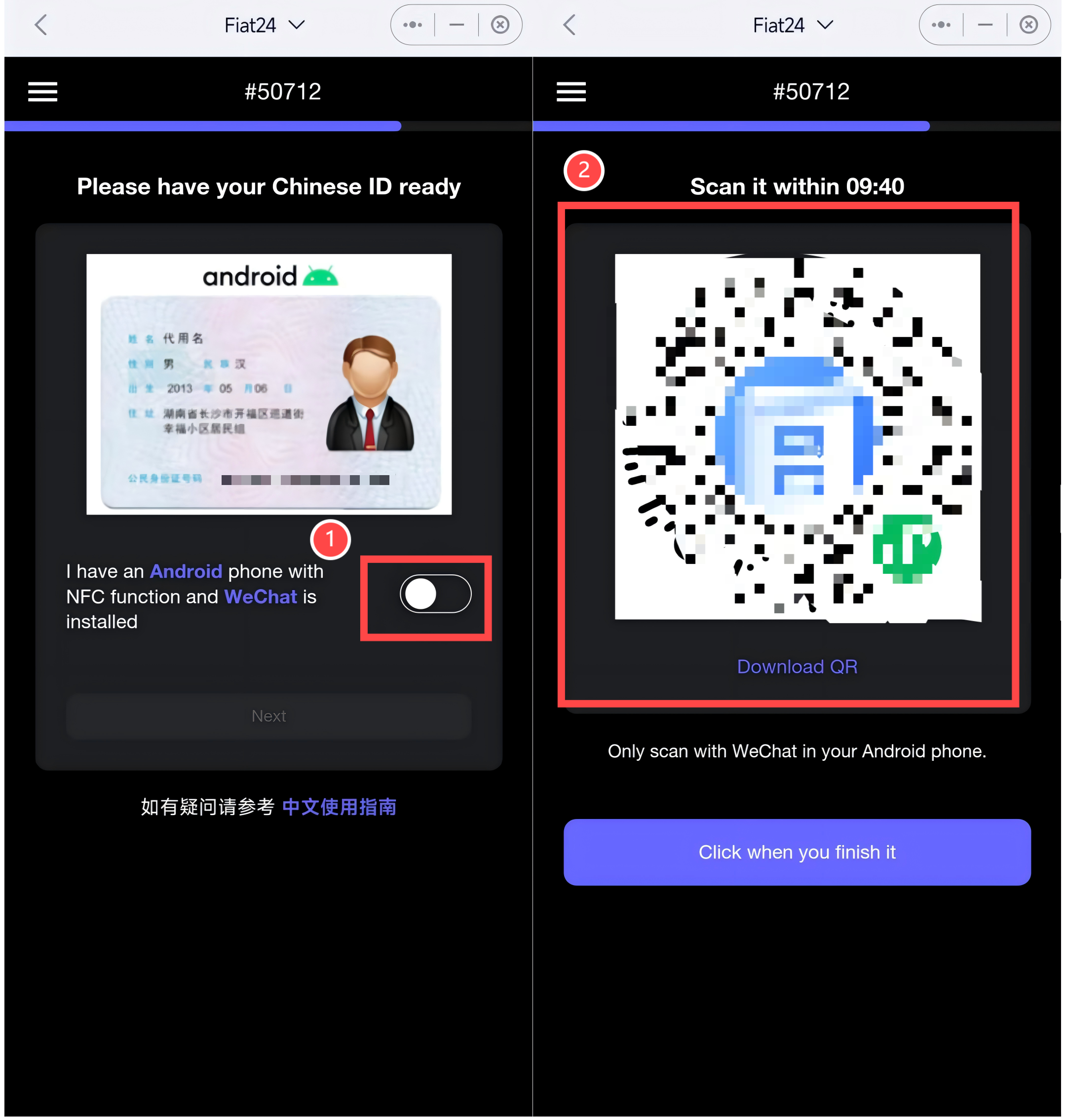

关于地址的选项点亮,然后选择 ID 或护照进行身份验证(带 NFC 功能的安卓手机用户可使用 ID,苹果手机用户建议使用护照,下文以安卓手机为例)。

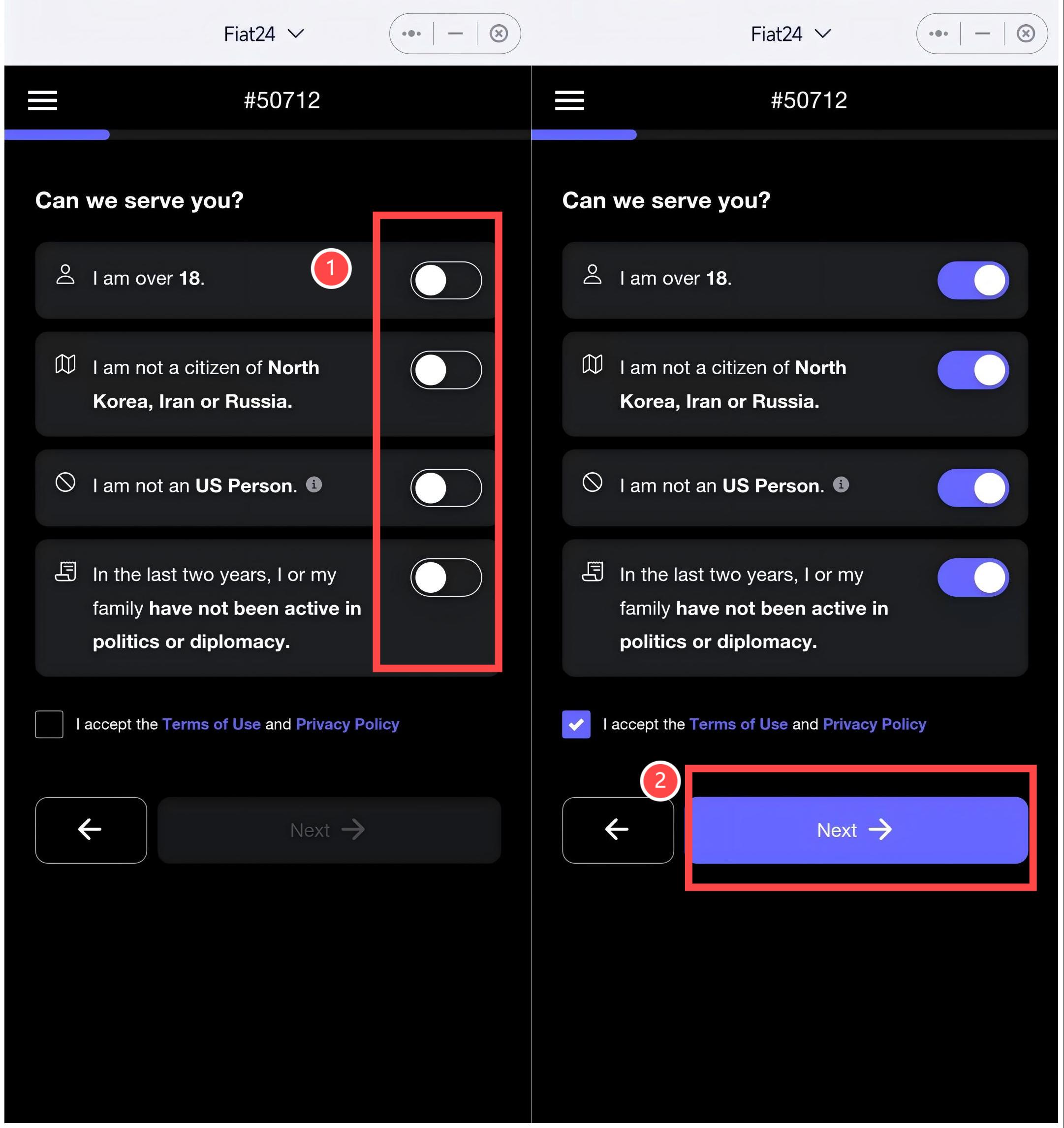

关于个人信息的 4 个选项依旧全部点亮,然后点击「Continue」进入下一页面。

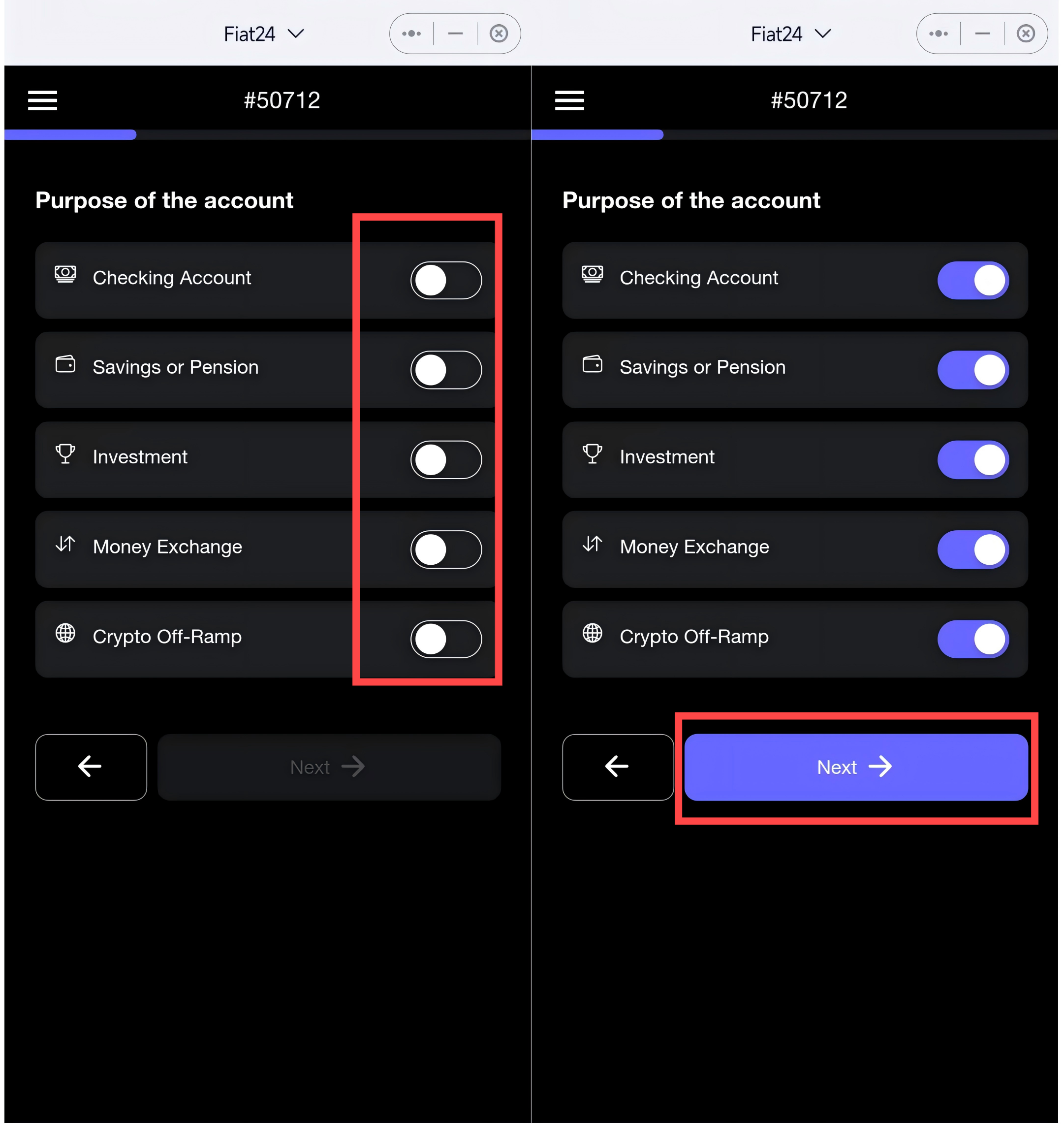

账户用途这里,建议全部勾选,然后点击「Next」进入下一页面。

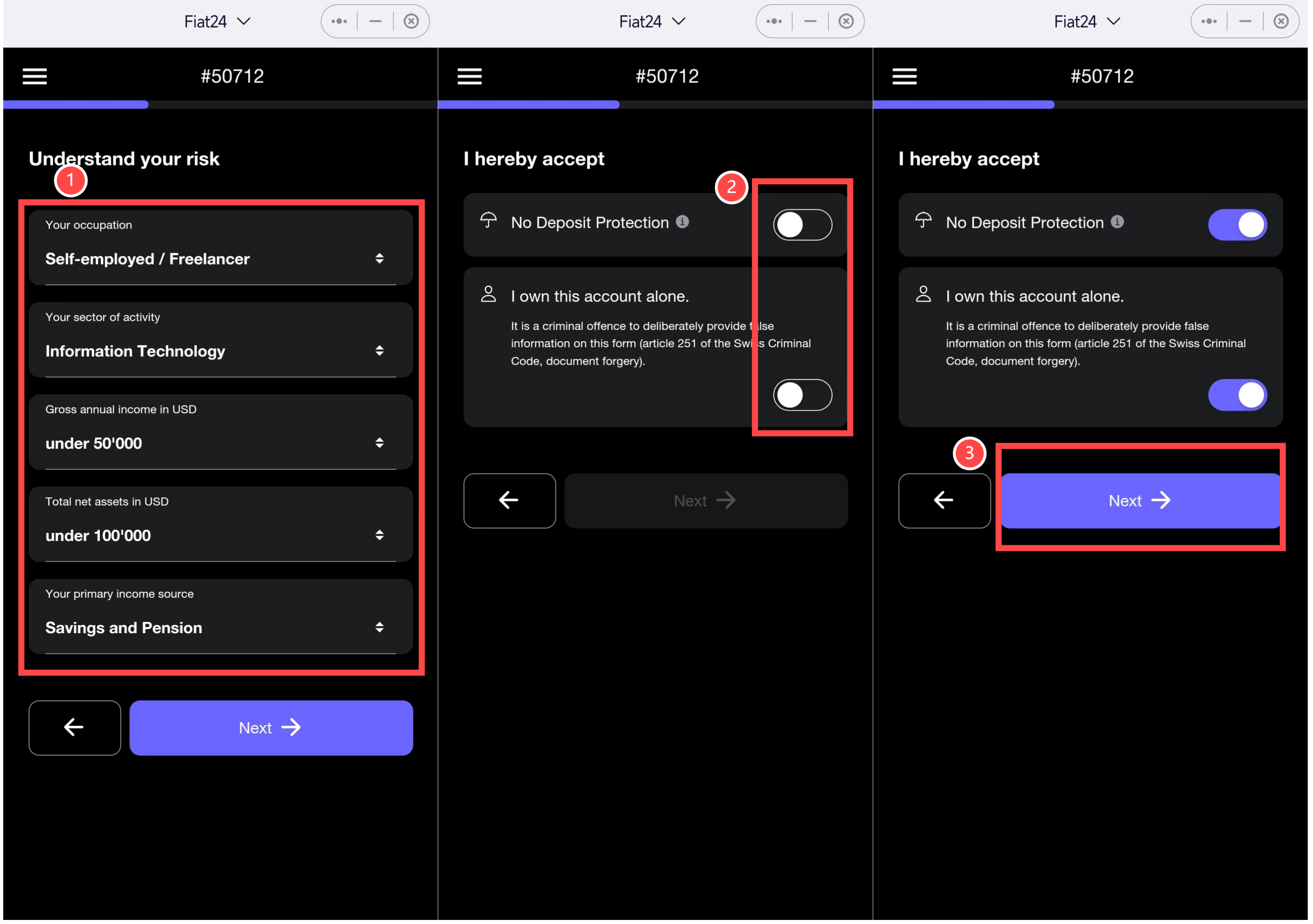

个人风险评测这里,关于个人的收入来源、收入情况等建议如实填写,随后点击「Next」;在知情页面,点亮 2 个选项,再点击「Next」。

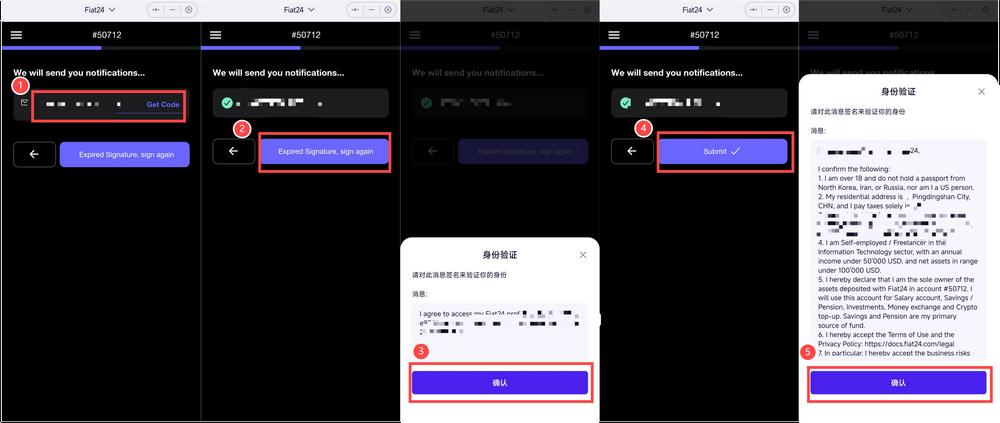

紧接着,需要接受邮箱验证码绑定邮箱,并作最后的签名确认:

- 先输入自己的邮箱地址,点击「Get Code」获取验证码;

- 收到验证码后,填入,并点击「Expired Signature, sign again」;

- 随后在身份验证弹出窗口点击「确认」,完成钱包签名;

- 签名完成后,点击「Submit」;

- 在身份验证弹出窗口点击「确认」,完成钱包签名;

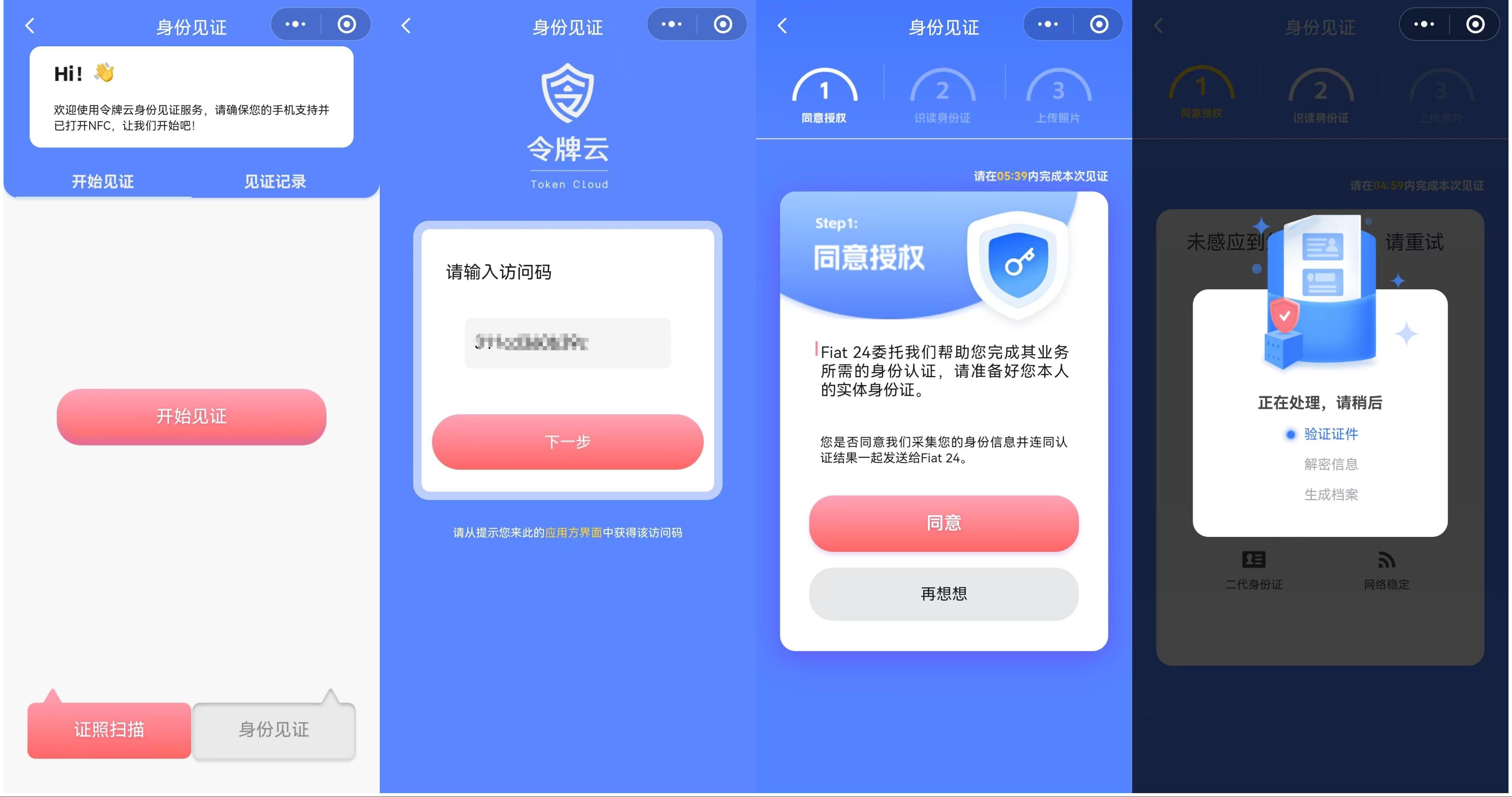

进入 ID 验证页面,点亮选项,然后用带有 NFC 功能的安卓手机,在微信内扫描该二维码,进入验证小程序。

首先 ID 放在手机后进行扫描——需提前打开手机 NFC 开关,否则可能提示不支持该手机,随后进行人脸识别,通过后即完成身份验证,返回 SafePal APP 内的注册开户流程,点击「Click when you finish it」,即可完成(官方 ID 开户视频教程参见链接)。

注意:部分手机由于兼容性问题无法正常进入 ReadID App 上传护照,可以用电脑上访问银行 KYC 网站,获取 KYC 二维码,然后用 ReadID App 扫二维码继续认证。

Fiat 24 审核通过后,银行账户即注册成功,在此基础上,国内地区可以选择申请开卡。

注意:内测期间,新开银行账户需要等待一天左右,方可激活万事达卡(至迟注册后 2-3 日内会收到申领入口)。

2.SafePal 万事达卡申领

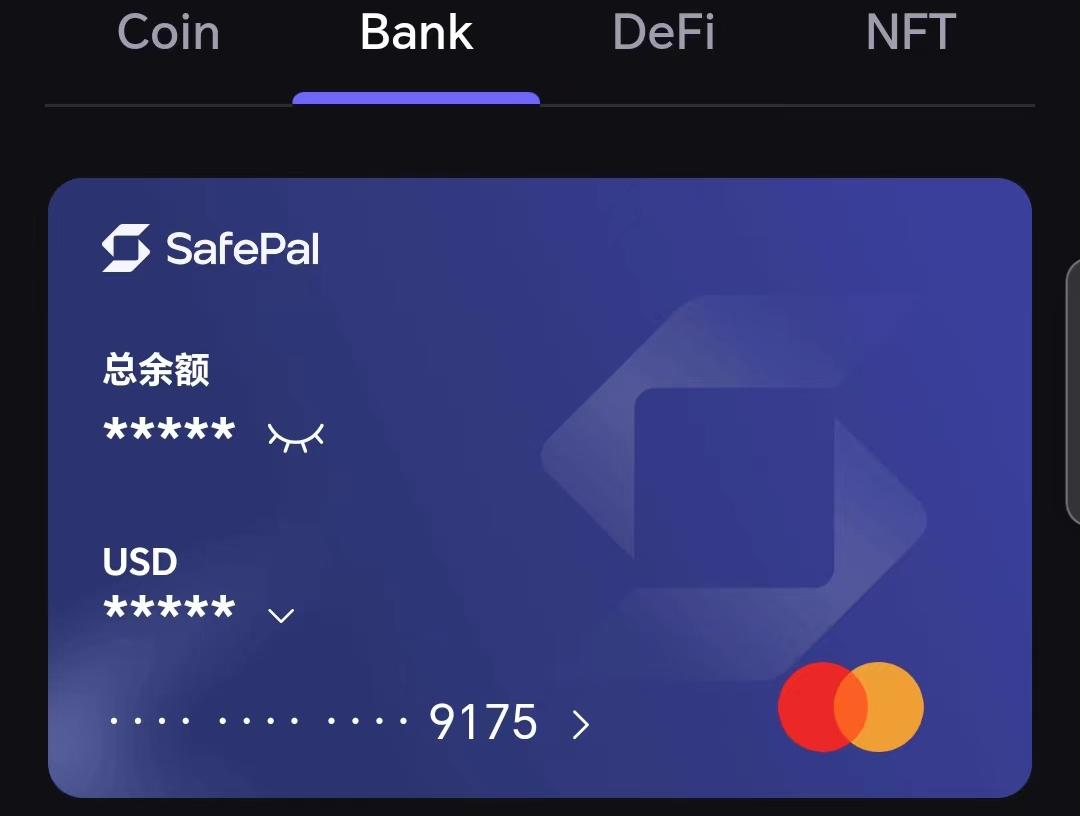

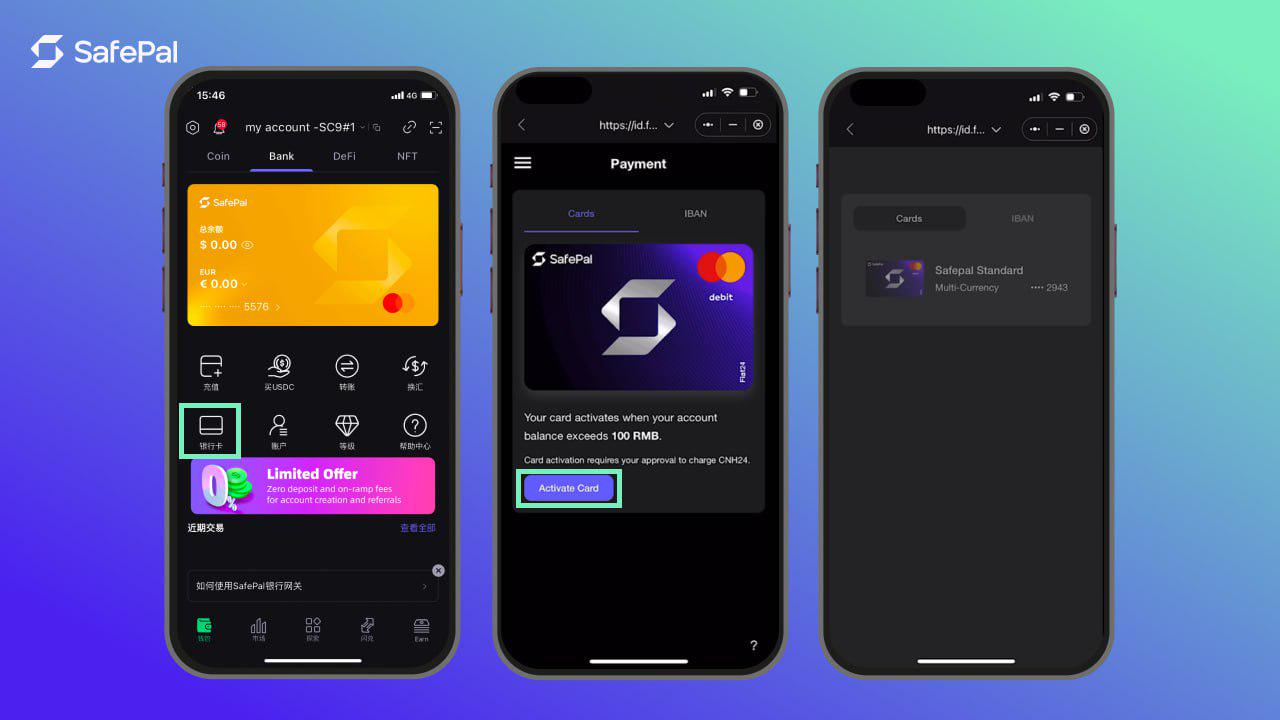

在 SafePal APP 内,「Bank」服务页面,点击「银行卡」即可申领自己的联名万事达卡。注意:要激活万事达卡需保证银行账户内至少有 10 USD 资产。

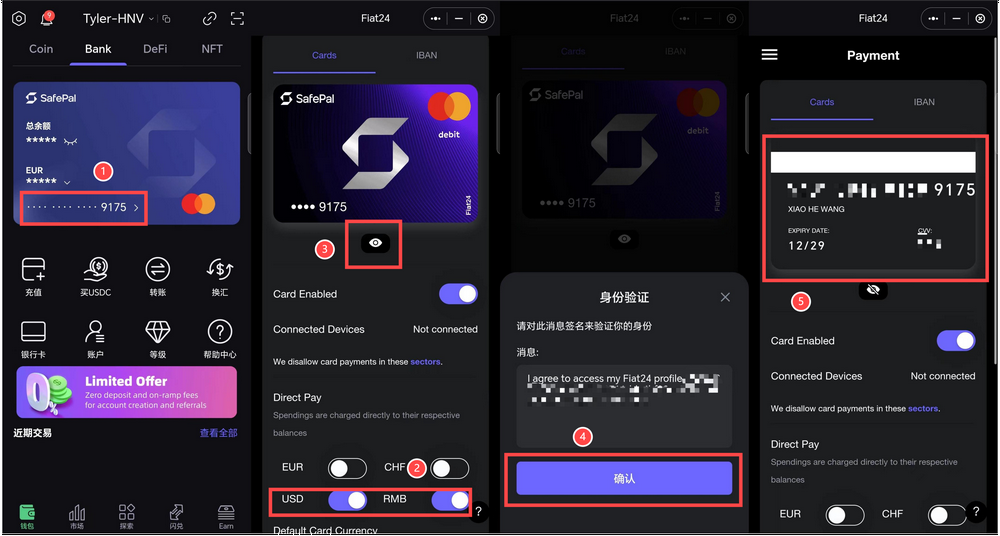

申领成功后,即可查看关于该万事达卡的卡片信息和支付设置:

- 点击卡片上卡号处的图标,进入详情页面;

- 支持美元(USD)/ 人民币(RMB)/ 欧元(EUR)/ 瑞士法郎(CHF)四种货币,根据需求自由开启相应账户,例如在国内消费选择 RMB,在海外或订阅国际服务时选择 USD 或其他货币,以减少换汇费用;

- 点击「眼睛图标」;

- 在身份验证弹出窗口点击「确认」,完成钱包签名;

- 授权后可以点击查看完整卡号、有效期和 CVV 安全码,以便绑定到微信、支付宝或用于其他支付场景(注意:请勿将 CVV 安全码泄露给任何人);

在 SafePal APP 内使用邀请码「 244274 」即可参与内测,如有任何注册与使用问题,可+ V「kleene 18 bot」,直达官方,一起交流,轻松上手~

三、SafePal 万事达卡使用指南

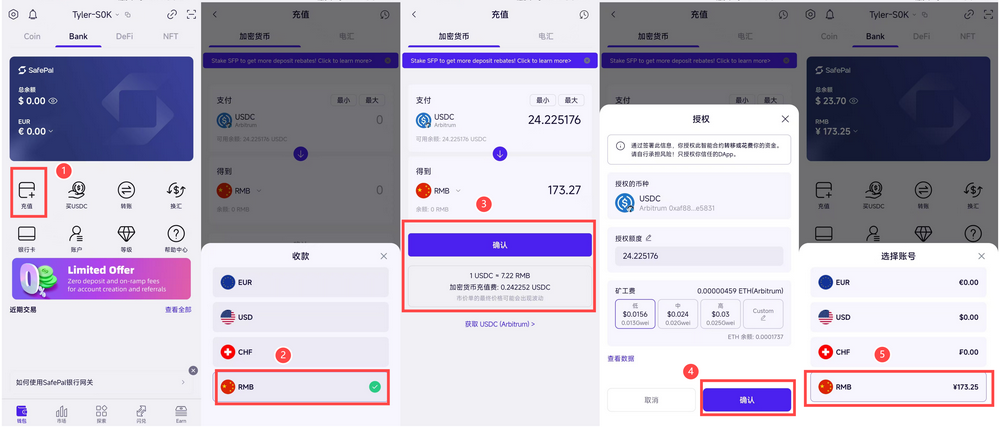

1.银行账户 / 万事达卡充值

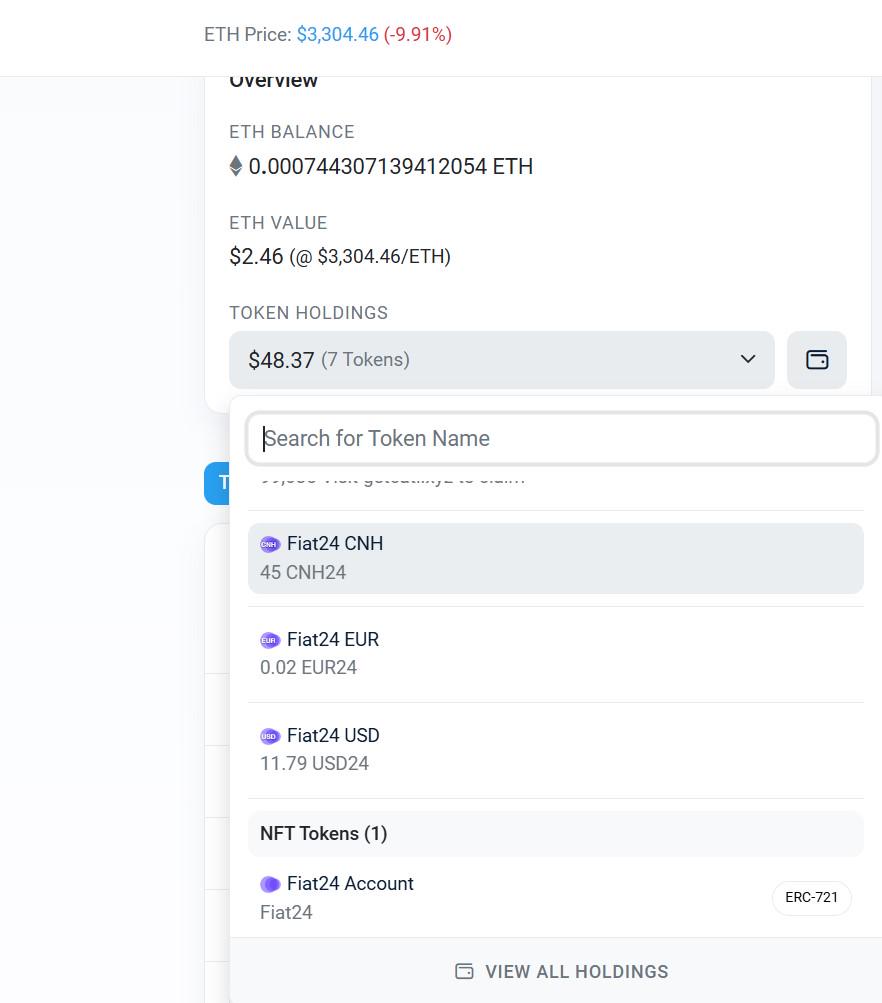

SafePal 银行账户(NFT),及存入的法币——美元(USD)/ 人民币(RMB)/ 欧元(EUR)/ 瑞士法郎(CHF),均基于 Arbitrum 网络,故用户需保证钱包内拥有 Arbitrum ETH 作为 Gas,且充值的稳定币 USDC 也需基于 Arbitrum 网络:

- 确保钱包内有足够的 Arbitrum ETH:由于充值过程需要在 Arbitrum 网络上进行交易,需确保钱包中有足够的 Arbitrum ETH 以支付 Gas 费用,建议至少准备 0.001 ETH 以确保交易顺利完成。

- 确认充值的 USDC 基于 Arbitrum 网络:确保您充值的 USDC 是基于 Arbitrum 网络的版本,以避免充值失败或资金损失;

在钱包内已有 USDC 的前提下,便可将加密货币充值进账户,自由兑换为美元(USD)/ 人民币(RMB)/ 欧元(EUR)/ 瑞士法郎(CHF):

- 点击「Bank」页面的「充值」按钮,进入充值操作界面;

- 可以看到支持的四种货币选项:美元(USD)、人民币(RMB)、欧元(EUR)和瑞士法郎(CHF),根据需求选择相应的货币类型进行充值;

- 在兑换页面可以看到实时兑换汇率与充值费用(目前活动期间 100% 返还);

- 签名授权,并再次签名确认交易;

- 兑换成功,可看到已兑换为 RMB 选项;

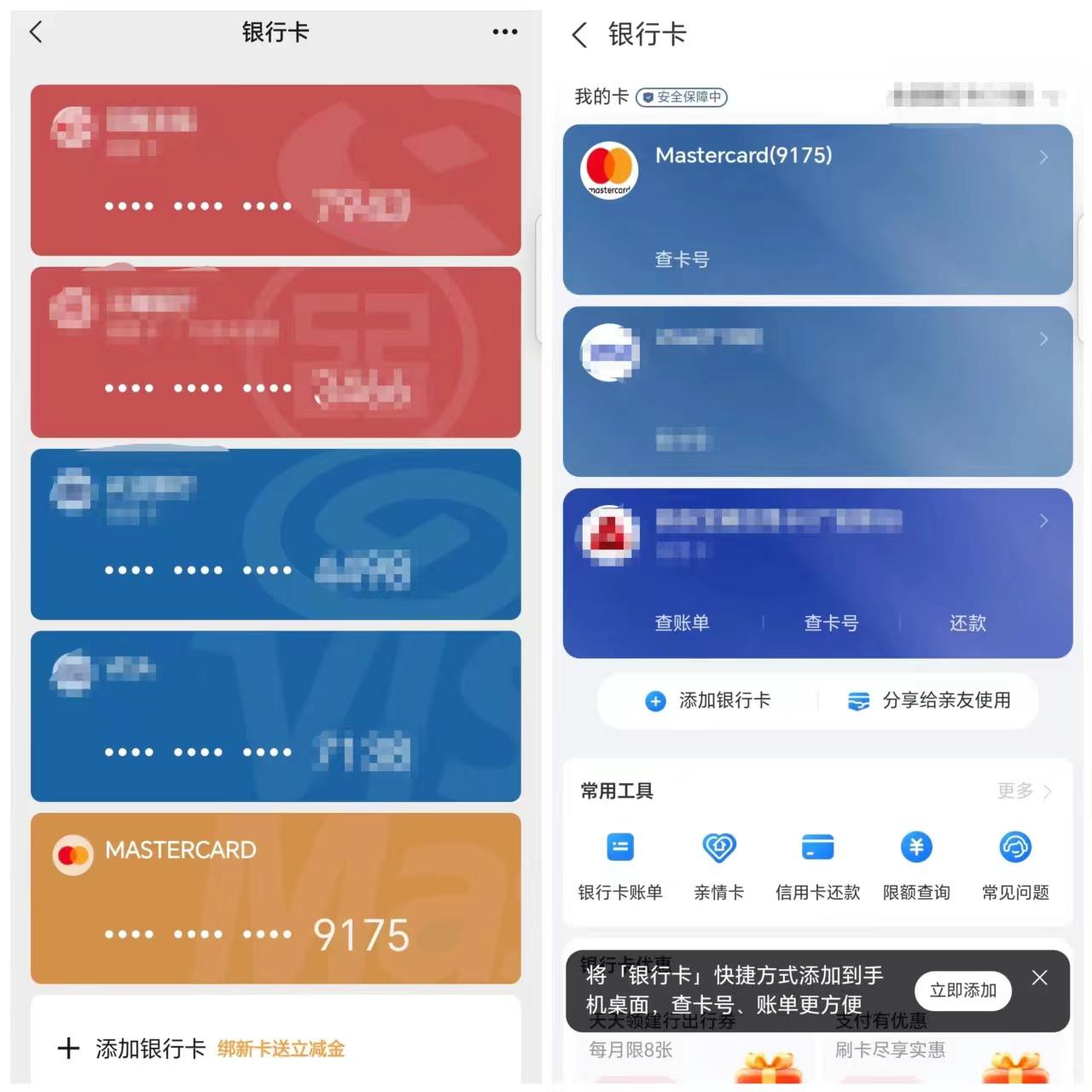

2.绑定支付宝 / 微信

在支付宝和微信的银行卡绑定页面,输入 16 位的万事达卡号,与上文提到的有效期限与 CVV 安全码,即可成功绑定。

3.其他消费场景

X、GPT 及 APPLE 等都支持将该万事达卡添加为付款方式。注意:在 GPT 付款时,需要使用瑞士 VPN(它规定只能在发卡机构所在地才能支付)。

此外官方表示目前券商支持了盈透证券和嘉信(笔者尚未实测),可以基于 IBAN 进行出入金交易。

四、初步使用体验与实际费率

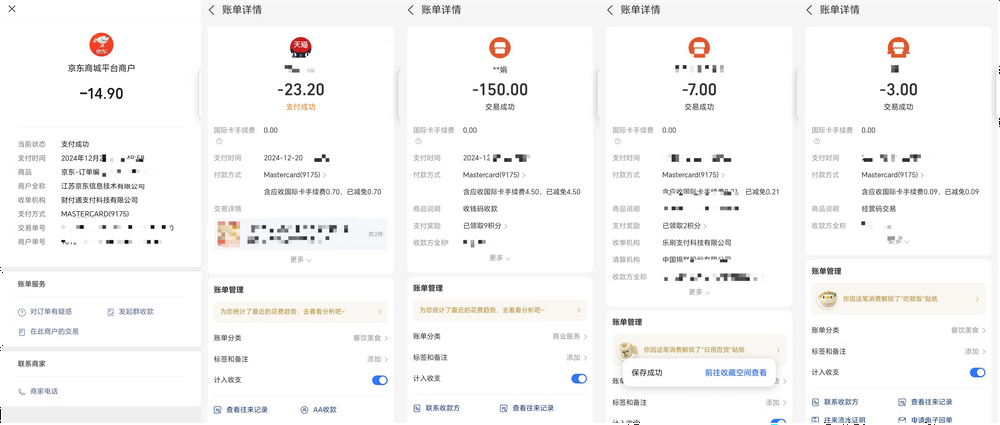

截至 12 月 20 日,笔者在国内地区绑定支付宝和微信后,进行了全方位的线上场景、线下商户实测:

- 线上场景:绑定支付宝和微信后,美团点外卖、淘宝购物、拼多多购物、京东购物均可成功支付,体验良好;

- 线下场景:商超、饭店、个人收款码等均可扫码(被扫码)支付;

实际损耗相对于目前的主流加密 U 卡,绝对属于低的一批——充值费仅 1% (长期活动, 100% 返还),无小额消费手续费,最棒的是,由于它本身支持人民币(RMB),因此相比于有些只以新加坡元(SGD)和美元(USD)结算的加密支付卡,在国内消费使用时可以省掉一笔最高 1% 的换汇费。

譬如测试当日,SafePal 兑换页面给到人民币汇率为 1 USDC ≈ 7.22 RMB,而当日官方人民币汇率中间价为 7.19 ,中行的现汇买入价 7.28 ,BN 的实际出金价 7.26 左右,实际磨损在 1% 左右,远低于目前 2-3% 甚至实际费率更高的其他加密支付卡。

即便是使用美元结算,加上换汇费,综合汇率也占优——其中两笔分别对应 150 RMB(20.85)、 7 RMB(0.97),对应的兑价是 7.1942、 7.2164 。

更有意思的是,上文也提过,SafePal 银行账户里的美元(USD)/ 人民币(RMB)/ 欧元(EUR)/ 瑞士法郎(CHF),都是基于 Arbitrum 网络的 Fiat 银行发行的 RWA 代币,所以实际上我们的余额和消费,都全程透明,确保没有第三方可以挪用或托管资金。

更详细的费率实测,以及与目前主流加密 U 卡的横向对比,将在近期完成,敬请期待。