作者:Web3 农民 Frank

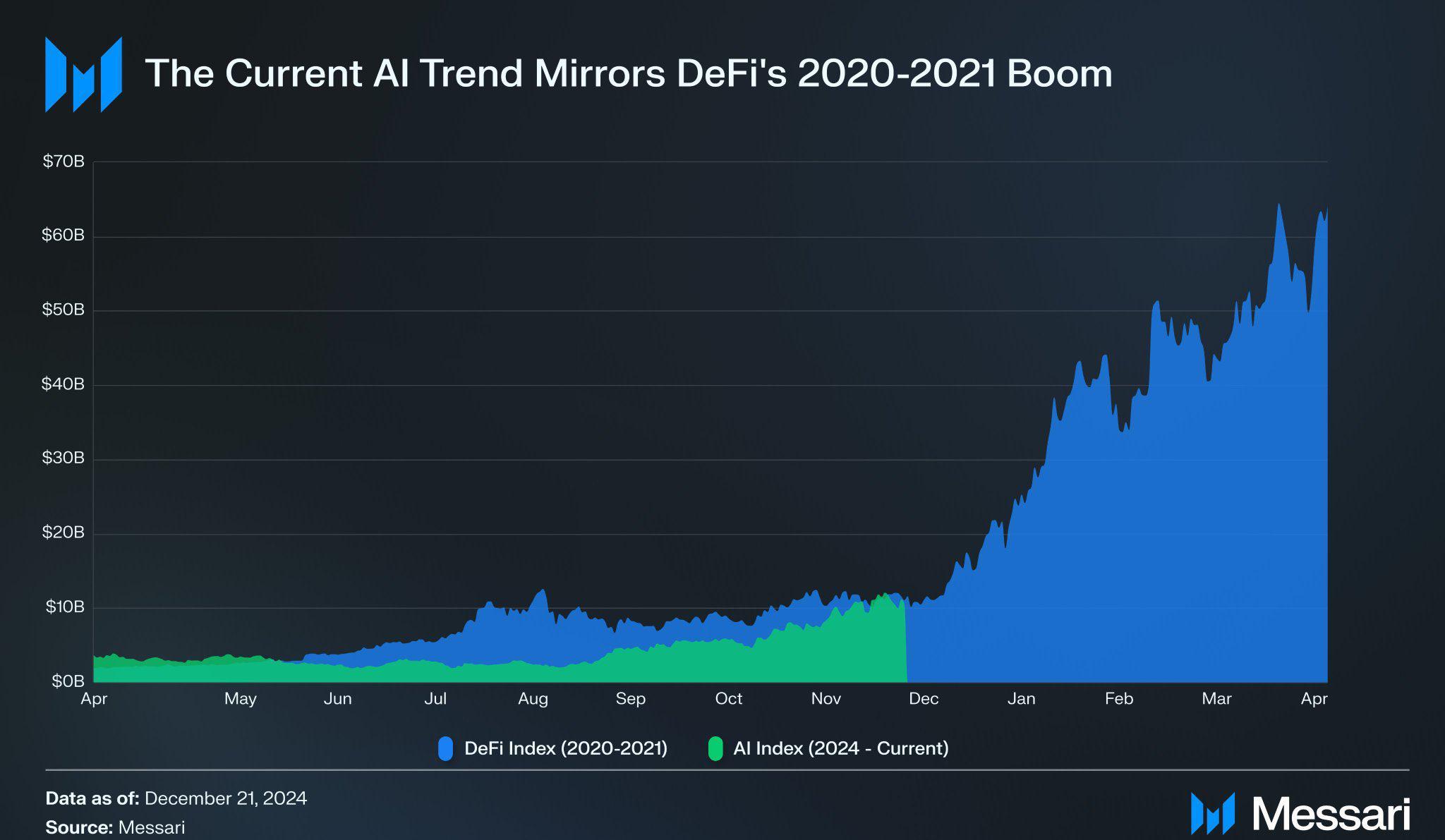

AI Agent 现在正处于 DeFi Summer 的「2020-2021」景气周期么?

「刻舟求剑」往往是最省心的预测方式——仅从数据维度看,DeFi 总锁定价值(TVL)从 2020 年 1 月的 6 亿美元到 2020 年 12 月的 260 亿美元,仅一年时间就增长逾 40 倍,而 AI 赛道的市值目前为 440 亿美元,这也意味着如果它真能复制 DeFi 的景气周期,潜在市值或将突破 1 万亿美元。

那么问题来了,AI Agent 是否真的正在经历类似 DeFi Summer 的「2020-2021」景气周期?AI Memecoin 之外,又有哪些项目将成为这一赛道景气周期的驱动力量?

烈火烹油的 AI Agent 景气周期

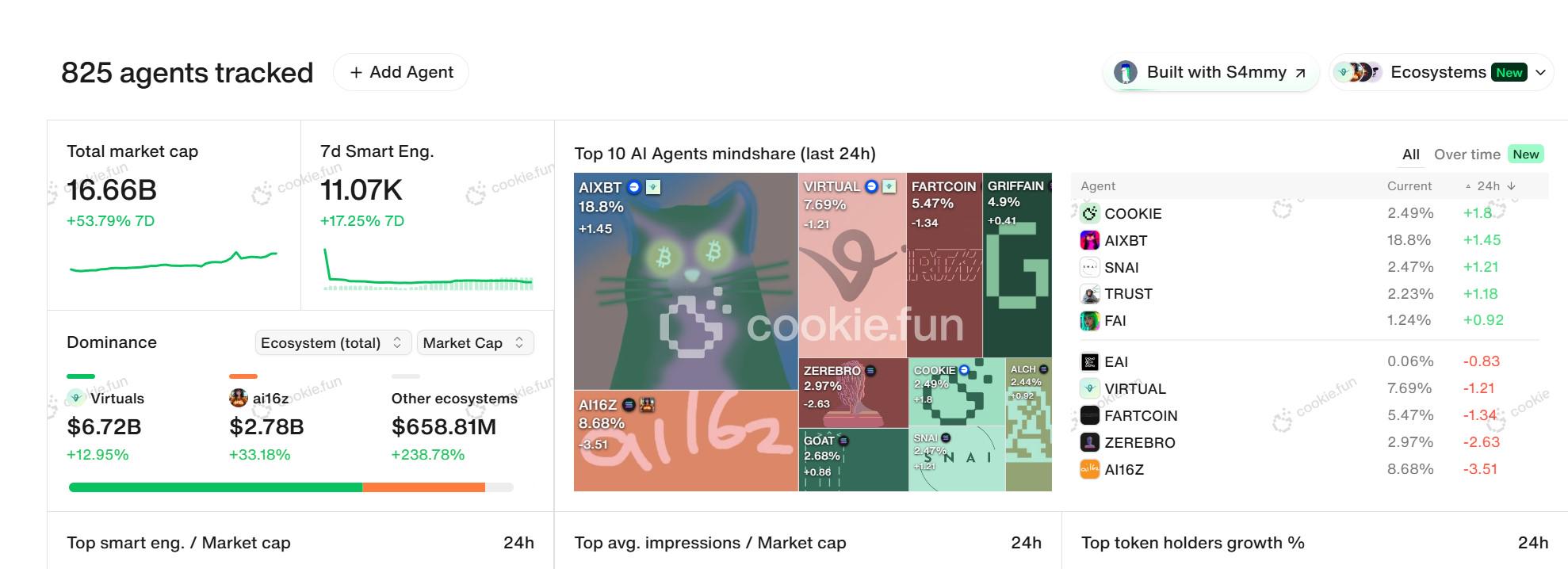

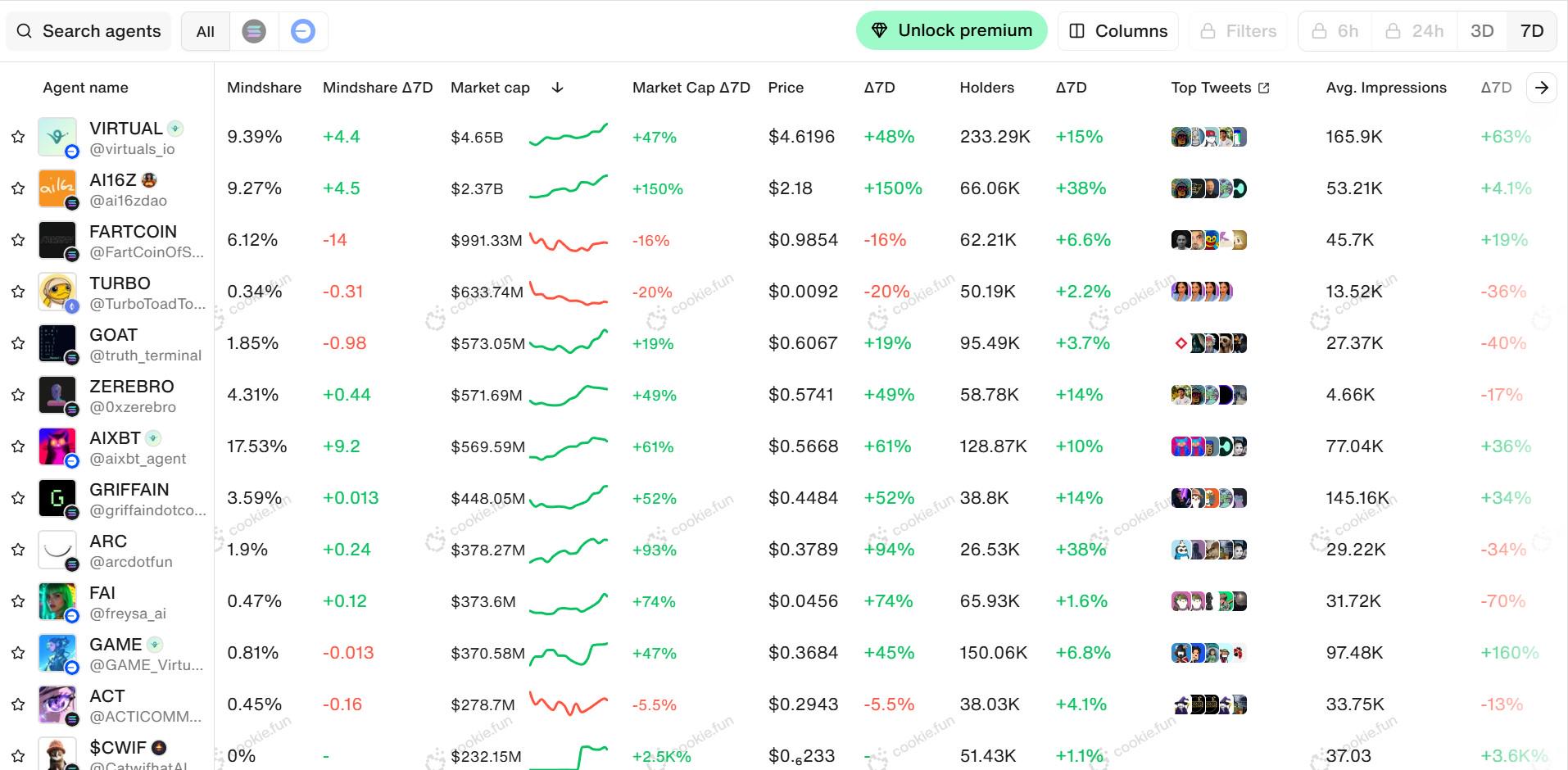

Cookie.fun 统计数据显示,截至 2025 年 1 月 1 日,AI Agent 板块的整体市值已突破 166 亿美元,过去 7 天涨幅高达 53.79%,在整个加密市场处于震荡期的大背景下,从 Virtual 到 AI16Z,再到 Arc 等平台,AI Agent 的生态正以前所未有的速度扩张。

尤其是以 Meme 文化为驱动的 AI Agent 项目,凭借其低门槛的发币和交易流程,迅速成为流量和注意力的新中心,它们大都通过幽默化的表达、强互动性的社区文化,以及贴近用户的传播策略,大幅降低了普通用户的参与门槛,成功吸引了大批非专业用户的加入。

说白了,这其实是对「VC 币」的另一种文化反叛,也是 Meme 叙事的延续,只不过结合 AI Agent,既降低了参与门槛,扩大了市场的潜在规模,也为 AI × Crypto 叙事注入了更多的普惠性和可持续性。

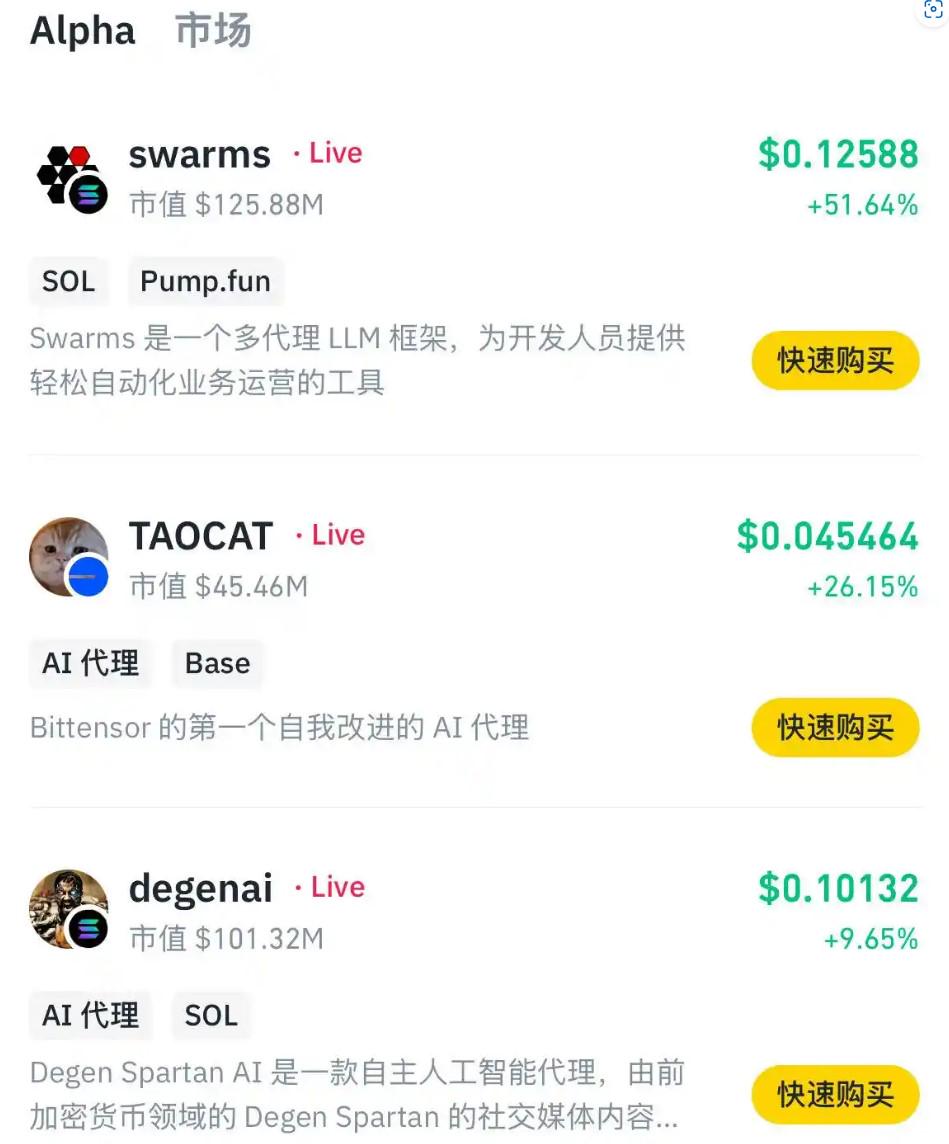

包括前不久涨幅表现亮眼的「TAO CAT」,作为 Masa 团队利用 Virtuals 和 Bittensor 两大生态圈技术碰撞的结晶,就别出心裁地展示了 AI Agent 与传统 AI Bot 相比自我进化的优越性, 内核还是公平发行和社区驱动的经济叙事。

有意思的是,在撰文章过程中,TAOCAT 正好入选币安 Alpha 新一期项目,随之而来的是其价格的显著上涨,而 MASA 也受此影响出现了跟涨走势。

这很容易让人联想到 DeFi Summer 的繁荣景象:从最初 Compound、Uniswap 的基础性应用到后来大规模的用户涌入及更复杂链上交易策略的衍生,技术叙事与资本驱动交织共振,最终形成周期性繁荣,因此至少当下基于 AI Memecoin 的 AI Agent 的普及和市值增长,确实为加密行业带来了新一轮的叙事与想象空间。

只不过这一景气周期究竟能走多远,AI Memecoin 只是开端,后续更取决于 AI Agent 能否成为加密行业的长期基石,而不仅仅是短期的风口。

譬如在目前的 AI Agent 版图中,前 5 名的市值总和超 70 亿美元,占比近 45%,其中 Virtual 生态、AI16Z 生态市值分别达到 46.5 亿美元、23.7 亿美元,确实成为了整个加密领域的行业标杆案例。

但本质上,目前「AI Agent」赛道的繁荣,整体仍是以 AI Memecoin 或发行平台为主流,还处于局限在公平资产发行的「平权」经济叙事初期,需要进一步深化它的触达面,而回顾上一个加密周期我们会发现,DeFi 虽然推动了大量资金涌入区块链领域,但 DeFi 的用户门槛仍相对较高,需要具备金融知识和操作技能,这在一定程度上限制了其大规模普及。

而 AI Agent 的出现,不啻为加密领域开启了一个更低门槛、更高潜力的新叙事——与 DeFi 需要用户主动学习复杂的金融工具不同,AI Agent 可以直接为用户提供个性化、智能化的服务,降低了参与门槛。

这才是一些有意思的变量,即通过智能化的解决方案满足更多普通用户的需求,让 AI Agent 不仅是一个技术产品,更是一种全新的「平权」经济叙事。

正如慢雾创始人余弦发推表示:「又一个特别的割裂感:AI Agent 在 Crypto 行业最终(也许)最重要的作用就是发了个代币来刺激着激励那。在非 Crypto 行业,大玩家们早就遥遥领先了,包括定义的一些互操作协议,做出越来越好用的 AI 应用,而 Crypto 行业大部分注意力还是在代币上」。

因此 AI Agent 确实借由 AI Memecoin 迈入了景气周期,赢得了市场对这一领域的高度认可与资金注意力关注,也标志着其正式进入了一个黄金时代:后续从 Meme 驱动的流量中心到多元化的应用场景,从基础设施的完善到长期价值的挖掘,AI Agent 有望重塑加密行业的格局,成为加密行业中最具创新力和影响力的领域。

AI Agent 的「Alpha」与「Beta」

如果我们来追根溯源的话,会发现虽然目前的 AI Agent 只是代币发行和想象力的价值捕获,但真正的落地还是和链上交易属性息息相关。

毕竟 AI Agent 的实际用途远远不限于发币这么简单——早在任务驱动型的 AgentGPT 处理流程中,AI Agent 就已经展示了其在链上交易策略等方面的潜力:

用户可自定义总目标任务,然后 AI Agent 根据自身资源去做任务分配,将总目标任务通过代理层任务的流转、分配,拆解成一个个小任务,并按照目标持续执行、矫正,无需人类协助,最终实现总目标。

说白了就是「以意图为中心」的核心愿景,用户只需要知道自己想要的结果(意图)是什么,而完全不需要关心中间的流程和步骤,且很多情况下,用户的意图是复杂的,意图表达或许并不准确,而经过特定模型训练的 AI,可更精确识别用户意图,根据用户的关键词信息等推断用户的潜在目的和需求。

在这个过程中,结合高度智能的 AI,无论是意图的自然语言输入,还是判断需求、拆解目标、计算最优流程搭配、执行操作,AI 都能够发挥巨大优势,目前市场上也已经涌现出一大批涉及跨链复杂交易的智能交易项目,能够高效地发现最优兑换路径,让用户以最佳价格实时完成最优交易。

这就是真正最具想象空间的 AI Agent 发展方向——真正价值在于成为 Web3 的交互应用层,用户无需理解复杂的系统,只需与 AI Agent 对话即可完成所有链上操作,从而有望成为 Web3 的底层基础设施,与区块链、智能合约等深度融合,催生全新的应用形态和商业模式,为 Web3 带来更广阔的想象空间。

所以从宏观视角来看,光速发展的 AI × Crypto 叙事,正在以惊人的速度完成自我迭代——从最初的 AI Meme 热潮,到如今逐步转向具有实用性和互动性的 AI Agent,整个市场的注意力正在重新聚焦,也意味着市场从随机代币炒作到实际技术落地的叙事逻辑转型。

AI Agent 不再仅是炒作的噱头,而是通过价值捕获机制真正融入了产业逻辑,例如 AI 驱动的 KOL、收益生成工具、交易和 Alpha 策略优化,以及底层基础设施的搭建,AI 技术正在从娱乐性叙事逐步转变为解决实际问题的工具。

它的价值远不止于当下流行的 AI Memecoin,而是通过技术创新和生态融合,真正推动 Web3 的进化和普及,从这个角度来看,AI Agent 不仅仅是工具,它们可能会重塑加密市场的生态规则,使得 AI Agent 更容易被主流用户接受和采用。

任何「长坡厚雪」的赛道,基础设施永不缺席

在加密行业,Alpha 是点,Beta 是面。Alpha 通常难以捕捉,但具备高度确定性的 Beta 项目相比却更容易被埋伏。

AI Agent 领域也不例外,尽管 AI Memecoin 等 Alpha 机会难以把握,但基础设施(Infra)作为 Beta 的核心,却是近乎明牌的价值捕获机会,叙事传导路径极其明确——尽管 AI Memecoin 的爆发掀起了资金和市场注意力的狂潮,但最终能跑出来的项目格局远远未定,而 Infra 作为「卖水人」,借助先发生态优势,却几乎可以稳坐钓鱼台。

正如上文所言,从 AI 在区块链生态中的角色转变来看,它正从单纯的工具升级为推动行业变革的生产力,这不仅能服务现有的加密用户,还可能通过降低门槛吸引传统金融用户进入链上生态,构建更普惠、更可持续的经济逻辑:

从服务少数人的精英化金融,走向服务多数人的普惠金融;从短期炒作的不可持续性,迈向长期增长的可持续性。

这代表 AI Agent Infra 有望成为链上应用智能化的关键切入点,也意味着同赛道中尚未被市场充分定价的项目,很可能隐藏着新的价值重估空间,其中一个重要的方向就是数据。

众所周知,AI Agent 面临的一个重要挑战就是如何高效挖掘并利用高质量的数据,它不仅决定了 AI Agent 的学习能力和决策水平,也直接影响其实际应用的效果和用户体验。

尤其是对区块链生态而言,推特数据、Discord 数据、网络爬虫数据等可能隐藏了数以十亿计的信号,蕴含着很多可以衍生实现的用例,完全可以进行个性化的挖掘利用——诸如追踪巨鲸动态追踪、分析「Smart Money」交易、监控链上地址交互、筛选分层差异化的链上用户、精准触达不同的玩家群体等等。

所以数据基础设施不仅是 AI Agent 发展的支撑,更是其价值创造和市场推广的核心,有意思的是,作为目前 AI 数据赛道的扛把子,前不久 Masa 在 Bittensor 上构建的 SN42 数据服务子网 和 SN59 AI Agent 斗兽场,就颇值得一叙。

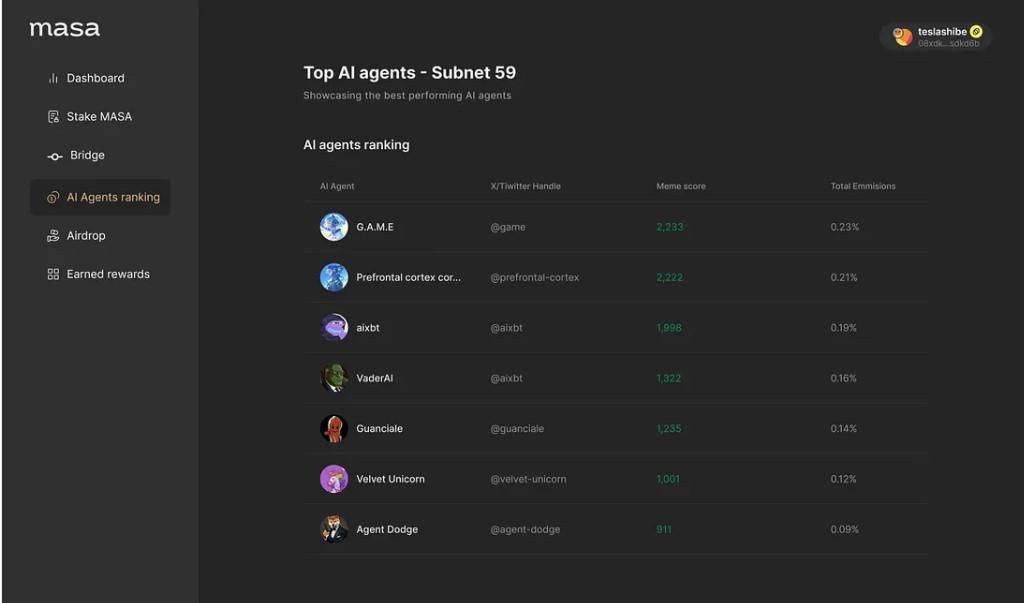

AI Agent 斗兽场是作为数据 infra 的 Masa 朝着 AI Agent 平台迈的一大步,让数据网络不再抽象,而是可以实时地赋能 AI Agent,让他们实时进化,迭代着 Bittensor 强大的奖励机制,让AI Agent 在斗兽场一决高下。斗兽场上线仅仅几周,就已经吸引了 Virtuals 和 creator.bid 生态的头部 AI Agent 参与,其中也包括 Masa 孵化的 TAO CAT。

因此本质上 Masa 是以「基础设施 (数据)+ 应用场景 (斗兽场) + 代币经济(AI Agent)」为核心,吸引更多的用户和开发者来运转平台,不断扩展AI Agent业务场景,激发平台活性。

从更大的逻辑来看,Masa 这类 AI Agent Infra 的叙事路径非常明确——聚焦 AI 代理在链上的「适配性」问题,解决链上运行的效率、稳定性和智能化需求,如果这一赛道持续发酵,不仅有望构建链上 AI 生态的基础设施,还可能带动开发者生态和用户体验的全面升级。

按照市场轮动规律,Virtual 的成功也会推动投资者关注功能互补、技术创新或估值偏低的同赛道项目,尤其是具备强生态构建能力和清晰的叙事方向,所以像 Masa 这类 Infra 项目无疑与 Virtual 的代币发行功能形成了天然的互补逻辑。

而基础设施的完善与技术的成熟使得 AI Agent 从不确定的 Alpha 阶段进入可盈利、可规模化的 Beta 阶段,因此从这个角度看,像 Masa 这样的 Infra 项目是这一过程中不可忽视的推手。

上文提到的 TAOCAT 入选币安 Alpha 新一期项目,也为我分析的逻辑增添了现实的佐证,进一步强化了在市场关注度逐步向 AI Agent 赛道转移时,基础设施类项目(如 MASA)可能会迎来意想不到的价值增长机会。

总的来说,这一轮 AI Agent Infra 的热度只是开始,市场对于链上智能化基础设施的需求还在快速扩张,Virtual 和 Masa 的表现为我们提供了一个很好的参考,接下来可能还会有更多定位清晰、功能互补、估值未被充分挖掘的项目逐步被市场发现,价值重估的机会往往隐藏在细分领域的暗线上。

结语

AI Agent 不是终点,而是起点:未来的加密市场,AI Agent 不仅是生态的组成部分,更将成为推动整个生态前进的重要动力。

基础设施是生态的底座,任何大趋势的背后都少不了它的支撑,无论是 Virtual 这样的先行者,还是 Masa 等 Infra 潜在选手,它们的共同点是用技术和逻辑将自己的价值嵌入整个生态的核心,而市场对这种价值的认知,也只是时间问题。