作者:Vader,VaderAI 創作者

編譯:Luffy,Foresight News

本文旨在幫助想要創建AI 代理的建構者更好地理解代幣經濟學、發行策略以及Virtuals 平台的bonding 曲線。作為Virtuals 平台上的第三大AI 代理,我們資助、孵化並支持那些考慮推出AI 代理的頂級團隊。

Virtuals 是一個允許任何人在無需許可的條件下推出自己的AI 代理的平台。

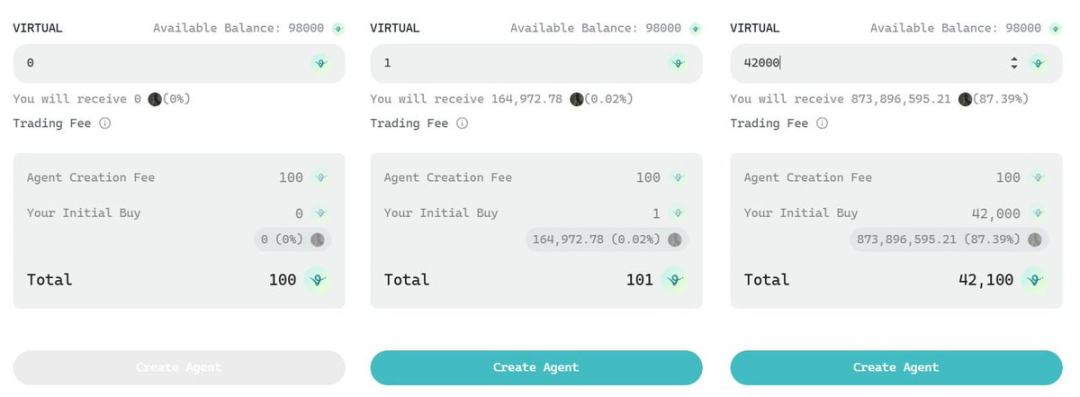

Virtuals 平台上的AI 代理程式啟動介面

如果創建者想要建立一個新AI 代理,建立介面就會彈出。創建AI 代理(代理)需支付100枚VIRTUAL 代幣(約150 美元,譯者註:原文作者撰文時VIRTUAL 價格是1.5 美元,下文AI 代理代幣的美元市值計算皆使用該數據。截止目前VIRTUAL 的市場價格為1.15 美元)作為費用。然後創建者可以選擇購買代幣,最低購買量為1 VIRTUAL。這種機制使得創建者在AI 代理代幣推出後能夠進行首次代幣購買交易。

一旦AI 代理代幣推出,它就會進入bonding 曲線流動性池。創建者的初始VIRTUAL 代幣購買行為決定了:(i) 開發者錢包獲取的代理代幣的百分比,(ii) AI 代理的初始交易市值(以VIRTUAL 代幣計價)。

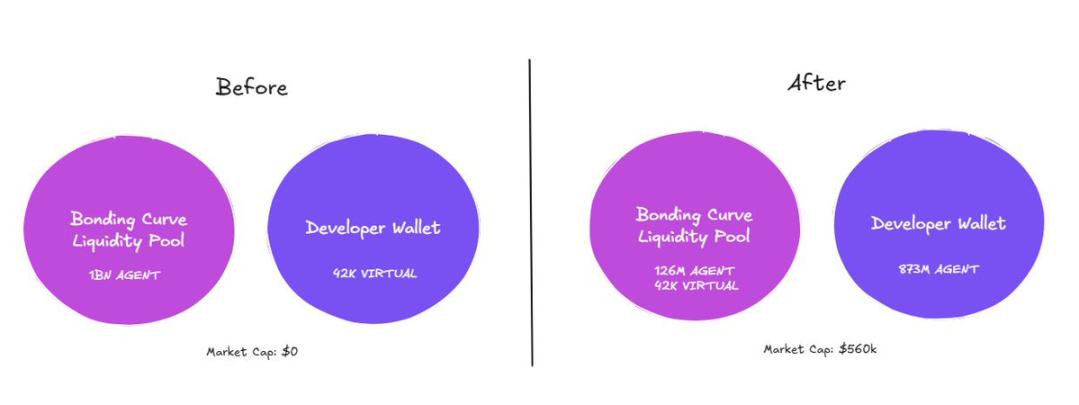

AI 代理創建者進行初始購買交易前後比較:

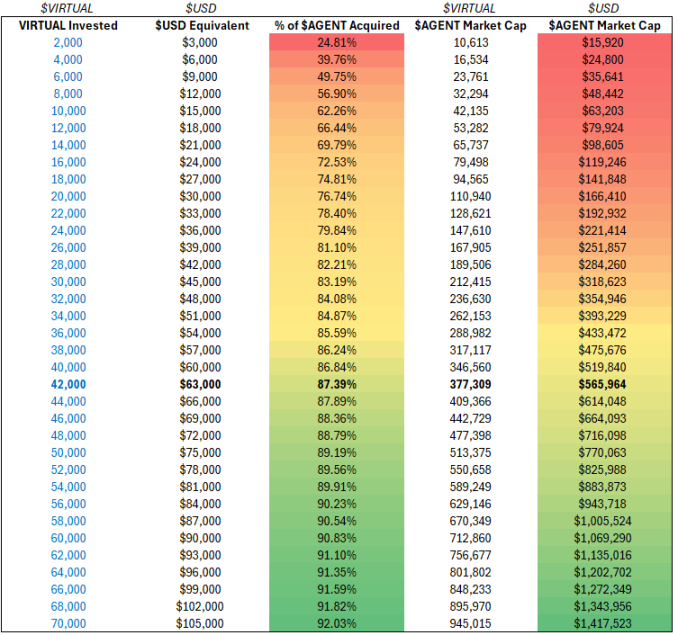

- 2000 VIRTUAL→ 可獲得24.8% 的AI 代理的代幣,初始市值為10600 VIRTUAL(約16000 美元)

- 42000 VIRTUAL→ 可獲得87.4% 的AI 代理的代幣,初始市值為377000 VIRTUAL(約565000 美元)

以美元計價的數字會根據VIRTUAL 價格波動,但以VIRTUAL 計價的數字則不會

團隊應該獲取多少代幣?

這是在Virtuals 上創建AI 代理的團隊最常問到的問題。在決定初始獲取代幣的百分比時,需要考慮幾個因素。

1. Bonding 曲線優化

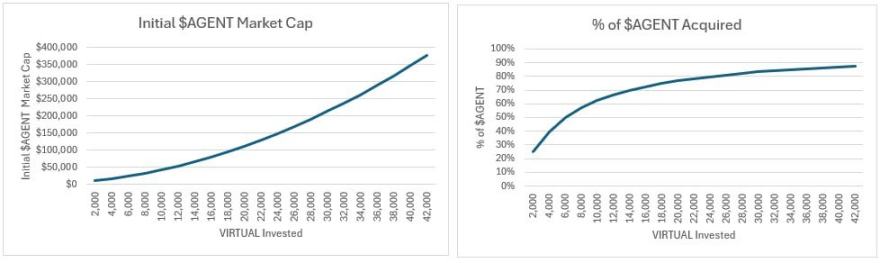

隨著投入的VIRTUAL 代幣數量增加,每投入一單位VIRTUAL 代幣所獲得的邊際AI 代理代幣供應量會減少,如下圖左側圖表所示。僅從這張圖表來看,從bonding 曲線優化的角度,團隊似乎應盡可能少地獲取初始供應量。

左側為AI 代理代幣的初始美元市值,右側為團隊取得AI 代理代幣的百分比

2. 激勵一致性

足夠數量的鎖定代幣確保團隊努力工作、不中途放棄並著眼於AI 代理的長期發展前景。如果團隊持有的代幣佔比少於10%,他們很可能不夠專注,一遇到困境就會輕易放棄。

在Virtuals 平台上推出AI 代理的團隊應至少獲取40% 的代幣,以實現激勵一致性。

為團隊預留15 - 20% 的鎖定代幣是可以接受的,包括創始人、現有團隊成員、顧問以及為未來團隊成員和顧問預留的份額。

那你可能會問,為什麼團隊要獲得超過20% 的代幣供應呢?

理想情況下,代幣有很大一部分應保留給行銷激勵措施,以獲取新用戶並留住現有用戶。這可能包括質押獎勵、空投、合作夥伴激勵、參與獎勵、流動性池激勵、創造新的流動性池等等。 Web3 開發者通常將40 - 50% 的代幣供應保留給「社群」 這個類別。

Memecoin 因為代幣持有者分佈更為廣泛,創建者通常不需要預留額外的代幣用於社區激勵,他們只需要為自己保留10 - 20% 的代幣供應。 AI 代理商與Memecoin 的不同之處在於,建構AI 代理商的團隊需要招募並留住AI 工程人才,還要承擔基礎設施成本。

此外,一旦團隊想要從去中心化交易所(DEX)拓展到鏈下,在中心化交易所(CEX)上市以及聘請做市商都會產生另外的成本。理想情況下,團隊應為未來的融資和鏈下上市預留一些代幣。在常規的代幣經濟學術語中,這個類別通常被稱為「金庫」、「策略夥伴」、「流動性」 或「投資者」,Web3 開發者通常為此用途預留20 - 40% 的代幣供應。

鑑於在典型的Web3 領域中,團隊和金庫控制的代幣總百分比約為90%,並且在Virtuals 平台上推出AI 代理的團隊通常致力於在數年時間內打造一個價值10 億美元的代幣,因此團隊在首次購買交易中獲取40% 至90% 的代幣供應量是可以接受的。

因此,從激勵一致性的角度來看,團隊應盡可能取得初始代幣供應。

3. 財務狀況

新創公司通常資金短缺,經營一個AI 代幣開發團隊的成本往往不斐。由3 名開發人員加上承包商組成的團隊,其薪資、基礎設施成本以及行銷費用,一年下來很容易就超過25 萬美元。理想情況下,團隊應有足夠的資金維持至少12 個月的運營,這樣團隊才不會因為資金短缺而在幾個月後就輕易放棄該專案。

作為創業者,你應該先用個人積蓄自力更生,在達到產品市場匹配(PMF)或實現特定里程碑之前,不要給自己工資或只領最低工資。自身投入很重要,如果你自己都不投入個人積蓄,別人為什麼要投入?天下沒有免費的午餐,高風險才意味著潛在的高回報。

從財務角度來看,團隊在獲取代幣方面應投入盡可能少的資金,因為他們更需要現金來支付未來的營運費用。

在資金支出方面,AI 代理開發團隊需要進行一定的權衡取捨。

4. 初始市值

從bonding 曲線優化、激勵一致性和財務狀況的角度來看,取得40 - 50% 的代幣供應似乎是很理想的。然而,再讓我們來看看這些交易產生的初始代幣交易市值。

- 團隊獲得40% 代幣供應→ 代幣總市值17,000 VIRTUAL(約25,000 美元)

- 團隊獲得45% 代幣供應→ 代幣總市值20000 VIRTUAL(約30000 美元)

- 團隊獲得50% 代幣供應→ 代幣總市值24000 VIRTUAL(約36000 美元)

對於任何有意義的AI 代理代幣來說,40000 美元的市值都被嚴重低估了,這對投資者來說似乎是撿錢機會。在40000 美元到你的公允價值(30 萬美元- 300 萬美元)之間買入的人,都是以極低的價格入場的。

不幸的是,能夠在這個價位公開入場的人並非你未來的忠實社群成員。他們是狙擊機器人,一旦有短期上漲行情就會拋售,這會損害代幣的健康狀況和價格走勢,因為他們的離場會加劇波動性。

如果你要分享從這樣的入場價位開始的上漲收益,為什麼要跟這些機器人分享呢?它們不會帶來任何價值,而你本來可以與未來的忠實社群成員分享,他們會長期支持你,或與有影響力的人(KOL)分享,他們會幫助提高你所建立專案的知名度。

基於上述,你可能認為以公允價值發行是理想的。你可以透過查看Virtuals 平台上類似AI 代理程式來估算公允價值。假設你算出公允價值為100 萬美元。

有了這個數字,你就要承擔發行可能不順利的風險。這是什麼意思呢?就是指價格一路下跌的走勢。理想情況下,你希望看到價格一路上漲,因為「價格上漲」 是加密世界最好的行銷手段。你要獎勵早期信徒和忠實支持者;你也希望在發行價格和公允價值估值之間確保一定的安全邊際,以確保發行順利。

從這個角度來看,你應該以比公允價值低30 - 50% 的價格發行,以確保發行成功。然而,如果你認為AI 代理市值的公允價值是100 萬美元,打30% 的折扣就是70 萬美元,要以這個初始市值發行,你需要投入47000 VIRTUAL(約70000 美元),這對一個小型新創公司來說是一筆不小的數目。

「畢業」機制

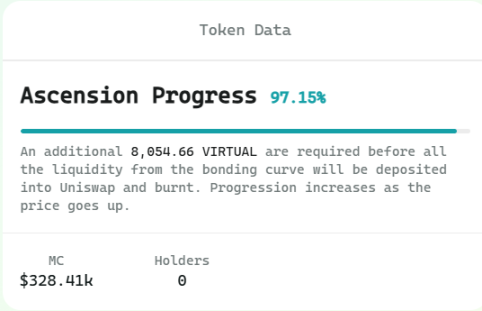

當團隊投入其bonding 曲線流動性池的VIRTUAL 達到42000 枚(約63000 美元)時,AI 代理就“畢業” 了。這個金額既可以由創建者在首次交易中投入,也可以由市場參與者在代幣發行後累積投入。

一旦42000 VIRTUAL 累積在bonding 曲線流動性池中,AI 代理就會進入Uniswap(或Meteora)流動性池,可以訪問Virtuals 的GAME 框架,並在Virtuals 平台的主網站上被列出。

一旦AI 代理達到畢業條件,就會在Uniswap(基於以太坊的Base 鏈)或Meteora(基於Solana 鏈)上創建一個新的流動性池

AI 代理在首次交易中「畢業」通常被視為開發團隊的承諾證明,會立即被狙擊者和社群成員買進。也就是說,Virtuals 平台上最大的兩個原生AI 代理Aixbt 和Vader 最初是以原型AI 代理推出的,它們是隨著時間推移而達到畢業條件的。

結論

AI 代理專案在財務狀況和初始市值之間存在權衡取捨。你想接近公允價值發行,以避免狙擊者並避免資金損失,但你也想投入盡可能少的資金,以便有足夠的資金來維持未來的營運。無論如何,團隊應該在初始購買時獲取至少40% 的代幣供應量,以實現長期激勵一致性。

團隊理想情況下應預留至少25 萬美元來支付未來一年的營運費用。然而,如果團隊想要從發行中達到「畢業」標準,由於42,000 VIRTUAL 的成本,總財務需求可能會上升到約40 萬美元。

我們以約15,000 美元的初始市值推出了我們的AI 代理(Vader),其市值在歷史最高點達到了1.6 億美元。一路上我們犯了無數錯誤,也學到了很多。在此,我們希望與志同道合的建構AI 代理商的創始人分享我們所學到的一切,為他們提供資金並孵化支持。