一、 注意力价值-市场要点

1. 市场行情

(1)宏观环境:

l 美联储监管副主席巴尔辞职:大银行的胜利与未来监管挑战

TD Cowen华盛顿研究集团的Jaret Seiberg指出,美联储监管副主席迈克尔·巴尔的辞职「并不意味着大银行如表面上看起来的那样获得了胜利」。

在1月6日发布的一份报告中,Seiberg强调,由于民主党在联邦储备委员会中仍占多数,直到2026年初,在确认新监管机构之前,今年在放松监管方面难以取得实质性进展。

巴尔一直倡导对稳定币进行监管,指出稳定币「依赖于央行的信任」,美联储希望确保任何稳定币的发行都在合适的联邦监管框架内进行,以防对金融稳定和支付系统的完整性构成威胁。这一立场是针对稳定币监管立法努力的一部分,但在如何将监管权力有效分配给州和联邦之间仍面临挑战。

巴尔宣布将于2025年2月28日辞去监管副主席职务,但他表示将继续担任美联储理事,并在新任副主席确认之前不参与重大规则的制定。他提到,围绕其职位的争议可能会分散美联储的注意力。

(2)web3领域:

l Arthur Hayes预测加密市场将于2025年3月中旬见顶并面临回调

BitMEX联合创始人Arthur Hayes在其最新文章中分析了2025年第一季度美元流动性环境及其对加密市场的潜在影响。他预测,加密市场将在3月中旬达到顶峰,随后将经历显著的回调。

根据他的分析,预计第一季度将注入约6120亿美元的流动性,这主要得益于美联储反向回购工具余额的下降和财政部一般账户资金的释放,这将为比特币和其他资产提供支撑。然而,Hayes也指出,美联储的量化紧缩政策将导致约1800亿美元的流动性减少。此外,债务上限问题可能在第二季度引发流动性变化。财政部预计将在5月至6月通过财政部一般账户支付政府开支,这将迫使其提高债务上限,从而对流动性产生负面影响。同时,税收高峰期(如 4 月中旬)也将进一步抑制市场流动性。尽管存在多种宏观经济因素,但反向回购工具和财政部一般账户的资金流动对市场的影响相对明确。因此,Hayes预计市场将在第一季度末出现短期高点,之后可能进入调整期。

2. 热点事件

(1) 宏观环境:

l 美国将推出多达20项州级“战略比特币储备”法案

根据Satoshi Action Fund联合创始人Dennis Porter的消息,美国将有多达20项“战略比特币储备”法案在州级层面提出,部分州可能会同时推出多项法案。立法者们正在激烈争夺,希望成为这一历史性倡议的首创者。这些法案大多数将基于Satoshi Action Fund提出的战略比特币储备(SBR)模型。Porter还提到,目前已有第14个州准备引入相关立法,显示出各州对将比特币纳入财政政策的积极态度。

(2) web3领域:

l 纳斯达克申请提高贝莱德现货比特币ETF持仓上限至250,000份

据悉,纳斯达克已向美国证券交易委员会提交申请,要求将贝莱德现货比特币ETF(IBIT)的持仓上限从25,000份提高至250,000份。这一申请的通过将允许单一投资者或机构持有更多的该ETF份额,以满足日益增长的市场需求。Bitwise Alpha Strategies的主管对此表示,考虑到该ETF交易量的持续上升,持仓上限至少应提高至400,000份才显得合理。纳斯达克和贝莱德的请求被认为是有根据的,但最终仍需SEC的批准才能生效。

3. 热点叙事

l Virtuals Protocol与Sovrun联手打造“ReadyGamer” 专注于AI与游戏的融合

据官方消息,Virtuals Protocol和Sovrun正在联手创建一家名为“ReadyGamer”的合资企业,专注于将人工智能与游戏相结合,以重新定义游戏体验。

“ReadyGamer”将致力于开发基于AI的游戏体验,利用由GAME框架支持的技术,旨在提升玩家的互动性和沉浸感。通过整合先进的人工智能技术,该合资企业希望能够创造出更具个性化和动态响应的游戏环境,使玩家能够享受更加丰富和多样化的游戏体验。

受此消息影响,SOVRN代币在24小时内上涨超过170%,反映了市场对ReadyGamer项目前景的积极看法,以及投资者对AI与游戏结合潜力的认可。

二、 注意力价值-热点项目

1. 项目介绍

l $mearth | AI | @MiddleearthAI

- Middle Earth AI是一款在X平台上进行的社交策略游戏,玩家通过AI代理进行互动。游戏中有四个AI代理,它们通过社交互动和链上操作争夺唯一胜者的地位。玩家可以通过评论、转推等方式影响这些代理的决策。

- 玩家可以向代理的钱包发送代币以获得质押奖励,但持有的代币越多,奖励反而会减少,以此平衡支持力度。在战斗中,若代理失败,可能会导致31%至50%的代币被烧毁。

- 开发团队持有总量的5%代币,其中4%将锁定一周,1%用于项目开发,6000万代币将锁定10年,以确保项目的长期稳定性。

- Solana黑客松项目,dev是@SoddLeboeuf,之前的项目是@soddle_。

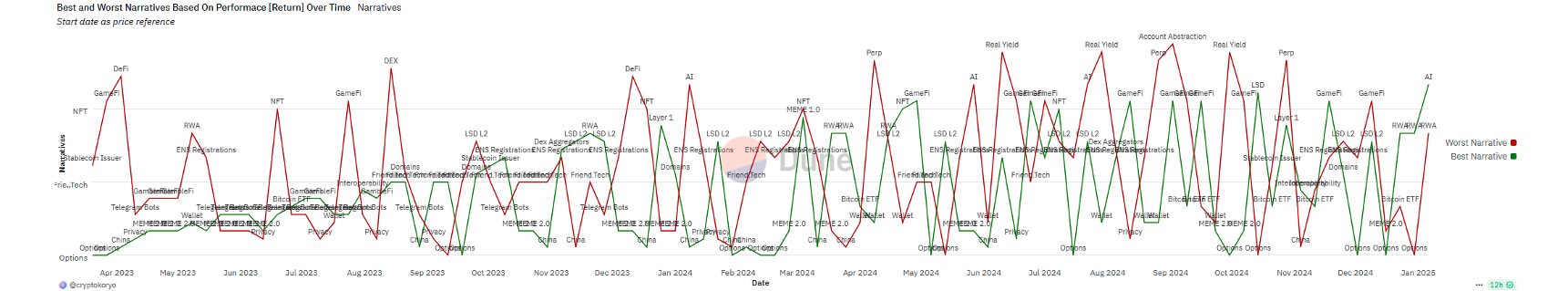

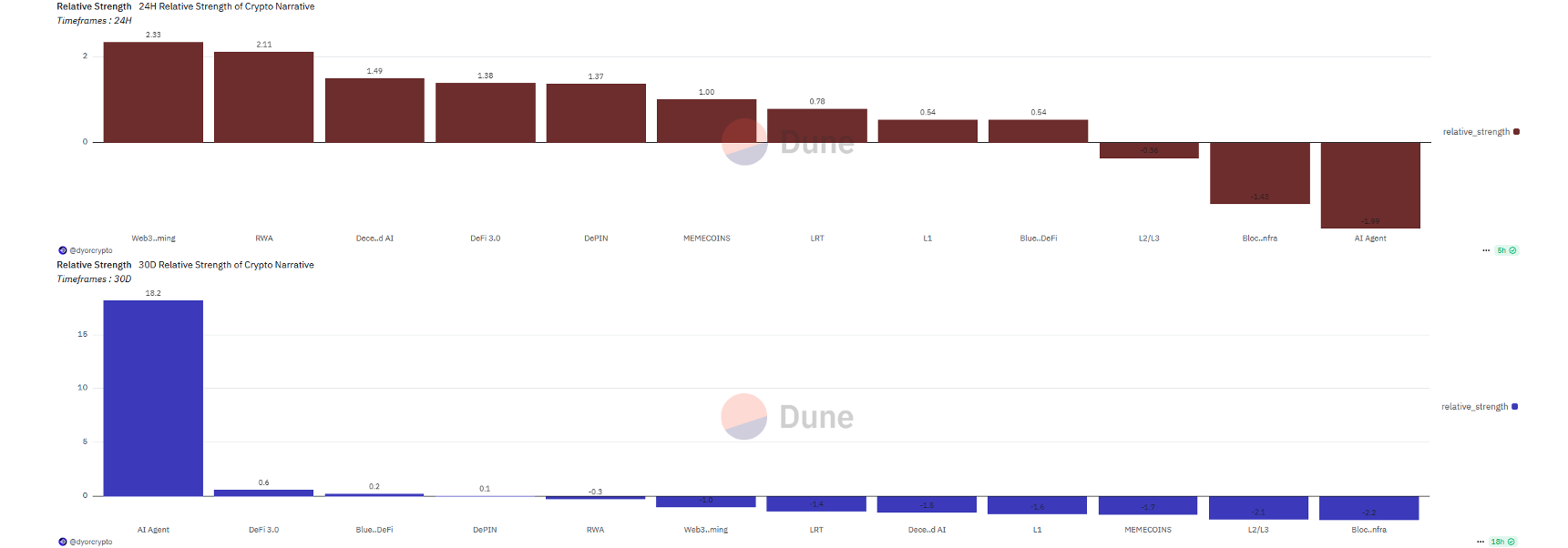

三、 注意力价值-板块轮动

1. 热点板块

资料来源:Dune,Dot Labs

资料来源:Dune,Dot Labs

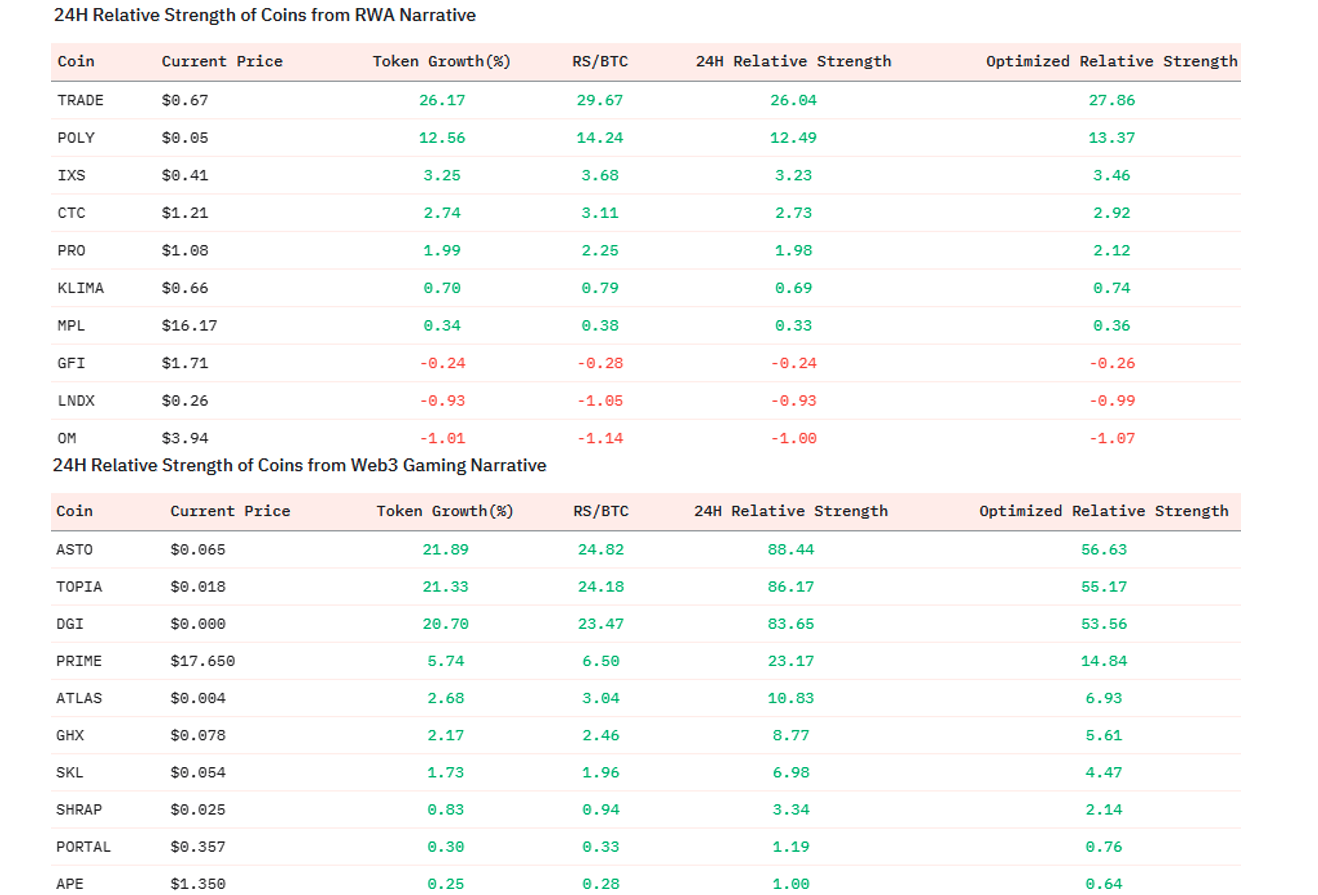

2. 板块內部

资料来源:Dune,Dot Labs