本文由响指研究所团队采编整理

原作者:Brian McGleenon

要点速览

- 摩根大通的分析师指出,未来几个月内可能影响加密货币市场的关键因素,包括季节性的「Uptober」趋势、美联储的降息,以及以太坊即将进行的「Pectra」升级。

- 尽管历史趋势与结构性发展带来潜力,但市场仍然对宏观经济因素保持敏感,并等待更明确的催化剂来推动持续增长。

摩根大通的分析师强调,技术、地缘政治和结构性事件在未来几个月可能影响加密货币市场的波动。他们在近期发布的研究报告中提到,季节性的「Uptober」趋势、美联储降息、比特币交易所交易基金(ETF)期权的批准,以及以太坊的 Pectra 升级,都是市场应关注的动向。

十月往往是加密货币的牛市月份

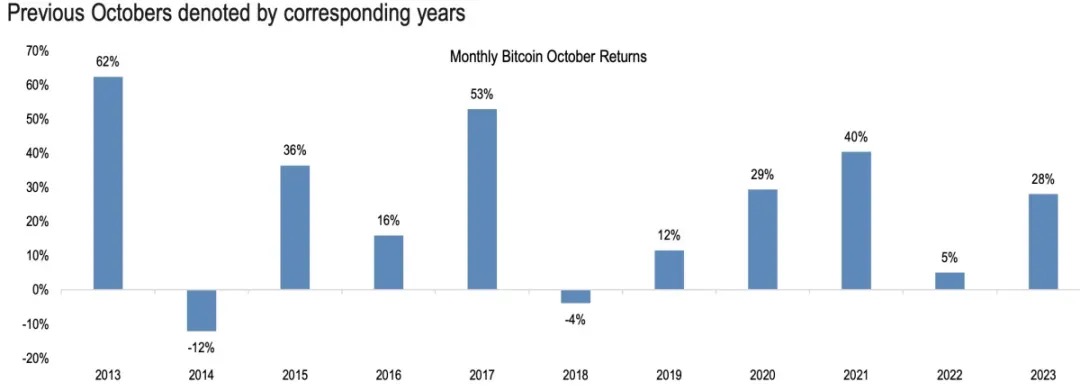

十月份往往是加密货币市场的上涨月。报告的一个重要结论是十月份在历史趋势上表现强劲,俗称「Uptober」。分析师提到,超过 70% 的十月份比特币都取得了正回报。

「虽然过去的表现无法预测未来,但『Uptober』这一概念的流行可能会影响市场情绪,从而使比特币在今年十月迎来积极表现」分析师解释道。

过去十年比特币在 10 月的价格走势

(图片来源:彭博社财经)

美联储的降息周期尚未影响加密货币市值

尽管美联储最近实施了降息,摩根大通的分析师指出,加密货币市场整体尚未出现预期中的积极影响。尽管利率下降的环境通常有利于风险资产,但数据显示,总体加密货币市值与联邦基金利率的相关性仍然较弱,仅为 0.46。

「自从美联储 9 月 18 日降息以来,尚未看到加密货币价格出现预期的反弹,市场可能仍在等待更加持久的稳定性,再作出明确的方向调整」分析师进一步解释。

此外,分析师补充,由于加密货币的出现较晚,缺乏历史数据,使得对其如何应对利率周期的预测充满挑战。「加密资产主要在 2010 年代初期至中期出现,而在此期间,利率大部分时间接近零。因此,与低利率相比,利率的稳定性可能对加密市场更加有利。」

比特币 ETF 期权有望加深市场流动性

另一个可能的催化剂是最近批准的现货比特币 ETF 期权交易。分析师预计这可能会加深流动性并吸引更多新参与者进入市场。「有了期权,投资者现在可以通过更灵活的方式与 ETF 互动,从而推动底层资产的流动性」分析师指出。这一发展可能会启动一个正向反馈循环,改善市场结构,并使机构投资者更容易进入数字资产领域。

9 月中旬,美国证券交易委员会(SEC)批准了在纳斯达克上市并交易的 BlackRock iShares 比特币信托现货 ETF 的期权。不过,最终的批准仍需经过期权清算公司(OCC)和商品期货交易委员会(CFTC)的同意。

Pectra 升级可能对以太坊产生长期影响

即将到来的以太坊升级「Pectra」是另一个值得关注的发展。Pectra 升级结合了布拉格(Prague)与 Electra 升级,将实施 30 多个以太坊改进提案(EIP),以提升网络效率、优化验证者操作并扩展账户抽象功能。

「尽管 Pectra 将对以太坊的功能产生深远影响,我们认为这次升级主要具有结构性意义,而不是短期内推动价格上涨的催化剂」分析师解释道。他们认为 Pectra 的长期影响将提升以太坊的运营效率和普及性,但不太可能在短期内引发以太币价格的飙升。

总体而言,摩根大通分析师得出的结论是,加密货币市场目前处于观望阶段,等待更明确的宏观经济或结构性催化剂来推动持续增长。

「加密生态系统对宏观因素的敏感性逐渐增加,我们正在等待下一个重要催化剂来推动发展,并提高零售参与度,从而为生态系统带来长期增长,」分析师总结道。

响指观点总结

1.「Uptober」趋势:摩根大通指出,十月常常是比特币的牛市月份,历史上超过 70% 的十月都带来了正回报,可能影响市场情绪。然而,过去的表现并不保证未来,市场仍在观望。

2. 美联储降息的影响:尽管美联储最近实施了降息,但加密市场尚未如预期出现积极反应。分析师认为,加密市场可能需要更持久的稳定性来显现出降息效应。

3. 比特币 ETF 期权:比特币现货 ETF 期权的批准被认为可能加深市场流动性,吸引更多机构投资者进入加密市场,并促进市场结构的改善。

4.以太坊的 Pectra 升级:Pectra 升级将提升以太坊网络的效率和普及性,但分析师认为,这次升级更多是结构性改进,短期内对价格影响有限。

-END-

【免责声明】:市场有风险,投资需谨慎。本文仅供交流学习,不构成任何投资建议。Not Financial Advice, Do Your Own Research.