一、注意力价值-市场要点

1. 市场行情

(1)宏观环境:

l 2025年美国Solana ETF上市可能性被低估 VanEck研究主管称将突破77%

加密货币预测平台Polymarket之前表示,2025年美国Solana ETF上市的可能性约为77%。对此,VanEck的研究主管Matthew Sigel认为这一预测被低估了。他指出,2024年6月,VanEck与竞争对手21Shares将向美国监管机构申请上市现货Solana ETF。Sigel在去年11月特朗普赢得美国总统竞选后曾表示,预计在2025年批准SOL ETF的可能性非常高。随着市场对加密货币ETF的关注不断增加,Polymarket的预测显示,Solana ETF获批的可能性已上升至86%。这一乐观态度反映了行业对更多加密资产ETF上市的期待,尤其是在特朗普支持加密货币的背景下。若Solana ETF想要成功上市,将需要采用类似于比特币和以太坊ETF的“授予信托”结构,并避免被认定为证券,以免面临更严格的监管要求。

(2)web3领域:

l Delphi研究员Robbie Petersen发布2025年加密市场预测 DePIN市值将增长五倍

Delphi研究员Robbie Petersen在X平台上发布了对2025年加密货币市场的预测,指出随着MEV供应链的成熟,交易所和验证者将面临更激烈的竞争,但前端仍将保持其垄断地位。此外,他预计DePIN市场总市值将在2025年增长五倍,而加密支付基础设施在代理交易中的应用将有限,传统支付渠道仍将继续存在。稳定币的角色也将发生变化,不再仅是DeFi的润滑剂,而是成为真正的交换媒介,预计到2025年活跃稳定币地址将突破5000万个,市场将迎来多方面的升温。同时,钱包和应用程序之间的界限将变得模糊,而链抽象在钱包层的实际应用中,通用L2s的重要性逐渐减弱。

2. 热点事件

(1) 宏观环境:

l 马斯克引发加密税务争议 CumRocket代币短时飙升124%

马斯克在其社交平台上发布了关于加密交易税务问题的争议。他提到了一位客户的案例,该客户以7000美元购买了CumRocket代币,并将其质押了3个月,以获得高达6900%的收益。然而,当客户出售和提取利润并投资于NFTitties的项目,却遭遇开发者的“rug pull”,最终只能成功清算10%的资金。马斯克询问,客户是否可以扣除铸币过程中的gas费用,以平衡短期资本利得税。此番言论迅速引起市场反响,CumRocket代币(CUMMIES)短时间内上涨了124%。据悉,CumRocket是一个旨在通过其原生加密货币CUMMIES改革成人内容行业的区块链项目,启动于2021年4月。

(2) web3领域:

l 以太坊慈善基金Endaoment创下历史最大交易 售出3,690枚ETH获1247万美元

以太坊慈善基金Endaoment最近通过一笔交易售出了3,690枚ETH,获得了1,247万美元的收入。这是该基金在过去10个月中的首次出售,也是其历史上最大的一笔交易。此次出售的ETH来源于一位参与2015年7月以太坊ICO的投资者,该投资者在创世区块时获得了10万枚ETH。截至目前,这位投资者已经以平均2,409美元的价格出售了14,990枚ETH,其中有13,190枚ETH 是通过Endaoment进行的。目前,该投资者在两个钱包中仍持有85,000枚ETH,市场价值约为2.938亿美元。这一交易引发了市场对以太坊的关注。

3.热点叙事

l AIXBT崛起引发市场关注 CookieDAO及$COOKIE潜力巨大

随着AIXBT在加密推特上崭露头角,成为市场领先的AI代理,其市值在短短几个月内已达到6亿美元。这引发了对其核心竞争优势的深入分析,尤其是其数据聚合技术的影响力。同时,作为市场领先的数据聚合和打包基础设施提供商,CookieDAO及其代币$COOKIE也受到了关注。随着人类和AI用户对cookie.fun的需求增加,数据聚合的价值正在显著提升。AIXBT的成功源于其独特的模型和强大的数据抓取能力,使其能够实时分析来自多个信息流的数据,并生成有效市场洞察。相比之下,CookieDAO则通过聚合数据源为AI代理提供支持,帮助它们在市场中竞争。尽管CookieDAO的市值仅为 3200 万美元,但其潜力被认为巨大,尤其是在AI代理经济不断发展的背景下。随着CookieDAO不断推出新的功能和激励机制,其代币$COOKIE的价值有望进一步上升,吸引更多用户参与。

二、 注意力价值-热点项目

1. 项目介绍

l $ZAILGO | AI | @wedtm

- ZAILGO是一个开源的AI代理和机器学习模型平台,作为ElizaOS框架的升级版本。平台集成了Solana区块链和向量数据库,提供了对Kubernetes和Docker的持续集成与持续交付(CI/CD)支持。这意味着用户可以更高效地开发和部署应用程序,利用现代云原生技术来优化软件开发流程。

- @wedtm发的币,他是山羊和doxxed的开发人员。

- 市值短时突破7000万美元,创历史新高,24小时涨幅208%。

三、 注意力价值-板块轮动

1. 热点板块

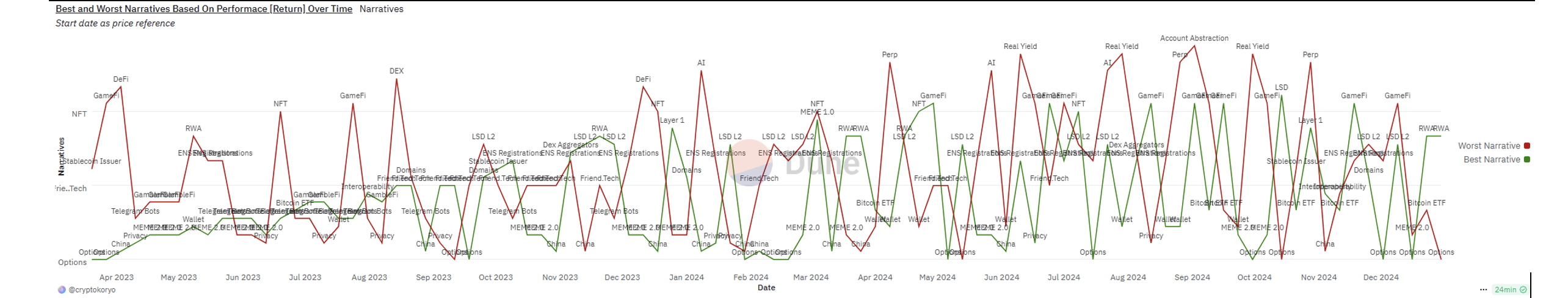

资料来源:Dune,Dot Labs

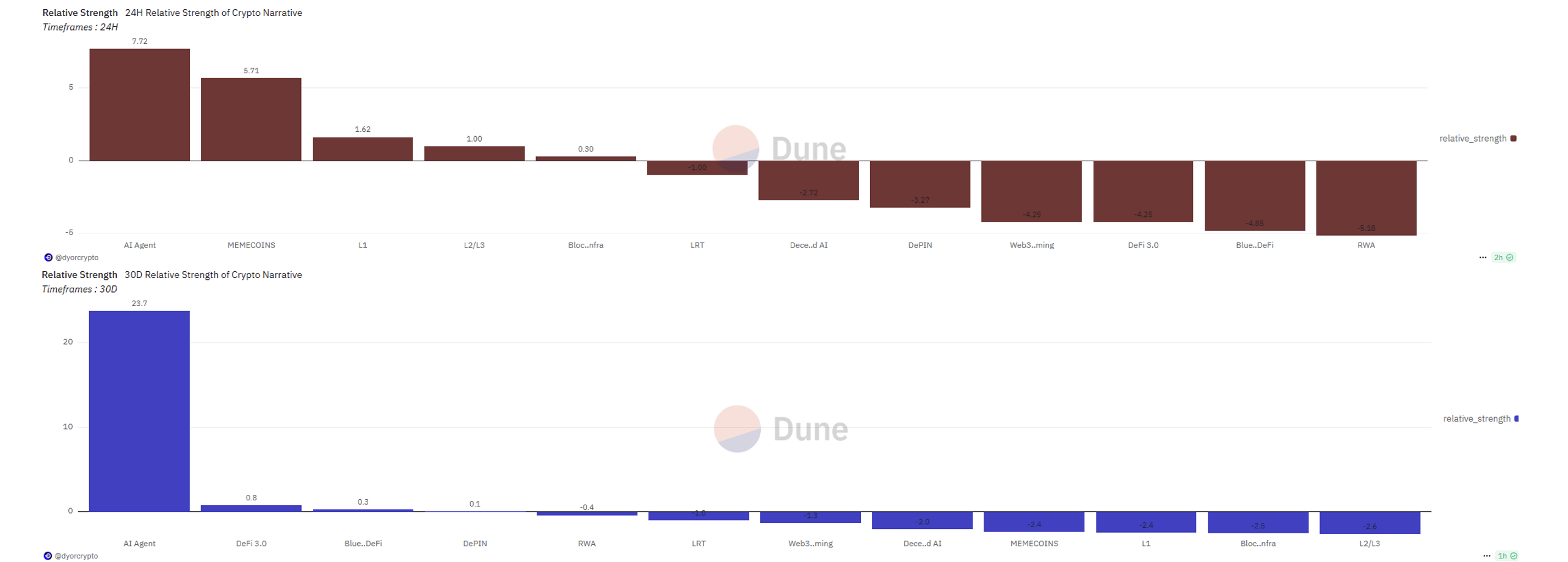

资料来源:Dune,Dot Labs

2. 板块內部

资料来源:Dune,Dot Labs