一、注意力价值-市场要点

1. 市场行情

(1)宏观环境:

l 高盛下调美联储降息预测 通胀回落趋势显著

高盛发布的报告对美联储的降息预测进行了调整,将今年的降息预期从100个基点下调至75个基点,并指出关于基本通胀反弹的报道被夸大。根据报告,核心个人消费支出(PCE)通胀在去年9月至11月的年化升幅为2.5%,略高于前一个三个月的2.3%,但仍低于2.8%的年同比升幅,显示出通胀持续回落的趋势。此外,达拉斯联储修正后的平均PCE通胀数据显示,去年9月至11月的年化PCE通胀为2.4%,而去年11月的通胀率为1.8%。随着劳动力市场逐渐紧缩,薪资增长年率已放缓至3.9%,处于3.5%至4%的范围内。如果未来几年生产力增长在1.5%至2%之间,这将与2%的通胀目标相符。

(2)web3领域:

l 美国国税局推迟加密货币税收报告规则至2025年底

美国国税局已将加密货币税收报告规则的实施推迟至2025年12月31日,以便为经纪商在面临法律和监管挑战时提供更多的适应时间。根据报道,IRS还发布了一项临时救济措施,预计将使2025年中心化金融(CeFi)交易平台的加密货币持有者受益。新规要求自2025年1月1日起,对加密资产采用先进先出(FIFO)会计方法,除非选择最高进先出(HIFO)或特定识别(Spec ID)等其他方法。

2. 热点事件

(1) 宏观环境:

l 叙利亚非政府组织提议建立基于比特币的银行系统以促进经济重建

一家叙利亚非政府组织呼吁新政府考虑建立一个基于比特币网络及相关技术的银行系统。叙利亚经济研究中心(SCER)在其政策提案中指出,这样的系统对于加速国家重建和保护民众免受通货膨胀及货币贬值的影响至关重要。这项被称为“叙利亚比特币政策”的提案,旨在为面临经济困境的国家提供新的解决方案。新任总统Ahmed al-Sharaa自2024年12月上任以来,正努力寻求国际社会的认可以获取重建资金。SCER强调,政府应建立全面的监管框架,以合法化比特币及其他数字资产的交易和挖矿,从而推动叙利亚经济复苏。此外,提案建议将叙利亚镑数字化,并考虑用包括美元和比特币在内的资产进行支持。

(2) web3领域:

l 以太坊新闻周刊宣布停运 坦言缺乏支持与可持续商业模式

以太坊新闻周刊(简称WiE)创始人Evan Van Ness在社交媒体上宣布,WiE将于2025年1月1日正式停止运营。他表示,此决定源于与以太坊基金会(EF)领导层的一次对话,沟通中表明EF对WiE的价值认知已显然降低,并且在2024年仅提供了象征性的资金支持。随着EF选择完全切断这微不足道的支持,WiE的运营也随之终止。Van Ness提到,尽管有机会通过募资继续运营,但他更倾向于专注于其他有意义的项目。他还指出,WiE未能找到可持续的商业模式,广告和赞助收入难以维持。此外,他强调了以太坊生态系统中存在的问题,即过于专注于代码开发和研究,而忽视了其他重要贡献。

3.热点叙事

l Elon Musk更名"Kekius Maximus"引发加密货币市场波动 KEKIUS代币价格飙升与暴跌

几天前,亿万富翁Elon Musk在社交媒体X上将账号更名为"Kekius Maximus",并使用PEPE青蛙作为头像,引发了网络社区的关注。然而,他已于近期将账号名称恢复为"Elon Musk",头像也换回了个人照片。在12月31日,Musk的这一举动让许多人感到惊讶,尤其是他选择了与网络文化密切相关的"Kekius Maximus",这一名字不仅与流行的PEPE青蛙形象相关,还隐含了拉丁语中的“Maximus”一词,意为“最伟大的”,反映了模因文化中常见的夸张风格。Musk的改名举动对加密货币市场产生了显著影响,尤其是与其新名称同名的KEKIUS代币,其价格在短时间内暴涨。尽管Musk并未直接提及与KEKIUS代币的关系,但他的社交媒体活动往往对加密货币市场产生强烈影响。在他改名之后,KEKIUS代币的价格从前一天的峰值水平下降了四倍,显示出市场对他的动态反应极为敏感。

二、 注意力价值-热点项目

1. 项目介绍

l $T3AI | AI | @trustInWeb3

- 一个结合AI的DeFi网络协议,使用@sendaifun的Solana Agent工具构建。

- 敘事: 为了解决DeFi生态中贷款需过度抵押所导致的杠杆投资和资产利用率受限的问题,T3项目引入了专属AI代理作为可信中介。通过动态风险管理算法,确保贷款的可偿还性,同时允许用户在链上自由进行投资、交易或质押,从而实现更高的资本回报。

- T3的代币分配为90.5%用于自由流通,9.5%用于开发奖励和社区活动,其中0.175%已出售以覆盖2025年1月1日的基础设施成本。此外,贷款的0.3%将作为收入,80%的收入将用于回购,贷款的10%将以$T3AI代币支付,其余90%则以SOL或USDC支付。

- 项目在短时间内经历了价格暴涨,开发团队在凌晨4点进行了大规模抛售(0.175%的持仓用于基础设施建设)。

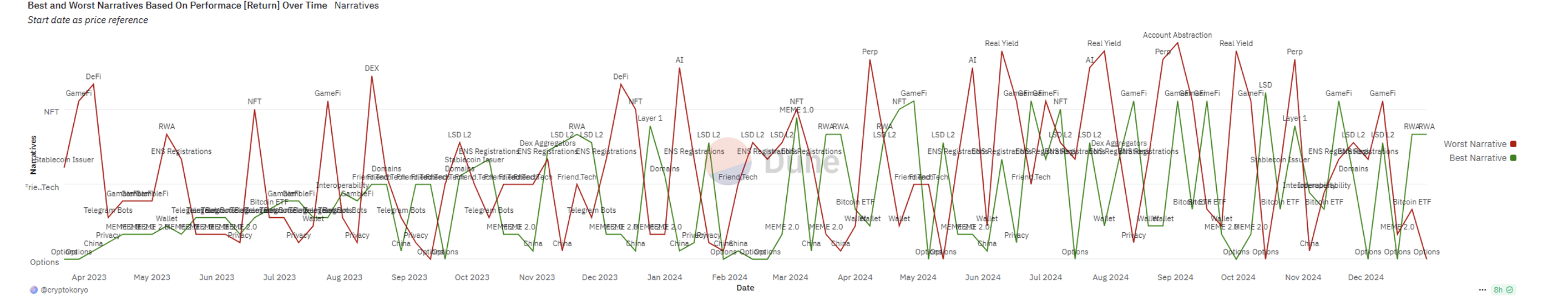

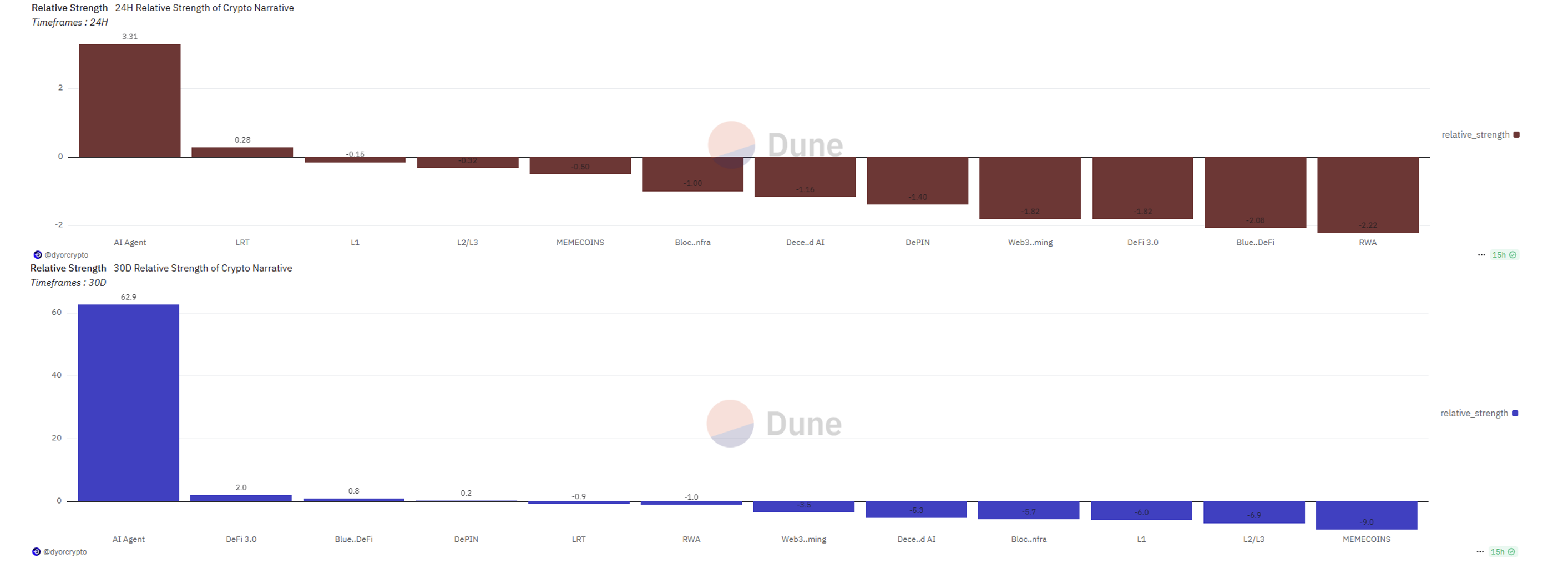

三、 注意力价值-板块轮动

1. 热点板块

资料来源:Dune,Dot Labs

资料来源:Dune,Dot Labs

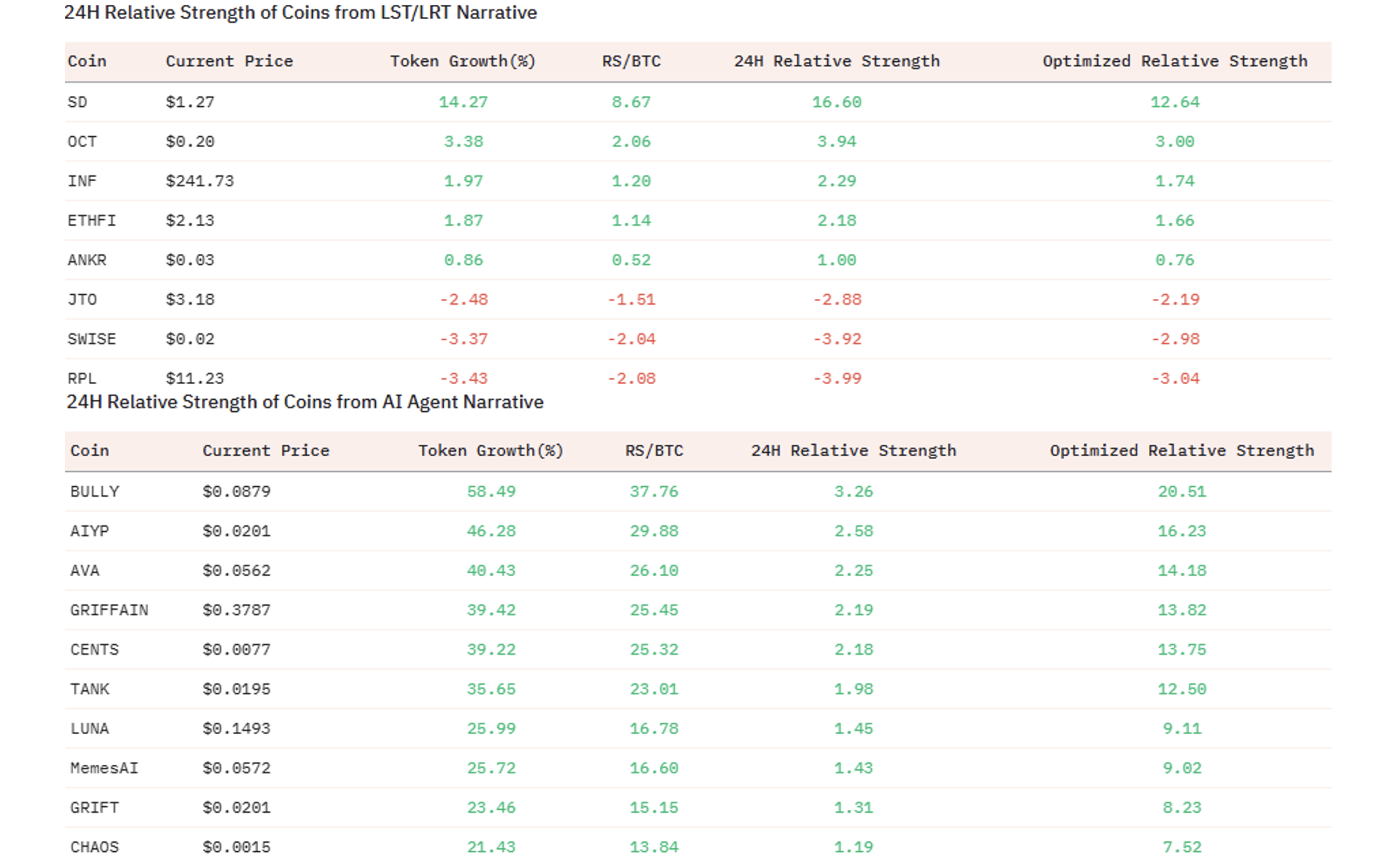

2. 板块內部

资料来源:Dune,Dot Labs