一、注意力价值-市场要点

1. 市场行情

(1)宏观环境:

l 市场谨慎加剧 散户交易量大幅下降 10x Research建议专注核心资产

12月9日,10x Research发布分析指出,随着圣诞假期的临近,市场环境变得愈加谨慎,横盘整理的风险也随之增加。散户交易量显著下降,例如韩国的加密货币交易量从峰值的250亿美元降至目前的66亿美元。同时,Binance的现货交易量也从600亿美元降至240亿美元,这表明整体动能正在减弱。鉴于这些趋势,现在是减少杠杆、巩固仓位并专注于高信念核心资产的合适时机。

对于比特币而言,关键支撑位在95,000美元。如果价格突破100,000美元,这可能会成为一个强劲的买入机会;然而,如果跌破95,000美元,交易者则应谨慎行事并小心管理风险。

(2)web3领域:

l 数字资产投资产品流入创新高 达38.5亿美元

根据Coinshares最新的周报数据,上周数字资产投资产品的周流入量创下历史新高,总额达到38.5亿美元,打破了几周前的纪录。以太坊的周流入量也创下新高,达到12亿美元,超过了7月份推出ETF时的流入量。同时,Solana的流出量为1400万美元。区块链股票的资金流入达1.24亿美元,为今年1月以来的最大流入。比特币的流入资金为25亿美元,年初至今总流入达到365亿美元。相比之下,比特币空头的流入资金仅为620万美元,显示出投资者在押注近期强劲价格势头时仍然保持谨慎态度,历史上价格大幅上涨后,流入资金通常会显著增加。

2. 热点事件

(1) 宏观环境:

l 微软股东大会将决定是否投资比特币 提案引发广泛关注

北京时间12月11日,微软将在年度股东大会上推进一项重要提案——通过股东投票评估将比特币纳入资产负债表是否符合股东的长期利益。这次投票被认为是本周影响加密货币市场走势的关键事件之一。

这项股东提案最初由美国保守派智库国家公共政策研究中心(NCPPR)提交。NCPPR指出,在持续的通货膨胀期间,公司的成功不仅依赖于经营状况,还取决于利润的保值能力。根据消费者价格指数(CPI),过去四年美国的平均通货膨胀率为5%,而NCPPR认为实际通胀率可能更高。因此,公司有责任保护利润免受贬值。然而,微软因将大部分资产投资于美国政府证券和公司债券,未能有效保护其资产免遭贬值。NCPPR在提案中指出,尽管比特币存在一定的波动性,但它仍然被视为一种出色的通胀对冲工具,甚至可能是最佳选择。因此,NCPPR建议微软考虑将至少1%的资产配置为比特币。

截至2024Q3,微软的现金储备达784.28亿美元。这意味着,如果提案顺利通过,并按照NCPPR的建议配置至少1%的资金,那么微软将具备至少7.8亿美元的买入比特币的能力。

(2) web3领域:

l 比特币DeFi生态系统蓬勃发展 Stacks即将推出sBTC

12月9日,比特币扩容解决方案Stacks发布了最新动态,指出比特币DeFi生态系统在其平台上蓬勃发展,sBTC即将推出。近期的亮点包括:由Hermetica提供的USDh年收益率高达35%,创下历史新高;Velar DEX推出了去许可的池创建功能;Bitflow发布了针对L2 Runes AMM的用户界面预告;ALEX Surge活动持续推动Stacks上代币化社区的活跃度。这些发展标志着Stacks在推动比特币生态系统创新和应用方面的积极进展。

3.热点叙事

l Pudgy Penguins发文“The calm before the storm” 或暗示发币将近

以可爱企鹅形象而闻名的以太坊顶级蓝筹NFT项目「胖企鹅」Pudgy Penguins,于12月6日上午在推特上宣布将在Solana链上推出官方代币$PENGU,并计划于2024年12月发行该代币。昨日,Pudgy Penguins于X 发文“The calm before the storm”,,暗示发币即将到来,Solana的联合创始人Toly也转发了该帖子。$PENGU的总供应量为88,888,888,888个,其中Pudgy社区将获得25.9%的代币,其他社区将获得24.12%的代币。Pudgy Penguins提醒用户,代币当前尚未发布,恶意攻击者可能会创建假冒网站和代币,请勿与这些网站或合约地址互动。

二、 注意力价值-热点项目

1. 项目介绍

l $JAIL | AI | @jailbreakme_xyz

- AI模型漏洞测试平台,目的是使公司能够在分布式环境中测试他们的AI模型和代理,在生产部署之前识别及时的漏洞和弱点。

- 参与者通过成功“越狱”发现AI模型中的漏洞,即可获得奖励。

- 这个项目使开发人员能够对其LLM进行压力测试,并改进其用于训练AI代理的基础设施。

三、 注意力价值-板块轮动

1. 热点板块

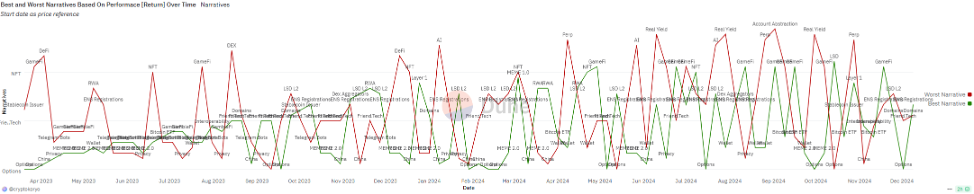

资料来源:Dune,Dot Labs

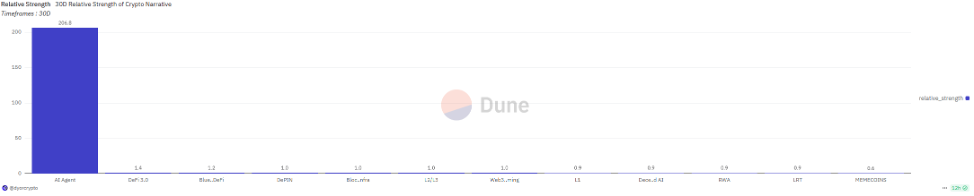

资料来源:Dune,Dot Labs

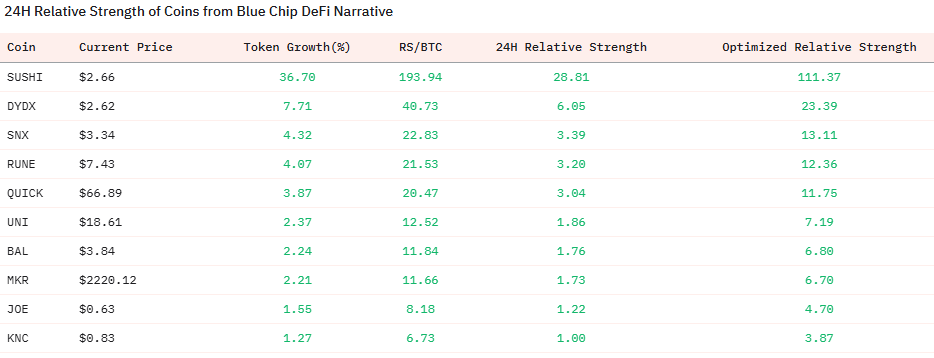

2. 板块內部

资料来源:Dune,Dot Labs