一、2024 Q3 投资策略

本季度,Web3Port Foundation 的核心投资策略继续专注于支持革命性的Web3项目,尤其是那些具备长期潜力并能显著改变行业格局的创新技术。我们认为,Web3不仅是技术层面的创新,更是推动创造力和生产关系变革的关键力量。所以 Web3Port Foundation 仍然在 Defi、AI、DePIN、Payment 等多个赛道进行布局。我们相信通过赋能那些能够引领行业发展、提供实际价值的项目,将会推动整个Web3生态系统的发展与进步。

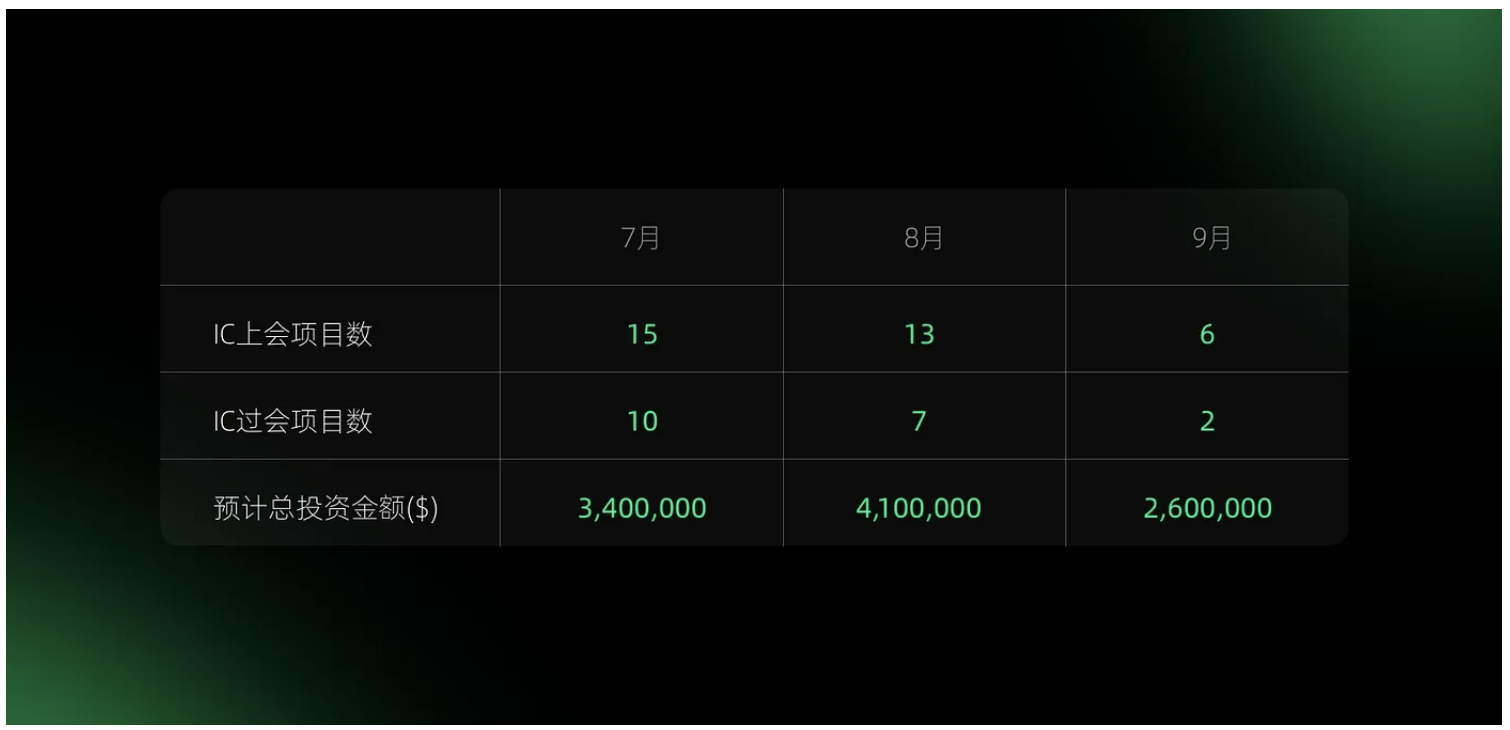

二、整体数据表现

Web3Port Foundation 在第三季度 一共扫描筛选 650个项目;其中有212个项目通过了初筛,占比32%;经过深度投研及综合调查,有34个项目到IC会上进行讨论,占比16%;最终成功投资19个项目,占比8.9%,总投资金额为1010万美元。

Web3一级市场在第三季度整体热度下降,市场情绪相对低迷,行业VC虽然对项目充满兴趣,但因整体的不确定性,而选择谨慎观望。这种市场冷却使得部分创业者和投资人产生了一定的焦虑。然而,Web3Port Foundation始终坚定长期看好Web3行业的发展机遇,继续保持较高的出手频率和投资金额。我们深信,Web3技术的变革潜力仍然不可估量,真正的创新和突破将源于那些敢于在挑战中前行的项目。因此,我们希望Web3的创业者们能够保持斗志,不畏艰难,坚持追求前沿技术与应用的突破。

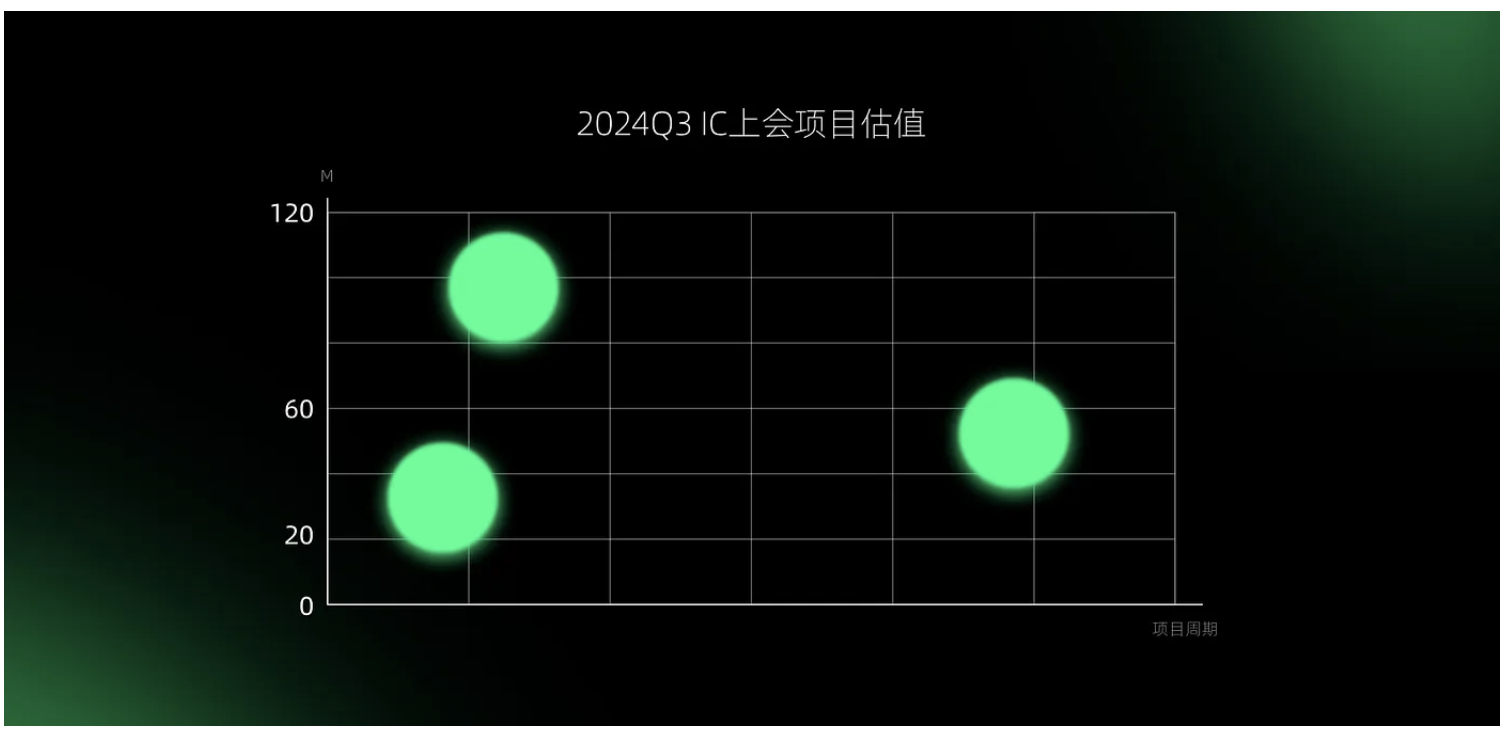

上会项目的分布,依旧体现W3P的投资策略,也就是重点关注早期pre-Seed/Seed项目,和中晚期的优质头部pre-listing项目,整体贯穿确定性,逐渐形成金字塔型的首尾呼应布局

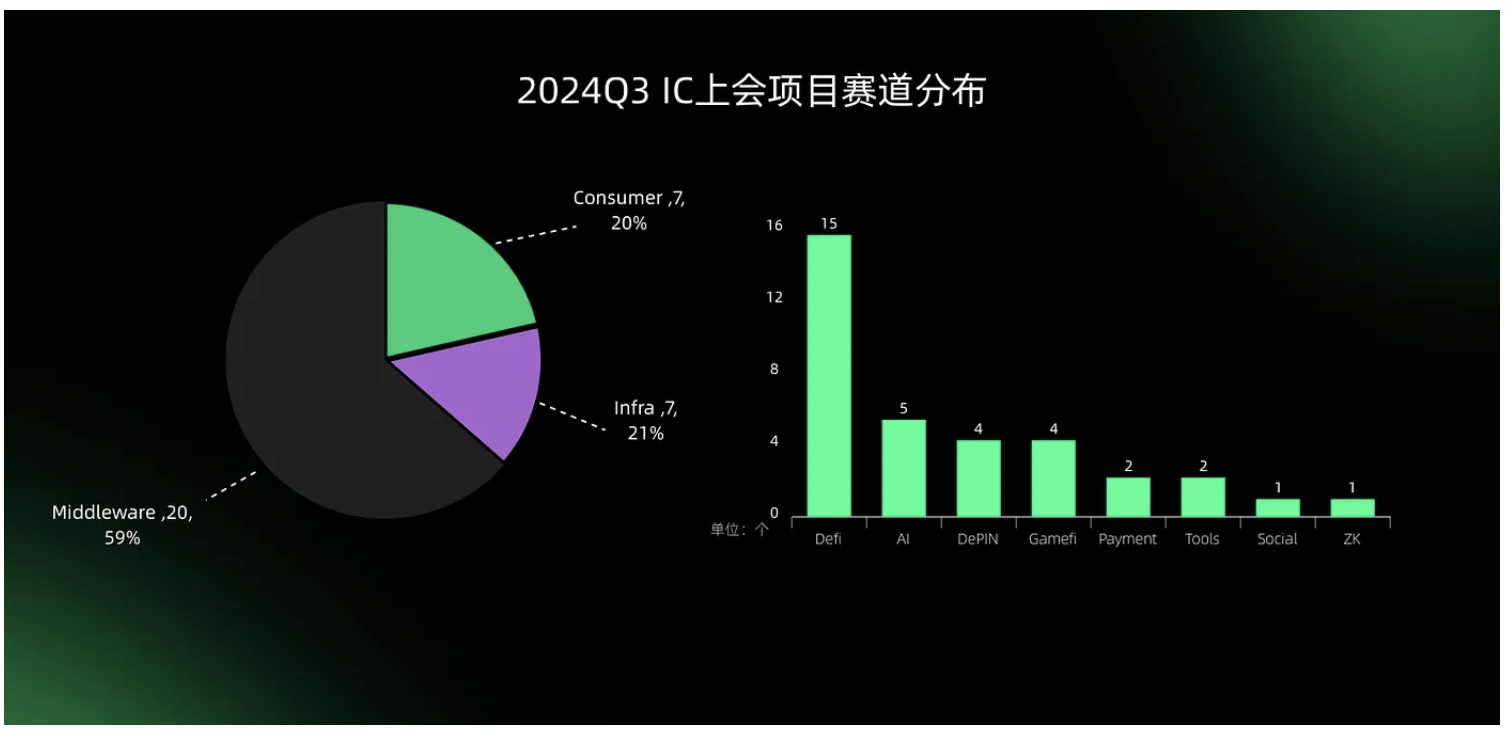

Web3Port Foundation对于所有项目,整体分为3大类:Infra:提供web3必须的技术架构、硬件和工具,如L1/L2(Movement,Bitlayer),AI算力(Aethir),ZK技术服务(Zerobase)Middleware(app/Dapp):连接infra和应用,为上层应用提供支持,使得上层应用或用户共享不同基础设施时间的信息、资源和流动性。如Defi三件套 Jupiter、Echelon,Trusta。Cosumer:核心商业模式为服务C端用户,C端用户贡献其最大的商业价值。UXLINK、Wildforest。

- 上会项目以Infra、Middleware等具有更高技术壁垒,更高市场天花板的项目为主。

- 基于Web3天然的金融属性,Defi项目仍为上会项目的主要赛道,其次为AI、DePIN及Gamefi类项目。

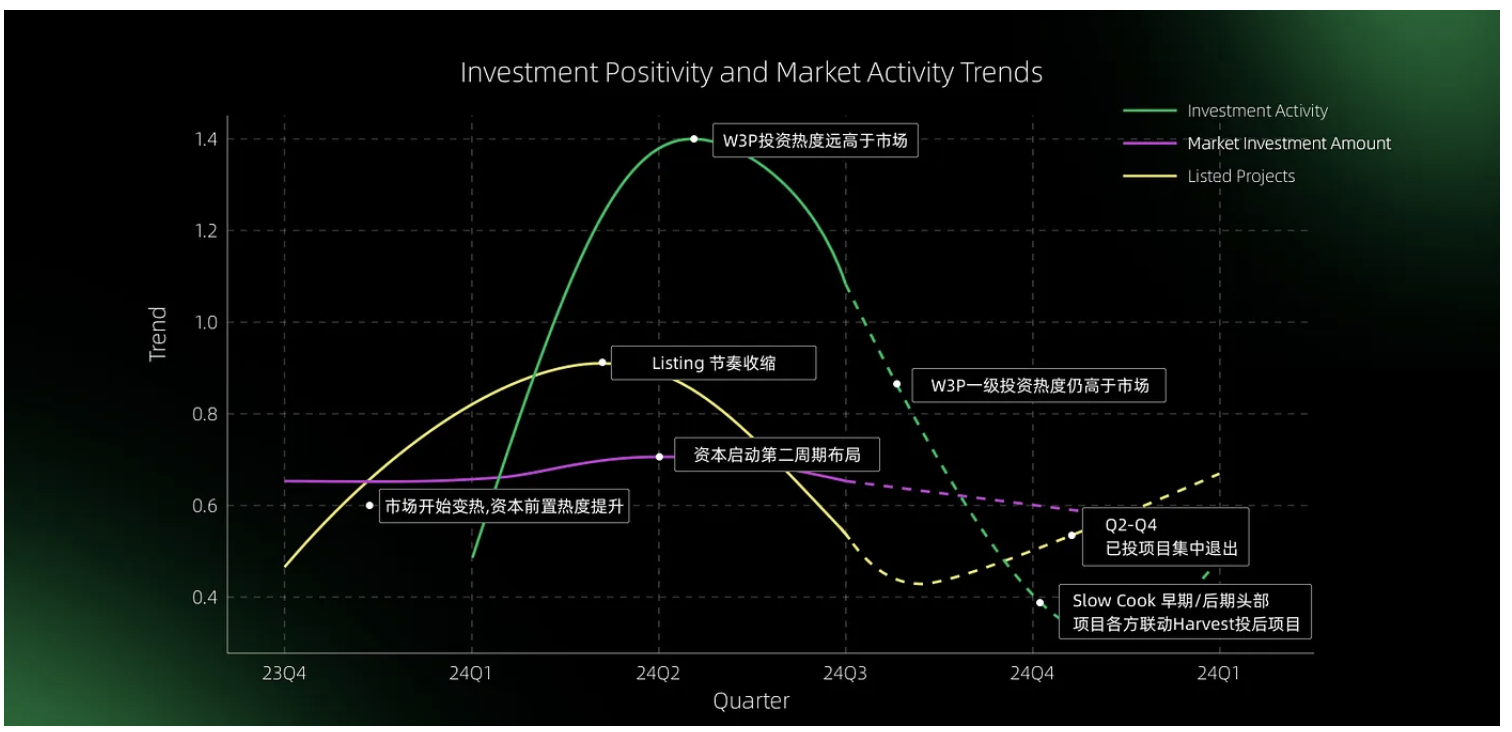

上图注释:本图所有曲线均由多个数值按比例抽象成“热度趋势值”,Q3后的虚线均为预测值

- Investment activity 是由Web3Port Foundation的投资热度,投资项目个数、金额等数据集组成;

- Market Investment Amount 是由Web3一级市场实际的投融资金额以及投融资项目数量,通过公开数据汇集而成;

- Listed Projects 是基于5个主流交易所(Binance, Okx, Bybit, Kucoin, Bitget) 的实际Listing项目数据加权平均汇集而成

三、部分赛道思考和分享

关于AI:

对于明年的市场预期,大多数T1 VC 对于赛道的预期比较高的共识在于AI赛道,由于AI赛道在今年已经有一些项目上线且一些项目融资投资阵容优质的标的,以至于在一级投资领域井喷出现各类蹭热度和盘局类项目。但是这个赛道上真正跟区块链本身相关联的或者说跟传统AI 区分开的项目却并没有出现,市场上在寻找真实落地去中心化这个概念,市场交出了一些答卷比如将去中心化与算力分布相结合;将代币经济学与AIGENT 的市场端相结合;给AI 应用更好的土壤,建设更适合的AI基础设施公链等等。这个思考并没有停止,更多的想法和创意在萌芽,更多的思考现在集中在AI AGENT 与个人的特性相绑定, AI AGENT 之间的支付转移, AI 路径的可验证化, AI 特定的分布式储存环境 等等。

关于DePIN:

DePIN赛道贯彻Web3利用去中心化和透明性增强基础设施的可扩展性和效率的逻辑,通过众包资源去除单一主体大规模资本投入的问题,在各个行业具有诸多的潜在应用,更容易实现Real business,随着每一轮DePIN项目的进化,我们看到了DePIN赛道已经不再是纯矿机盘逻辑,如Aethir、Akash等项目开始有了比较可观的业务收入,收入可以不仅可以对代币进行反哺,矿机销售与业务收入的双重叠加让项目对于投资资金的依赖减弱,具有自我造血功能的产品更受投资人和交易所欢迎;

DePIN项目也不再拘泥于资源的单一聚合,而是逐渐向复合化资源聚合协议发展,如存算一体,如带宽共享和计算加速等,目前仍多集中于基础设施领域,常作为AI的上游出现,AI叙事的爆发也会带动相关DePIN赛道;DePIN通用基础设施、中间件、与AI结合的EdgeAI、DePIN消费级产品如穿戴设备都是潜力赛道。DePIN赛道项目的共通性在于均需要社区和地推网络进行矿机设备的售卖,在布局过程中,将这些分销网络逐渐内化成我们的能力是可探索的方向。

关于普通投资者&Meme:

普通投资者的核心诉求是获得收益,在ICO 和 Defi summer 之后并没有很好的收益区间,但是市场总是有暴富的故事,就像赌场永远不会缺少赌徒,今年的热度集中在以pump.fun 为主的Meme以及 TG 生态的零成本的 knock knock to earn 的撸空投玩法。去VC 去 CEX 去做局化 也反应了散户真实内心想法。但我们相信 VC的专业眼光一定也能给市场带来让普通投资者赚钱的项目,希望Web3Port Foundation 努力做到这一点。

Meme赛道也逐渐出现了项目方、做市商、KOL、早期发现者和传播者为核心的去中心化的“阴谋集团”,由阴谋集团主导的Meme代币比例明显增加;Meme也不再是单纯的链上PVP资产标的,对于主叙事为非Meme的项目来讲,Meme开始成为品牌传播的媒介以及增加社区热度的工具,常规项目的运营玩法将和Meme结合更加紧密。

结语:

Q3我们秉承着初心,给市场提供力所能及的帮助,重点支持了AI, Defi,基础设施赛道并与多个公链达成了深度的合作,也为未来的潜在爆发项目埋下了种子,我们坚信未来市场将会带来更多的可能性。

目前美国的选举已经尘埃落定,我们看到政策导向和市场热钱都开始重新向Web3回笼,这令人振奋。我们对Q4充满信心,我们将会坚持向有潜力,有价值的项目提供包括但不限于资金的全方位支持,欢迎大家联系我们。